Ivan Kuchin

Investment Thesis

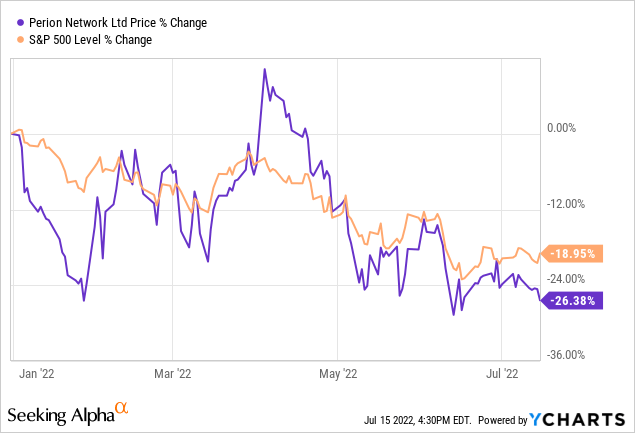

Perion Network Ltd. (NASDAQ:PERI) has lost about a quarter of its market cap since I last covered it in December 2021. The stock is now priced at a little lower than $18 per share, underperforming the stock market in 2022 after losing one-third of its share price since April as fear and macroeconomic factors took control of the market.

Since April 28th, the stock continued its descent despite posting an almost 3.7 times YoY EPS growth in Q1 2022 earnings report, undervaluing it and putting it out on a discount for potential investors.

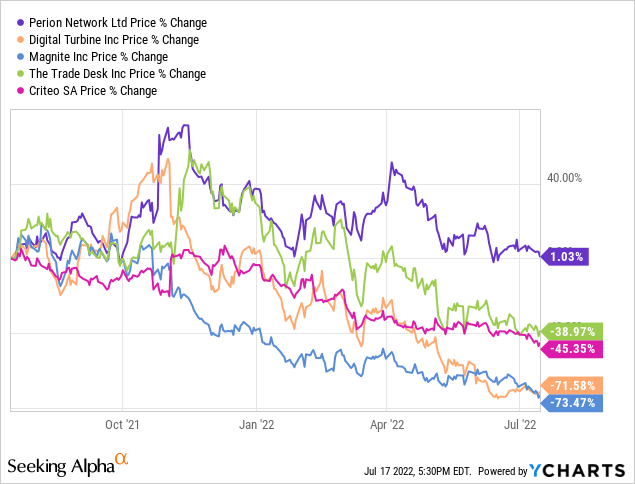

The company has had consistent top and bottom line growth with over 12 consecutive quarters of revenue and EPS consensus analyst target beats. This has led to PERI outperforming its competitors in the previous 52 weeks and YTD despite tech stocks nosediving during 2022.

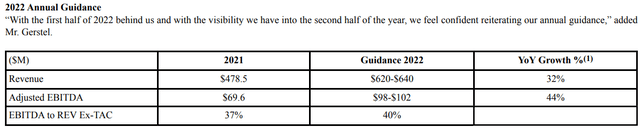

The company’s strong performance has led to it increasing its guidance for 2022 for the third time despite fears of the recession, exhibiting an optimistic attitude amid a volatile market, which should boost investor confidence in the company’s stock.

Despite the stock going down since my buy recommendation, I am still bullish on the stock. I expect it to slingshot and generate substantial returns when the macroeconomic pressures pulling the whole market down alleviate.

A Positive Update on SORT

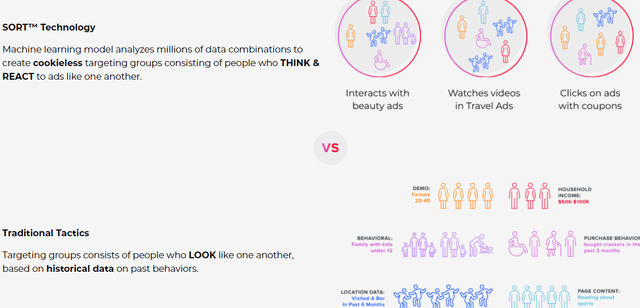

Cookies have been a means of consumer tracking for advertisers for over 20 years by saving browsing information, including the location, the contents of shopping carts, etc. Marketers and advertisers used this information to target their audiences. However, with growing concerns over data privacy, Google has published a timeline wherein it states that it will phase out third-party cookies, under the “Privacy Sandbox” initiative, over a 3-month period finishing in late 2023, to preserve user privacy. Similarly, Apple’s IDFA updates have already pushed out the use of third-party cookies.

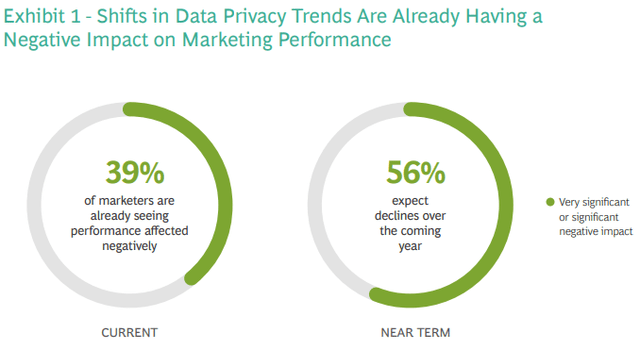

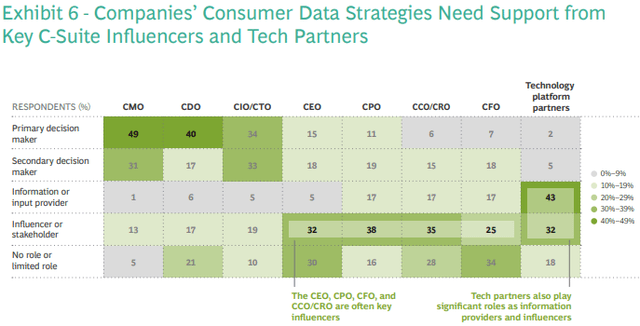

Without cookies, advertisers will have to rely on alternative means of attaining audience insights. Accordingly, a survey conducted by the Boston Consulting Group and LinkedIn concluded that 39% of advertisers already stipulate that data losses have begun, negatively affecting their performance.

The survey reveals that marketers are heavily inclined toward partnering with Tech platform providers to address these issues. However, In light of the uncertainty spread in the advertising community, executives are concerned that a vast number of tech companies “claim to have a solution for this, but it’s not clear if they will actually work and how it will play out.” This indicates that marketers are actively looking for cookie-less solutions and will most likely cling to credible, outperforming solutions.

Perion Network’s SORT technology addresses all these concerns as it does not collect any Personally Identifiable Information (PII), adhering to all industry regulations while outperforming traditional cookie-based methods according to internal studies.

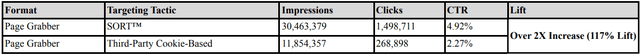

Neutronian critically acclaimed the SORT Targeting Technology in June for outperforming “third-party cookies while protecting consumer privacy and providing total anonymity by not tracking or storing user data,” putting Perion at a huge advantage as we move toward a cookie-less world, as is apparent from the recent financial statements, which were Perion’s first full quarter results that included SORT.

The company’s 80% YoY revenue growth from the Display Advertising segment was largely attributable to the wide adoption of SORT at about 30%. This has also moved the management toward providing improved guidance for the year as it expects its revenues to move further up amid aggressive SORT adoption.

Perion Network Investors Presentation

Amid growing concerns of a declining market in anticipation of a recession, upward revised guidance should provide elevated confidence to investors that the company does not expect any pullbacks in the current macroeconomic environment, which appears to be a driving force behind the stock price movement in 2022.

