Sundry Photography

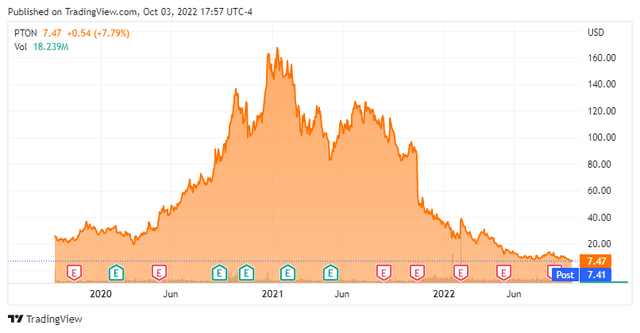

Peloton Interactive (NASDAQ:PTON) was a pandemic hero as shares appreciated from roughly $20 on March 13th, 2020, to a height of around $168 on January 13th, 2021. Over a 10-month period, PTON generated a 740% return as shares appreciated by $148. While PTON has become one of the best trades for many investors, it’s been a capital destroyer for others. Since its peak of $168 on January 13th, 2021, PTON has fallen -95.55% to $7.47. Earlier in the year, there were rumors about Amazon (AMZN) possibly acquiring PTON, which didn’t materialize, and shares continued their downward descent, falling -78.78% in 2022.

Recently, PTON announced 2 partnerships with Hilton Hotels (HLT) and DICK’S Sporting Goods (DKS), but the market hasn’t rewarded shares as they are down -8.9% over the previous 5 days and -17.28% over the past month. I think these partnerships are a move in the right direction, but they will probably have minimal impact on PTON’s income statement. The biggest problem for PTON is their expenses, and I don’t see these deals moving the needle. I think it’s going to take much more than deals with Hilton Hotels and DKS to resuscitate shares of PTON.

Going over Peloton’s Income Statement and why I am not bullish on their future

PTON doesn’t report on a calendar year, as its fiscal year ends in Q2. I will be discussing results in their fiscal years, with the most the recent fiscal year 2022 representing Q3 and Q4 of 2021 and Q1 and Q2 of 2022.

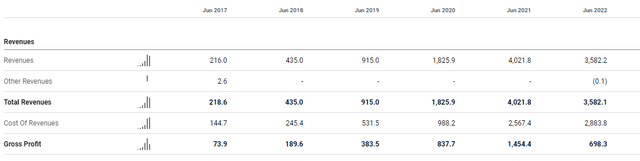

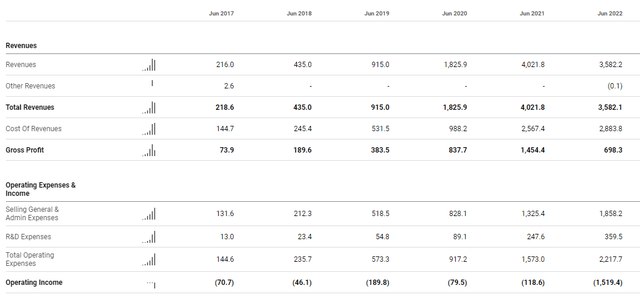

PTON was one of the hottest companies during the height of the pandemic as gyms across the country closed and individuals changed their lifestyles. In the fiscal year 2020, PTON’s revenue grew by $850.9 million, which was a growth rate of 87.27%. In the fiscal year 2021, PTON witnessed a huge surge as its revenue grew by an additional $2.2 billion, which was a YoY growth rate of 120.26%. There is no question that PTON created a great product, but what PTON couldn’t do was turn a profit. PTON generated -$189 million of net income, -$0.64 of EPS, and -$570.1 million of FCF during the fiscal year of 2021, which has been its largest year of revenue. PTON recently reported their fiscal year 2022 numbers, and total revenue declined by -$439.7 million (-10.93%), and they lost -$2.8 billion. If you can’t break even or turn a profit during the largest year of revenue on the books and growth is now decelerating, it will take significant efficiencies and cost-cutting to break even, essentially capping PTON’s potential.

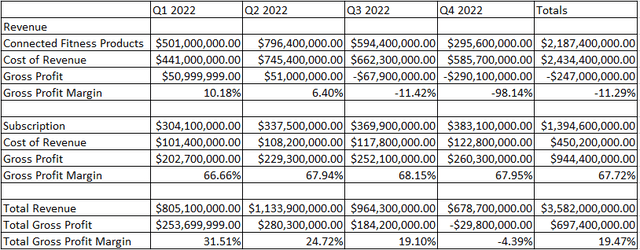

PTON’s revenue is divided into 2 segments, Connected Fitness Products and Subscriptions. I went through PTON’s quarterly shareholder letters and broke out PTON’s quarterly revenue and gross profit for the fiscal year 2022.

