Joe Raedle

Pfizer (NYSE:PFE) stock price decreased by 16% in the last six months as the company’s COVID-19 vaccine sales are expected to decrease. However, investors are ignoring the Paxlovid revenues, which I estimate to be more than $12 billion in the second half of 2022. Moreover, my analysis shows that due to its healthy financial position, Pfizer can stay profitable even with lower 2H 2022 COVID-19 vaccine sales. I am bullish on Pfizer stock.

2Q 2022 highlights

In its 2Q 2022 financial result, Pfizer reported revenues of $28 billion, compared with 2Q 2021 revenues of $19 billion, up 47%, driven by strong contributions from Paxlovid and Comirnaty. In the second quarter of 2022, Pfizer recorded the highest quarterly sales in its history. The company’s net income increased by 78% YoY from $5.6 billion in 2Q 2021 to $9.9 billion in 2Q 2022. Pfizer announced a 2Q 2022 adjusted income of $11.7 billion, or $2.04 per diluted share, compared with a 2Q 2021 adjusted income of $6.0 billion, or $1.06 per diluted share. The company’s cost of sales increased from $7.0 billion in 2Q 2021 to $8.7 billion in 2Q 2022. Also, Pfizer increased its R&D expenses from $2.2 billion in 2Q 2021 to $2.8 billion in 2Q 2022. “Pipeline programs that have achieved milestones since previous earnings release include bivalent mRNA COVID-19 vaccine, enhanced mRNA COVID-19 vaccine, Paxlovid, modRNA, influenza vaccine, once-daily oral GLP-1 receptor agonist and anti-interferon-β,” the company announced. For the first time in the industry, Pfizer launched an initiative to distribute its medicines and vaccines to the 1.2 billion people living in 45 lower-income countries at not-for-profit prices. “Even while launching these initiatives to support a healthier, more equitable world, we remain equally committed to strong financial execution on behalf of our shareholders,” the CEO explained.

