Fokusiert

Interest-rate-sensitive assets have been challenged in 2022 as high inflation has eroded asset values. As long-term and short-term interest rates have risen, most rate-sensitive assets have faced material declines. One particularly exposed asset class has been preferred equities such as those in the popular Virtus InfraCap U.S. Preferred Stock ETF (NYSEARCA:PFFA).

PFFA’s price had declined by around 11.2% this year, reaching its last bottom in June when its price was temporarily down by over 17%. PFFA has bounced dramatically higher since then but has experienced a small renewed bout of weakness over the past week. With this in mind, many investors are likely wondering if the rally in preferred equities, and most other assets, is a recovery or a bear-market rally that proceeds to a more significant drawdown.

I covered PFFA a year ago in “PFFA: Leverage, Preferred Stocks, And Rising Rates Do Not Mix.” At the time, I was among the few sounding the alarm on preferred equities as, although interest rates were low last August, it seemed rising inflation would soon trigger an increase in interest rates. Given PFFA’s leverage and high exposure to highly levered segments (such as mortgage REITs), it appeared the fund might face considerable losses.

That article was published when PFFA was at $25.10, near its cycle peak. PFFA’s price is around 12% lower today, but its total loss is closer to 5% due to its dividend yield. Looking forward, I believe PFFA’s more significant losses may still be on the horizon. The fund has high exposure to highly levered real estate firms that have suffered considerable equity drawdowns this year. Combined with the fund’s leverage, I still believe this is a recipe for greatly compounded losses. Further, current market dynamics suggest long-term interest rates may not have peaked. If long-term interest rates rise another wave higher, I believe PFFA may see drawdowns similar to 2020, but likely without such a rapid recovery.

PFFA’s Compounded Interest Rate Exposure

Many investors see preferred equities as a means of obtaining high dividend yields with less risk than common stocks. In general, preferred equities pay much higher yields and have a lower chance of loss than common stocks since they have priority in the case of bankruptcy. However, most investors, and models, focus on the performance of preferred equities over the past decades, which have been marked by low, and often falling, interest rates combined with low inflation. In my view, this factor has biased many not to see the relatively large inflation and interest-rate risk of preferred equities.

Higher interest rates directly lower the fair value of most preferred equities with fixed rates. For example, a perpetually paying preferred equity with a 9% yield should lose around 10% of its value if long-term Treasury rates rise by 1% (calculated as old yield over new yield or 9% ÷ (9% + 1% competitive rise from the change in Treasuries). In general, the lower the interest rate on preferred equity, the higher its interest rate sensitivity as a 4% yielding preferred stock would lose around 20% of its price if its yield rose to 5% on a 1% rise in Treasury rates.

