MCCAIG

This is an abridged version of the full report published on Hoya Capital Income Builder Marketplace on August 12th.

Real Estate Weekly Outlook

U.S. equity markets advanced for a fourth-straight week as inflation showed signs of peaking from multi-decade-highs, potentially relieving some pressure from the Federal Reserve to aggressive hike interest rates. For the major equity benchmarks, the four-week rally – which counterintuitively began the same week that GDP data revealed that the U.S. entered a technical recession in early 2022 – follows a brutal stretch of 11-of-15 weekly declines as investors pin hopes on a potential monetary policy “pivot” even as Fed officials were vocally adamant that it’s too soon to “declare victory” over inflation.

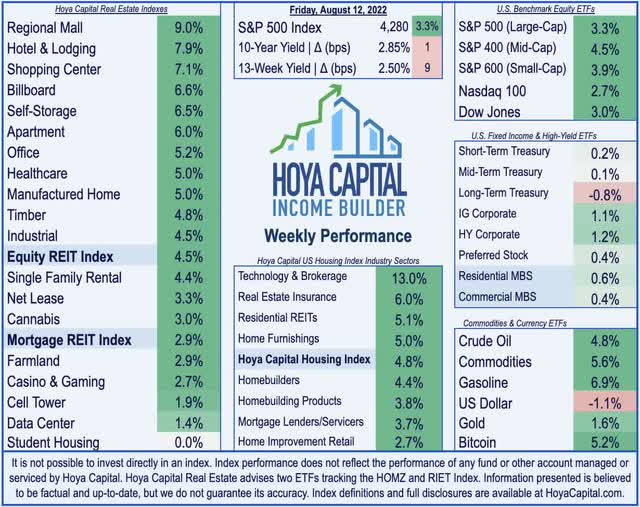

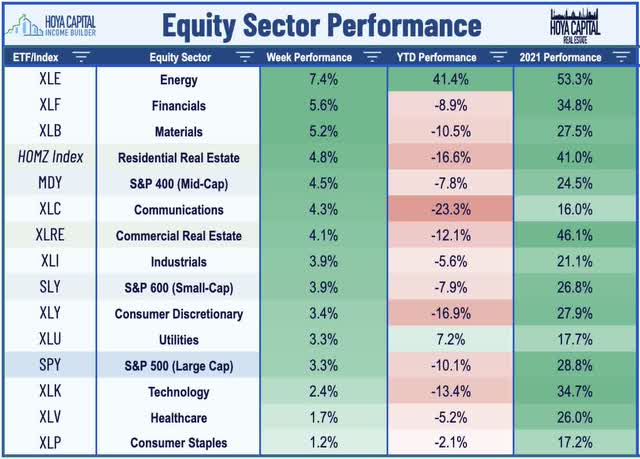

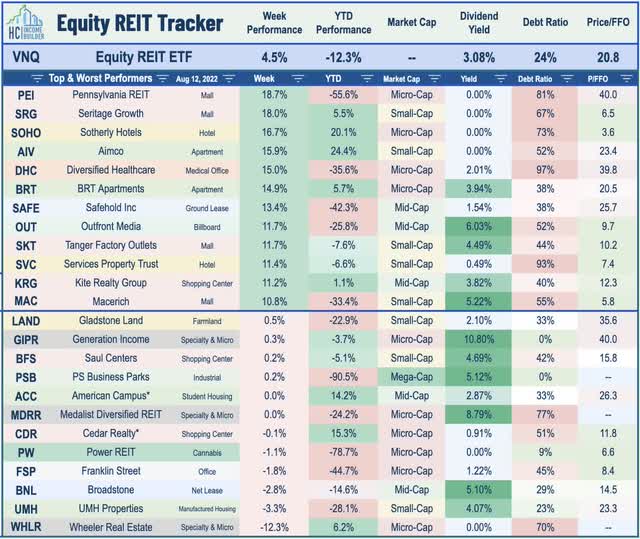

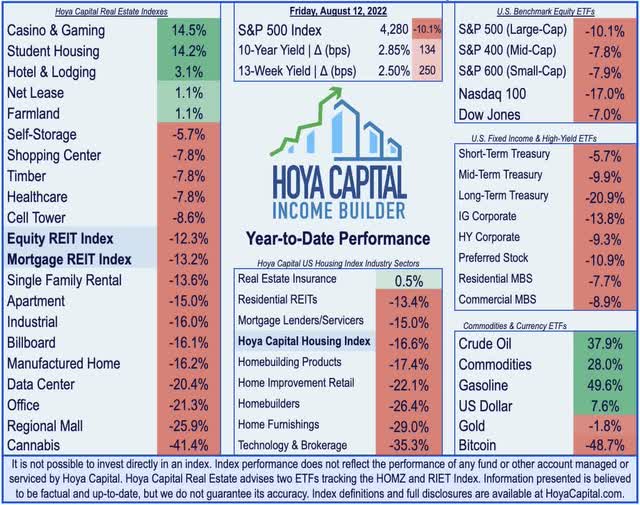

Delivering its first four-week winning streak since last November, the S&P 500 rallied another 3.3% on the week, trimming its year-to-date declines to around 10% after bottoming in mid-June at a nearly 25% drawdown. The outperformance continued for the more-domestic-heavy benchmarks with the Mid-Cap 400 rallying 4.5% while the Small-Cap 600 advanced 3.9%, each outpacing the tech-heavy Nasdaq 100 which gained 2.7%. Real estate equities were among the strongest performers on the week as earnings season wrapped up with a handful of solid reports and another wave of dividend hikes. The Equity REIT Index rallied 4.5% on the week with all 18 property sectors in positive territory while the Mortgage REIT Index advanced by 2.9%.

Lifted by cooler-than-expected inflation reports throughout the week, credit markets rebounded following a sell-off in the prior week, but the 10-Year Treasury Yield held firm at 2.85% as inflation optimism was offset by a nearly 5% surge in Crude Oil prices and the passage of another sweeping $430 billion spending plan that includes several new taxes including a 1% excise tax on corporate buybacks. All was overshadowed by developments surrounding an FBI search of former President Trump’s residence – a stunning revelation that added uncertainty over the upcoming 2022 midterm elections. All 11 GICS equity sectors finished higher on the week with Energy (XLE) and Financials (XLF) leading the way while homebuilders and the broader Hoya Capital Housing Index also rallied nearly 5%. Technology stocks lagged, however, after chip manufacturers NVIDIA (NVDA) and Micron (MU) warned of softening demand.

Real Estate Economic Data

Below, we recap the most important macroeconomic data points over this past week affecting the residential and commercial real estate marketplace.