The market outlook

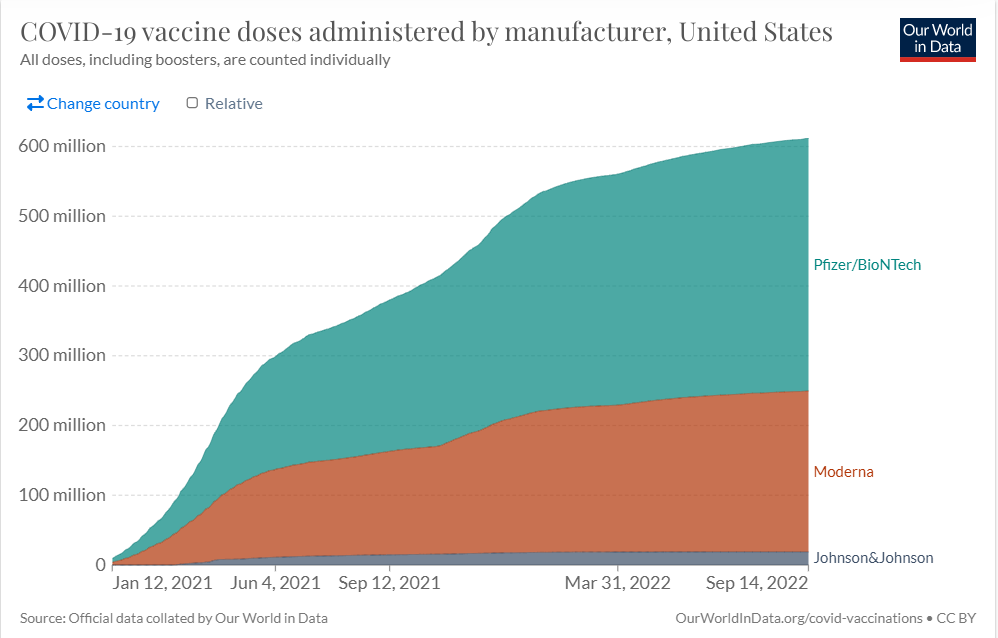

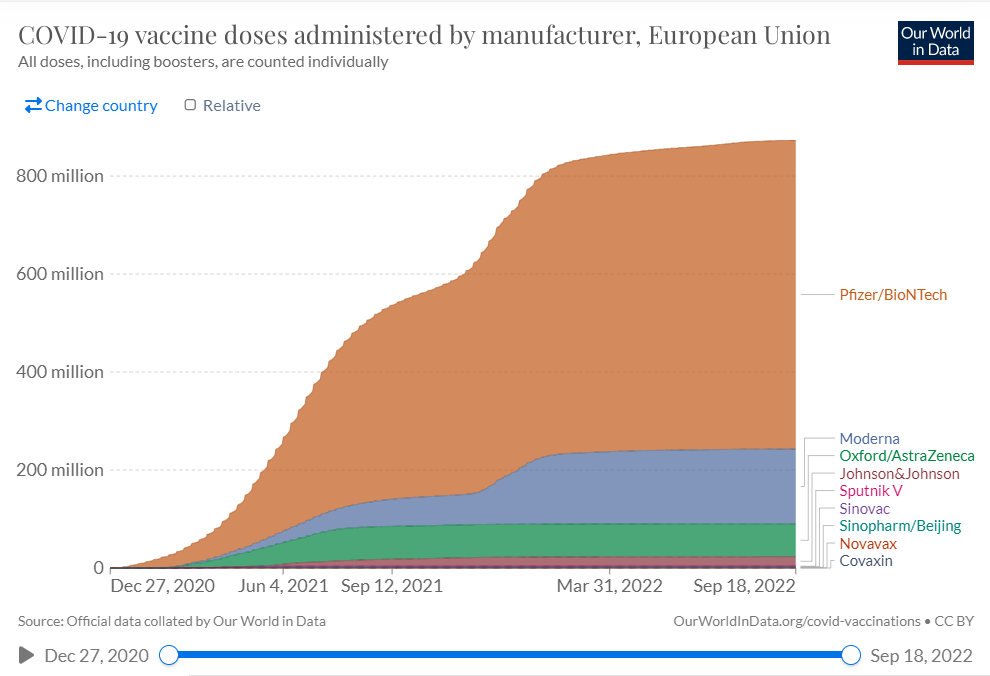

According to ourworldindata.org, 68% of the world population has received at least one dose of a COVID-19 vaccine. More than 4 million doses of COVID-19 vaccines are administered each day. Moreover, more than 75% of people in low-income countries haven’t received at least one dose of the COVID-19 vaccine. Figure 1 shows the number of Pfizer/BioNTech COVID-19 vaccine doses administered in the United States increased from 331 million on 31 March 2022 to 352 million on 30 June 2022, or 231000 doses per day during the period. From 30 June 2022 to 14 September 2022, Pfizer/BioNTech COVID-19 vaccine doses administered in the United States increased to 363 million, or 145000 doses per day during the mentioned period. Also, according to Figure 2, Pfizer/BioNTech COVID-19 vaccine doses administered in the European Union increased from 606 million on 31 March 2022 to 620 million on 30 June 2022, or 154000 doses per day during the period. From 30 June 2022 to 18 September 2022, Pfizer/BioNTech COVID-19 vaccine doses administered in the European Union increased to 631 million, or 138000 doses per day during the mentioned period. My calculations indicate that the share of Pfizer/BioNTech vaccine doses administered worldwide decreased from 64.05% in 1Q 2022 to 63.96% in 2Q 2022, and increased to 65.14% in 3Q 2022 (as of 19 September 2022). However, Pfizer/BioNTech vaccine doses administered globally decreased from 858000 per day in 2Q 2022 to 566000 per day in 3Q 2022 (as of 19 September 2022). Thus, despite the increased share of Pfizer/BioNTech COVID-19 vaccine during the third quarter of 2022, I expect Pfizer revenues from its COVID-19 vaccine to decrease in 3Q 2022.

