Justin Paget

Before the market opens on August 25th, the management team at Peloton Interactive (NASDAQ:PTON) is due to report financial performance covering the final quarter of the company’s 2022 fiscal year. Heading into that release, there seems to be a great deal of pessimism regarding the company. All those shares have risen nicely in recent months, they have, in general, been beaten down quite a bit this year. In fact, year to date, the stock is down 67.3%. To some, this might represent a good buying opportunity. But for other investors, it’s just a sign of the deficiencies of the business and how overpriced its stock was previously. Heading into the release, there are some things that investors would be wise to keep a look out for. What the company reports regarding these particular items will go a long way toward determining the future prospects of the enterprise.

Watch out for the following in Peloton’s Q4 earnings:

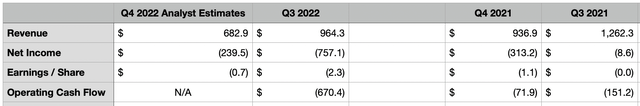

The most obvious thing that investors should keep a close eye on would be the top line and bottom line results of the company. These are the headline items that the news will report following the company’s earnings release. For starters, we should touch on revenue. For the quarter, analysts are currently anticipating revenue of $682.9 million. If this comes to fruition, it would represent a significant decline compared to the $964.3 million generated in the second quarter of this year. It would also be far below the $936.9 million generated in the final quarter of the company’s 2021 fiscal year.

Interestingly, however, it’s unlikely that revenue will be down across the board. You see, the company currently breaks up its sales across two separate categories. The first of these would be the Connected Fitness Products the company sells. Examples include the Peloton Bike and Peloton Bike+, as well as the Peloton Tread. Revenue here also involves the new Peloton Guide, which operates as a camera that turns your television into a connected workout device. The second category would be the company’s Subscription products. This mostly involves the All-Access Membership, but it also includes the cheaper Peloton App offering.

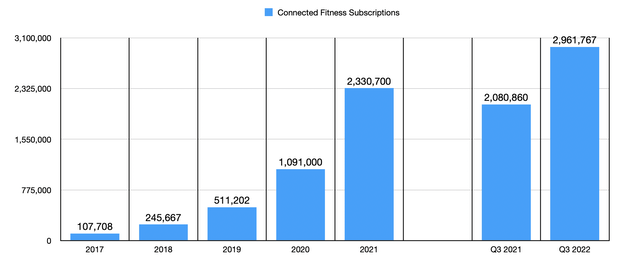

Over the years, the number of subscribers to the company’s services has risen nicely. Consider recent performance. At the end of the firm’s 2021 fiscal year, it boasted 2.33 million subscribers on its platform. This number ultimately grew to 2.96 million by the end of the third quarter this year. That’s up from the 2.08 million reported one year earlier. Although there is a relationship, long-term, between the equipment sold and subscriptions, it wouldn’t be surprising to see the number of subscribers continue to expand in the final quarter of the year. On top of that, it’s likely that revenue associated with subscribers will eventually increase. After all, the company did recently increase the price of its All-Access Membership from $39 per month to $44 per month. Although this may be a deterrent to some, management did also express in their third quarter earnings release that they made a mistake by not previously pushing this higher-tiered premium subscription onto the subscribers of its app. The price of the app comes out to $12.99 per month. By pushing this, we might see stronger than expected growth in subscription revenue. On the other hand, if we see the opposite occur, that could prove very problematic for the company even as management has touted its goal of continuing to grow subscribers over the next few years.

The more complicated side of the picture involves the sale of its Connected Fitness Products. already this year, the company has exhibited tremendous weakness in this space. Previously, it had suffered as a result of price cuts last year. But in addition to that, it also experienced a decline in units shipped. Unfortunately, management has not revealed the specific number of shipments from quarter to quarter. But they did admit that the decline took place in the latest quarter. That ultimately proved instrumental in pushing revenue associated with these products down from $1.02 billion to $594.4 million. Almost certainly, further weakness will be shown in the final quarter. If this does come to pass, then it will also throw into doubt management’s recent decision of increasing the pricing of its major products. Earlier this year, for instance, the company raised the price on its Bike+ from $1,995 to $2,495. Meanwhile, the Tread saw a price increase from $2,695 to $3,495.

This is not to say that the company doesn’t have anything to offset this. Customers do have the option to rent the company’s equipment, with the Bike starting off at $89 per month, plus a $150 delivery fee, while the Bike+ is $119 per month with the same delivery fee. Included in this is the All-Access Membership, effectively reducing the monthly cost of the bikes down to $45 and $75, respectively. More likely than not, however, this would not be enough to offset the decline in units entirely or even close to it. But long term, it could be a good avenue for revenue for the business.

With revenue expected to decline, profitability for the company will also be an issue. Analysts currently anticipate that the company would generate a net loss of $0.71 per share. On an adjusted basis, this should be even higher at $0.77. To put this in perspective, the company generated a loss per share of $1.05 in the final quarter of 2021. That translated to a net loss of $313.2 million. It’s worth noting that, recently, the company has missed expectations on the bottom line. The loss per share in the second quarter of this year was $2.27. That was off the mark by $1.39. Though if we adjust for certain factors, the company did manage to beat expectations by $0.04 per share. Investors should also pay attention to cash flow. Operating cash flow in the latest quarter was negative to the tune of $670.4 million. Though if we adjust for changes in working capital, it would have been negative by $147 million. In the final quarter of last year, it was negative by $170.7 million on an adjusted basis. Management has expressed a keen desire to push cash flow into positive territory, with a goal of doing that, on a free cash flow basis, by sometime next year.

Although I don’t expect much for the fourth quarter, there is no denying that management is making moves to cut costs. Increasing revenue by raising prices might help in that regard, particularly when it comes to its subscriptions. However, the company also announced previously that it was reducing its headcount by 784. On top of that, the firm recently announced, on July 12th, that it had decided to exit all of its owned manufacturing operations and was, instead, expanding its relationship with Taiwanese manufacturer Rexon Industrial Corp. The company also announced then it will be suspending operations at its Tonic Fitness Technology facility for the rest of 2022, part of a business that it acquired in late 2019. It’s unclear, however, what this impact will mean for the firm.

Takeaway

At this point in time, the fundamental picture for Peloton Interactive is anything but great. The company is making a number of significant changes that it hopes will improve its results. While this is entirely possible, any significant improvement will likely take a while. No doubt, the company’s decision to increase what it charges on its units does suggest some degree of desperation. To increase prices at a time when orders are falling is one of the worst things that can happen. But management is doing what it feels it has to in order for the company to turn itself around. Long term, the company may very well end up being a great prospect. But when I wrote about it back in July of this year, I acknowledged that a lot of pessimism had been priced in but that the company might see further downside before the picture gets better. I ultimately rated the business a ‘hold’ and, since then, shares have rebounded by 26.1% at a time when the broader market has risen by 9.8%. And in truth, given recent developments, I have a difficult time believing that the company will post strong enough financial results in such a short timeframe to warrant such upside potential. Because of this, I decided to change my rating on the company from a ‘hold’ to a ‘sell’.

Be the first to comment