InCommunicado/E+ via Getty Images

As the leading foodservice distributor in the US and now the largest convenience store distributor (post acquisition of Core-Mark), Performance Food Group (NYSE:PFGC) offers investors a great way to play the post-COVID foodservice demand rebound. Over the long run, PFGC is also positioned to gain share in foodservice and convenience while growing margins by extracting more operating efficiencies amid an easing labor market. While a potential macro downturn could weigh on the P&L, the defensiveness of the business model should allow it to outperform – recall that in 2008/2009, PFGC sustained positive growth, benefiting from channel diversification, as well as its pricing power.

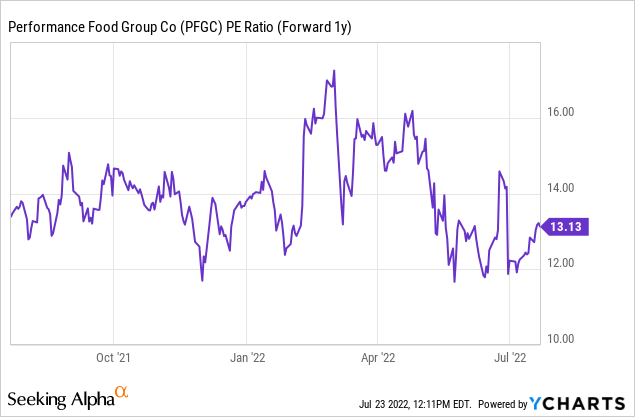

Finally, recent acquisitions (Eby-Brown and Reinhart in 2019 and Core-Mark in 2021) offer incremental earnings upside as PFGC unlocks synergies, while the strong balance sheet presents M&A-led growth optionality down the line. At ~13x PE (a deep discount to historical levels), investors don’t need much to go right for the stock to work.

Stage Set for High Single Digit % Growth Algorithm Through 2025

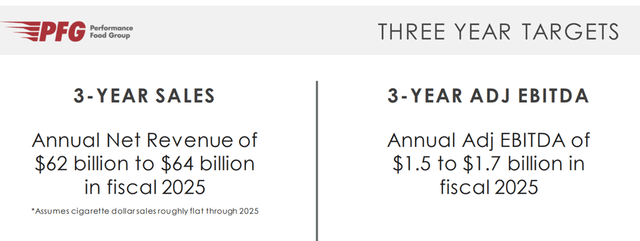

PFGC unveiled a new mid-term sales target of $62-64bn at this year’s investor day (webcast), factoring in a mild recession at the low-end and a short-term macro slowdown at the mid-point. In both cases, the revenue CAGR holds at an impressive >7% from the 2022 base (sales guidance of $50.5-51bn). Growth will be more heavily weighted to 2023, though, given the contribution from Core-Mark (double-digit % growth) before normalizing to a mid-single-digit % growth algorithm in 2024/2025.

The revenue guidance makes sense, in my view – PFGC is well-positioned to gain foodservice share as it re-focuses on new account generation. Amid easing supply chain pressures and a recovery in fill rates post-COVID, PFGC’s new account generation has already seen double-digit YoY growth momentum as of Q3 2022 (historically its primary sales driver). Meanwhile, the convenience side should benefit from PFGC’s move to add more chain business in 2023 as well as its strong pipeline – a notable shift from its focus on independents during the pandemic. Over the long run, the secular foods sales tailwind remains intact as well, supporting PFGC’s efforts to accelerate new customer acquisition and extend the growth runway via opportunistic M&A.

Long-Term Margin Expansion Potential Intact

Building on the solid revenue guidance, PFGC also signaled $1.5-1.7bn of adj EBITDA generation through 2025 – a 17% CAGR relative to the 2022 base and well above the 7-8% revenue growth outlook at the midpoint. In other words, PFGC’s adj EBITDA margin is set to expand at an impressive 15-23bps/year to 2.4-2.7% in 2025 – well above the 2.0% guide for 2022. The margin assumptions also embed reasonable assumptions around deal synergies, gradually normalizing inflation levels, and labor efficiencies post-COVID, leaving room for upward revisions in the coming quarters. Of note, this year’s financial update excludes any segmental detail other than that all three businesses would see adj EBITDA margin expansion through 2025 – a justifiably conservative approach, in my view, given the current macro uncertainty.