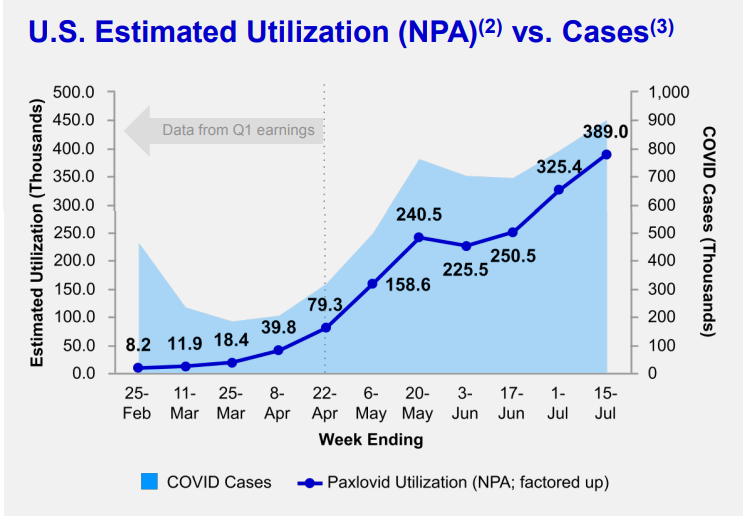

On the other hand, I expect the company’s revenue from selling Paxlovid to increase in the third quarter of 2022. In June 2022, Pfizer announced the submission of an NDA to the FDA for approval of Paxlovid for the treatment of COVID-19 in both vaccinated and unvaccinated individuals who are at high risk for progression to severe illness from COVID-19. On 6 July, FDA revised EUA to authorize state-licensed pharmacists to prescribe Paxlovid under certain conditions. According to CDC, Paxlovid is one of the two preferred antiviral drugs for those who are at high risk for progression to severe COVID-19. CDC says that 50-60% of the U.S. population aged 12 and older will experience one or more risk factors for progressing severe COVID-19 illness. Pfizer has reaffirmed the 2022 Paxlovid revenue guidance of $22 Billion. In the second quarter of 2022, Pfizer’s Paxlovid sales were $8.1 billion. In the first half of 2022, the company’s Paxlovid sales were $9.6 billion. As of 15 July, there were more than 41000 sites with Paxlovid supply in the United States. Figure 3 shows that Paxlovid utilization increased significantly in the first month of 3Q 2022. Aldo, from 24 June 2022 to 15 July 2022, Paxlovid usage across international developed markets increased by 116%. Thus, I expect the company to record $12 billion in Paxlovid revenues in 2H 2022.

Figure 1 – COVID-19 vaccine doses administered in the United States (by manufacturer)

Our World in Data

Figure 2 – COVID-19 vaccine doses administered in the European Union (by manufacturer)

Our World in Data

Figure 3 – Paxlovid is getting more popular in the United States

2Q 2022 presentation

Pfizer performance outlook

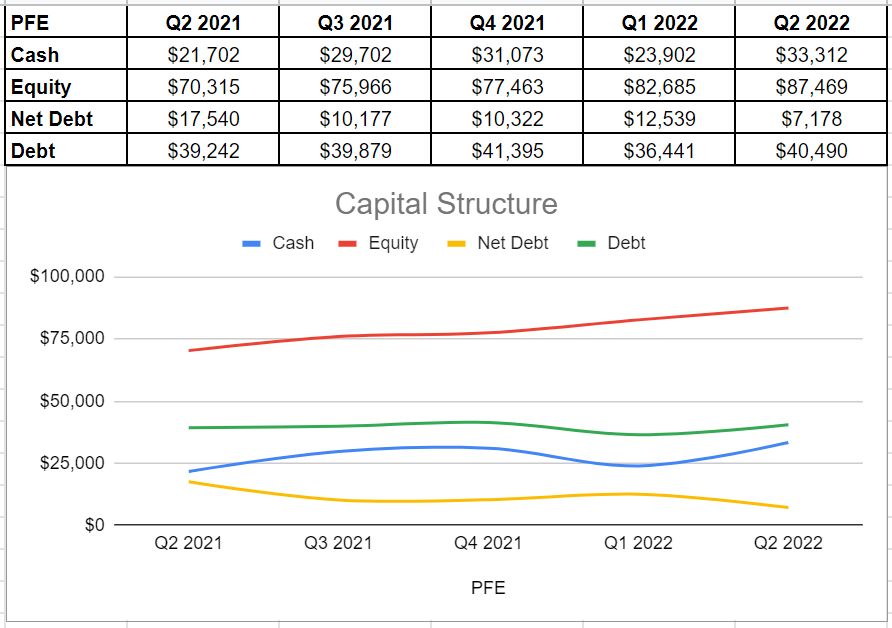

In the following section, I provided a detailed analysis of Pfizer’s capital structure for those readers who wish to scratch beneath the surface. In the second quarter of 2022, Pfizer saw an impressive 39% higher cash which was $33.3 billion, versus the previous result of $23.9 billion in the first quarter of 2022. Notwithstanding an increase in the company’s total debt, its net debt declined by 42% and sat at $7.17 billion in Q2 2022. This was for the sake of its cash growth, which surpassed its debt increase. Also, it is worth mentioning that Pfizer’s equity surged amazingly during 2022 compared with its level at the same time in Q2 2021. In Q2 2022, total equity surged and sat at $87.46 billion versus its level of $70.3 billion in Q2 2021 (see Figure 4).

