designer491

The preferred equity market has had a challenging year, with top preferred funds like iShares Preferred and Income Securities ETF (NASDAQ:PFF) erasing ~18.5% of their value YTD. That loss is nearly four years of the ETF’s 2021 dividend yield. Many preferred equities are now trading back at 2020 “crisis crash” lows, creating a potential support level for the equity class. Of course, preferred equities are subject to numerous headwinds, including a potential continued rise in inflation and deterioration in the health of countless financial entities.

Despite preferred’s “lower risk” aura, they have lost more value than common stocks over the past year. I warned about this possibility last December in “PFF: Preferred Equities Are Riskier Than Common Stocks Today,” explaining that a significant potential rise in long-term interest rates would likely catalyze significant losses for PFF and its constituents. In 2022, PFF has seen its price decline by ~2-3% more than the S&P 500 as higher long-term interest rates lower the present value of fixed-income assets like preferred equities.

Looking forward to 2023, I believe PFF is subject to fundamentally different risks. As long as inflation does not rise higher, it seems unlikely that long-term interest rates should continue to increase. Accordingly, PFF’s largest threat in 2022 is likely not as significant in the future. If the Federal Reserve reverts to a dovish stance and inflation falls dramatically, lower interest rates may boost PFF’s value. Of course, that possibility would likely require a sharp decline in economic activity, which may be bearish for PFF by increasing the credit risks in its holdings.

Even if the economy slows, I believe the energy shortage could cause inflation to remain high or even rise higher, despite an economic slowdown. That possibility is certainly not guaranteed, but it could create even more considerable compounded losses for PFF if interest rates continue to rise as economic activity slows. Overall, I believe PFF is likely headed even lower in 2023; however, its risk profile is probably not as large as it was late last year.

Preferred Equities and Long-Term Rates

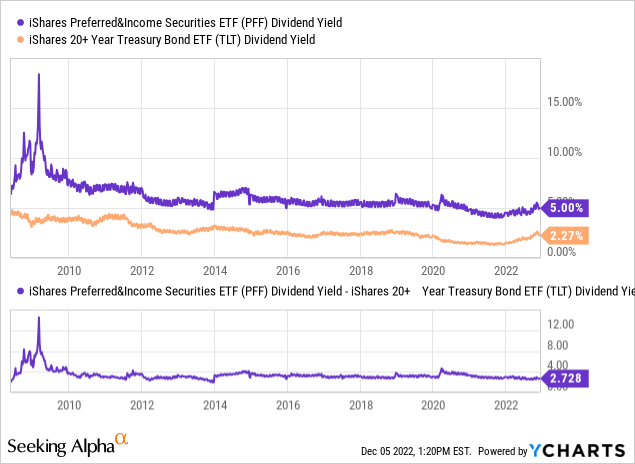

All fixed dividend preferred equities carry significant exposure to interest rates. As Treasury bond yields rise, investors could find superior returns in those lower-risk bonds, causing PFF’s “fair yield” to increase proportionally to longer-term Treasury rates. In general, PFF pays a dividend yield ~2.5-3.5% above that of the long-term Treasury bond ETF (TLT). Today, PFF’s yield is ~2.75% above TLT’s, indicating it is roughly appropriately valued. The only time its yield deviates significantly from Treasuries is during periods of economic turmoil, such as 2008-2011 and, albeit much less pronounced, in early 2020. See below:

PFF’s SEC yield today is 6.15%, above its TTM level, since interest rates and yields have grown over the past year. TLT’s SEC yield is also higher than its TTM level at 3.75% today, so the spread between the two remains normal at ~2.4%. Keeping the spread constant, another 1% rise in long-term Treasury rates (increasing PFF’s dividend to 7.15%) would lower PFF’s price by around 14% (assuming payments are constant). Conversely, a 1% decline in interest rates (dropping PFF’s dividend back to 5.15%) would increase the fund’s value by ~20%, bringing its price back to pre-2022 levels.

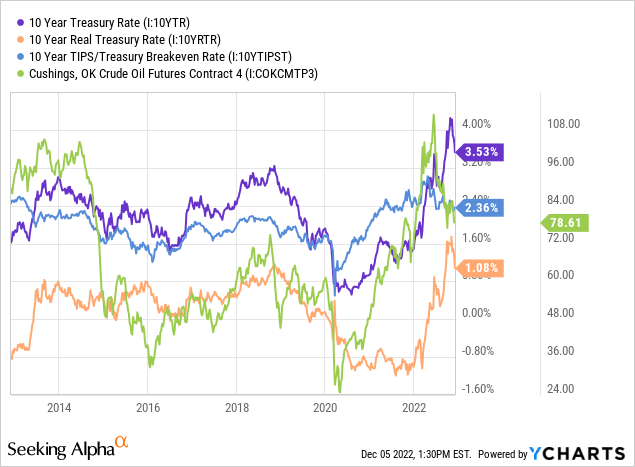

There are a variety of factors influencing long-term interest rates today. To gauge 2023’s interest rate potential, I break the rate into two primary components: inflation expectations and real interest rates (rates after expected inflation). Real interest rates more closely fluctuate with changes in the long-term Federal Reserve policy outlook, primarily determined by real economic activity. When real GDP growth is high, the Federal Reserve becomes hawkish, and real interest rates rise and vice versa. On the other hand, inflation expectations are more closely correlated to the price of crude oil, which drives global inflation and is outside the Federal Reserve’s sphere of direct influence. See the data below:

In the orange line above, real interest rates are pretty high today and appear to be peaking. A decline in real interest rates is supported by negative trends in US and global real economic growth and falling future growth indications. This factor implies interest rates may decline.

