hapabapa/iStock Editorial via Getty Images

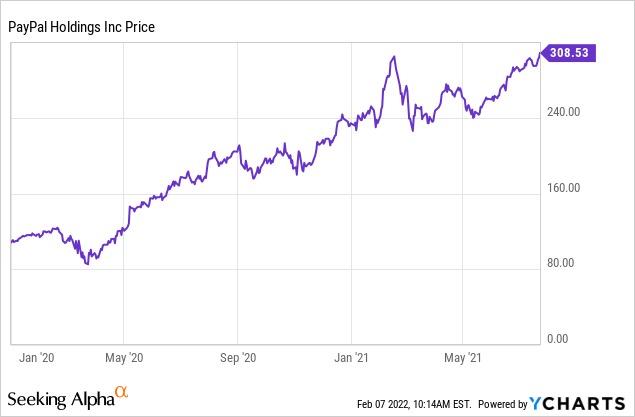

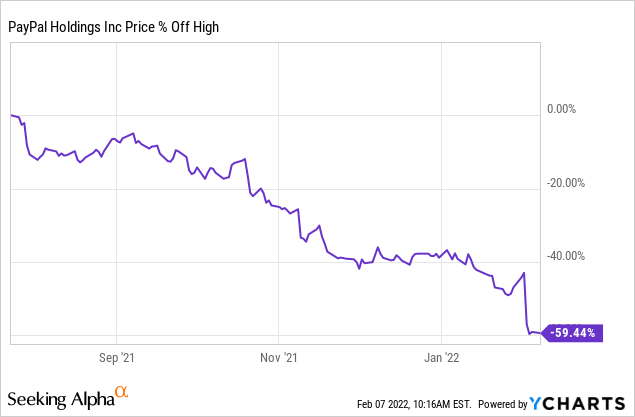

PayPal (PYPL) released earnings, narrowly missing expectations for growth next year. That triggered a market reaction that led PayPal to lose 25% in a single day and crashed PayPal price 60% below its recent highs. Today’s article aims at explaining whether this is an overreaction and PayPal’s multiples are expensive, fair or at a discount.

2021 Highs

So much news has been given to us by the company in the last year. In particular, it’s interesting to relate the price movement of the stock to the news and see when we hit highs:

- On February 11, the company presented its medium-term growth plans to investors on “Investor Day“. It pushed PayPal around $300/share, given investors’ excellent news and guidance.

- Similarly, PayPal surpassed the $300/share threshold in mid-July, when in the wake of the success of cryptocurrencies, it had informed the market that it was raising the threshold for crypto purchases within its app to $100,000 per week with no annual limit.

However, the price lost over 60% in less than seven months after this news.

2021 Earnings and 2022 Guidance

I would start comparing revenues goals with the guidance, primarily to assess the company’s growth.

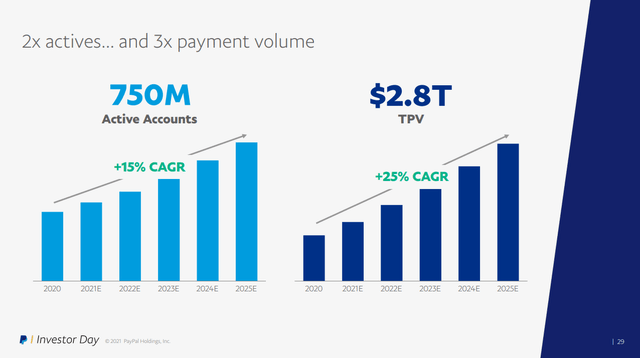

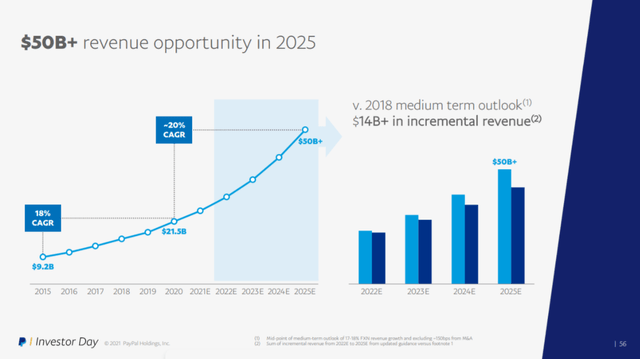

PayPal’s goal is to reach 50 billion in revenue by 2025. The management expected to have a compound growth rate of 20% to achieve that.

That seems like a very ambitious target, considering that the company in the last ten years has only reached and exceeded 20% growth in 2017 and 2020.

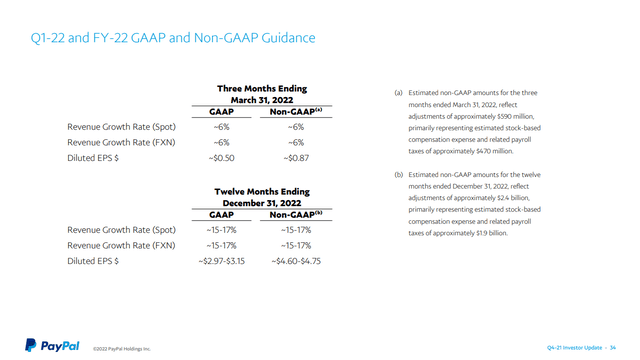

And in fact, it has already betrayed expectations in 2021, delivering growth to shareholders of just under 20%. But the main problem came after the latest quarterly earnings call, where the company reported guidance for the first quarter of 2022. PayPal expects to grow 6% year-over-year in the first quarter. That’s a meager growth rate compared to what the market expected and compared to what investors expected after analyst day.

