imaginima

On Thursday, November 3, 2022, Canadian midstream giant Pembina Pipeline Corporation (NYSE:PBA) announced its third-quarter 2022 earnings results. At first glance, these results were quite solid as the company posted growth in terms of both revenue and net income. This is generally the trend that we have been seeing all across the midstream sector as most of the companies in the sector are reporting stronger financial performance than in the prior year quarter due to rising production of crude oil and natural gas. This is not likely to be an isolated occurrence though as the demand for both substances is expected to continue to increase over the coming years, which will result in increasing levels of business for companies like Pembina Pipeline. The company has been working quite diligently to attempt to take advantage of this and it certainly shows in these results and in Pembina Pipeline’s recent stock performance. In fact, the company’s stock is up 10.54% year-to-date, which substantially beats most of the major indices and companies in sectors other than energy. Despite this strong appreciation though, the stock still yields 5.76% at the current price, which is respectable but not nearly as high as Pembina Pipeline’s yield has been in the recent past. Overall, though, the company still deserves consideration for any income-focused portfolio.

As my long-time readers are no doubt well aware, it is my usual practice to share the highlights from a company’s earnings report before delving into an analysis of its results. This is because these highlights provide a background for the remainder of the article as well as serve as a framework for the resultant analysis. Therefore, here are the highlights from Pembina Pipeline’s third-quarter 2022 earnings results:

- Pembina Pipeline reported total revenue of C$2.779 billion in the third quarter of 2022. This represents a significant 29.32% increase over the C$2.149 billion that the company reported in the prior-year quarter.

- The company reported a gross profit of C$874 million in the most recent quarter. This represents a 28.15% increase over the C$682 million that the firm reported in the year-ago quarter.

- Pembina Pipeline handled average resource volumes of 3.424 million barrels of oil equivalent per day in the reporting period. This represents a slight improvement over the 3.411 million barrels of oil equivalent per day that the company handled in the same period last year.

- The company reported an operating cash flow of C$767 million in the current quarter. This represents a 15.99% decline over the C$913 million that the company reported last year.

- Pembina Pipeline reported a net income of C$1.829 billion in the third quarter of 2022. This represents a substantial increase over the C$588 million that the company reported in the third quarter of 2021.

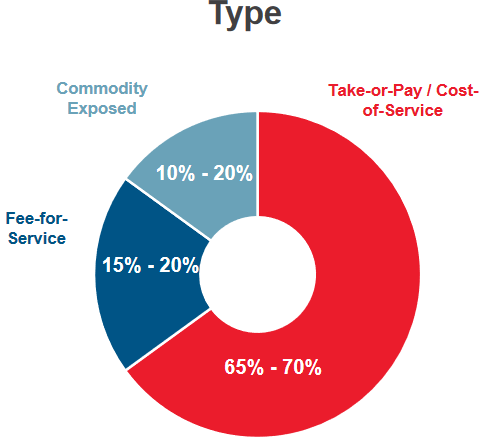

It seems certain that the first thing anyone reading these highlights will notice is that Pembina Pipeline saw year-over-year improvements in every area of financial performance except for operating cash flow. One major reason for this is that the company enjoyed higher transported volumes on its Peace Pipeline system, which is the company’s primary pipeline infrastructure network. Curiously, Pembina Pipeline did not actually specify what the volumes were on each of its pipeline networks, which is confusing since this company has provided this information in the past. The reason that higher volumes would result in improved financial performance is because of the business model that the company uses. In short, Pembina Pipeline enters into long-term (typically five to ten years in length) contracts under which the company stores and transports resources on behalf of its customers. The customers then compensate Pembina Pipeline based on the volume of resources handled, not on their value. In fact, between 80% and 90% of Pembina Pipeline’s cash flow comes from these contracts:

Pembina Pipeline

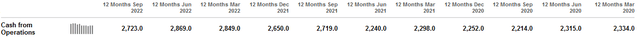

This is the reason why the company does not see its cash flow change much when energy prices do, despite the fact that the company’s stock usually does react fairly strongly to declines in energy prices. This is why these companies are sometimes equated to toll roads as opposed to being true energy firms. At this point, some readers might point out that the production of crude oil and natural gas tends to decline when prices do. This is true, but Pembina Pipeline has ways of protecting itself against this problem. It does this by including minimum volume commitments in its contracts, which specify a certain minimum volume of resources that a customer must send through the company’s infrastructure or pay for anyway. This provides Pembina Pipeline with remarkably stable cash flows over time. We can see this quite clearly here:

(all figures in millions of Canadian dollars)

This is something that we can appreciate as dividend investors because it provides a great deal of support for the dividend. After all, it is easier to budget when the amount of cash that is received every month or every quarter remains relatively stable. This allows the company to pay out a greater percentage of its cash flow than it otherwise could and thus allows us to receive a somewhat higher dividend yield than a company whose cash flow fluctuates wildly could pay out.

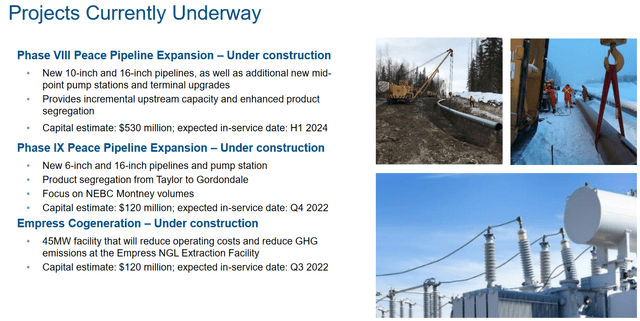

We can also see above that the company’s operating cash flow has generally increased over time. This is something that we also like to see since as investors we are interested in more than just simple stability. Pembina Pipeline is likely to continue this trend going forward because of the projects that the company currently has under construction. The company currently has three projects under construction that are expected to come online within the next two years:

The reason why it is necessary for the company to generate growth is that infrastructure such as pipelines or storage facilities only have a finite capacity of resources that they can store or transport. Thus, it is necessary to construct additional projects in order to handle higher volumes. We note above that the Empress Cogeneration facility is scheduled to come online during the third quarter of 2022. This did not happen on time. Pembina Pipeline reported in its earnings report that it managed to complete the construction of the facility during the third quarter, but it will not actually begin operating until November. The company is still reporting this as being on time and on budget though, but it does not look that way to me as it was not in service during the third quarter.

The more important project for the company’s growth though is Phase IX of the Peace Pipeline Expansion project. This project consists of the construction of new 6-inch and 16-inch natural gas liquids pipelines in the area north of Gordondale, Alberta. Pembina Pipeline stated in its earnings report that the project would be operational before the end of the year, although it did not provide any more information than that. Assuming that this is actually correct then we should see a bit of a cash flow increase during the fourth quarter due to the incremental volumes from this project. The bigger impact will come during the first quarter of next year due to the new pipeline carrying resources for the entire quarter (thus having higher volumes) as opposed to just part of the quarter.

One of the nicest things about both of the Peace Pipeline expansion projects is that Pembina Pipeline has already secured contracts from its customers for the use of the new infrastructure. This is nice because it ensures that Pembina Pipeline is not spending a great deal of money to construct infrastructure that nobody wants to use. In addition, the projects should all begin generating cash flow as soon as they start operating. This is especially certain because right now Alberta is somewhat bottlenecked with a lack of takeaway capacity. Thus, Pembina Pipeline’s customers are as eager to see this new infrastructure come online as the company itself is. Thus, we see a growth pathway for the company over the next two years, albeit not as strong as the ones that Enbridge (ENB) or Energy Transfer (ET) currently possess.

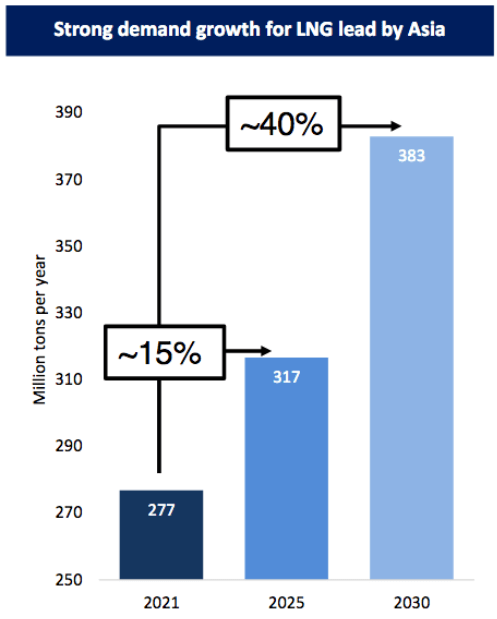

In previous articles on Pembina Pipeline, I mentioned that the company is actively trying to take advantage of some of the potential growth in the North American liquefied natural gas export market. This is a sector of the energy economy that is expected to see tremendous growth over the coming years as both Europe and Asia attempt to increase their imports of the substance alone. In fact, Asia alone is expected to increase its demand by 40% over the 2021 to 2030 period in an effort to combat some of the continent’s smog problems:

Golar LNG

In Europe, the situation is similar as the continent is attempting to reduce its dependence on Russian energy, and liquefied natural gas is seen as one possibility to accomplish that. The current energy crisis facing the European Union clearly shows that renewables alone are not going to work as a permanent solution for the region’s difficulties.

