JasonDoiy/E+ via Getty Images

U.K.-based education provider Pearson (NYSE:PSO) continues to underwhelm. It recently knocked back a trio of takeover offers from a private equity bidder, but I don’t see an equivalent catalyst to unlock shareholder value in its current existence as a listed company. I continue to think it has a good set of assets on paper, but the latest results underline its ongoing struggle to transform them into a sufficiently rewarding business model.

Another bid from somewhere could boost the share price, but in the absence of that I see no upside for the shares at their current level and am reducing my rating to “sell”.

Apollo Launched Three Unsuccessful Bids for Pearson

Last month the company confirmed that it had been the target of three takeover bids, all made by Apollo Global Management and its subsidiaries. The first unsolicited offer was in November and pitched at £8 per share. In March the offer was raised to £8.54 and then again effectively to £8.84. Pearson’s board “concluded that it significantly undervalued the Company and its future prospects.”

Looking back to Pearson’s share price history, the bid does look opportunistic. The Pearson share price has taken a pounding over the past couple of years. Apollo’s bid basically just values the business at where it was for part of 2019 (and indeed below where it stood the prior year). With its ability to wring out costs I expect that the price would indeed be a bargain for Apollo.

On the other hand, Pearson’s share price was sliding in 2019 well before pandemic concerns surfaced. The company has grappled with a variety of other challenges and has a long history of shareholder destruction. So although I thought the Apollo bid (even at its final level) lowballed, I felt that Pearson management ought to have engaged more constructively with it. I think it is also noteworthy that the bid did not bring out any rival potential suitors for the company.

So the bid was a reminder that there is clear value in the Pearson asset base – but also that realizing that full value may be beyond current management.

Results

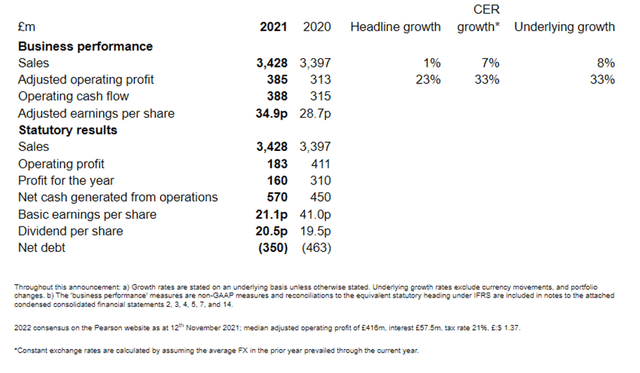

In February the company announced its prelim results for 2021. Sales inched up, free cash flow fell 42% (failing to cover dividends) and statutory profits almost halved. For all the positive noises, that was not quite the good news many investors had hoped for.

Source: company prelim results announcement

Revenues and profits are both below pre-pandemic 2019 levels and even then the long-term trend had been one of decline. 2021 had challenges just like 2020, but unlike most U.K. companies, Pearson turned in a worsening performance on most key metrics.

The concern the results sparked in me is that as has been the case for so long, Pearson on paper has a great sounding collection of assets, but somehow consistently fails to translate that into strong commercial performance. While the company raised the full-year dividend per share 5% from 19.5p to 20.5p, that was not merited by the financial performance in particular. That 1p per year rate of increase, as I noted elsewhere, is only enough to get the dividend back to its 2016 level by 2052.

Valuation Now Looks High

Back in January, in Pearson: Fair Value But Not Cheap Enough To Tempt Me, I rated Pearson as a hold on the basis that it was fairly valued. Since then, the shares have moved sharply up. In my view that is in response to the Apollo bid. As I write, the London-listed shares trade at 96% of the initial Apollo bid price. Their 12-month high was exactly the price of Apollo’s final offer. So I expect that, in the absence of any other offers or significant corporate news in coming months, they will drift downwards again.

The bid’s reminder of the value of the group may lift the baseline of support for the shares, however. Nonetheless, at the current price, I see them as overvalued. They trade at a P/E ratio of 37 based on last year’s statutory earnings per share. That looks overpriced to me for a company with Pearson’s lackluster economic characteristics. I would take the opportunity to sell at the current price unless hanging on for the hope of a bid from another quarter (or renewed bid from Apollo down the line).

Be the first to comment