Morsa Images

Paycom Software, Inc. (NYSE:PAYC) is an Oklahoma-based human capital management solution provider for small to mid-sized businesses in the U.S. Its cloud-based solution offers data analytics and functionality for human resource management. It includes applicant tracking, background checks, tax credit services, time and attendance management, and payroll. Since its foundation in 1998, it has grown to become one of the thriving traded companies in the industry. Also, it is one of the first online payroll providers.

Today, Paycom maintains impressive revenue growth and margins. It continues to flourish despite its already impeccable historical growth. Even better, its fundamental stability is still evident with its stable cash levels and low borrowings. These attributes place it in a strong position, allowing it to take advantage of market opportunities. But, it must watch out for the looming recession, which may affect its performance. Also, the stock price does not appear cheap as the price metrics suggest.

Company Performance

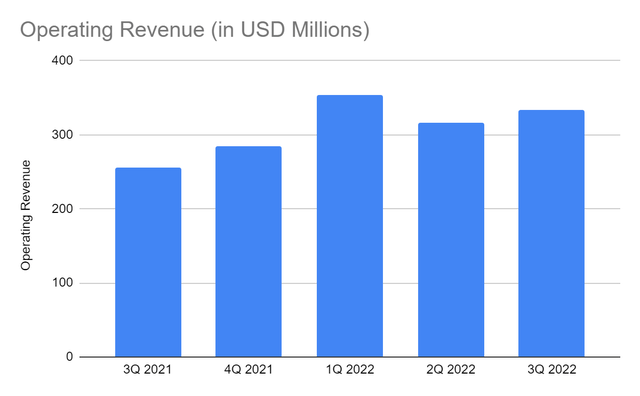

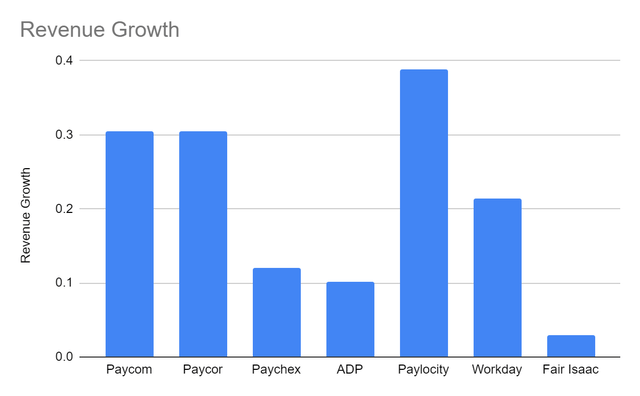

The events in the last two years have led to massive market changes. The pandemic restrictions limited the operating capacity and workforce management of businesses globally. Despite all these disruptions, more opportunities arose. They opened more growth avenues for Paycom Software, Inc., one of the leading HCM solution providers. Amidst the stormy market landscape, Paycom Software, Inc. remains unperturbed. It maintains its robust performance with its operating revenue of $334 million, a 30.4% year-over-year growth. It further fortifies its already solid and intact fundamentals. Thanks to the increased demand for user-friendly HCM solutions, it is adding more clients to its service. Its strong customer base and established reputation help it remain an industry staple. Also, its mature sales offices boast higher productivity and efficiency gains, generating more returns.

Operating Revenue (MarketWatch)

Pandemic restrictions and digital transformation also continue to drive its solid growth. As remote and hybrid work setups persist, the need for a solution to virtually handle human resources intensifies. And unsurprisingly, businesses adapting to the trend are turning to HCM solution providers like PAYC. Moreover, interest rate hikes translate into higher yields on its client funds, raising the recurring revenue further. Increased non-refundable upfront conversion fees from new clients, driving the increase in other revenues. Since these are deferred, the rate varies with the estimated duration of client retention, making prices flexible.