In its third-quarter report, Pembina Pipeline stated that it formed a partnership with the Haisla First Nation to develop the Cedar LNG project. The proposed plant will be a floating liquefaction plant off the coast of British Columbia that will produce about three million tonnes of liquefied natural gas per year. This position is near ideal since it provides easy transit to Asia across the Pacific Ocean. The company did not provide any details about who exactly is financing this project or how the revenues would be split. It is likely that Pembina Pipeline, the Haisla First Nation, and possibly a government entity within Canada would be sharing the costs somehow but this information is not currently forthcoming. Pembina Pipeline did state that the revenue model for the facility would be volume-based however, so it should be much more stable than energy prices. In addition, we do not yet have a timetable for the development of the project but the company stated that the final investment decision as well as more details will be coming no later than the third quarter of 2023. As always, I will provide updates about this in my regular articles on Pembina Pipeline as we get nearer to that date. This is something we will want to keep an eye on for sure.

One of the biggest reasons that investors purchase shares of Pembina Pipeline is because of the dividend that the firm pays out. Indeed, Pembina Pipeline currently boasts a 5.76% yield, which is quite a bit higher than the 1.64% yield of the S&P 500 index (SPY). Pembina Pipeline also has a long track record of raising its dividend over time:

Some readers might point out that there is a great deal of month-to-month fluctuation in the company’s dividend. That is caused by the company paying its dividend in Canadian dollars. Those investors that purchase the shares through most American brokerages are receiving the shares that are traded on the New York Stock Exchange. Those shares pay the dividend in U.S. dollars at whatever the exchange rate is at the time. As the exchange rate varies quite a bit from month to month, so does the dividend. Pembina Pipeline has never cut its dividend when measured in Canadian dollars.

The fact that the company raises its dividend consistently is very nice today because of the effect that inflation has on our purchasing power. Due to inflation, the number of goods and services that we can purchase with the dividend is steadily decreasing so it can feel as if we are getting poorer and poorer over time. The fact that Pembina increases the amount that it pays us over time helps to offset this effect and maintain the purchasing power of the dividend.

As is always the case, it is critical that we ensure that the company can actually afford the dividend that it pays out. After all, we do not want to be the victims of a dividend cut since that would reduce our incomes and likely cause the company’s stock price to decline. The usual way that we judge a company’s ability to pay its dividend is by looking at its free cash flow. The free cash flow is the amount of money that was generated by the company’s ordinary operations that is left over after it pays all its bills and makes all necessary capital expenditures. This is the money that is available to do things such as reducing debt, buying back stock, or paying a dividend. In the twelve-month period that ended September 30, 2022, Pembina Pipeline had a levered free cash flow of C$1.0015 billion but the company’s dividend costs C$1.44594 billion based on the current outstanding share count. This is concerning since it indicates that Pembina Pipeline is consistently failing to generate sufficient cash to pay its dividend.

However, midstream firms can frequently be thought of much like utilities. This is because many of the characteristics are similar including the generally stable cash flows and the very high capital expenditures. After all, it costs Pembina Pipeline an enormous amount of money to construct new pipelines over large geographic areas. One thing that utilities are well known for is financing these costs through the issuance of debt and equity while paying dividends out of their operating cash flow. In the trailing twelve-month period, Pembina Pipeline had an operating cash flow of C$2.723 billion. This is more than enough to cover C$1.44594 billion in dividends with a great deal of money left over for other purposes. Overall, this dividend is probably pretty safe.

One thing that investors appreciate about Pembina Pipeline’s dividend is that the company pays it monthly. This is nice for those that are relying on their portfolio income to pay bills because most bills are due monthly so a monthly income makes budgeting easier. In addition, those that reinvest the dividends tend to like monthly payments because it allows for more rapid compounding. Unfortunately, Pembina Pipeline will not be making monthly dividend payments for much longer. The company stated that it will move from a monthly to a quarterly dividend schedule in 2023 during its conference call. It is conceivable that this will exert some negative pressure on the stock due to the general desirability of monthly payments so this may provide investors with a buying opportunity in a few months.

In conclusion, Pembina Pipeline continues to perform quite well in the latest quarter. This is something that anyone can greatly appreciate. The company is certainly not resting on its laurels however as it is likely to continue to deliver some growth over the next few quarters as Phase IX of the Peace Pipeline expansion project comes online. Perhaps the worst thing in these results is the company switching from a monthly to a quarterly dividend but that’s not really an issue that has to do with performance. Overall, Pembina Pipeline continues to look like a reasonably good investment for a portfolio.

Be the first to comment