In the fiscal year 2022, PTON generated $3.58 billion of revenue, of which $697.4 million became gross profit. PTON’s gross profit margin isn’t optimal at 19.47%, as this doesn’t leave much room for operating expenses after the cost of revenue is accounted for. PTON’s vision is great as they built a high-level piece of equipment and brought personal training and community into your home. Once someone purchases a Peloton, they will most likely purchase a monthly subscription plan, which is the key to PTON’s success. The problem is that PTON has been losing money on manufacturing the equipment to drive revenue from subscriptions.

In the 2022 fiscal year, PTON generated $2.2 billion of revenue from selling Connected Fitness Products, but their cost to generate the $2.2 billion of revenue was $2.43 billion. This business segment had a gross profit margin of -11.29%, as its gross profit was -$247 million. Subscriptions are PTON’s bread and butter as this is a high-margin business. PTON generated $1.39 billion of revenue from subscriptions in its most recent fiscal year, and its cost was $450.2 million. PTON generated $944.4 million in gross profit from subscriptions which is a 67.72% gross profit margin. Overall, PTON operated at a 19.47% gross profit margin, generating $697.4 million in gross profit.

There are some severe problems embedded in the income statement. PTON’s revenue declined by -10.93%, from $4.2 billion to $3.58 billion YoY, but its cost of revenue grew by $316.4 million (12.32%), and its total operating expenses grew by $644.7 million (40.99%). PTON’s operating income fell to -$1.52 billion, declining by -$1.4 billion (-1.181%). There are just too many things that need to fall into place, from their manufacturing costs getting under control to slashing operating expenses, just to have the possibility of turning a profit. It’s hard to see the long-term growth potential in PTON’s non-existent net income or FCF to get excited. Life is going back to normal, people are going back to gyms, sales of their equipment are declining, and QoQ subscription revenue growth is minimal. I am not bullish on PTON’s prospects, and the Hilton Hotel and DKS deals aren’t enough to get me to even speculate on PTON.

The Hilton Hotel Deal

In full disclosure, I like the Hilton deal much more than the DKS deal, but after running the numbers, it’s not going to do much initially for PTON.

Hilton announced a partnership with PTON, and by the end of 2022, almost all of the 5,400 U.S. Hilton branded hotels from Hampton by Hilton to the Waldorf Astoria will feature at least 1 Peloton bike in their fitness center. While this seems like a big win on the surface, as it’s better than nothing, it’s not a game-changing deal by any means.

I will speculate and give PTON the benefit of the doubt that manufacturing has improved, and they will sell the bikes at cost to HLT and break even. The real money is in subscriptions. PTON has 3 levels of subscriptions, $12.99/mo for the App Membership, $24/mo for Guide Membership, and $44.99/mo for All-Access Membership.

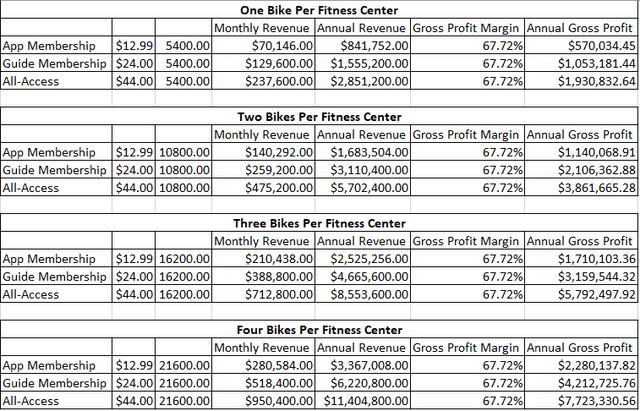

I created a table illustrating how much gross profit PLTN would generate from the subscriptions associated with the equipment placed in HLT’s facilities. The press release said nearly 5,400 hotels would feature at least 1 Peloton bike in their fitness centers. In the grid below, I showed the gross profit in the best-case scenario of all 5,400 fitness centers placing from 1-4 bikes in their fitness centers.

Assuming that each bike has a subscription, if HLT was to place 1 bike in each fitness center, the All-Access membership would bring in $237,600 of monthly revenue ($44 * 5,400). Annually this would be $2.85 million. PTON has a 67.72% gross margin, so its annual gross profit would be $1.9 million. If there was an average of 4 bikes per fitness center, PTON would generate $11.4 million in annual revenue from the subscription fees, which would translate to an additional $7.72 million of gross profit. The possibilities range from $570,034.45 in annual gross profit assuming 1 bike was placed in each fitness center, and an App Membership was purchased to $7.72 million of gross profit from an average of 4 bikes per fitness center with the All-Access Membership. This is hardly a game-changing deal, and while it’s better than nothing, it’s not nearly enough to move the needle.

