Ranimiro Lotufo Neto/iStock via Getty Images

Petróleo Brasileiro S.A. – Petrobras (NYSE:PBR) is a state-owned Brazilian oil and gas company that benefited from the oil market condition in the last year. According to Seeking Alpha’s quant rating, PBR is a strong buy. Also, according to the Wall Street price target, the stock has a low price target of $13 and a high price target of $19. My valuation shows that PBR is worth more than $25 per share. However, some huge risks cannot be ignored. The future of the company is linked severely to politics. Fuel inflation in Brazil is a problem, and President Bolsonaro is increasing his control over Petrobras to win the upcoming election. PBR is financially undervalued; however, politically risky. The CEO of the company has resigned, and despite strong financial results, Petrobras has faced national challenges.

1Q 2022 highlights

In its 1Q 2022 financial results, Petrobras reported sales revenues of $27 billion, compared with 4Q 2021 and 1Q 201 sales revenues of $24 billion and $16 billion, respectively. The company’s gross profit increased by 80% to $14.4 billion in 1Q 2022 from $8 billion in 1Q 2021. On the other hand, PBR’s operating expenses increased by just 5.4% to $2.1 billion in the first quarter of 2022. Petrobras’s net income (attributable shareholders) increased by 4681% to $8.6 billion in 1Q 2022 from $180 million in 1Q 2021. The free cash flow of PBR increased by 41.8% (YoY) to $7.9 billion. Also, the net debt and net debt/LTM adjusted EBITDA ratio of the company decreased by 31.4% and 60.1% to $40 billion and 0.81x, respectively. From 1Q 2021 to 1Q 2022, the domestic basis oil by-products price increased by 66.5% to $104.62 per barrel from $63.82 per barrel. PBR’s ROCE increased from 7.1 percentage points (YoY) to 9.9% in 1Q 2022. “These financial results are due to the fact that today we have a healthy Petrobras, which has reduced its debt burden, invest responsibly, and operates efficiently,” the CEO commented. “Petrobras is distributing the fruits of its value generation to the Brazilian population,” he continued.

The market outlook

Due to the higher oil prices and higher volume of oil sales in the domestic market and foreign market, Petrobras experienced an extraordinary quarter. In the first quarter of 2022, PBR’s domestic and foreign sales increased by 74.5% (YoY) to $19.9 billion and 69.8% (YoY) to 7.4 billion, respectively. I expect the company’s sales to increase because of two reasons:

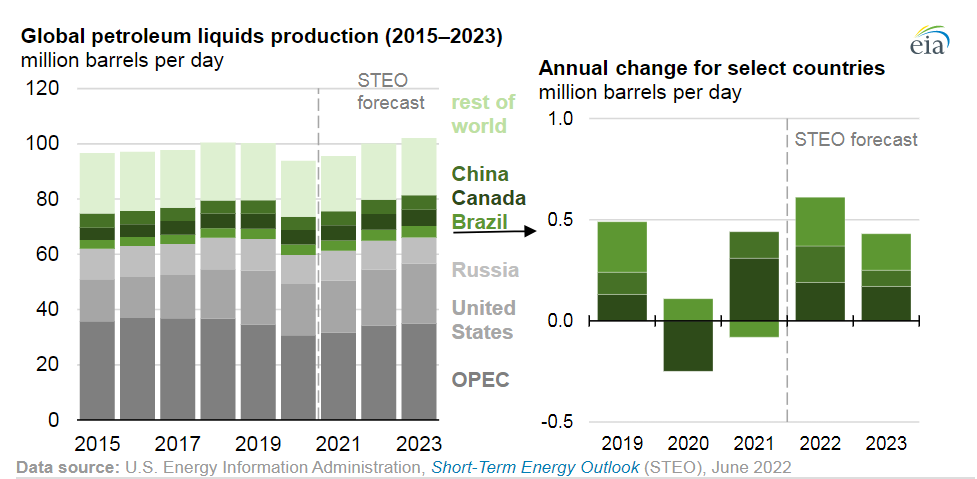

Due to the geopolitical tensions in Europe and sanctions on Russian oil imports, the demand for Brazilian oil is increasing. EIA forecasts that oil production in Brazil will ramp up through 2023 (see Figure 1). “We expect Brazil’s production to increase from 3.7 billion b/d in 2021 to 3.9 million b/d in 2022 and 4.1 million b/d in 2023,” EIA said. Recently, Petrobras has chartered three vessels to support its oil operations. Thus, as I expect oil prices to remain high (as long as the war in Ukraine is going on), I estimate PBR’s 2Q 2022 and 3Q 2022 foreign market sales to be higher than in 1Q 2022. Petrobras finally decided to increase fuel prices. The company announced it will increase gasoline and diesel prices by 5.18% and 14.26%, respectively. With higher gasoline and diesel prices, PBR’s revenues will increase significantly.

Figure 1 – Global petroleum liquids production (2015-2023)

eia.gov

PBR performance outlook

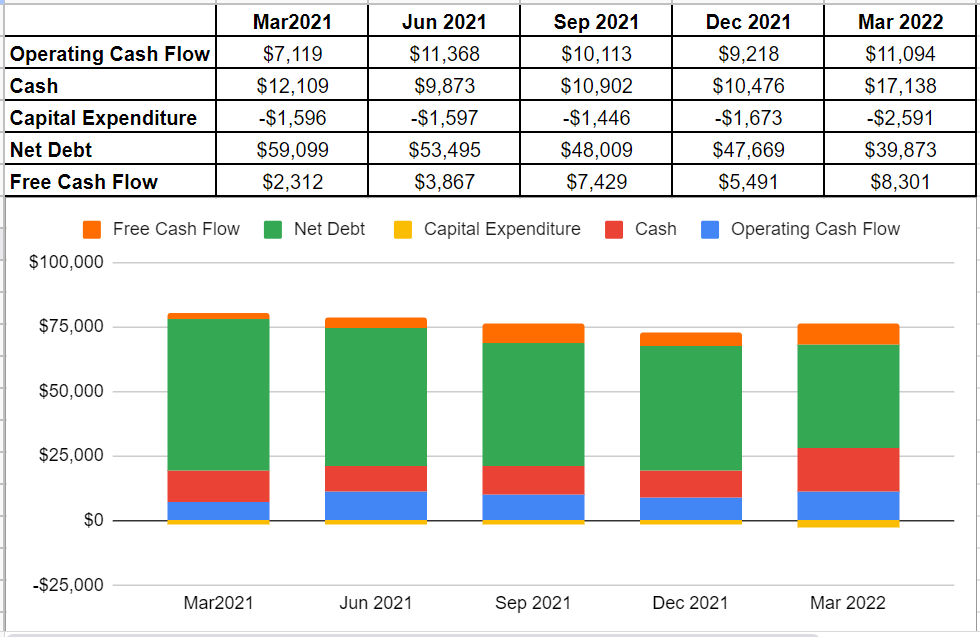

As it can be seen from PBR’s operating performance, the company’s operating cash flow of $11 billion during the first quarter of 2022 increased by more than 55% year-on-year compared with its level of $7.11 billion during the first quarter of 2021. The company’s growth of 20% in operating cash flow versus its previous level of $9.2 billion at the end of 2021, combined with a 54% increase in capital expenditure to $2.59 billion, resulted in $8.3 billion free cash flow in 1Q2022 compared with its previous level of $5.49 billion at the end of 2021, up 51%.

PBR’s net debt level of $39.8 billion in the first quarter of 2022 shows a considerable decline year-on-year versus its previous result of $59 billion during the quarter of 2021. Moreover, the cash balance increased impressively to $17.1 billion versus $12.1 billion in 1Q2021. Thus, in light of their up-to-now performance compared with recent quarters, we can expect strong cash and capital structure outlook for the rest of 2022 (see Figure 2).