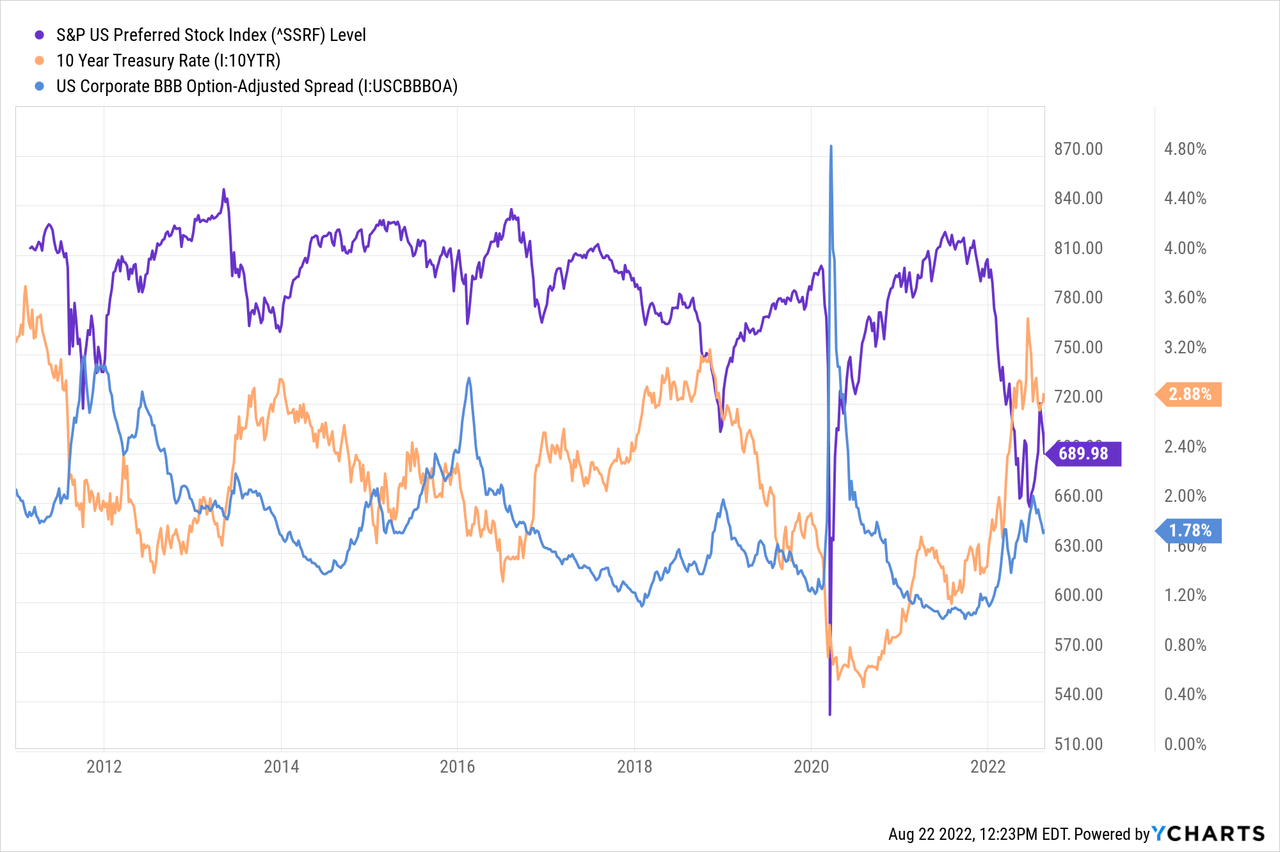

Variable-rate preferred equities have no direct interest rate risk, and some preferred have maturity dates, call options, or fixed-to-floating mechanics that mitigate interest rate risk. Still, there is a strong negative correlation between the 10-year Treasury rate and the U.S. Preferred stock index. Additionally, an increase in corporate bond credit risk, usually associated with economic slowdowns, negatively impacts preferred equities. See below:

Depending on credit risk and specific preferred equity mechanics (call options, etc.), preferred yields are usually very similar to yields on BBB to CCC rate corporate bonds. Often, preferreds have a higher sensitivity to interest rates than corporate bonds due to their long-term or infinite maturity lengths. In the case of a significant economic recession, preferred often carry more credit risk as companies can temporarily slash preferred equity dividends without bankruptcy.