For this deal to pay off, PTON needs several things to occur. First, they need people to use the hotel fitness center equipment. Then PTON needs to hope people fall in love with the product so much that they buy one for themselves. PTON also needs other hotel chains to upgrade their fitness centers by adding Peloton bikes to create a comparable experience to HTL locations. This deal could extrapolate down the road but how much exposure it brings remains to be seen.

The DICK’S Sporting Goods Deal

DKS and PTON reached a deal where PTON products would be housed inside a branded fitness shop inside more than 100 DKS locations, and their products would be sold through DKS e-commerce platform. DKS has over 850 locations so there could be room for growth with a larger in-store presence if the branded shops do well.

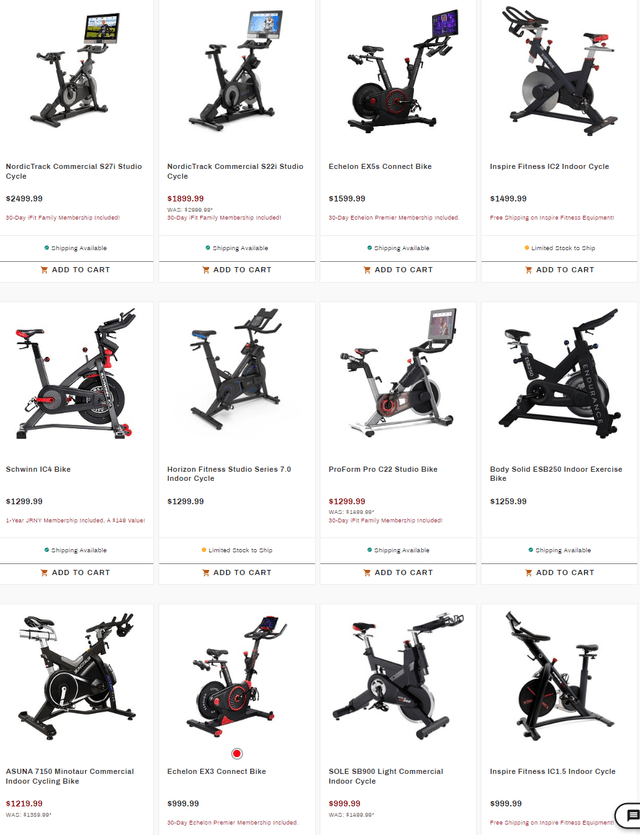

There are two problems with the DKS deal. First is the unknown, and second is what did PTON give up in the deal? Starting with the unknown, it’s hard to speculate and come up with an accurate number of how many Peloton bikes DKS will sell both in-store and via their website. When I went on the DKS website, there were 12 bikes at a price point of $999 and higher that one could say would be similar to a Peloton. We’re going to need some data over the next several quarters to see how effective selling at DKS is. Peloton bikes were so popular that I am not sure how much in additional sales they will see through DKS. I feel like if someone wanted a Peloton bike, their first instinct would be to go to PTON’s website, not DKS.

The second problem is not knowing the deal PTON made with DKS. Currently, PTON loses money making the actual equipment, so I can’t see them selling the bikes at a greater loss to DKS. Last quarter Connected Fitness Products had a -98.14% gross profit margin as it cost $585.7 million to generate $295.6 million of revenue. We also don’t know if DKS will get a percentage of the subscription plan from the bikes sold through DKS locations or website. I know that if I made this deal, I would make sure that DKS was generating money on the backend through the monthly subscription and upfront on the product. DKS is in the driver’s seat as PTON needs them more than DKS needs PTON. It’s entirely possible that DKS is getting paid on both ends, which would eat into PTON’s gross profit center on the subscriptions.

Conclusion

Unless PTON can revolutionize another area of fitness, I am having a hard time seeing a bright future for them. The financials aren’t appealing, PTON lost money in its largest revenue year, and expenses have increased. Even if manufacturing costs get under control and their operating costs drastically decrease in the 2023 fiscal year, there is still a large uphill battle just to break even. At this point, I feel like you need to hope PTON is taken over by a company such as Nike (NKE). Here is something to think about. If PTON represents a great value today, why didn’t DKS just buy the company? DKS has $1.89 billion in cash and could have lined up financing or issued equity for PTON, as its market cap is $2.35 billion. I wouldn’t be a buyer here, as it doesn’t look like a white knight is going to swoop in and save PTON. There are too many things with the numbers that don’t work for me, and the road just to getting back to even is going to be tough, especially if revenue continues to decline.

Be the first to comment