Q4 2021 Investor Update – PayPal

Sure, the decrease in revenue from eBay is a factor; excluding commissions from eBay, the company will grow 14% in the first quarter. But, on the other hand, for the whole year, PayPal expects to grow 16%, a number closer to the 20% expected by the market.

Indeed, inflation and supply chain pressures can affect consumers’ spending choices, but PayPal’s recent management communications are pretty different from Visa, which reported excellent quarterly results.

The high revenue growth target was expected to come even with 22% compound EPS growth. At the midpoint, GAAP EPS of $3.06 represents a decrease in earnings per share. Even going by the non-GAAP numbers, we have virtually flat expected growth, not good.

Where Is The Issue?

PayPal’s take rate represents the problem. But, again, we see how the total volume of payments grew by 31% in the last year, well above the 25% aggregate predicted by the guidance on the investor day.

Q4 2021 Investor Update – PayPal

This should be the driver of revenue, and in fact, we see how the growth of this, according to PayPal, would have led to a comparable increase on the revenue side. However, this was not the case in 2021.

In fact, in the call, it was explained how the YoY take rate declined 17 basis points, and half of that was due to eBay’s lower weight of revenue. As such, as eBay becomes less critical in PayPal revenue, we can expect this to normalize and disappear when we have ex-eBay quarters as comparables. In addition, PayPal is also starting to monetize other forms of payment, such as Venmo, which is now accepted on Amazon. In this way, PayPal aims to increase the average revenue per user.

In the buy-side call, the management explained how these estimates made a year ago with a medium-term plan are now more challenging to reach. They expect to meet the target from 2023 onwards, but not to make up for the lack of growth in recent years (2021 and 2022). I appreciate the sincerity, but probably the mistake was in the initial estimates. I find it unacceptable that the company realized that their medium-term guidance was set too high already one year after the presentation.

These were some of the negative aspects of the last quarterly report and guidance, to which we can also add the downtrend in margins and the low growth of new users.

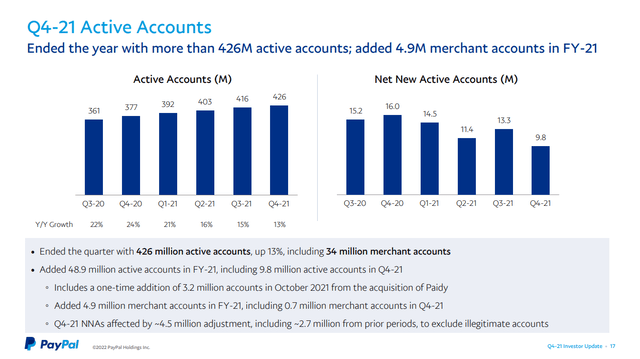

Q4 2021 Investor Update – PayPal

The Price

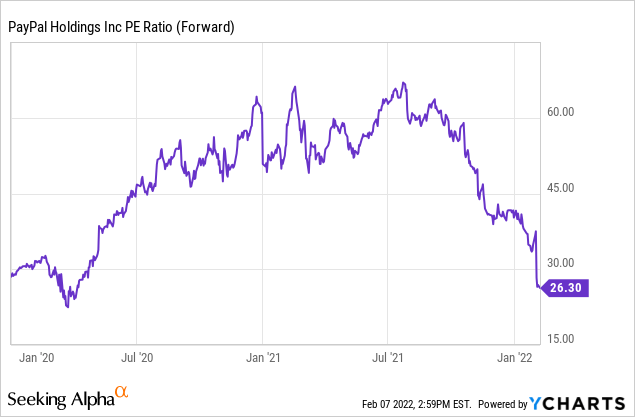

It is interesting to see the evolution of PayPal’s P/E over time.

Compared to the price, we see that the forward price-earnings multiple has seen a massive expansion after the COVID, to return to the pre-COVID average in recent months.

However, we must remember that there are changes in the multiples through the life of a company. For example, PayPal was priced as a high growth company in 2017, 2018 or 2019. Even more so in 2020 and part of 2021. But now? PayPal’s numbers regarding expectations for 2022 may make some investors doubt the possible growth over the next few years.

Do you think the target given at the beginning of 2020, with an aggregate annual growth of 20% over the next five years, is a possible figure, despite the guidance, already for 2022 points to a slowdown in revenue growth, increase in the number of users and a decline in margins? If so, the company, at these prices, is an apparent bargain.

If, on the other hand, you expect that this downward trend in growth may be the norm in the future, well, needless to say, at this price, PayPal is still a risk. Multiples have been compressed, but there is room for further compression of multiples with possible single-digit revenue growth.

Be the first to comment