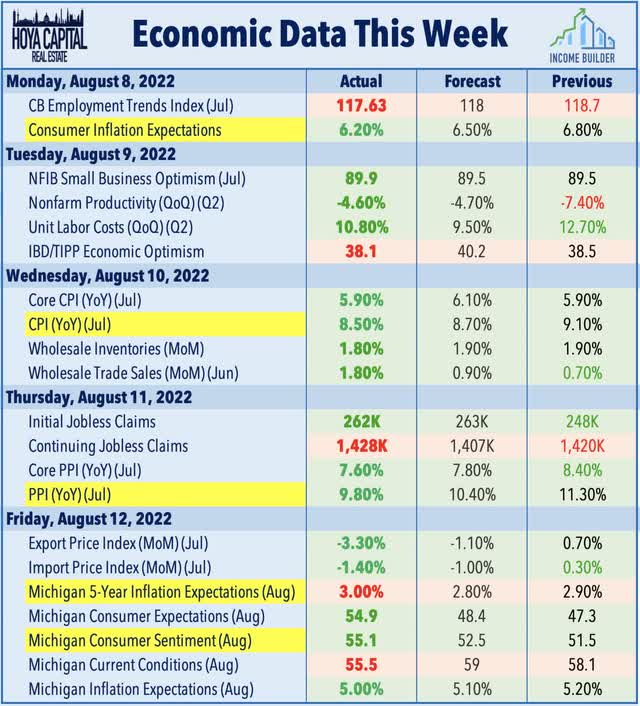

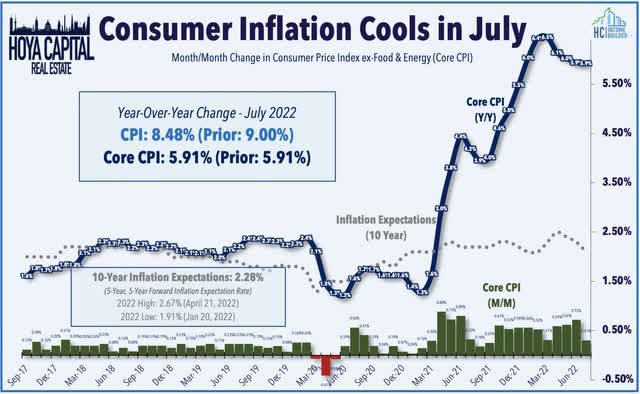

Peak Inflation? Perhaps. Consumer prices decelerated in July from multi-decade highs set in June as slowing global economic growth helped to put downward pressure on gasoline and commodity prices, offsetting a continued rise in services costs. The annual increase in the headline Consumer Price Index decelerated to 8.5% in July – below the 8.7% rate expected – and below the 9.0% rate last month which was the highest since January 1981. Notably, the month-over-month change in the headline CPI was fractionally negative – the first monthly price decline since May 2020 – as the gasoline index fell 7.7% in July to offset increases in the food and shelter indexes. The Core CPI – the metric on which the Fed focuses its attention – rose 5.9% – steady with last month but cooler than estimates of 6.1%. Meanwhile, the headline Producer Price Index fell 0.5% from June – its first month-over-month decrease since April 2020 – and significantly better than the expected increase of 0.2%. On a year-over-year basis, the index is higher by 9.8%, snapping a record streak of seven months of double-digit inflation.

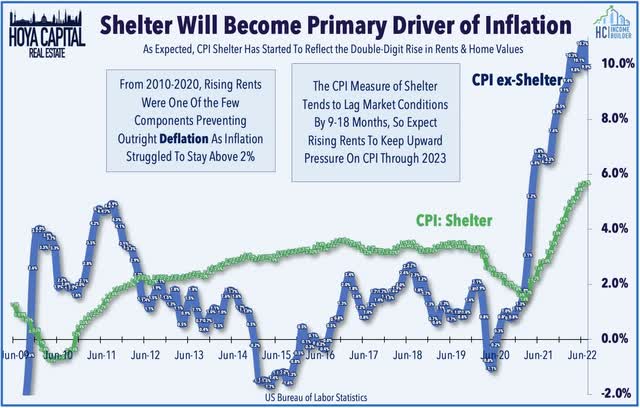

As we’ve discussed for the last year, we expect that shelter will increasingly become the primary driver of inflation – a role it assumed for much of the prior decade – which will be especially likely given the delayed recognition of soaring shelter costs – the single largest weight in the CPI Index – which is just beginning to filter into the data. The shelter index rose 5.7% over the last year, accounting for about 40 percent of the total increase in all items less food and energy, but we believe this still significantly understates the actual rise in shelter costs as private market rent data has shown that national rent inflation has been in the 10-15% range over the past twelve months while home values have risen by 15-20%. The Dallas Fed published a report highlighting the data issues at the BLS, finding a 16-month lag between the BLS inflation series and real-time market pricing of home prices and rents which will add an estimated 0.6-1.2% to the Core CPI index in 2022 and 2023.

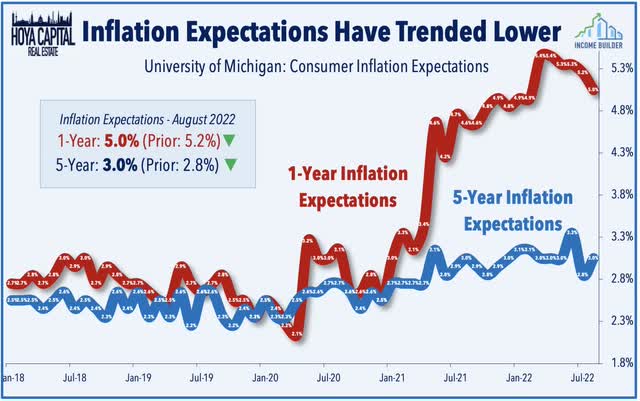

Survey data this week also showed early signs of moderating consumer inflation expectations. A New York Federal Reserve survey showed a sharp decline in consumer inflation expectations in July as recession concerns fueled significant declines in expectations of food prices, energy, and home prices over the survey horizon. Notably, consumers see the three-year inflation rate at 3.2% – down from 3.6% last month – and only marginally above the 10-year average inflation expectation of around 3.0%. Later in the week, the Michigan Consumer Sentiment survey showed that one-year inflation expectations moderated to 5.0% from 5.2% – the lowest since February – but five-year inflation expectations drifted higher to 3.0%, but still below the 3.3% peak in June. The Fed is particularly interested in the 5-Year Inflation Expectations survey, looking for signs of a potential “wage-price inflation spiral” through elevated consumer wage expectations.

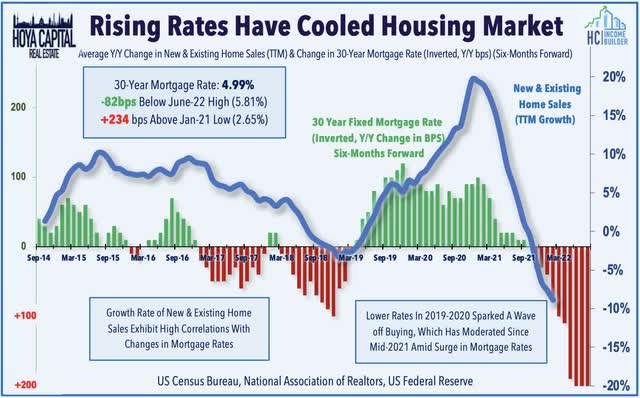

The retreat in inflation expectations is particularly welcome news for the U.S. housing market, which has been slammed especially hard by the historic surge in mortgage rates since last November. Since peaking in June at above 6%, rates on a 30-Year Fixed Rate Mortgage have declined anywhere from 50-90 basis points across various data series with some quotes back in the high-4% range. As discussed in Homebuilders: Short Term Pain, Long-Term Gain, those looking for a deep value “contrarian play” need not look much further than the homebuilders, which are perhaps the most unloved industry group across the entire equity market. These discounted valuations may have been justified if mortgage rates continued their extraordinary surge seen in early 2022 – a surge that rapidly turned the housing market from red-hot to icy-cold – but the housing market looks markedly different with rates in the 4% range compared to the 6% range. While not out of the woods yet given the ongoing uncertainty over the path of inflation – which ultimately dictates the path of Fed policy and mortgage rates – we believe that the risk-reward for the homebuilding sector is now skewed heavily to the upside.

Equity REIT Week In Review

Best & Worst Performance This Week Across the REIT Sector

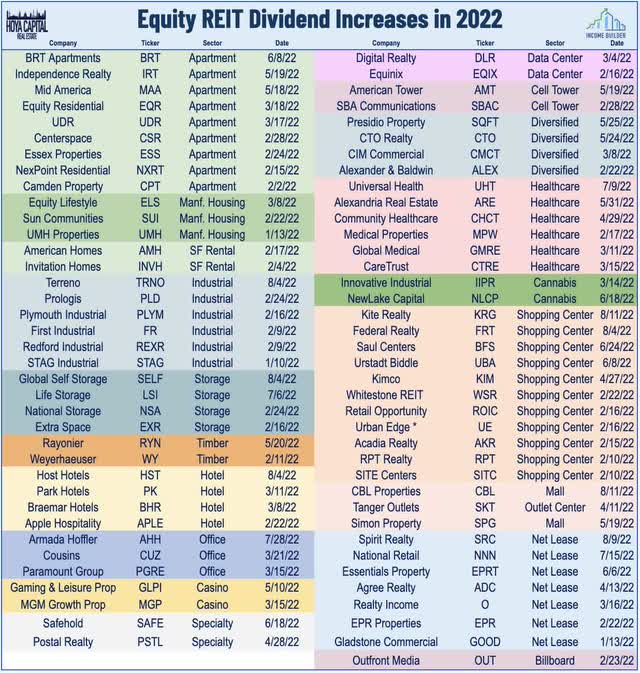

Real estate earnings season wrapped-up this week on a high note with solid reports from a handful of retail REITs and another wave of dividend hikes. As discussed in Rents Paid, Dividends Raised, the U.S. REIT industry – which remains relatively “early” in its post-pandemic recovery – exhibited few signs of softness in the second quarter even as the U.S. entered a technical recession. Earnings results from residential, self-storage, and shopping center REITs were most impressive, followed closely behind by industrial and net lease REITs. Another dozen REITs hiked their dividends this earnings season including Kite Realty (KRG) – one of our three “Best Ideas in Real Estate” – which surged more than 11% this week after it raised its quarterly dividend for the third time this year to $0.22/share, a 33% increase from its third quarter dividend last year. Elsewhere, net lease REIT Spirit Realty (SRC) hiked its dividend by 4%, bringing the full-year total across the REIT sector to 86.

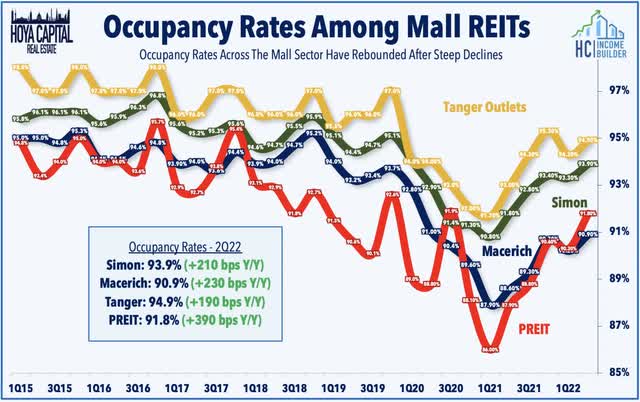

Malls: Tanger Factory Outlet (SKT) rallied nearly 12% this week after reporting decent results and raising its full-year NOI and FFO growth outlook by 60 basis points, but to levels that are still 24% below 2019-levels. Encouragingly, SKT did record its strongest 12-month average rent spread in nearly five years of 4.1% while reporting an increase in occupancy to 94.9% – up 190-basis-point from last year. Small-cap Pennsylvania REIT (PEI) surged nearly 20% on the week after reporting better-than-expected results including its first quarter of positive FFO since it emerged from Chapter 11 bankruptcy in November 2020. Importantly, PEI reported progress in its plan to sell assets to pay down its extreme debt loads, noting that it paid down $82M in debt so far in 2022 and has roughly $250M in asset sales in the pipeline. Property-level fundamentals remain soft, however, with total renewal spreads of -1.5% in Q2 – down from the -1.4% spread in Q1. Elsewhere, small-cap mall REIT CBL & Associates Properties (CBL) – which emerged from Chapter 11 bankruptcy last year – maintained its dividend which was reinstated in June at $0.25/share.

Healthcare: Medical office REIT Healthcare Realty (HR) advanced 5% on the week after reporting better-than-expected results in its first report since its completed merger with Healthcare Trust of America. HR recorded same-store NOI growth of 3.3% in Q2 – slightly better than most of its MOB peers – while recording FFO growth of 4.7% over Q2 of 2021. Senior housing REIT Welltower (WELL) was among the laggards this week – but still advanced 2.5% – after reporting mixed results in the second quarter, reporting stronger-than-expected FFO in Q2 but noted that it saw a “significant drop in tour volume” in July and ended the month about 5% below June before seeing trends pick-up later in the month. Elsewhere, skilled nursing REIT National Health Investors (NHI) gained 5% after reporting decent results and boosting its full-year normalized FFO guidance. NHI now expects its FFO to decline 2.1% in 2022 – a 160 basis point improvement from its prior outlook – while reporting progress in its “portfolio optimization” which involves the conversion of several triple-net agreements into “SHOP” operating structures. The company commented that it’s “not out of the woods yet… as the [SNF operator] industry continues to deal with elevated operating costs.”

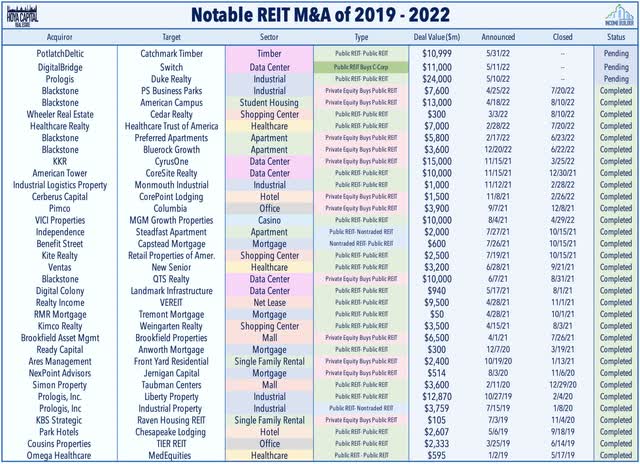

We also had some news on the REIT M&A front over the past 24 hours as a pair of acquisitions were finalized. Blackstone (BX) closed on its acquisition of student housing REIT American Campus (ACC) for its non-traded REIT platform Blackstone Real Estate Income Trust (“BREIT”) in a $12.8B deal. Meanwhile, Cedar Realty (CDR) announced with Wheeler Real Estate (WHLR) that the total proceeds to Cedar common shareholders from the sale of Cedar’s assets and subsequent merger in a series of related all-cash transactions will total $29.00/share and CDR’s Board of Directors declared a special dividend of $19.52 per share with the remaining $9.48 being paid out in cash as merger consideration. Elsewhere, apartment REIT Aimco (AIV) rallied more than 15% after activist investor Land & Building Investment Management built a 5% stake in the company and is pushing the company to explore a potential sale. Back in 2020, Aimco split into two independent REITs – forming Aimco as a property development-focused REIT and Apartment Income (AIRC) as a traditional apartment REIT.

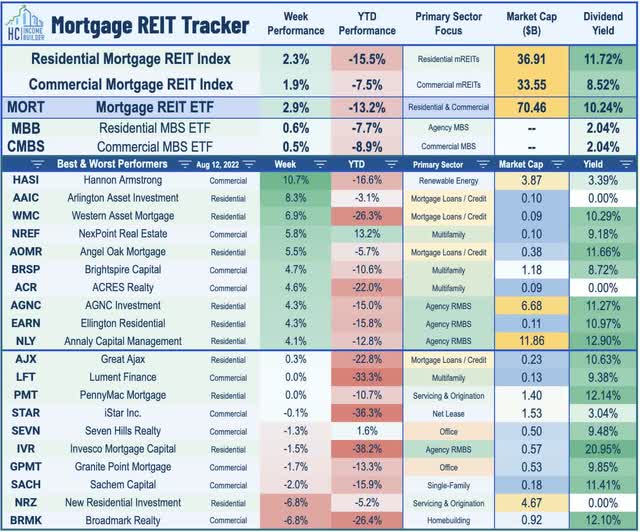

Mortgage REIT Week In Review

Mortgage REITs resumed their impressive rebound since their recent lows in late June as earnings season wrapped up with a handful of solid reports. As discussed in our REIT Earnings Recap, the mortgage REIT rebound has come along a recovery in mortgage-backed (MBB) bond valuations following a historically brutal sell-off in the first half of 2022. There was some M&A news this week as iStar (STAR) announced that it will merge with its subsidiary – Safehold (SAFE) – an equity REIT focused on ground lease assets that iStar externally managed. The merged company will operate under the Safehold name upon the expected closing by early 2023. Under the arrangement, iStar shareholders will own 37% directly and 14% indirectly through a spinoff that will own all remaining non-ground lease assets and $400M of Safehold shares while Safehold shareholders will own 34% of the merged company.

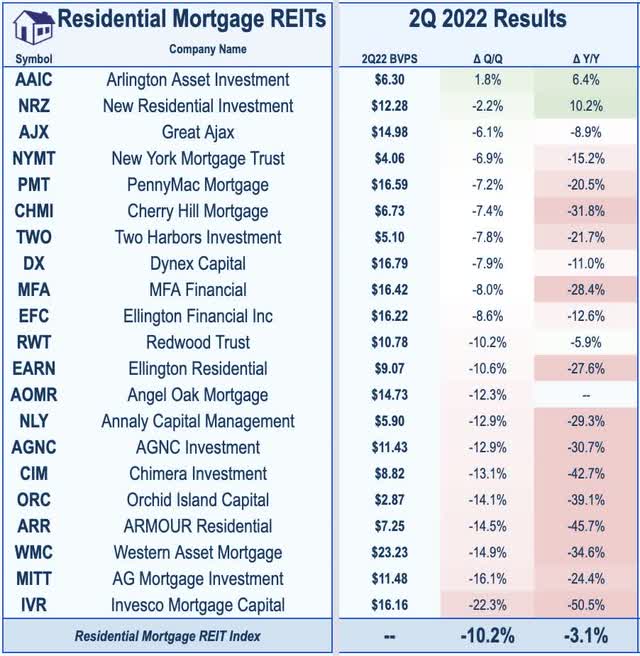

On the earnings front on the residential mREIT side, Arlington Asset (AAIC) rallied 8% on the week after reporting an 1.8% increase in its book value per share (“BVPS”) – the only residential mREIT to record an increase in book value in Q2. Angel Oak Mortgage (AOMR) gained more than 5% on the week after reporting better-than-expected results as strong distributable earnings growth offset a 12% decline in its BVPS. Ellington Residential (EARN) advanced 4% after reporting decent results with a BVPS decline of 10.6% in Q2 – roughly matching the sector average – as the “challenges of the previous quarter intensified during the second quarter” but noted that the wider yield spreads “have been a tailwind for earnings.” EARN noted that it had a “strong July” as interest rate volatility subsided and MBS spreads tightened from unusually wide levels.

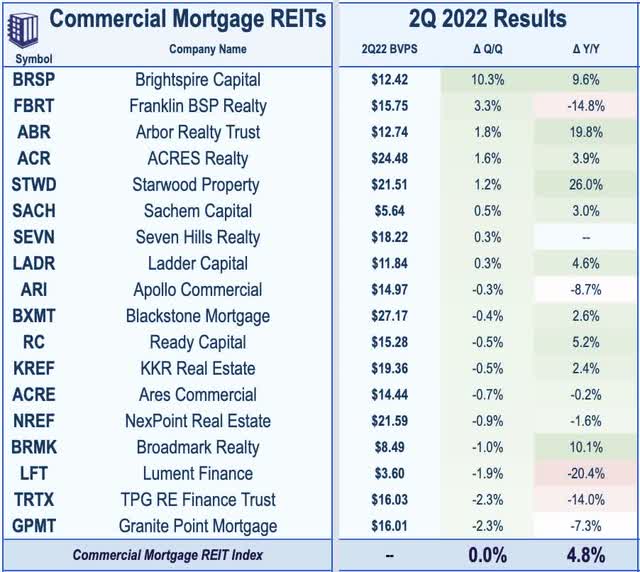

On the commercial mREIT side, cannabis lender AFC Gamma (AFCG) gained nearly 4% on the week after reporting solid Q2 results including a 2.5% increase in its book value per share (“BVPS”) to $17.03. Small-cap Lument Finance (LFT) traded flat on the week after missing consensus EPS estimates while reporting a 2% decline in its BVPS in Q2. On the downside this week, Granite Point (GPMT) slumped 2% after reporting mixed results with a better-than-expected EPS offset by a 2% decline in its BVPS. Elsewhere, Broadmark (BRMK) dipped 7% after reporting disappointing results amid an uptick in default rates in its book of residential construction loans.

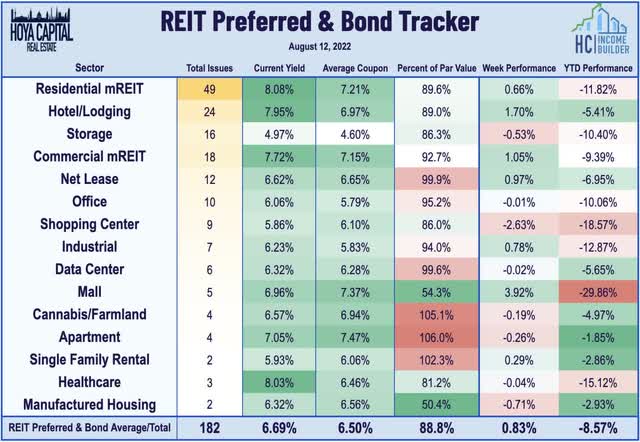

REIT Capital Raising & REIT Preferreds

The Hoya Capital REIT Preferred Index finished higher by another 0.83% this week, trimming its year-to-date declines down to roughly 5% on a total return basis. It was a particularly strong week for the preferred series of troubled mall REIT Pennsylvania REIT (PEI) after reporting solid earnings results and for the preferred series of New York Mortgage (NYMT). The preferreds of Cedar Realty (CDR) had another tough week ahead of the expected closing of the merger with Wheeler Real Estate (WHLR) next week in which CDR’s preferred distributions are expected to be suspended indefinitely.

2022 Performance Check-Up

Now halfway through August, Equity REITs are lower by 12.3% on a price return basis for the year while Mortgage REITs have slipped 13.2%. This compares with the 10.1% decline on the S&P 500 and the 7.8% decline on the S&P Mid-Cap 400. Within the real estate sector, another three property sectors climbed into positive-territory this week for the year with hotel, net lease, and farmland REITs joining casino and student housing REITs as the top-performing sectors. At 2.85%, the 10-Year Treasury Yield has climbed 134 basis points since the start of the year, but has been under pressure since climbing to its highest level since the Great Financial Crisis in June of 3.50%.

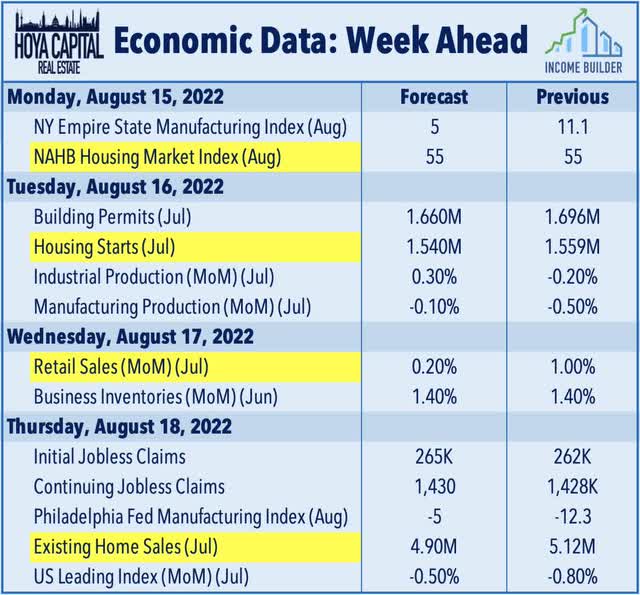

Economic Calendar In The Week Ahead

The state of the housing market will be in focus next week with a trio of reports expected to show a continued cool down in activity over the past month, reflecting the surge in mortgage rates which climbed to nearly 6% in late June before moderating in recent weeks. On Monday, we’ll see Homebuilder Sentiment data which is expected to show the lowest print in four years excluding the brief pandemic dip in April and May 2020. On Tuesday, we’ll see Housing Starts and Building Permits data which is expected to show a continued moderation in the pace of new home construction, particularly within the single-family segment. On Thursday, we’ll see Existing Home Sales data which is expected to slow to the lowest rate since June 2020. There are some early signs that the recent dip in mortgage rates, moderating home prices, and slightly higher inventory levels shave pulled some potential buyers back into the fold in recent weeks, however, as the Redfin Homebuyer Demand Index has rebounded 17% from the week of June 19 when mortgage rates peaked. We’ll also see Retail Sales data on Wednesday and will be watching Jobless Claims data on Thursday.

For an in-depth analysis of all real estate sectors, be sure to check out all of our quarterly reports: Apartments, Homebuilders, Manufactured Housing, Student Housing, Single-Family Rentals, Cell Towers, Casinos, Industrial, Data Center, Malls, Healthcare, Net Lease, Shopping Centers, Hotels, Billboards, Office, Farmland, Storage, Timber, Mortgage, and Cannabis.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Be the first to comment