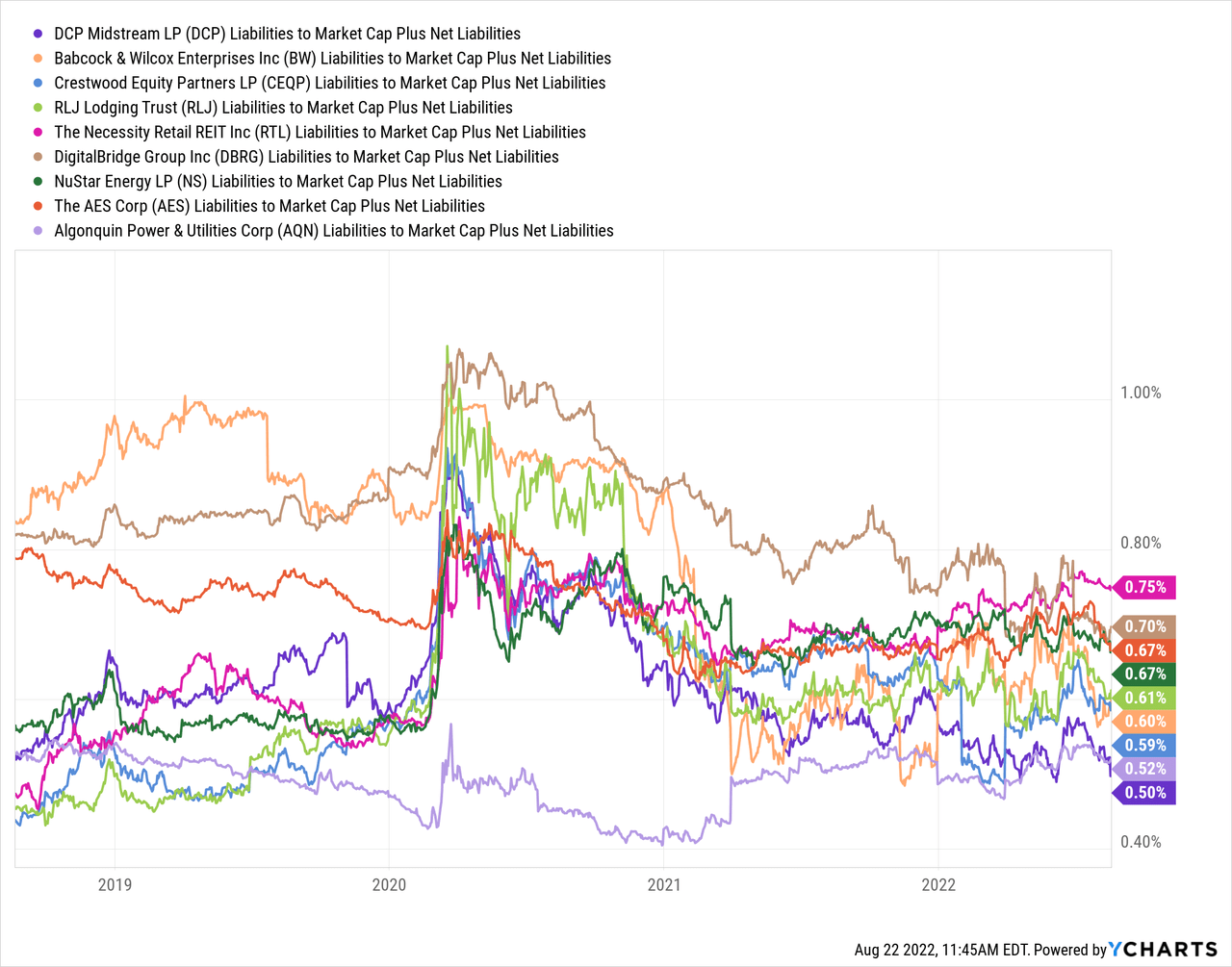

Most companies that issue preferred equities have higher leverage and operate in capital-intensive industries such as banking, real estate, utilities, and energy. Financial debt-to-EBITDA metrics vary wildly across the top holdings in PFFA (due to earnings volatility), and total liabilities-to-assets do not fully account for non-balance sheet assets. Considering preferred equities are protected by the value of common stocks, I believe the “liabilities-to market cap plus net liabilities” is a good measure for PFFA’s holding leverage. This measure is a proxy for “total liabilities-to-assets” but accounts for the market value of equity instead of the book value of equity. As you can see below, the top holding’s in PFFA have around 60% liabilities to enterprise value.

