PeopleImages

While I really like many of the funds that PIMCO has to offer, there is one that I would suggest avoiding right now. The management team at PIMCO knows a lot about bonds and fixed income investments. They are known as a giant in the world of bond investing. In fact, according to a 2021 article in the Wall Street Journal:

Pimco remains one of Wall Street’s biggest and most-successful bond investors, with a deep pool of managers whose insights move markets and hold central bankers’ attention.

Several of the funds that PIMCO manages are funds that I own, and I appreciate the high yield income that I receive from those funds including PIMCO Dynamic Income fund (PDI), PIMCO Dynamic Income Opportunities fund (PDO), and more recently PIMCO Access Income fund (PAXS). And several of these funds are well positioned to withstand the difficult economic environment that many are expecting, including the PIMCO team. This excerpt is from an insight that discusses the Risk Off – Yield On asset allocation outlook that they suggest for current market positioning.

PIMCO’s business cycle models forecast a recession across Europe, the U.K., and the U.S. in the next year, and the major central banks are pressing ahead with policy tightening despite increasing strain in financial markets. The economy in developed markets is also under growing pressure as monetary policy works with a lag, and we expect this will translate into pressure on corporate profits.

We therefore maintain an underweight in equity positioning, disfavor cyclical sectors, and prefer quality across our asset allocation portfolios. The return potential in bond markets appears compelling given higher yields across maturities. As we look toward the next 12 months and the eventual emergence of a post-recession, early cycle environment, we will assess a range of market and macro factors to inform our thinking on when and how to re-engage with risk assets.

However, not all of the PIMCO offerings are winners all of the time. Recently, I decided to review one of the smaller funds that PIMCO manages called PIMCO Global StocksPLUS & Income Fund (NYSE:PGP), and I would avoid starting a position in that fund right now. In fact, for some reasons that I will discuss in more detail, I would be a seller of PGP if I were a holder of any shares right now.

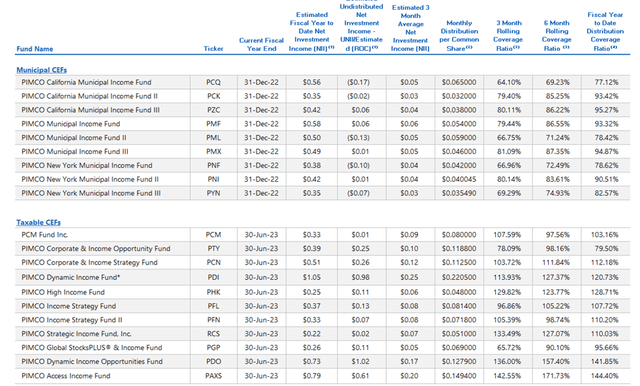

For one thing, the monthly UNII report from October 31, 2022, shows that each of PDI, PDO, and PAXS are all exceeding the coverage of their distributions with UNII based on the past 3-month and 6-month rolling coverage ratios as well as fiscal year (which ends November 30) coverage. However, PGP has been seeing a decline in the 6-month and 3-month rolling coverage ratios to the point of only about 65% coverage over the past 3 months.

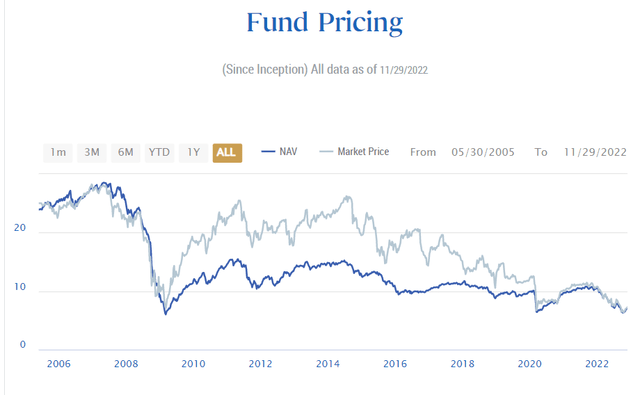

PGP currently pays a monthly dividend of $0.069 which results in an annual yield of about 11.5% at the closing market price of $7.25 as of 11/29/22. The fund’s objective is to seek total return comprised of current income, current gains and long-term capital appreciation. The fund’s inception date was 5/31/2005. The current NAV of the fund is $7.03 which implies a 2.4% premium.

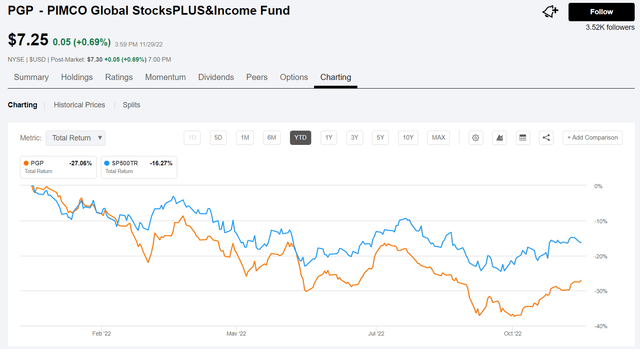

For most of the fund’s life it has traded at a premium. Over the past five years the premium reached as high as 50% and it has only rarely traded at a discount. That all changed in 2022 as the market price has dropped by a third YTD and the premium has all but vanished.

On a total return basis, the PGP fund has lost -27% YTD compared to the S&P 500 TR of -16%.

Bond funds in general have performed poorly in 2022 with rising rates impacting price performance. But PGP is a hybrid fund with an allocation to global fixed income. So how does the fund generate income?