Figure 4 – PFE’s capital structure (in millions)

Author (based on SA data)

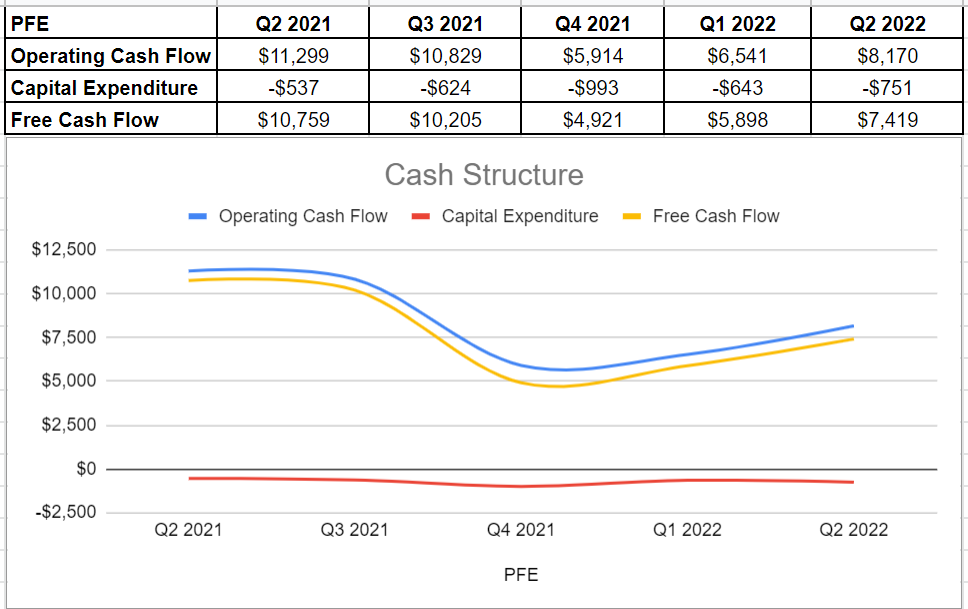

More detailed analysis by analyzing the company’s operating conditions shows that Pfizer’s operating cash flow increased from $6.54 billion in the first quarter to $8.1 billion in the second quarter of 2022. Albeit lower cash operation in Q2 2022 versus the same time in 2021, the company’s current projects are likely to bring more operating cash in the rest of the 2022. Also, Pfizer’s capital expenditure saw an increase from $643 million in Q1 to $751 million in Q2 2022. When all was said and done, the company’s free cash flow ultimately sat at $7.4 billion at the end of the second quarter, which is 25% higher than its level of $5.9 billion at the end of the first quarter of 2022. Thus, Pfizer’s cash structure illustrates a healthy and well-performed operation position to address a brighter future (see Figure 5).

Figure 5 – PFE’s cash structure (in millions)

Author (based on SA data)

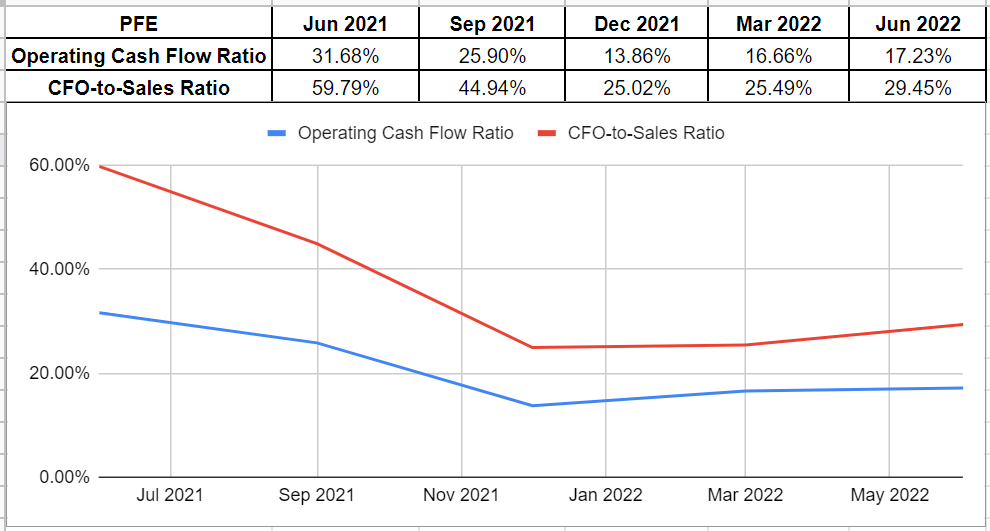

Under the lens of the company’s liquidity and performance conditions, I investigated Pfizer’s operating cash flow and CFO-to-sales ratios. PFE’s operating cash flow ratio increased gradually during 2022 and sat at 17.2% in recent quarter although it is still deeply lower than its amount of 31% in Q2 2021. This ratio indicates how well the company is able to pay off its current liabilities with the cash flow generated from its business operations. To shed some light, at the end of the second quarter, Pfizer could cover its current liabilities 17.2x over. Furthermore, PFE’s CFO-to-sales ratio increased by 396 bps to 29.45% compared with its 25.49% in the first quarter of 2022. Overall, a decline in the company’s liquidity conditions compared with the same time in last year is greatly due to the decline in COVID-19 vaccine sales, but its current situation is well enough to bring more benefits in the future (see Figure 6).

Figure 6 – PFE’s financial metrics

Author (based on SA data)

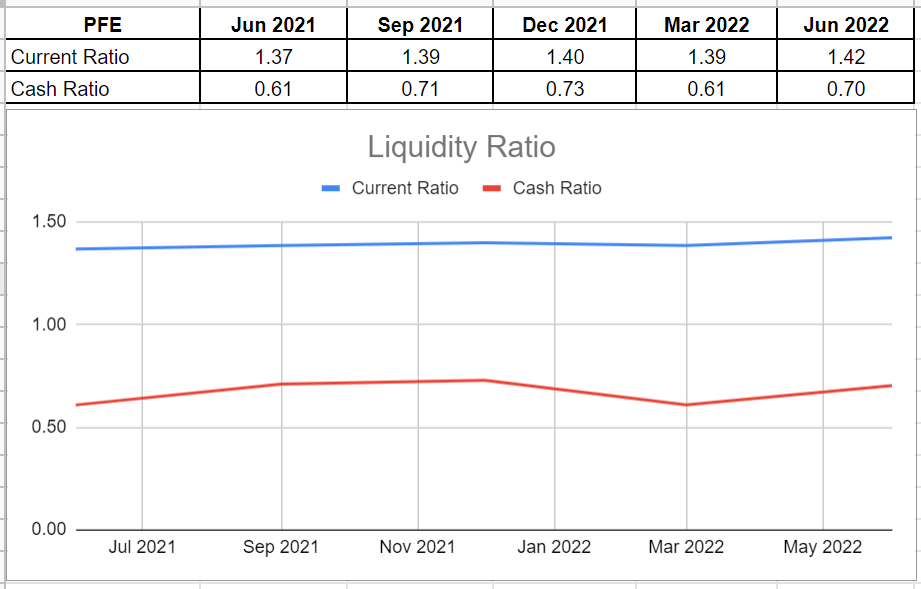

Its current ratio has been quite steady during the last year: Pfizer’s current ratio in Q2 2022 sat at 1.42x compared with its amount of 1.39x at the end of last quarter. On the other hand, its cash ratio indicates an increase back to 0.7x in the Q2 2022 from 0.61x in the first quarter of 2022 after a decline from 0.73x at the end of 2021 (see Figure 7).

Figure 7 – PFE’s liquidity ratios

Author (based on SA data)

Conclusion

In short, after covering a more detailed analysis of Pfizer’s cash and capital structure and analyzing some financial metrics, it is observable that the company has performed well and is in an acceptable financial condition. Also, despite lower COVID-19 vaccine sales in the following quarters, Pfizer’s Paxlovid revenues are expected to be strong in the second half of 2022. In short, based on the recent financial prospects, I believe that Pfizer stock has a bright future and is a buy.

Be the first to comment