Design Cells

A humble man speaks not of his own humility” – Jeremy Aldana

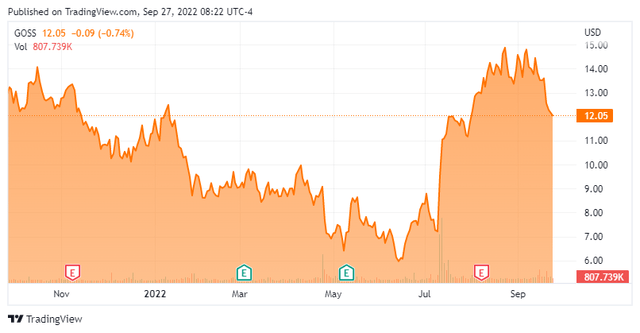

Today, we are shining the spotlight back on Gossamer Bio (NASDAQ:GOSS) for the first time since our last article on this small biotech name back in October of last year. The stock trades almost exactly where it was during our last look at it, which given the carnage in the markets here in 2022, counts as a victory. The shares had some insider buying in July within a private placement. No one else on Seeking Alpha has touched on the company since we last revisited it. In addition, the stock has had a wild ride in recent months. Therefore, it seems to be a good time to incorporate developments in 2022 and update our take on Gossamer. An analysis follows below.

Company Overview:

Gossamer Bio is clinical-stage biopharmaceutical concern focused on the development or procurement of therapies in the areas of immunology, inflammation, and oncology. The company is based in San Diego and the stock currently trades at around $12.00 a share and sports an approximate market cap of $1.1 billion.

Recent Developments:

August Company Presentation

The company has a couple of pipeline assets in development. The most important of which is a compound called seralutinib which is also known as GB002. This candidate is targeting Pulmonary Arterial Hypertension, commonly known as PAH. The condition is a function of abnormal cell growth within and around small blood vessels of the lung that move blood from the right side of the heart to the lungs. Despite products on the market to treat this condition, the five-year survival rate is just over 55%.

August Company Presentation

Seralutinib has Orphan Drug status both in Europe and U.S. for this indication. This candidate is an inhaled inhibitor of the following tyrosine kinases: platelet-derived growth factor receptors α and β (PDGFRs), colony-stimulating factor 1 receptor (CSF1R), and c-KIT. It is designed to treat PAH as described in the slide above.

August Company Presentation

Currently, seralutinib is being evaluated in a Key Phase 2 trial called Torrey. This is a clinical study in patients with PAH whose disease has progressed despite standard-of-care therapy. The primary endpoint of this trial is the change in pulmonary vascular resistance from baseline at week 24. Topline results are scheduled to be out anywhere from the back half of November or first half of December of this year.

August Company Presentation

Last week, Wedbush reiterated their Buy rating on GOSS. The analyst there noted:

This mid-stage trial has a high likelihood of success due to seralutinib’s mechanism of action and positive results in both the preclinical and early-stage studies.”

She further stated that she ‘believes that seralutinib has the potential to capture 42% of the market in the U.S. in 2030 with projected sales of $2.5B, assuming that the drug is launched in 2026.’

August Company Presentation

The company has a couple of other earlier staged assets in development. The only out of the clinic is GB5121. This is an oral, CNS-Penetrant BTK Inhibitor that is targeting Primary CNS Lymphoma (PCNSL) and other Rare CNS Malignancies. Currently, an open-label Phase 1b/2 study ‘STAR’ is underway to evaluate GB5121 for these indications. That study recently dosed its first patient. Management has stated that data from STAR will be presented at relevant medical conferences, as data become available.

August Company Presentation

Analyst Commentary & Balance Sheet:

The company ended the second quarter with just over $220 million in cash and marketable securities on its balance sheet after posting a net loss for the quarter of $56.5 million. Two weeks after the quarter closed, management executed a private placement that raised an additional $120 million in proceeds. Four insiders including the CEO and CFO bought nearly $1.2 million in total of the private placement in mid-July. Up to that point, insiders had sold approximately $600,000 worth of shares in aggregate in 2022. Just over 20% of the outstanding float in GOSS is currently held short. The company has just over $200 million in long-term debt.

August Company Presentation

Since the private placement, seven analyst firms including Wedbush and UBS have reissued or assigned Buy or Outperform ratings on the stock. Price targets range from $15 to $24 a share. Here is the take from Piper Sandler ($15 price target) who maintained the Overweight rating right after the private placement:

The fundraising with this group of “strong investors” increases the analyst’s conviction call for a positive data readout in Q4 given that the majority of the existing top investors chose to pursue the investment after reviewing available Phase 2 TORREY data. The analyst, now has increased confidence in a positive outcome for the ongoing 24-week Phase 2 TORREY study“

JPMorgan seems the lone current bear on the stock right now, initiating the shares as a Neutral last week with a $17 price target.

Verdict:

The company’s near- and medium-term future will be determined by the success or failure of the development of seralutinib. Investors will get their next data point from that front in approximately two months when topline data from the TORREY trial is disclosed.

One needs to balance the potentially large market seralutinib will enjoy in PAH if eventually approved with the fact any commercialization is many years away. The company’s current funding needs are met. However, Gossamer will have to do at least one more significant capital raise (outside a buyout or collaboration deal) before any potential FDA approval of seralutinib.

Analyst firms seem sanguine on the company’s long-term prospects while the stock has a high short position. Given all that, Gossamer probably continues to merit only a small ‘watch item‘ position for now. Options are available against this equity, making a covered call strategy viable, which is how I am holding my small stake in GOSS within my own portfolio.

Egotism ends the moment you realize you’re going to die like everyone else.” – Marty Rubin

Be the first to comment