The portfolio manager builds a global equity and debt portfolio by investing at least 80% of the fund’s net assets (plus any borrowings for investment purposes) in a combination of securities and instruments that provide exposure to stocks and/or produce income.

The fund may make substantial use of interest rate swap and other derivatives transactions (“paired swap transactions”) for the principal purpose of generating distributable gains that are not part of the fund’s duration or yield curve management strategies.

The fund may employ a strategy of writing (selling) equity index call options on the U.S. equity portion seek to generate gains from option premiums, which may limit the fund’s gains from increases in the S&P 500 Index. The fund may also purchase put options on the S&P 500 in an effort to protect against significant market declines.

The fund employs leverage (40% current effective leverage) using reverse repurchase agreements and credit default swaps. With only $73M in net assets, total managed assets amount to $122M. Total Managed Assets are defined in the footnotes:

Total Managed Assets include Net Assets Applicable to Common Shareholders (“Common Net Assets”) + Preferred Shares + Reverse Repurchase Agreements + Credit Default Swaps + Floating Rate Notes Issued in Tender Option Bond (“TOB”) transactions, as applicable. In TOB transactions, a fund sells a fixed rate municipal bond to a broker who places that bond in a Special Purpose Trust from which Floating Rate Notes and Inverse Floaters are issued.

In terms of portfolio composition, one of the largest holdings is mortgage securities at 24% based on MV (market value), but over 80% based on DWE% (Duration Weighted Equivalent). Agency MBS makes up the largest percentage at 68% DWE with non-agency MBS 9% MV and over 15% DWE. High Yield Credit makes up 16% by MV and over 18% DWE. Investment Grade Credit represents only 3% by MV but over 12% DWE. Emerging Market debt, CMBS, non-US developed, Municipal, and Other each make up less than 5% MV, while US Treasuries (including TIPS, futures, swaps, and Fed guaranteed securities) represent less than 5% MV but -20% DWE due to leverage. Net other short duration instruments make up 35% of MV and -7% DWE, again due to the use of leverage.

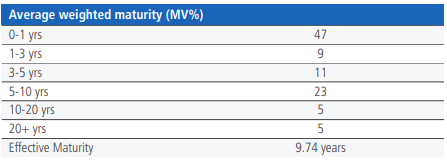

The fund’s average weighted maturity by MV is shown below as of September 30, 2022.

PIMCO

The total leverage-adjusted effective weighted duration of the portfolio is estimated at 4.56 years. The short duration instruments include securities with duration of less than a year and are typically investment grade. As described in the fund literature,

Total Leverage -Adjusted Duration represents the Fund’s effective portfolio duration taking into account its use of leverage, including both portfolio leverage (e.g., reverse repos, credit default swaps, and tender option bonds), and any structural leverage, such as auction-rate preferred shares, if any, issued by the Fund. Effective duration is the duration for a bond with an embedded option when the value is calculated to include the expected change in cash flow caused by the option as interest rates change.

This is where I believe the sudden rise in interest rates in 2022 due to inflationary pressures has led to problems with the fund’s use of leverage. While PIMCO managers are expecting the Fed to pause rather than pivot, continued upside inflation surprises may prevent them from doing so. In another PIMCO blog, they had this to say about expectations for future rate increases:

While the statement language left the door open to a further continuation of 75-bp rate hikes, we interpret the language changes as setting up the Fed for a pause in the hiking cycle in early 2023. At the press conference, Fed Chair Jerome Powell emphasized that the Fed may slow the pace of rate hikes as soon as the December meeting, while also warning that the ultimate destination for the fed funds rate may also be higher than previously anticipated as inflation is now higher and appears stickier than the Fed’s forecasts at the September FOMC meeting.

It may be more wishful thinking than reality when it comes to hopes for the Fed to pause or even stop hiking the base interest rate next year. The bond market has had a rough year so far in 2022 (along with growth stocks) and some are expecting, or perhaps hoping that bond prices will begin to improve now that the end of rate hikes appears to be near the finish line.

According to PIMCO, rates could even start to reverse toward the end of 2023 if inflation cools and becomes deflationary or stagflation (staying at an elevated rate of inflation but not increasing). For these reasons, and based on the PGP fund’s composition, I feel that there is more pain ahead before things get better for this fund which could be mid to late 2023.

Looking at the distribution history for this fund, the picture does not get any brighter. The dividend has been reduced 3 times over the past 5 years and is likely to be cut again in 2023.

Summary and Conclusion

While I admire PIMCO and enjoy the monthly income from several of the fixed income funds they manage, including PDI, PDO, and PAXS, I would not be a buyer of the PGP fund given current market and macroeconomic conditions. The fund’s use of leverage has negatively impacted the fund performance in the rising interest rate environment and is not likely to improve until late next year when the Fed is eventually done increasing rates and inflation has cooled.

While the fund does offer investors a nice high yield income stream of more than 11% based on the current monthly distributions, the UNII coverage is severely lacking and getting worse, not better. I would not be surprised to see the fund managers reduce the distribution in 2023 which is likely to send the market price of the fund down even further.

If you are considering PGP as a long-term investment and do not mind suffering a short-term loss, it may offer some benefits for those willing to hold it through more volatile market conditions in the short-term, but I would suggest waiting until next year before buying if you are considering it for your portfolio. If you are already an existing shareholder, I would consider selling the shares and trading them for one of the other funds that I do like such as PDO or PAXS, which both trade near par or at a slight discount and have solid UNII coverage.

Be the first to comment