Figure 2- PBR’s cash and capital structure (in millions)

Author (based on SA data)

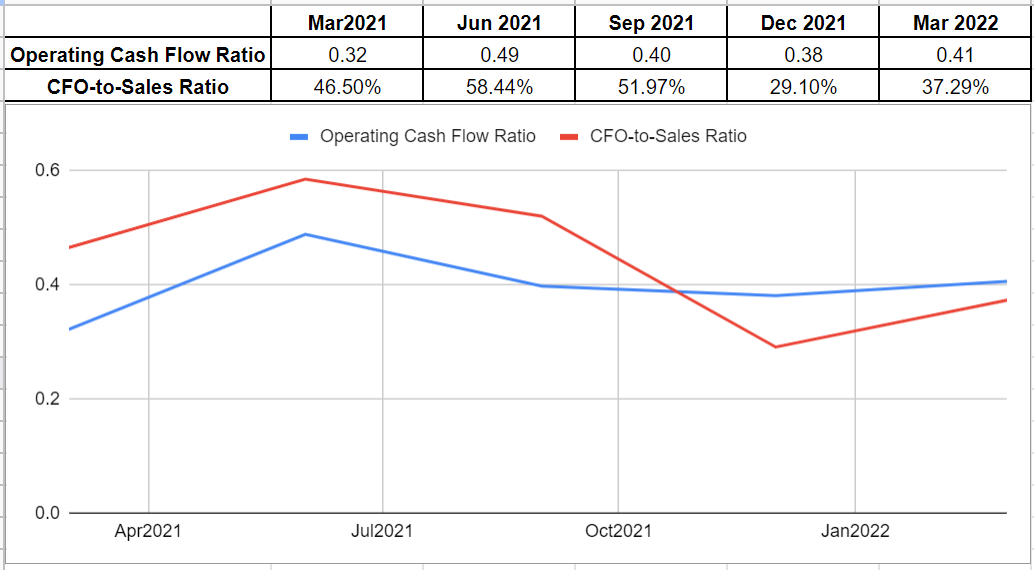

Also, to analyze the company’s liquidity and performance conditions, I investigated PBR’s operating cash flow and CFO-to-sales ratios. PBR’s operating cash flow of 0.41 in the first quarter of 2022 is slightly higher than its level of 0.32 in the first quarter of 2021. This ratio indicates how well the company can pay off its current liabilities with the cash flow generated from its business operations.

Albeit the CFO-to-sales ratio dropped by 1740 bps to 29.1% at the end of 2021 compared with 46.5% in 1Q2021, it increased back by 819 bps to 37.29% in the first quarter of 2022. This is a sign of the company’s ability to turn its sales into operating cash flow. Generally speaking, it indicates that Petrobras is profiting and growing steadily (see Figure 3).

Figure 3 – PBR’s operating cash flow ratio and CFO-to-sales ratio

Author (based on SA data)