The expected long-term inflation rate has also declined amid a sharp fall in the price of crude oil from spring levels. If energy prices continue to slide, interest rates could be headed much lower as both inflation and real rates may fall simultaneously. That said, I doubt oil and inflation can fall too fast due to OPEC+’s apparent willingness to cut production in response to lower prices (and a waning demand growth outlook). A variety of other factors in the US market (low storage, slowing production growth, etc.) may also prove bullish for crude oil. With that in mind, I would not bet too much on lower interest rates since these factors could cause inflation to remain elevated for longer than many expect.

Still, there is minimal strong evidence that interest rates should continue to rise since slowing economic growth promotes lower real interest rates and more-dovish Federal Reserve policies. That was the primary factor influencing my bearish outlook on PFF last year. A sharp rise in energy prices would certainly renew the “inflation” bearish catalyst, but PFF appears to be safe from further inflation-caused deterioration.

Large Financial Holdings Could Spell Trouble

Around 2008, PFF temporarily lost around 70% of its peak value as banks and other firms in the financial industry experienced massive and rapid declines. PFF’s yield rose exceptionally quickly, from around today’s level to nearly 17% in months. Many investors expected banks to face bankruptcy, causing many preferred equities to be wiped out or turned into common stocks (at a significant loss). Fortunately, this did not often occur due to the government’s bank bailout, interest rate cuts, and the first wave of quantitative easing. In my opinion, that experience has caused many investors to over assume the probability of the government and Federal Reserve pursuing similar actions if another financial crisis occurs.

There have been no significant recessions since 2008, considering the 2020 crash was short-lived and stemmed from non-economic forces. Of course, the 2020 crash caused massive QE and interest rate cuts, spurring the inflationary crisis plaguing markets today. Most importantly, today’s high inflation level substantially lowers the probability of more QE or other stimulative measures in the event of a significant recession or financial crisis since doing so could considerably worsen inflation (see record declines in foreign currencies this year). Today, there is a very high probability of the US entering a prolonged recession, but the Federal Reserve is continuing to hike short-term interest rates. As mentioned earlier, idiosyncratic issues in the energy market could also cause inflation to remain high even with moderate declines in economic demand, limiting the Federal Reserve’s ability to bail out banks or provide significant liquidity to financial markets.

Around 70% of PFF’s assets are in financial institutions, up from ~61% a year ago. Over half of the assets in PFF do not carry “investment-grade” credit quality, indicating potentially significant exposure to economic and financial risk factors. This year, most large banks have seen moderate declines in EPS as financial service demand has plummeted. Certain large international banks, such as Credit Suisse (CS) and Deutsche Bank (DB) (to which PFF is not directly exposed), are arguably facing the most significant financial strain since 2008, opening the door to potential systemic liquidity issues.

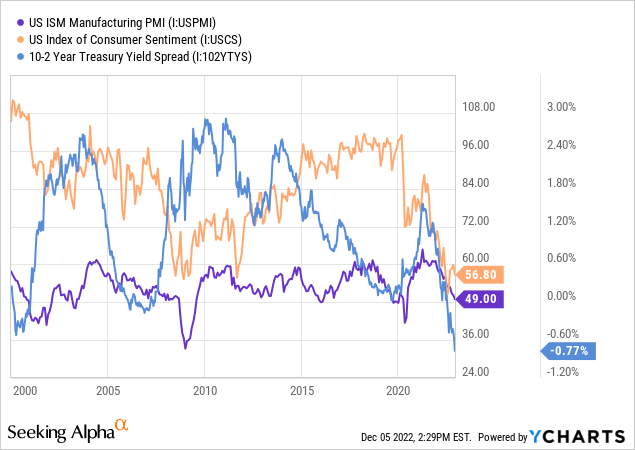

The US yield curve is also the most inverted it has been in many decades, with the 2-year yield ~80 bps above the 10-year yield. Over time, inverted yield curves are highly problematic for banks because they increase borrowing costs disproportionately to loan returns, compressing net-interest margins. Since default rates are low, most banks appear more solvent than in 2008, but that could change quickly if the economy continues to shift into a lower gear. Combined with a low (and falling) PMI and abysmal consumer sentiment, the immense yield curve inversion indicates a high probability of a prolonged economic downturn. See below:

At this point, there are no strong concrete indications that PFF will suffer as severe a decline as it did in 2008, but leading indicators are arguably more bearish than they were in 2008. That potentiality will likely become more apparent over the coming weeks and months as “leading” economic indicators (such as those above) change the tune in “lagging” indicators (GDP growth, inflation, defaults, unemployment, etc.). Fundamental changes to the economic structure may lower the efficacy of these historically strong leading indicators; however, I see little reason for that.

The Bottom Line

Overall, I believe PFF may decline over the next year due to its immense financial exposure, the falling economic outlook, growing banking risks, and the Federal Reserve’s likely inability to “save” the market again. Looking forward, it seems generally unlikely that PFF will continue to fall directly due to higher long-term interest rates. That factor could cause PFF to remain in a range for some time and temporarily boost its value. However, if banks suffer a significant decline in solvency, as I suspect will occur in 2023, PFF could lose even more value than it has this year. Further, if inflation remains elevated and the government/Federal Reserve cannot aid the market, PFF’s losses may be permanent as some of its lower-quality holdings face restructuring.

I have a bearish outlook on PFF and believe it offers low potential returns and relatively high downside risk today. That said, I would not bet against the fund since the market has not yet realized the seemingly high probability of negative economic catalysts in 2023. Once common banking stocks decline in value, PFF may become a stronger short opportunity as credit risk spreads increase.

Be the first to comment