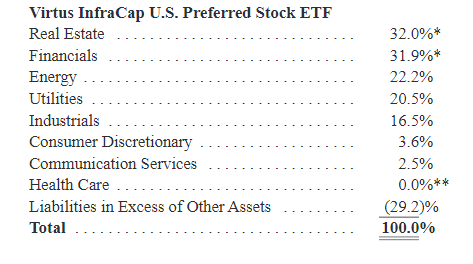

Note, the charting system decimal is off, so “0.60%” equates to 60%”. The “total liabilities to assets” of these firms tend toward the same median of ~60% but have greater variability due to differences in book value and market value. The fund’s last total sector exposure is shown below:

PFFA Sector Exposure (Virtus Semi-Annual Report 2022)

Most of these companies are in capital-intensive sectors such as utilities, financials, real estate, and energy, so they naturally operate at higher leverage. Their high leverage was not an issue when interest rates were falling but may soon become a larger one now that rates have risen. These firms will likely see interest costs rise significantly over the coming years as their debt is rolled forward at higher interest rates. If interest rates remain high, many of these firms may see their credit risk grow significantly as more of their income goes to repaying debt, meaning less is available to preferred equity.

Interest Rates May Still Rise Higher

The core issue I see with PFFA is that its interest rate risk is compounded not only by the relatively high leverage of its holdings but also by its own ~30% in leverage. Investors will also see lower benefits from this leverage as short-term interest rates rise and increase PFFA’s borrowing costs (which are likely near the Fed Funds Rate). During times of sustained moderate economic growth and low and stable inflation, PFFA’s strategy is a great way to boost dividend returns. However, today, economic growth slumps while inflation remains abnormally high, making it possible for PFFA to face rapid declines as credit and interest rate risks grow simultaneously.