PBR stock valuation

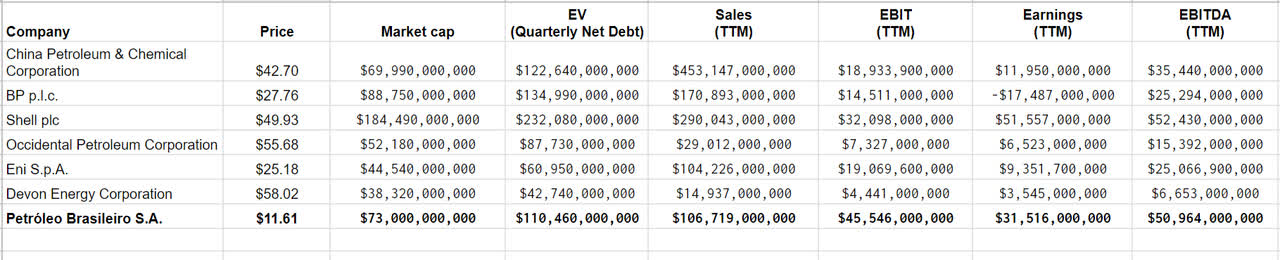

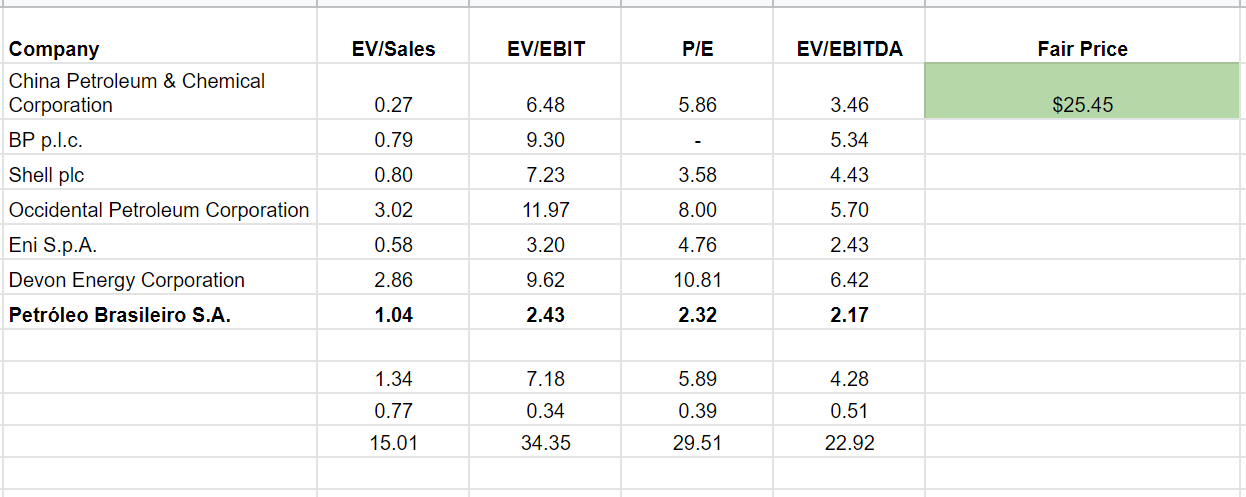

I used Competitive Companies Analysis (CCA) to evaluate PBR stock. Comparing Petrobras with other peer competitors and using the CCA method, I estimate that the stock is considerably undervalued and has an upside potential to reach about $25. Based on market caps and financial operations, I selected its peers and used common key ratios in a CCA method to illustrate the value of similar companies. Data was gathered from the most recent quarterly and TTM data (see Table 1).

Table 1- PBR financial data vs. its peers

Author (based on SA data)

Comparing PBR’s ratios with other peer companies, I observe that the stock is undervalued – PBR’s EV/Sales ratio is 1.04x, which is a bit lower than the group’s average of 1.34x. Also, the company’s EV/EBITDA ratio is 2.17x, which is about half of the peers’ average of 4.18x. Moreover, PBR’s P/E ratio equals 2.32x, which is well beneath the average of 5.89x. These ratios indicate that the company is attractive as a potential investment (see Table 2). In a word, notwithstanding existing volatility in the stock’s price due to the volatility in the oil and gas market, compared with its peers, Petrobras is a well-performed company with good potential for investment.

Table 2 – PBR valuation

Author

Risks

According to financial results, the market outlook, and the comparative company analysis, Petrobras is a buy. However, some risks cannot be ignored. After Petrobras announced fuel prices increase, President Bolsonaro got angry and publicly reproached the company for abusive profits and betrayal of the Brazilian people. To respond to the President’s anger over the fuel price hike, the CEO of Petrobras resigned. Bolsonaro is seeking re-election in October 2022. Inflation in Brazil has turned into a challenge. Higher fuel prices provoke inflation and will decrease Bolsonaro’s chance for the upcoming election. Thus, the President is trying to increase his control over Petrobras, restricting the management in making strategic decisions and following the global trends in fuel prices. Moreover, Petrobras has been under pressure to subsidize fuel. The performance of the company is tied to politics, imposing huge risks on PBR’s investors.

Summary

In terms of market outlook, PBR is well-positioned to benefit from the increased oil prices and increased demand for its products. Also, in light of PBR’s up-to-now performance compared with recent quarters, we can expect strong cash and capital structure outlook for the rest of 2022. The company’s CFO-to-sales ratio indicates that Petrobras is profiting and growing steadily. Finally, using the CCA method, I estimate that the stock is considerably undervalued and has an upside potential to reach about $25. However, the risks of political challenges cannot be ignored.

Be the first to comment