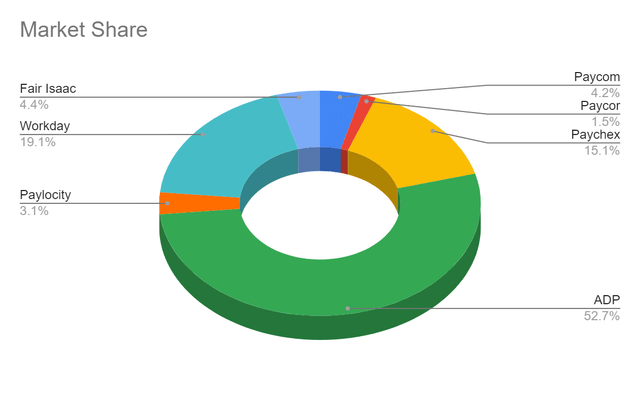

With regard to its competitors, its revenue is relatively smaller. ADP (ADP) has $4.2 billion, Workday (WDAY) has $1.5 billion, and Paychex (PAYX) has $1.2 billion. Yet, it remains one of the most durable, viable, and fastest-growing companies in the industry. It holds a market share of 4.2%, a notable increase from 3.4% in 2021. It has one of the best revenue growth records, showing it has more room for potential expansion once the market stabilizes. Also, its expanding operating capacity maintains efficient asset management. The operating costs have almost the same year-over-year growth. So, its gross profit remains almost unchanged. This shows that its prudent strategies and increased demand offset the impact of inflation.

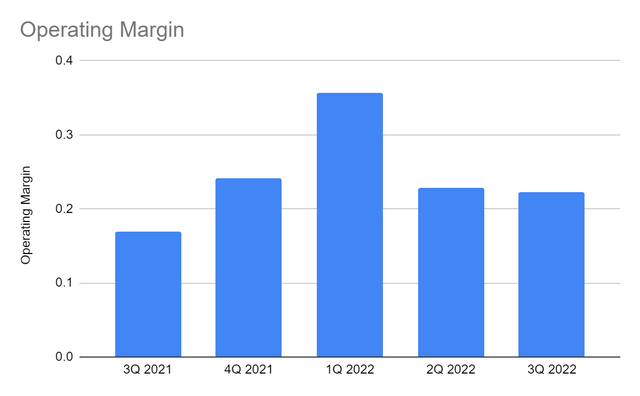

Even better, operating expenses are higher, but the increase is more manageable. As such, it embodies the goal of its products, which is to optimize human resource efficiency. The operating margin of 22% increased from 17% in the comparative quarter. Its net profit margin of 16% is higher than 12% in 3Q 2021 is an improvement of its overall viability. It also shows the consistency in its core and non-core operations. This is within the market average, making it a strong contender in the industry. Its increased viability further strengthens its already solid fundamentals and sustains its capacity.

Operating Margin (MarketWatch)

How Paycom Software, Inc. May Stay Afloat Amidst Risks And Opportunities

Paycom Software, Inc. must not be complacent with its current positioning. The economy remains volatile, which may pose more risks to its performance. Although the current inflation rate of 7.7% suggests a Winter lull, it remains way higher than the pre-pandemic average. It must also watch out for the skyrocketing interest rate, as the Fed raised the Fed funds rate by another 75 bps. The current estimates range at 4-4.5% compared to the initial estimates of 3-3.25% in the first half. This may increase the client fund yields further, but its valuation may also be affected.

With the looming recession, its performance may become lethargic in the following quarters. It is because elevated inflation and interest rates hurt the purchasing power of consumers. They also discouraged borrowings, disrupting business expansion and investments. In turn, they may lower production, leading to a lower labor force and demand for HCM solutions. Hence, Paycom must be ready by making its rates more flexible and reassessing its asset efficiency. Doing so may help it remain viable during market lows.

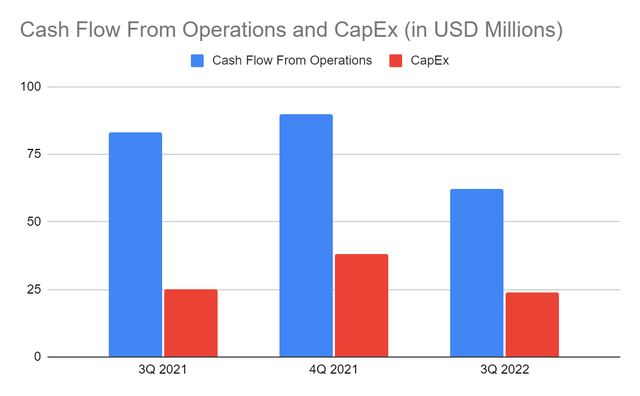

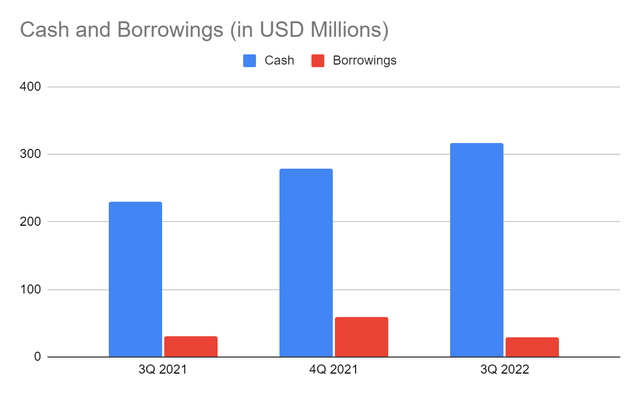

Fortunately, it can cover its transactions. Even if it is increasing and replenishing its operating assets and paying liabilities, its cash inflows remain stable. The actual value can cover its CapEx. Companies like Paycom may not be capital-intensive since they do not require massive properties. But, they have to invest in machinery and equipment to manage expanding networks. Also, they have to update from time to time as digital transformation peaks. Doing so will allow it to reach the changing market standards and go head-to-head with its peers. It is feasible since it has excess cash inflows even after deducting CapEx. It has an FCF of $38 million, which can be used to cover borrowings. Fortunately, PAYC is cautious with its financial leverage. Its borrowings are only $29 million. Note that these are all non-current borrowings and less than 10% cash. So, it can make a single payment for its borrowings and accounts payable. It is also conservative with its equity because while common stocks increase, it raises its stock repurchases.

Cash Flow From Operations And CapEx (MarketWatch)

Cash And Cash Equivalents And Borrowings (MarketWatch)

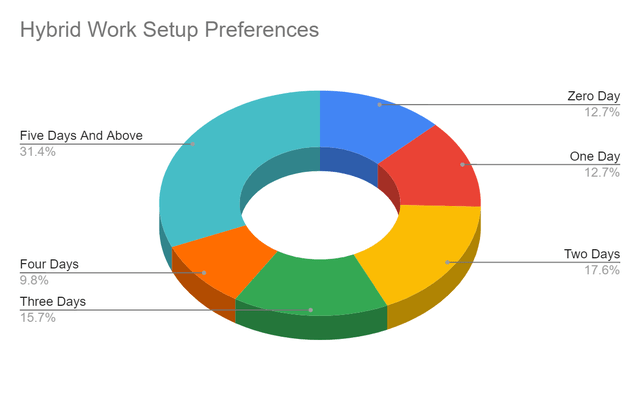

Moreover, there are lots of market opportunities it can enjoy. First is the continued implementation of remote and hybrid work setups. Despite the easing of restrictions, the changes in the labor market segment are here to stay. Many companies are trying to avert or at least cushion the blow of the Great Resignation by flexible work arrangements. The vast majority of employees favor it, so HCM solutions are more of a staple. In a study, 31.4% of employees want remote work for five days or more. The remaining portion is divided almost equally. Overall, 87% of employees prefer remote and hybrid work setups.

