After a recent credit facility drawdown by Gaming and Leisure Properties (GLPI) to bolster cash balances, the company decided to cash out prime tenant Penn National Gaming (PENN) with $337.5 million in lease credits in exchange for one of its Las Vegas gaming assets. Additionally, Penn has made the decision to cease paying furloughed workers in order to control costs as closures continue to devastate its business. In our last article, we explained how to value GLPI partially as debt and explained our discount rate in light of a potential default of important tenants. Given assuaged liquidity concerns for tenants in a protracted COVID-19 closure and reduced operating leverage from cut personnel expense, we will temper our assessment of Penn’s default probability and, consequently, revalue GLPI to a more optimistic price target.

Penn’s Liquidity

It is unsurprising that GLPI launched into action as investors like us began to worry about Penn’s liquidity situation, especially in a company where customer concentration was of prime concern. To quantify the safety of its balance sheet, we want to determine how long Penn can withstand the closures devastating the casino industry. Keeping in mind Penn’s recent decision to cease salaries of furloughed employees, we will assess its capacity to withstand closures with sensitivity to operating leverage.

With the lease offset of $337.5 million in lease credits, the company’s immediate liquidity is $1.04 billion in cash and undrawn credit against an offset total of contractual obligations of $783 million.

(Source: PENN 2019 10-K)

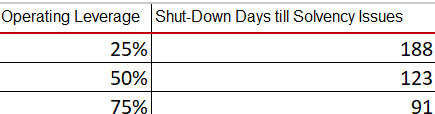

We know that the shutdown will continue for a long while, but how long does it have to last for the surplus, the difference between the immediate liquidity and contractual obligations ($257.5 million), to be entirely spent and for Penn to be in trouble? To consider that, we assume that Penn earns its revenue on a straight-line basis. Additionally, to be conservative, we will assume that once the shutdown is over, it will take the rest of the year from the point when casinos open to normalise to pre-shutdown levels of activity. Using EBITDAR and excluding any rents on triple-net leases to get a pre-obligation income, we get the following using Excel’s goal-seek.

(Source: Mare Research Database)

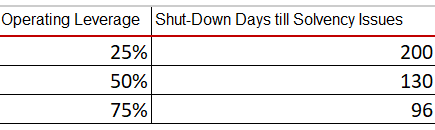

If you imagine that capital expenditure commitments of $54.1 million might be waived by GLPI and VICI due to the unforeseen circumstances, we get the following:

(Source: Mare Research Database)

Compared to our analysis under the previous more strained liquidity conditions, we see a substantial improvement of around a month for how long Penn can withstand closures. The improvement is most stark under lower operating leverage assumptions, which may have become more justifiable given Penn’s decision to cease salaries to furloughed employees – a source of substantial operating leverage. Given the uncertainty of the duration of closures and the economic impact of COVID-19, such a decision seems a necessity to keep the business running.

Given that Italian data is beginning its improvement about 3 months after COVID-19 started to spread across the country, liquidity to withstand an additional month should not be underestimated, as it may be the difference between weathering the storm and bankruptcy. This is especially true for the US, where responses were delayed and the high-order exponential growth was allowed to be fueled unabated for a whole additional month.

Valuing GLPI

As described in the last article, Boyd Gaming (BYD) is well-capitalized and continues to be a low-risk tenant, while cash flows from Eldorado Resorts (ERI) remain substantially uncertain. Now, however, Penn joins Boyd as a low-risk tenant, while also accounting for more than half of GLPI’s rental income.

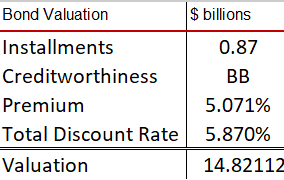

In spite of the renewal of the Penn master lease, we will continue to value GLPI 50:50 bond and equity. As such, we will assume for the bond part that 25% of the income that would come from Eldorado dries up under a default scenario, while the remaining income from Boyd and Penn can be discounted at a safer discount rate commensurate with a BB rating, which is what Penn and Boyd were rated with before the pandemic. Based on quintile data and an assessment of the credit risk premium relative to B- rated bonds, we will assume a premium 0.6% lower than B- bonds for BB.

The following is the valuation of the bond part:

(Source: Mare Research Database)

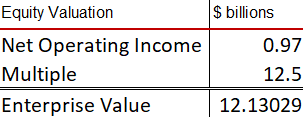

Note that we have assumed that the installments are simply the total deducting the share of income coming from Eldorado. This is because we have assumed that the lost cash income due to the lease credit is a fair transfer for the Tropicana Las Vegas asset added to the GLPI portfolio, meaning no incremental shareholder value gains. Under the same fair value of acquisition assumption, we will not change the net operating income in the equity valuation from the last time we did it either. As such, our equity valuation has not changed since the last article, where we used 2019 operating income. The reason we’ve concluded to do this is because we believe that private market investors, the next line of defense for operators, will appreciate their ability to generate cash on GLPI’s assets at levels they have in the past:

(Source: Mare Research Database)

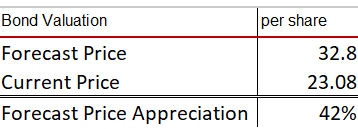

Given our assumed 50:50 bond equity allocation of value, and considering the NFP of $6.42 billion, we get the following price target:

(Source: Mare Research Database)

On this week’s market open, GLPI dropped again like a rock due to its irrational one-to-one correlation with Penn, providing even further margin for investors entering now. Remember that this is a 42% price appreciation opportunity in something that is a quasi-credit investment, a rare and compelling margin of safety.

Final Remarks

Although we have been conservative, firstly by assuming Eldorado defaults on its lease payments and secondly with the implicit assumption that COVID-19 closures will last for at least another 3 months or so, there are still risks to this thesis. Even though these risks do not justify the discount, in our view, there is certainly a possibility that the COVID-19 situation in the US is particularly acute due to the late US response, whereby the European situation does not constitute a good comparable for forecasting the length of necessary shutdowns. In such a case, even after these liquidity injections, Boyd and Penn would be in peril. The mitigant is that these businesses are still attractive to investors, and the impact on GLPI’s rental income, although material, is unlikely to cause permanent capital loss on lease renegotiation due to the current margin of safety.

Furthermore, asset-heavy businesses like GLPI are quite attractive for fixed-income investors as well. GLPI’s ability to raise cash for the sake of injecting liquidity into tenants’ businesses should not be underestimated, especially since it will get its income in the coming quarterly installments before tenant peril is certain.

Overall, GLPI continues to trade in a way that suggests an arbitrage opportunity, sharing similar volatility to the operator businesses over which it basically lords creditor status. In addition to that, it seems to be trading at a discount even assuming a perpetual fall in rental income due to an Eldorado default – an exceedingly conservative assumption. To us, this conclusively indicates an excellent value play with all the makings of a multi-bagger. As such, we continue to see GLPI as a high-conviction buy.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in GLPI over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment