Huang Evan

Thesis

Investors in PIMCO Dynamic Income Opportunities Fund (NYSE:PDO) have been hammered in 2022, as the closed-end fund’s (CEF) exposure to debt securities has been pummeled given the synchronized rate hikes globally to combat high inflation rates.

As a result, even the 60/40 portfolio posted its worst performance in 100 years, as Barron’s reported:

Such portfolios are comprised 60% of stocks and 40% of fixed-income and cash. It’s a supposedly less-volatile model often used by people who are contemplating or approaching retirement. Well, that portfolio hasn’t been so safe this year. The annualized change in its recent year-to-date value has been down 34.4%, according to Bank of America. That’s the worst performance in 100 years. – Barron’s

As a result, fixed income investors also felt tremendous pain as the Fed’s record pace in hiking rates has set alarm bells ringing globally, reaching emerging markets as liquidity started to dry up in their attempts to issue debt. As a result, PDO’s globally diversified portfolio (10.7% in emerging markets, and 28% ex-US, per YCharts data) couldn’t effectively mitigate these risks, as it sunk to its lows in October.

Accordingly, PDO posted a YTD total return of -27.1%, despite factoring in its TTM distribution yield of 14.77%.

We assess that PDO is at a critical juncture as it attempts to form a counter-trend rally against its medium-term downtrend. We discuss the vital levels for investors to watch and whether the underlying market conditions are conducive for PDO investors to consider adding exposure.

High Risk, High Return If It Goes In Your Favor

According to CEF Connect, PDO’s credit quality suggests that 42.9% of its exposure is in non-rated securities. Furthermore, it uses a significant level of leverage, with total leverage amounting to 48.4% of total managed assets. Again, its leverage is mainly focused on reverse repo (46.57%), which is essentially what we call “borrow short.” However, given the unprecedented surge in short-term yields since June 2021, it has also led to a massive upswing in borrowing costs if not hedged appropriately.

Therefore, the battering in fixed income securities justifiably reflects the pummeling in PDO. Furthermore, PDO also has substantial exposure to mortgage-backed securities (MBS). PIMCO highlighted that PDO has 19.88% exposure (in market value terms) in mortgage and 17.86% in CMBS. The pummeling in mREITs has also been attributed to the surge in the Fed’s rapid rate hikes, which sent 30Y mortgage rates to the 7% range recently.

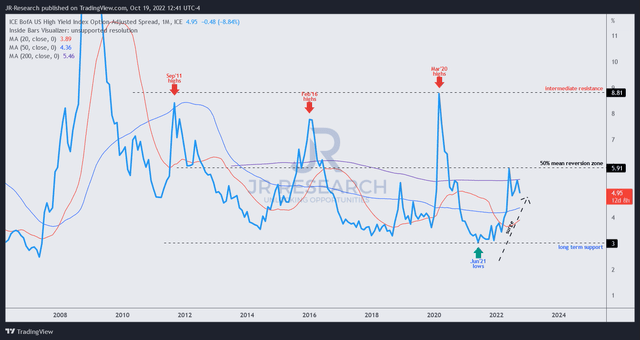

BofA US High Yield Index Option-Adjusted Spread % (TradingView)

PDO also has significant exposure in high-yield credit (28.67% of market value). The sharp widening of spreads has also impacted their market value, as the market priced in tightening financial conditions. Hence, PDO’s use of leverage has not been beneficial in such unprecedented market conditions.

But, the critical question investors need to ask is whether the damage has been contained. Can there be further downside to the current levels?

Is PDO CEF A Buy, Sell, Or Hold?

We presented in a recent article on Rithm Capital (RITM) expounding why we could be close to seeing the terminal rate reached on the Fed Fund rates (FFR) in December 2022.

Notwithstanding, global financial instability risks have intensified. Therefore, it’s still too early to rule out significant consequences to the global financial system resulting from the rapid rate hikes. Even the consistently bullish JPMorgan (JPM) global markets strategist Marko Kolanovic sounded increasingly cautious as he articulated in a recent commentary:

Given the recent escalation in hawkish rhetoric, the likelihood of central banks committing a policy mistake with negative global consequences has increased, and this started showing in various cracks in FX and rates markets. Even if a mistake is avoided, a delay will likely be introduced for the global market and economic recovery. – Seeking Alpha

Moreover, veteran fund manager Mark Mobius highlighted that investors anticipating a Fed pivot so soon could be courting disaster. Bloomberg reported:

“If inflation is 8%, the playbook says you’ve got to raise rates higher than inflation, which means 9%,” the co-founder of Mobius Capital Partners told Bloomberg TV on Monday. While policymakers may not hike so aggressively should consumer prices soften, the 86-year-old investor said he doesn’t see inflation receding “anytime soon.” – Bloomberg

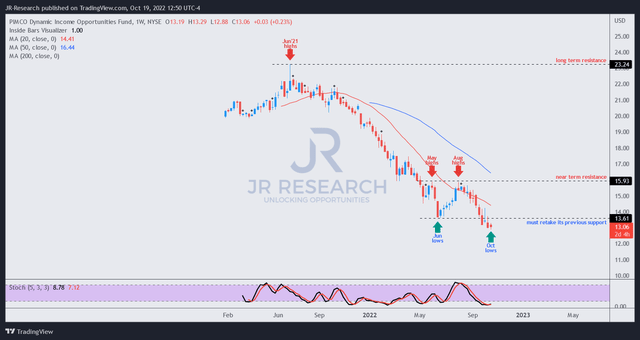

PDO price chart (weekly) (TradingView)

With that in mind, we urge investors to turn to PDO’s price action to glean critical clues to the market’s forward intentions.

We observed that PDO buyers attempted to stage a bullish reversal at its October lows. However, while PDO seems to be consolidating, the reversal has been elusive.

We believe retaking PDO’s June lows decisively and staying above it is a critical precondition for validating PDO’s mean-reversion opportunity. Therefore, a failure to retake that support level suggests that the medium-term downside in PDO is unlikely to be over, even though it’s already near- and medium-term oversold.

Hence, we urge investors to bide their time from the sidelines, given the medium-term downtrend in PDO.

As such, we rate PDO as a Hold for now.

Be the first to comment