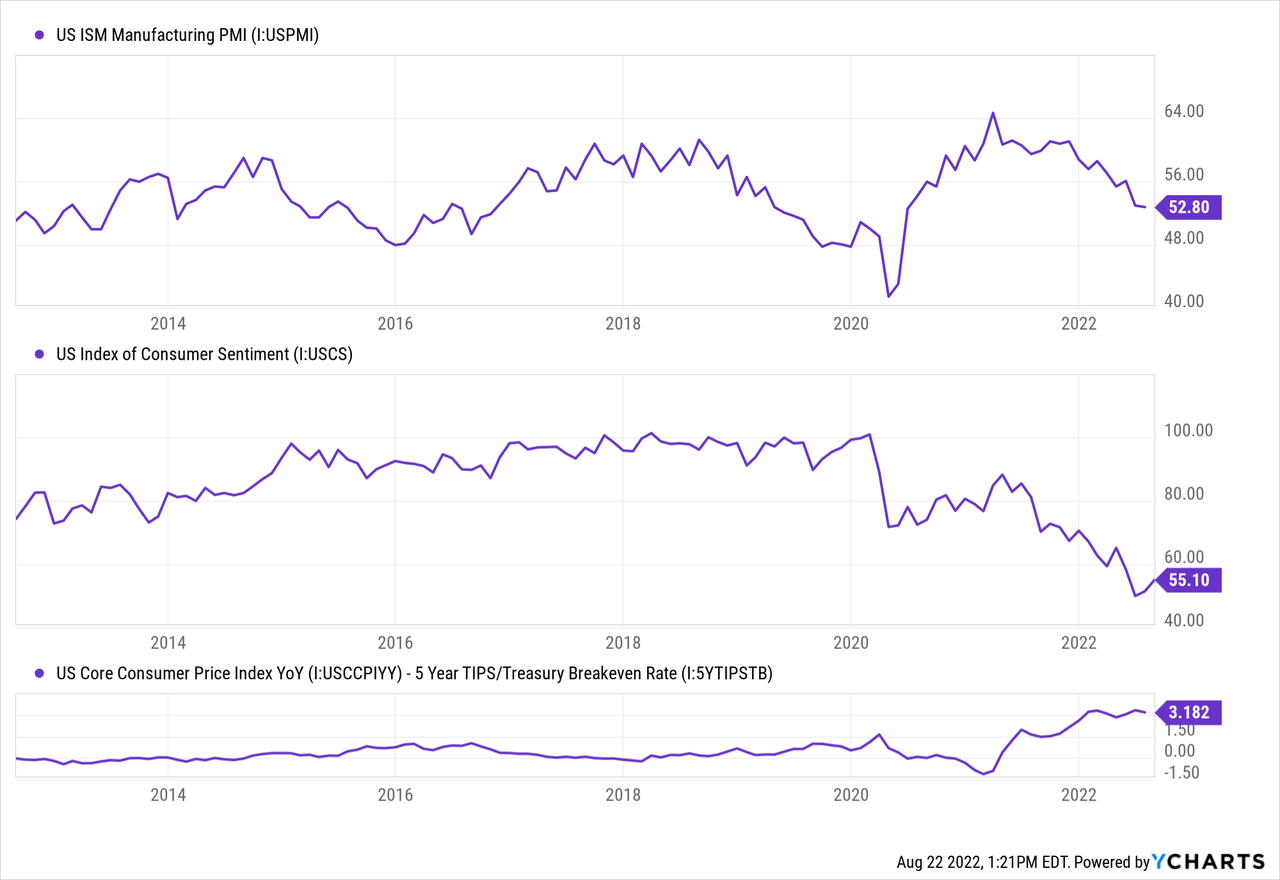

The U.S. manufacturing PMI shows a clear slowdown in business activity, while abysmal consumer sentiment shows personal spending is likely waning. Further, core inflation remains around 3.2% above the Treasury market’s “expected” five-year average inflation rate. See below:

It is relatively clear that the U.S. economy is slowing. The inflation outlook has weakened with economic data, but this may be primarily due to the recent decline in oil prices. Core inflation continued to rise in July. Further, even if energy demand slows, ample evidence suggests commercial oil inventories may decline further, promoting another wave higher in crude oil and natural gas. A further increase in energy prices would boost inflation and potentially higher interest rates. Higher natural gas prices may create a financial strain for the utility companies in PFFA (see the debt crisis in European utilities).

Even with the 10-year Treasury rate at a long-term high of around 3%, I do not believe it is high enough given today’s 8-9% inflation rate. The market assumes inflation will rapidly return to normal levels as the economy slows and the Federal Reserve hikes interest rates. However, commodities may rise higher and extend inflation. Further, the job quits rate remains very high, signaling a growing “wage-price spiral.” Overall, I believe these economic factors clearly show strain on preferred equities, particularly PFFA.

The Bottom Line

Overall, I am very bearish on PFFA and believe it will likely continue declining over the coming months as interest rates and credit risks rise simultaneously. PFFA’s downside risk is more considerable than that of most other preferred equity ETFs due to its leverage. Based on my base case view that the U.S. is headed for (and truly already in) a stagflationary recession, I would not be surprised to see PFFA trading near its 2020 recession lows of $10-$15 by next year. Further, because the Federal Reserve will need to be extremely careful about restarting Q.E. given high inflation, PFFA may not recover nearly as quickly as it did in 2020.

My bearish thesis could be proven wrong under a few circumstances. One, if there is a swift peaceful end to the Russia conflict that frees up energy supplies and renews international trade flows, inflation may decline, and the economy may stabilize to the benefit of preferred equities. Second, if the labor shortage clears while consumption demand rises, the stagflation economic risk to PFFA would be mitigated. In my view, at this point, it is highly unlikely economic demand will increase or that inflation will decline. However, PFFA’s downside risk would be significantly lower if so.

Investors may find a better alternative in floating rate preferred equities such as (PFFV) since they carry less direct interest rate sensitivity. However, PFFV still has significant credit risk, a more crucial bearish factor given the waning economy. In my opinion, Midstream energy assets such as (AMLP) are a decent option in my view since they have high yields (similar to PFFA) and have positive exposure to most of today’s economic trends. Still, with the market’s seeing yet another spout in volatility, it may be best to build an ample cash supply to buy more reasonably-priced opportunities in the future.

Be the first to comment