Andrii Yalanskyi

Investors who are wary of the recent recovery in stock prices might be looking for conservative investments that aren’t getting carried away with market exuberance. We posit that an investment into preferred shares, like through the iShares Preferred and Income Securities ETF (NASDAQ:PFF), are not a great idea despite the ‘security’ that a preferred share income stream brings. Being like a riskier perpetuity, the value of preferred shares are going to be levered to the current rate hike environment. They are best avoided.

PFF Breakdown

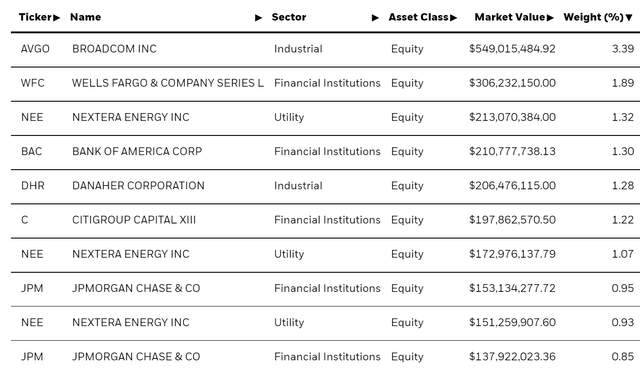

In the US, most larger cap preferred shares are from financial institutions. Indeed, that’s where the PFF focus is. But there are also plenty of industrial names too, some tech-industrial names like Broadcom, that also make the list.

PFF Holdings (iShares.com)

Credit quality isn’t exactly the concern we have. We think deleveraging risk is fairly remote, and that when we get a recession it’ll be garden variety or just a period of stagnation if it never technically becomes a recession. The problem is rates, nominal and real, are rising, while preferred share cash flows are surely falling in real terms.

Preferred Shares Have Duration Risk

Preferred shares for the most part are like risky perpetuities, where delinquent payments don’t cause default and can go on indefinitely. The risk aspect of preferred share cash flows aren’t the key problem. The problem is duration, where perpetuity horizons make durations pretty high for preferred shares. The PFF has declined less than 10% YTD, yet an increase in reference rates by 1% to add to a 5% benchmark pre-pandemic risk rate should penalise the value of a perpetuity with a higher discount factor by 20%. We are already seeing increases in reference rates greater than that.

It’s true that preferred shares do share in the equity while bonds do not, once guaranteed their preference value. So if the company’s assets have appreciated in value in lockstep with the developments in the current environment, preferred shareholders see that benefit economically when imagining how the liquidated version of the company would spill back into stock accounts. Exposure to financials is not the worst for preferred shareholders as retail banking businesses should do better. On the other hand, corporate businesses are going to do worse due to worsening financial conditions. It is rather ambiguous whether equity values of the banks are likely to rise for the PFF companies, so deltas in business value aren’t a strong justification for buying preferred shares incrementally. The residual equity value that preferred shareholders have access to is downside protection, but the cash flows from the preferred dividend still matter a lot to the value of preferred shares.

PFF isn’t necessarily over or undervalued, the story is more complicated in order to determine that, because we’d need to determine what part of the preferred share values are from the dividend and what is from the residual equity that they’d own on an as-converted basis. With so many elements in the portfolio it would be very difficult to work that out. But what should concern investors from this point is that as rates likely continue to rise to combat shocking increases in employment, preferred shares should become less attractive to the market. We think that further down in the capital structure, equity shares in a REIT does the job better for downside protection in a recessionary environment than the PFF does.

While we don’t often do macroeconomic opinions, we do occasionally on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment