Atstock Productions

Investment Thesis

Peabody (NYSE:BTU) reported Q3 results and the market was decidedly muted. At first. But then, investors started to come to their senses. And despite harping on this stock for so long, it’s finally starting to make some headway.

I believed that this stock was going to be a home run in 2022. And guess what? It went absolutely nowhere for the best part of 6 months!

I’m told that investing in energy was the only winning trade of the year. And I was left with an egg on my face for the bulk of 2022.

But now, as we are coming within weeks of calling 2022 a wrap, is it possible that I was just too early?

I’m inclined to believe that if 2023, is anywhere near as good as 2022, Peabody is going to sizzle higher.

The Buyback Problem

In my previous article, I highlighted the problem. Peabody hasn’t got a clear capital allocation strategy, since its debt has restrictive covenants. This is what Peabody’s SEC filings state:

the Company entered into a transaction support agreement with its surety bond providers which prohibits the payment of dividends through the earlier of December 31, 2025, or the maturity of the Credit Agreement (currently March 31, 2025).

This is part of the reason why Peabody’s valuation is so compressed. Because investors that are interested in investing in other coal companies will probably opt for those that can buy back their shares or return capital to shareholders via dividends.

So, until Peabody tackles its debt, there’s not going to be any capital returns for shareholders.

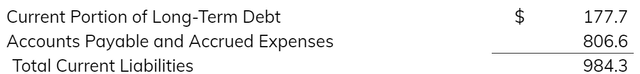

With this in mind, consider Peabody’s Q2 2022 liabilities:

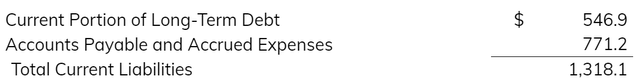

And now, consider Peabody’s Q3 2022 liabilities and see if you spot a difference?

The difference is that Peabody has made approximately $545 million of its senior debt current.

During the Q&A section of the earnings call, Peabody’s management stated,

With the [accounting] classification, the current liabilities of all of our secured debt, it’s a clear signal that we will eliminate that remaining $550 million over the next 12 months.

So, management is looking to deleverage its balance sheet.

However, in later parts of the call, Peabody’s management went on to discuss further organic opportunities to broaden its portfolio alongside shareholder returns.

[In a few months we] regain that financial flexibility, we can reinvest in organic projects like North Genial.

[…] That’s a 25% return, and that’s only utilizing 28% of the existing reserves in that project. So while we have a great organic portfolio opportunities, we’re also looking to do that side-by-side with shareholder returns and elimination of this debt.

For shareholders that are only too accustomed to fossil fuels companies squandering precious capital on lofty acquisitions, investors didn’t take too kindly to management’s lack of shareholder-friendly initiatives.

BTU Stock Valuation — Cheap, So What?

In my previous article, prior to Peabody’s earnings, I declared that Peabody was on track to make more than $1 billion of free cash flow in 2022.

Given what we saw in Q3, I believe that this figure is now easily achievable. In fact, it will probably be surpassed by some measure. Can Peabody make $1.3 billion of free cash flow in 2022?

That’s probably going to be a stretch. But it’s more likely than not going to end in that ballpark.

The big question here is what will 2023 look like? And that’s where things rapidly get complicated.

But before we overly complicate and intellectualize what metallurgical coal is going to be in 2023, and postulate over thermal coal prices, I think that the question that investors have to formulate some view on is whether management will prioritize organic projects or capital returns?

Because very few investors will seriously reward a rapidly growing coal company. Investors would vastly prefer to get strong capital returns rather than embrace growth capex.

The Bottom Line

There are two bearish considerations facing Peabody.

Firstly, we are talking about investing in a coal company. Yes, 2022 was very strong. But can we expect 2023 to be on par with 2022?

Bears would contend that somehow, natural gas prices will roll down in 2023, which will change the supply-demand equation for thermal coal. And by extension, this would see this highly capital-intensive company’s free cash flows wither away.

Secondly, can we trust management to put shareholders ahead of empire-building?

For my part, I strongly believe that those bearish considerations are already significantly priced into Peabody’s valuation.

In fact, I suspect that in less than 12 months’ time, I will be discussing, not whether Peabody will be returning capital to investors. But rather, what proportion of its free cash flow will shareholders get via share repurchases?

Be the first to comment