JHVEPhoto/iStock Editorial via Getty Images

Investment Thesis

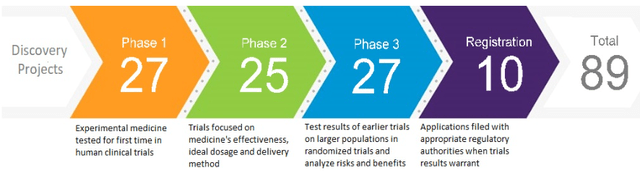

Pfizer (NYSE:PFE) is a global biopharmaceutical company, and they discover, develop, manufacture, and sell drugs and treatments. They have a strong portfolio of drugs and treatments in vaccines, oncology, internal medicine, inflammation & immunology, and rare diseases. Also, Pfizer has a formidable R&D pipeline with 89 total drug and biological products (27 in phase 3 and 10 in registration stage). Pfizer’s revenue has been growing at a solid pace for the past 5 years, and with their strong portfolio and acquisitions, I expect this growth to continue. I believe Pfizer is a great option for an investor because:

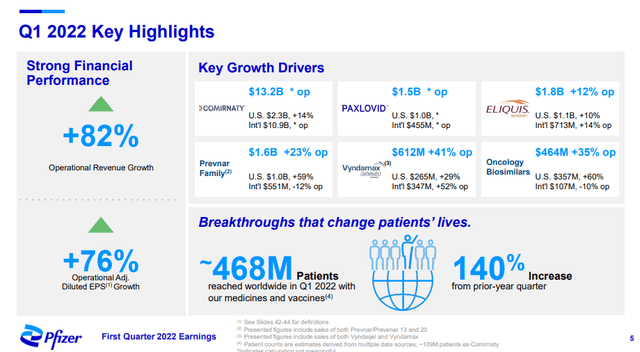

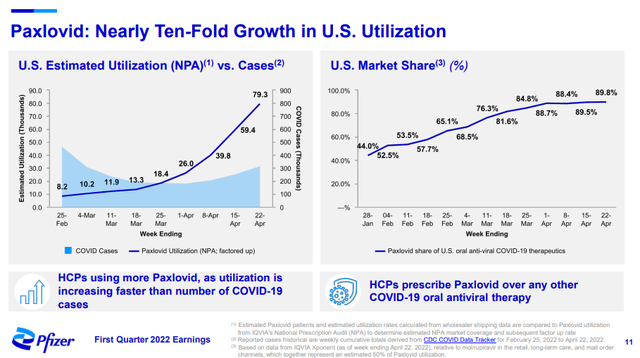

- Covid-19 vaccine and treatment have been a huge cash generator in the past two years, and there is still gas left in the tank.

- Recent acquisitions will boost Pfizer’s growth trajectory, which is already formidable given the existing strong R&D pipeline.

- Their strong cash position and profitability will allow them to weather any economic cycle, while maintaining a strong dividend.

Outstanding Cash Generating Ability

Pfizer has been a highly profitable company for a long time, and the additional revenue from Covid vaccine and treatment has showered Pfizer with even more cash. Pfizer’s operating cash flow was already reaching well above $10 B over the past decade, but jumped to $34 B in the past twelve months, largely thanks to the Covid-19 vaccine (Comirnaty) and treatment (Paxlovid).

Previously, some experts predicted that the pandemic would eventually subside, and pharmaceutical companies would lose this revenue stream. However, it seems more and more likely that Covid-19 variants are here to stay for the long haul, which will extend that tailwind. Recently, the FDA authorized Pfizer/BioNTech Covid-19 vaccine for use in children as young as six months old. Also, some doctors believe that new variants will continue to emerge following a six-month cycle. Of course, there is no way for anyone to know the extent and duration of the future impact. However, it is safe to say that it won’t be “one and done,” and Pfizer will continue to benefit.

Pfizer Q1 2022 Highlights (Pfizer Investor Relations) Paxlovid Utilization Trajectory (Pfizer Investor Relations)

Strong And Well Managed Growth Trajectory

It is always critical for a pharmaceutical company to maintain a healthy pipeline. In that regard, Pfizer is doing an outstanding job. They have 89 total projects in the pipeline, and 37 of them are in Phase 3 or later. Some blockbuster candidates in the pipeline include a Lyme Vaccine, Hemophilia therapy, and atopic dermatitis treatment.

Not only is Pfizer maintaining a strong pipeline for organic growth, but they have also been acquiring companies to beef up their growth. Recently, they acquired ReViral (antiviral targeting respiratory syncytial virus), Arena (Oral Ulcerative Colitis Drug), and Biohaven (dual acting migraine therapy). Even after purchasing these three companies, Pfizer’s Covid-19 windfall leaves plenty of cash remaining for future deals. These acquisitions will certainly boost their growth trajectory and positively impact revenue and profit in the future.

R&D Pipeline (Pfizer Investor Relations)

Here is the potential market value of several pipeline therapies.

Lyme Disease Vaccine

The Lyme disease market is over $600 M as of 2020, and it is expected to grow to over $1 B by 2028. At this point, VLA15 of Pfizer is the only Lyme disease vaccine candidate in clinical trials. Capturing this market will add a significant revenue stream for Pfizer and growth.

