caio acquesta/iStock Editorial via Getty Images

Investment Thesis

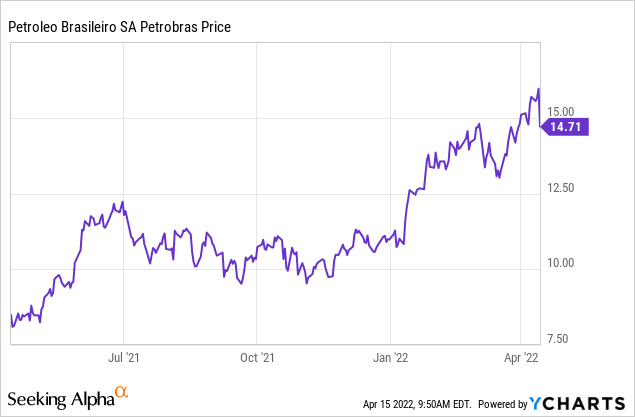

As higher inflation continues to eventuate, investors are finding it increasingly difficult to find vehicles in which they can store the value of their money. At a year-over-year inflation rate of 8.5%, investors need to be more vigilant than ever when selecting an investment in which can best protect their hard earned savings. For this reason, I believe that Petrobras (NYSE:PBR) is a great addition to a portfolio if you are mid-term time horizon investor that’s looking to add an inflation hedge to their portfolio. Firstly, the company has provided long-term shareholder value over the 2010’s with multiple per share metrics growing faster than inflation. Secondly, Petrobras operates in a sector which has a historically positive track record when faced against high inflation. Thirdly, Petrobras has significantly improved its financial position with decreasing leverage, reduced dependency on capital expenditure, and long-term free cashflow growth. Lastly, the company is reasonably priced when doing a comparable analysis with other oil majors.

Petrobras Per Share Expansion Versus Inflation During The 2010’s

Petrobras not only has a business model in which thrives during inflationary pressures, but the company has long-term per share expansion in which has beat inflation comfortably over the last 5-10 years. The first per share metric we will be looking at is earnings per share. The following is a chart of Petrobras 5 year annual EPS.

Source: Seeking Alpha

As you can see, Petrobras’s EPS expansion has been mostly on the uphill over the past 5 years. Moreover, when looking at the company’s 9 year dividend per share and earnings per share CAGR, you see that PBR has beat the average inflation rate of 2.73% during that same period.

Excel

Source: Authors Calculation

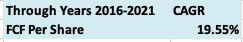

In addition to EPS and DPS expansion, Petrobras has also expanded its free cashflow per share greatly since 2016, beating the average inflation rate comfortably.

Excel

Source: Authors Calculation

To conclude, PBR’s management has expanded value on a per share basis faster than the pace of inflation over the long-term, representing evidence that the company can hold its own during periods of high inflation.

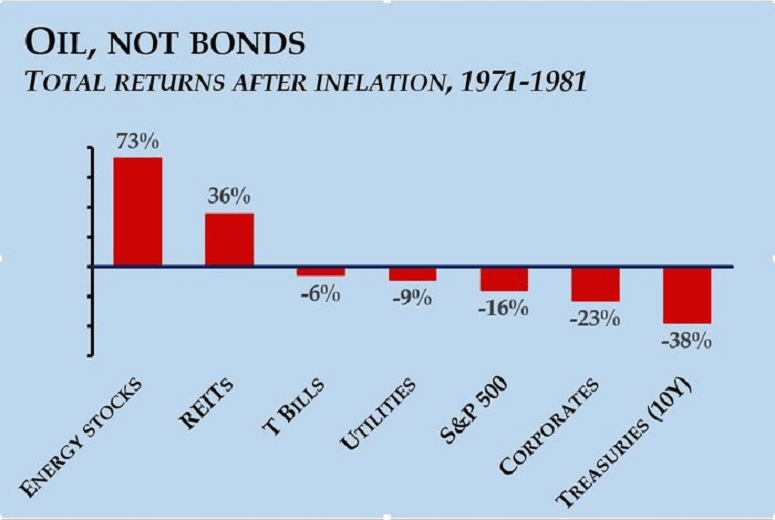

Petrobras and Big Oil Benefit as Energy Prices Continue to Drive Cost Push Inflation

When searching for an inflation hedge for your portfolio, what better than to add the companies in which are the source of the rising inflation. In the case of our current inflationary environment, energy and fuel prices appear to be the main drivers in our annual CPI, with fuel oil rising 46.5%, gasoline rising 40%, and energy commodities rising 39%. All of these increases in commodity prices have benefited Petrobras’s operations greatly, explaining the stock’s 73% price appreciation year-over-year. Additionally, oil stocks in general perform very well during periods of secular inflation. During the 1970’s which consisted of a decade of high inflation, oil stocks were the best performing sector with an annual real return of 7.3% and a total real return of 73%.

Investor Junkie

Moreover, PBR’s financial metrics have soared year-over-year since inflation began eventuating in 2021 with earnings per share growing 257% in 2021, comfortably beating inflation. Lastly, even though it appears as though the Federal Reserve is ready to fight inflation, rate hikes can only slow down demand, but not necessarily mitigate the effects of a commodity supply crunch. Meaning the Feds could have their hands tied and individuals may have to live with higher than average inflation. This however is extremely beneficial for Petrobras’s core business.

