dolgachov/iStock via Getty Images

Introduction

Since the Fed started its tightening policy last March, PepsiCo (NASDAQ:PEP) stock has shown impressive performance, rising by 5.5%. During the second quarter of 2022, the company reported revenues of $20.23 billion, surging 5.3% year-over-year and beating analysts’ expectations. The strong and resilient performance across all categories allowed management to increase their guidance for 2022 from 8% to 10% organic revenue growth. Its stock is trading above $165 per share, -4.6% year-to-date, compared to a 19.1% decline for the S&P 500.

This multinational company is part of our US Growth Equity portfolio. As we will explain in this article, it has strong quality, value, and momentum factors, which resulted in a high overall ranking in our factor-based system. Accordingly, we determined that it provides an attractive investment opportunity. We still believe those factors could shape the stock’s performance in the medium term since the good results were not priced by the market yet.

Resilient revenues across all segments and a promising outlook

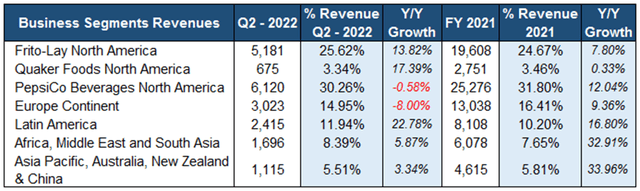

PepsiCo divides its business into geographical areas and generates its revenues from seven different segments as follows:

- Frito-Lay North America (‘FLNA’) includes snack food businesses such as Cheetos, Doritos tortilla chips, Lay’s potato chips, and others;

- Quaker Foods North America (‘QFNA’) includes convenient food businesses like cereal, rice, pasta, and other branded food;

- PepsiCo Beverages North America (‘PBNA’) consists of the beverage businesses, including soft drinks, ready-to-drink tea, and coffee products;

- For the remaining segments, revenues include all beverage and food businesses generated from the specified region.

Amid extremely high inflationary pressures, increasing rates, and supply chain bottlenecks across the globe, PepsiCo could sustain strong profitability no matter what was happening in the broader economy. In 2021, most businesses experienced significant growth, while as 2022 began, macroeconomic events started weighing on various sectors. Still, during the first half of 2022, the demand for PepsiCo products was not affected, which is not something new for companies in the Staples sector. In fact, for FY2022, management increased their guidance for organic sales growth to 10% compared to the 8% expected earlier this year.

Shareholders enjoy high returns in terms of dividends and share buybacks

PepsiCo is a great option for investors looking for steady and safe dividend income, with a fair dividend yield of 2.66% at current market prices. The company has a long track record of dividend payments (almost 50 years), which has been consistently growing even during the COVID period when major companies cut or suspended their dividend payments. Additionally, the company is still committed to a value of $1.5 billion in share repurchases in 2022, continuing its long-term trend of buying back its shares and returning value to shareholders.

Competitive advantage

PepsiCo is continuously working on maintaining its position as one of the global market leaders in the food and beverage industry. As it has a promising growth outlook, we’ll evaluate its market positioning and competitive edge using the Porter Five Forces. This framework helps assess the company’s current strategic position within its industry.

Threat of New Entrants (Low)

PepsiCo owns 23 brands, such as Pepsi, Lays, Tropicana, and others, and succeeded in being among the most valuable brands in the world. Accordingly, it is challenging for a new entrant to create a similar brand image and enter the market. Additionally, PepsiCo optimized its distribution network, which is nearly impossible for a new entrant to match. New entrants willing to compete in the Cola-flavored industry or other food businesses do not represent a real threat to PepsiCo.

Threat of Substitutes (High)

Since switching costs are negligible in the food and beverage industry, the threat of substitutes is a strong force as all beverages are considered alternative products to Pepsi, such as tea, coffee, and juice. Moreover, when it comes to packaged foods and snacks manufactured by PepsiCo, many similar products are available at almost the same prices.

Bargaining Power of Customers (Low)

Customers are emotionally attached to PepsiCo products, and it is difficult for them to stop buying the products despite their life circumstances. The only factor affecting the company’s turnover is the recent trend of consumers willing to avoid soda, caffeinated or sugar-based drinks and their migration to healthier products. Still, PepsiCo continuously works on innovating its product offering to cover this segment as well.

Bargaining Power of Suppliers (Medium)

PepsiCo’s raw materials are readily available based on the geographical location of its manufacturing facilities. The company deals with many suppliers who cannot negotiate the terms of their deals due to standardization on PepsiCo’s side.

Competitive Rivalry (High)

Pepsi’s main global competitor in the beverage industry is Coca-Cola. Historically, both companies were engaged in ongoing marketing and advertising wars, but both maintained their market share and eliminated any potential additional competitors. Although PepsiCo is diversified into snacks and convenient foods, we think that competitive rivalry, even from smaller market players, might threaten PepsiCo due to aggressive marketing approaches across all its business segments.