Hemophilia Treatment

Pfizer currently has a strong portfolio of therapies for Hemophilia (Gene Therapies for Hemophilia A and B, and laboratory-engineered monoclonal antibody, Marstacimab). The market for Hemophilia treatment exceeded $11.1 B in 2021, and is estimated to grow around 5% per year. Therefore, capturing part of this market will significantly boost Pfizer’s growth trajectory.

Antiviral For Respiratory Syncytial Virus

An antiviral drug for Respiratory Syncytial Virus (RSV) could shorten the recovery time for patients hospitalized with serious respiratory infections. RSV infections hospitalize over 250,000 young children and senior citizens every year in the U.S. There is no effective drug yet for RSV, making Pfizer’s Sisunatovir a promising potential treatment for this population.

Financial Strength And Profitability

Pfizer is clearly top of the line in terms of profitability. Across the board (gross profit, EBIT margin, net income margin), Pfizer’s profit margins are far above the sector medians. These high profit margins are not really surprising since Pfizer has one of the strongest economic moats with patent protection, technological superiority, and brand recognition.

With this strong profitability and cash generating ability mentioned above, Pfizer truly holds a formidable financial position. They have a total of $23.9 B cash, with a liquidity position above the industry average. Their current ratio (1.39x) and quick ratio (1.02x) are higher than competitors (Eli Lilly or Novo Nordisk). With this strong balance sheet, Pfizer won’t have any problem supporting acquisitions, R&D, and operations regardless of whether the economy is in a boom or bust cycle.

Fair Value Estimation

Since it’s nearly impossible to estimate the long term demand for Covid-19 therapies, an intrinsic value using DCF calculation is unreliable. If I apply my standard approach (operating cash flow of $34 B, expected growth rate of 23%, and etc.), Pfizer’s intrinsic value should be well above $100 per share. As mentioned, I do believe Pfizer will continue to benefit from Covid vaccines and treatments in the near-term as new variants repeatedly appear, albeit at a reduced level from 2021-2022. Also, Pfizer has a formidable pipeline, strong balance sheet, pending acquisitions, and is in a position to aggressively move to support growth.

Looking at valuation metrics, their P/E ratio (10.48x) and Price/Sales ratio (2.51x) is below the sector median and their historic average. Therefore, Pfizer is undervalued according to valuation metrics as well. Current market volatility and uncertainty around Covid-19 therapies is creating a great entry point, so investors should take advantage of the opportunity.

Cappuccino Stock Rating

| Weighting | PFE | |

| Economic Moat Strength | 30% | 5 |

| Financial Strength | 30% | 5 |

| Growth Rate vs. Sector | 15% | 4 |

| Margin of Safety | 15% | 5 |

| Sector Outlook | 10% | 4 |

| Overall | 4.8 |

Economic Moat Strength (5/5)

Pfizer has a clear economic moat protected by patents, brand recognition, and technological superiority. With heavy spending on R&D and acquisitions, I believe Pfizer will maintain this economic moat well into the future.

Financial Strength (5/5)

Pfizer has been a cash generating machine for a while, and the recent boost from the Covid-19 vaccine and treatment only added to their success. Their cash position is very strong ($23.9 B) and liquidity is above industry average. With a cash dividend payout ratio of 28%, Pfizer’s dividend is pretty safe.

Growth Rate (4/5)

Pfizer is set up well for future growth. Given their enormous size, I don’t expect them to grow faster than sector median on a consistent basis. Organic growth from their R&D pipeline and inorganic growth from recent acquisitions will boost growth.

Margin of Safety (5/5)

As mentioned in the fair value estimation section, Pfizer is undervalued at this point. DCF calculation and valuation metric both show that Pfizer is being traded at a bargain price. Investor should take advantage of the current set-up.

Sector Outlook (4/5)

Healthcare and pharmaceutical industry is positioned well for the future. With the advancement of technology and an aging population, the need for healthcare will only grow. Also, healthcare is usually an essential item, so the major players tend to be recession resistant.

Risk

Even though I believe the tailwind from Covid-19 will last for the foreseeable future, the magnitude and duration are unknown. Therefore, until we have a better idea how the future revenue stream will shape up (e.g., annual booster vaccine for Covid-19 like flu shots), the stock price won’t follow its intrinsic value.

Pfizer has plenty of experience with acquisitions and successfully incorporating those companies into their business model, but the acquisition process inherently contains high risk. The incorporation process may take longer than planned, or worst case, the drugs in the pipeline of the acquired company may not even materialize. Some deals end up bringing in enormous revenue, but the investor should be wary of assuming that will be the case.

Conclusion

Pfizer has been an outstanding investment for a long time. With a huge influx of cash from Covid-19 related products and a strong pipeline, Pfizer is set up well for future growth. Current market volatility has created a great opportunity for investors to grab Pfizer shares. The murky outlook around Covid-19 and the ability of recent acquisitions to replace Covid-19 growth bring some uncertainty, but I believe Pfizer is positioned for continued strong growth. Also, the current dividend yield of 3.4% is a big plus.

Marketplace In Preparation

Thank you all for reading my article. I’m in preparation for a Marketplace launch soon. Please get excited! Also, let me know the types of analysis or information you would like to see more of in my articles. I will take that into consideration for the marketplace. Thank you all for your support!

Be the first to comment