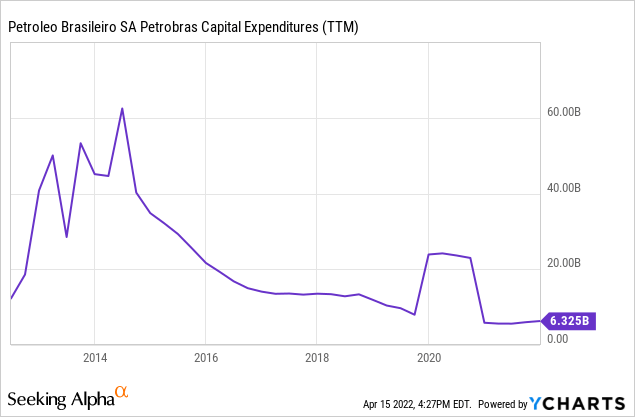

Significantly Improved Financial Position

Aside from per share expansion beating inflation and the company currently operating in a favorable environment, Petrobras has made great strides in improving their financial position with reduced leverage and reduced capital expenditure leading to increased free cashflow. Since 2009, PBR’s capital expenditure has decreased at an annual rate of 19%.

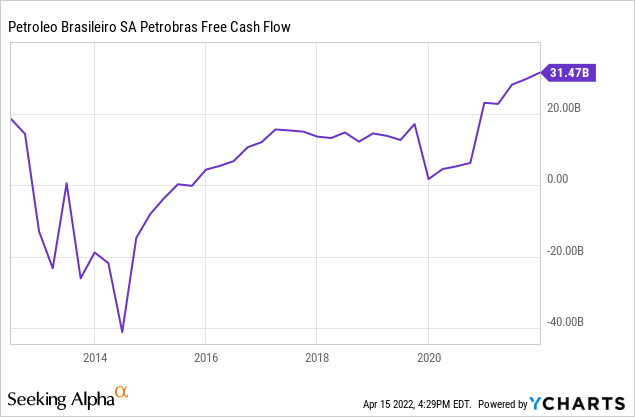

This has led to higher free cashflow generation in the long-term. In the chart below, you see that Petrobras’s free cashflow has been mostly upward trending.

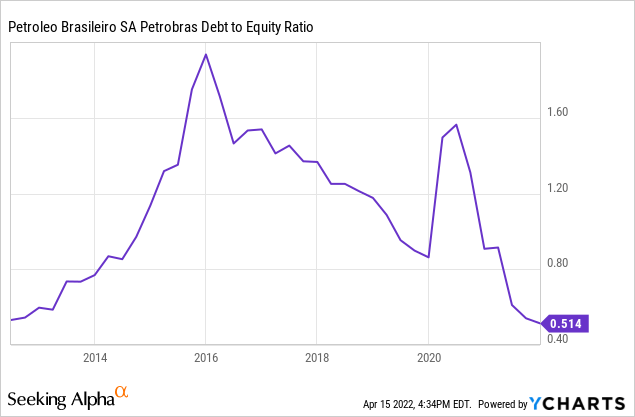

Furthermore, Petrobras has also improved its balance sheet with a healthier net debt position. Over the last 9 years, the company has reduced its net debt position by 4.44% annually and has significantly improved its debt/equity ratio.

If Petrobras continues down the path of reducing their debt burden and CapEx spending and the oil and gas rally continues, investors could continue to see an increase in shareholder returns in the forms of dividends and buybacks.

PBR Stock Valuation

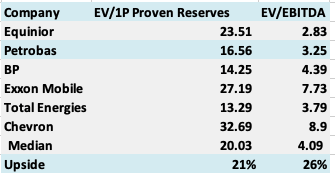

When looking at the valuation of Petrobras, you can see that the company is relatively cheap when comparing the company’s EV/EBITDA and EV/P1 Reserves to their peers. For those that don’t know, P1 reserves are proven oil reserves with a 90% or higher chances of being economically extracted. In the case of Petrobras, the company falls much below the medium in these two multiples.

Excel

Source: Authors Calculation

Overall, I arrive at the consensus based on these two multiples that Petrobras is cheaply priced when compared to their peers with an approximate upside range of 21%-26%.

Global ESG Pressures Could Force Lower IRR Investments

A big risk factor which could hinder Petrobras’s financial performance is global ESG pressures forcing the company to pursue low return on investment renewable energy projects. Renewable energy investments have proven to yield much lower returns than traditional oil and gas investments, especially in this current environment. If for some reason global ESG pressures continue to increase and greater renewable energy investment becomes mandatory to avoid social opprobrium, Petrobras does face the risk of seeing lower returns on investment due to the increase in lower yielding projects.

Conclusion

To conclude on why I think investors should consider adding Petrobras to their portfolio, higher inflation appears to not be transitory, and instead seems to be here for an indefinite period of time. Therefore, if you’re an investor in need for an inflation hedge, Petrobras is worth considering to add to your portfolio. The company has demonstrated long-term EPS, DPS, and free cashflow per share expansion easily beating the average inflation rate during the 2010’s. In addition, oil stocks perform extremely well during inflationary periods and the Fed’s damage control is most likely not going to mitigate supply driven inflation. Lastly, the company’s financial position has improved over the years and the shares are compellingly priced when compared to the other global oil majors. Therefore, investors who fear inflation and wealth erosion should take a look at Petrobras.

Be the first to comment