Pristine Financial Statements

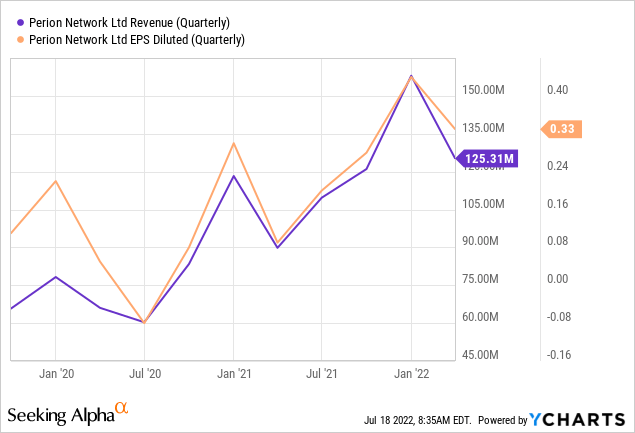

Perion Network’s growth and profitability metrics have been consistently improving, with the MRQ revenue almost doubled from Q1 2020 and growing 40% YoY. This was largely attributable to substantial growth in its Display Advertising segment (DA), which grew 80% YoY, driven by a 341% YoY growth in the video and CTV solutions section, which accounted for about 46% of the DA revenue. The DA segment has rapidly grown in the previous 2 years, accounting for 36% of revenue in 2020, 42% in 2021, and 55% in the MRQ.

Similarly, the company’s profitability has also significantly improved, leading to a sixfold EPS increase in the MRQ from Q1 2020 and around a 360% increase from Q1 2021.

The EBITDA jumped 158% YoY, and the EBITDA margin leaped from almost 10% to over 18% as its AI-driven central intelligence hub, iHub, drove scalable operational efficiencies and improved media margin, which grew from 39% to 43% YoY in the MRQ. Using the central hub lets Perion keep its costs down as most of them are fixed, resulting in the company achieving higher profitability per dollar of revenue earned. As such, Perion’s traffic acquisition costs (TAC) decreased by 4.5% YoY.

The company’s exceptional financial performance is backed by exemplary operational performance, leading to sustainable growth and profitability augmentation. For instance, Perion’s display Clickthrough Rate (CTR) of 1.2 is 2.6 times higher than the Google benchmark of 0.46, resulting in a 42% increase in average price spend and a higher average spend per customer, with a 3% YoY increase in the number clients.

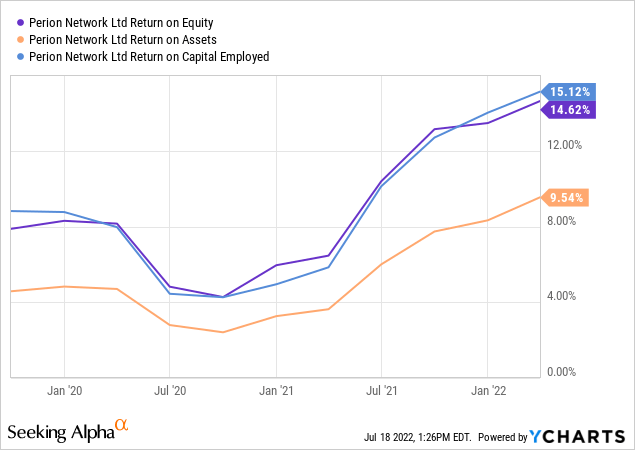

The excellent resource management by the company has led to sustainable, organic growth, resulting in significantly above-industry-median management effectiveness ratios, including net income per employee of over 7 times higher than the sector median.