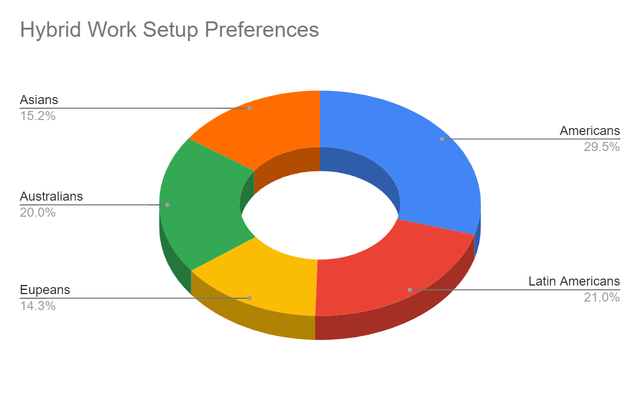

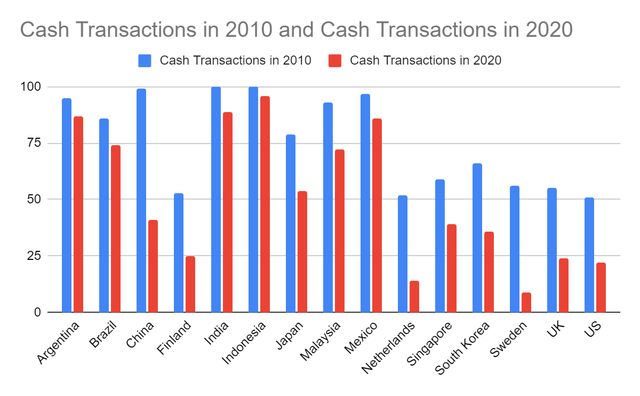

It is also essential to note that 31% of these employees are from North America, since this region is one of its primary markets. Its online payroll system has become more appealing as the fintech industry hyped up. Digital wallets and VCCs are bound to dominate business transactions and processes. In the U.S., cash transactions have dropped to 22%, making workforce-related financial transactions geared towards digitization. Hence, Paycom stays ahead of the current market changes.

Hybrid Work Setup (McKinsey & Company)

Hybrid Work Setup Preferences (McKinsey & Company )

Percentage Of Cash Transactions (The Straits Times)

Stock Price Assessment

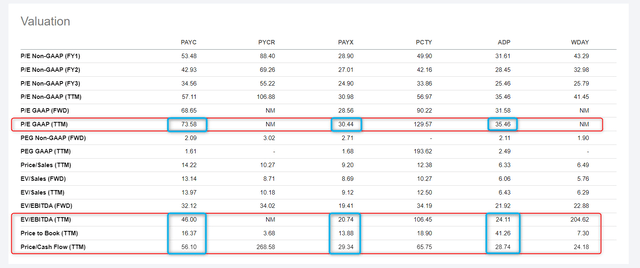

Since the start of the year, the Paycom Software, Inc. stock price has been moving sideways. But, the downtrend has been more prominent, especially in the last few months. At $316-317, it has already been cut by 24%. However, its price metrics do not suggest undervaluation. It is traded at a 73x earnings multiple, which is way above the S&P 500 10-year average of 29x. It is also higher than the peer average. The other price metrics show similar observations. Suppose the EPS is the same as the NASDAQ forecast of $4.66. It will decrease to 68x but will remain high. Income may be higher due to its seasonality. Given this, PAYX and ADP are better alternatives. To assess the stock price better, we can use the DCF Model.

Price Assessment (Seeking Alpha)

FCFF $412,000,000

Cash $317,000,000

Borrowings $29,000,000

Perpetual Growth Rate 4.8%

WACC 9.2%

Common Shares Outstanding 57,867,000

Stock Price $316

Derived Value $247

The derived value adheres to the supposition of overvaluation. The Paycom Software, Inc. stock price may decrease by 22% in the next twelve months. So, an investor may choose to wait for a better entry point or switch to better alternatives.

Bottom Line

Paycom Software remains an industry staple with its robust performance and solid fundamentals. Its stable cash flows and stellar Balance Sheet will allow it to sustain its operating capacity. Yet, it has to be more careful, given the looming recession, which may affect its revenues. The stock price adheres to its financial uptrend but now appears too high. Long Paycom Software, Inc., but it is better to hold it for the moment.

Be the first to comment