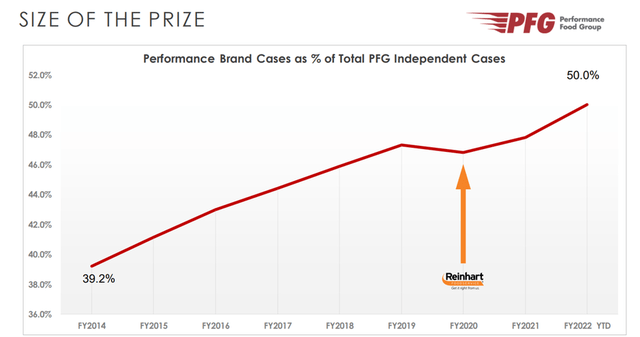

At first glance, PFGC’s margin guidance sets a low bar – even if the low-margin tobacco segment slows amid a broader economic slowdown, the higher-margin independent foodservice contribution should pick up the slack. In particular, the exclusive Performance Brands mix has seen steady growth and now contributes ~50% of all PFG independent cases, along with non-tobacco food/drink within convenience. In addition, PFGC might have held back on the long-term opportunity to leverage operating efficiencies to expand margins as the labor market eases and transitory costs fade post-COVID. With labor at ~70% of operating costs and investments in warehouse/automation already set to ramp up in the next year or so, I see gross profit outpacing expectations as commodity inflation eases as well. Plus, the company has proven its ability to pass through inflation via pricing to protect its margins, so PFGC should continue to have a solid base of profitability into the coming years.

Unlocking Incremental Earnings from M&A

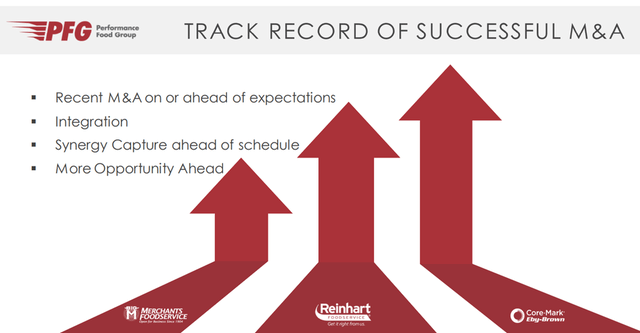

Unsurprisingly, future acquisitions will continue to be a factor in the latest mid-term plan, building on PFGC’s recent M&A success. That said, the guidance only calls for a “small” future M&A contribution – likely a sign of conservatism by management. Within the foodservice segment, for instance, PFGC has previously signaled its willingness to pursue more transformative acquisitions in areas where its footprint is limited (e.g., the western region of the US). Given PFGC also benefits from strong relationships with other operators across the industry and has a demonstrated track record of effective integration, I would pencil in a larger contribution from future M&A opportunities. Balance sheet capacity shouldn’t be an issue either – the 2.5-3.5x leverage target (vs. ~3.7x currently) looks well within reach, given the company’s steady cash generation.

For now, PFGC has its hands full with post-M&A integration – recall that the company acquired Eby-Brown in early 2019 to build out its convenience store presence, followed by Reinhart towards the end of 2019 to expand its broad line foodservice business. Core-Mark, the most recent major addition to the portfolio (late-2021), further expands its convenience channel exposure. Though Core-Mark has been a drag on margins thus far, PFGC remains on track to unlock ~$40m opportunity from cost synergies by 2024 (~$15m to date). Meanwhile, there’s more to come from the Reinhart integration as well – per guidance, this will come mainly from distribution cost savings from shared warehousing (albeit a few years out), further extending its earnings growth runway post-acquisition.

A Defensive Pick Poised to Ride Out Any Macro Turbulence

Coming out of the pandemic, PFGC looks set to build on share gains with independents as it re-focuses on new business generation amid a recovery in the legacy Vistar business and unlocks new cross-selling/synergy opportunities following the acquisition of Core-Mark. While PFGC’s margin profile has temporarily moved lower following the Core-Mark acquisition, the long-term margin expansion outlook remains intact as PFGC leverages its expanded scale and operations to drive operating leverage benefits across the business. Net, PFGC has the resilience to ride out a macro downturn, while from a valuation perspective, the undemanding ~13x P/E (a wide discount to historical levels) offers ample re-rating potential going forward.

Be the first to comment