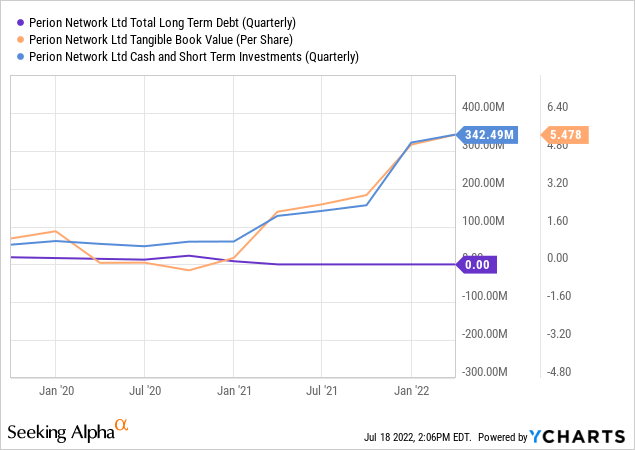

Moreover, Perion also sports a pristine balance sheet, more than doubling its Tangible book value per share YoY and eradicating its long-term debt. Adding debt to the company’s balance sheet might be useful to maximize its returns further as debt is generally cheaper than equity financing.

The company also holds a war chest of cash at $342.5 million, almost 43% of its market cap, facilitated by a 3-year levered FCF growth CAGR of 50% and an FCF margin of 13.5%.

This cash may be better utilized in investing activities to generate higher returns elsewhere as the company doesn’t appear to have any impending cash-intensive expenditures.

In essence, the company’s balance sheet is extremely well-maintained, but a little risk exposure might result in even better financial performance.

Attractive Valuation

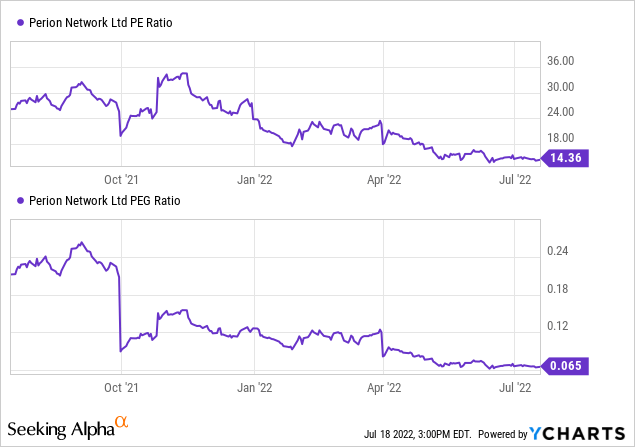

Technology companies usually trade at higher multiples because of their affinity for aggressive growth. Perion’s growth figures are higher than its peers, and accordingly, I would expect the company to trade at least equivalent to the industry medians, if not higher.

However, the company is currently trading at a discount with a TTM P/E multiple of 14.13x and a forward P/E multiple of 13.2x compared to the industry’s 15.82x and 17.8x, and a PEG ratio of 0.07x compared to the industry’s 0.57x.

Going by my usual method of taking all the company’s figures and calculating them based on the sector median and then extracting a price tag based on the average of all these relative valuation figures, PERI shares have a fair value of over $37 per share.

Even though this is slightly higher than the highest, $36 per share, Wall Street price target, the company’s share price is likely to catch up with its aggressive growth as the market volatility caused by macroeconomic factors subsides.

Conclusion

Perion Network’s exceptional financial and operational performance has led to the company being resilient to the severe downtrend faced by its peers. Even though the company has shown negative returns during the year, it neither reflects its past nor future performance.

The exceptional performance in the MRQ was merely the first time its SORT technology was put to full quarter use; it is only expected to do better with time as we move closer to a cookie-less world.

If the company achieves the same sequential growth numbers as the previous year and retains the 40% YoY topline growth figures, the full-year revenue will exceed $665 million. Despite seemingly a herculean task, Perion has historically proven to under-promise and over-deliver, beating market expectations.

| Reporting Period | Q1 | Q2 | Q3 | Q4 | Full Year |

| 2021 | 89.80 | 109.70 | 121.00 | 158.00 | 478.50 |

| QoQ Growth | 22% | 10% | 31% | ||

| 2022 | 125.30 | 153.07 | 168.83 | 220.46 | 667.66 |

The lower price tag has presented a unique opportunity to investors looking for a solid long-term tech stock. When the systemic volatility around the market dissuades, I expect the stock to slingshot to heights experienced during 2013.

Be the first to comment