Rankings

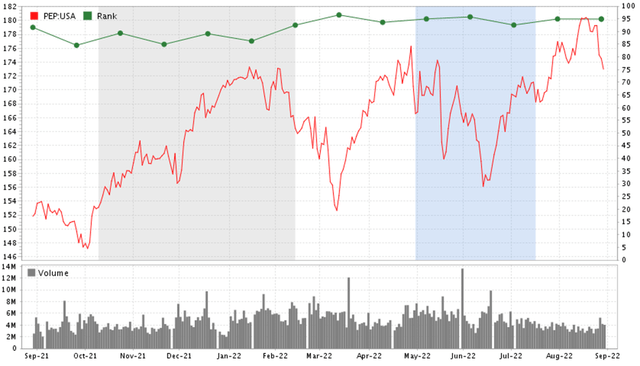

PepsiCo is currently included in our Factor-Based US Growth Equity Strategy as it has a high ranking (98.1) according to our multi-factor ranking system, which analyzes nine factors spread across quality, value, and momentum.

|

Ranking (%) |

Quality (45%) |

Value (20%) |

Momentum (35%) |

|

98.1 |

90.6 |

90.4 |

84.2 |

Source: Factor-Based

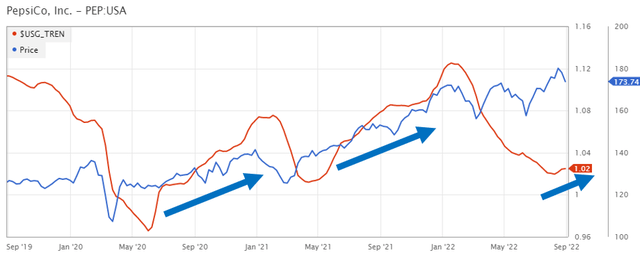

Companies with a rank higher than 90 have an attractive upside potential compared to the market. The chart below shows that PepsiCo has always had a high rank. However, since last March, it has increased above 90.

To reach the final rank, we start by allocating a weight for each factor, then we normalize to a percentile (The Factor-Based US Growth Equity Strategy presentation illustrates the whole process). Now, let’s look at those factors, and discuss how they contributed to PepsiCo’s high rank.

Quality

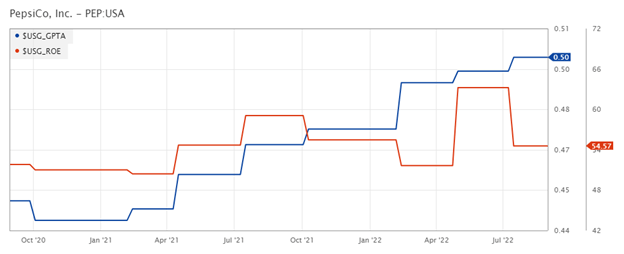

PepsiCo’s quality rank is 90.6, which assesses the company’s profitability. The return on equity (ROE TTM) and the gross profitability ratio is among those factors. Despite the store closures during the COVID period and the increasing prices, PepsiCo has consistently increased its ROE since 2020. Additionally, the gross profitability, calculated as Gross Profit / Total Assets, showed a significant increase over this period, indicating enhanced profitability.

FactSet

Value

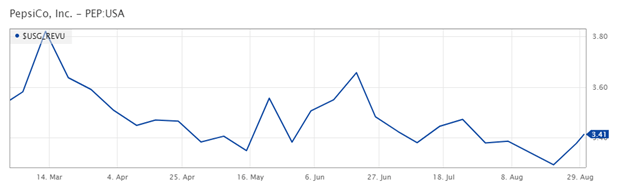

We use a metric called REVU, where we estimate for each unit of Enterprise Value, how much EBITDA is being generated after adjusting for Research & Development as per the following formula: (EBITDA – CAPEX + R&D) divided by EV. Although this ratio was on a downward trend for PepsiCo, it reversed recently and increased slightly, implying greater efficiency in generating profits.

FactSet

Momentum

The trend factor is one of our momentum factors, which measures the price slope and helps to identify firms with a medium-term bullish trend. The ratio is computed as the 63-Day VMA (Volume Weighted Moving Average) divided by the 252-Day VMA. Despite a downward trend earlier this year, the ratio is at the lower end of a rising trend and is now at 1.02, and usually, an upward trend is a potential bull indicator for the stock.

Investment Risks

Although PepsiCo is a blue-chip stock, investors should be aware of some risks that might be developing for the company. Hence, we would like to emphasize the following two risks:

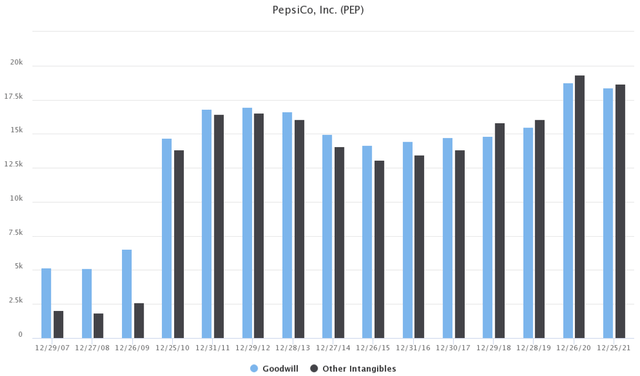

- The dilutive impact of M&A: In order to stay ahead of the competition, PepsiCo acquired 27 companies over the years and invested in several other companies. It most recently invested $550 million in Celsius (CELH), and acquired a 20% stake in AQUA Carpatica, a premium Romanian spring water company. This M&A activity exposes the firm to potential dilution in the future, or a goodwill impairment since the value of goodwill and intangible assets has increased significantly over the last decade.

- Unfavorable Foreign Currency (Stronger USD): PepsiCo sells its products globally in over 200 countries, and a significant part of its revenues are generated in foreign currency. A stronger dollar may imply lower reported income (in USD) and may impact valuation in the coming period. Management expected a 2% foreign exchange translation headwind in their latest earnings. This might further increase due to economic uncertainty putting more pressure on the company’s bottom line.

Conclusion

Finally, like all businesses, PepsiCo’s productivity was threatened by rising interest rates and high oil prices, weighing on consumers’ purchasing power. However, the firm benefited from solid sales over the last year as it increased its prices without reporting a decrease in demand for its products, proving that it is still among the attractive Staples companies. Based on our multi-factor ranking system, PepsiCo has been classified as an attractive growth-at-a-reasonable-price (GARP) opportunity. It is currently part of our Large Cap US Equity portfolio.

Be the first to comment