AZaytsev

Introduction

In an omnibus service company article recently produced for members of the Daily Drilling Report, Patterson-UTI Energy (NASDAQ:PTEN) was highlighted as a top pick based on the financial data presented and the forward market opportunity in the year ahead. PTEN was the recipient of a recent upgrade by Raymond James analyst, James Rollyson:

“A sustained period of underinvestment during an exceptionally weak macro environment coupled with rising energy transition pressures set up the current oil supply situation, for which there is no short-term fix.

Rollyson noted further that the OFS sector is set up for a multi-year run as tight supplies of Tier I Super Spec rigs boost day rates and margins.

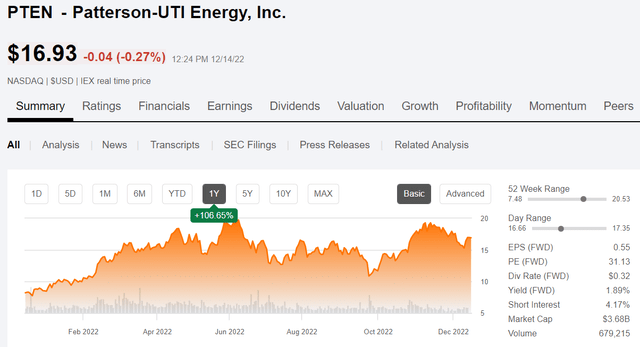

PTEN price chart (Seeking Alpha)

Against that backdrop we will review key financial data reported by the company, and the macro picture we see developing for U.S. shale.

PTEN seems well positioned to thrive in the coming year, and from what we can see, for years to come. The only way to get oil out of shale is to first drill a hole in the ground, and that is what companies like PTEN are uniquely set up to do. The more holes you make in the ground, the more oil you can get.

We think there will be more holes drilled in the ground next year, than this year, and still more in the year beyond that, providing a fertile ground for PTEN to run as this market develops.

Note – this article appeared in the Daily Drilling Report on Dec. 14th.

The thesis for PTEN

PTEN is a large technologically oriented contract driller with a significant number of highly sought after Tier I, “walking rigs” that can move around on a frack pad without being broken down. This saves time and enhances the value to the client. Rigs provide about 60% of PTEN’s revenue. PTEN also runs a small fleet of frac spreads (12-13), and has recently taken steps to upgrade some of its frac fleets to Tier IV status. There is some synergy between these businesses, as once you drill a hole in the ground, and run casing, you are ready to begin the perf and plug process we know as fracking. Fracking delivers about 10% of PTEN’s revenues.

What turned me around on the drillers? It’s a fair question as traditionally I’ve been a little dour on the category, seeing them as a value trap that would keep all but the earliest investors underwater. Sometimes for years. They were typically run on spec, where an operator might tell them they were going to drill a bunch of wells and needed rigs. Drilling contractors would then oblige, borrowing the money to build them…only to be left holding the bag when oil prices dropped and the operators canceled their plans. The whole industry was run this way for most of my 38 active years in the business. Boom and bust.

Things started changing a few years back as companies flirting with bankruptcy brought on by legacy debt from the last boom and perennial low oil prices, caught a break. Oil and gas prices bottomed and then began to rise, breathing life into a stagnant industry. Equipment was retired, balance sheets repaired, technology provided new sources of revenue and enhanced profits, and by the time 2022 rolled around PTEN and its peers began to see a shift in the operator/drilling contractor dynamic.

For the first time in almost a decade…it was a sellers market.

Day rates have doubled this year to nearly $40k per day for Tier I Super Spec walking rigs. This forms an upper threshold against which rates for lower tier rigs also rise. On the horizon are electrified rigs with the company’s proprietary EcoCell LI batteries that have eliminated 700K gallons of diesel thus far in 2022. One can presume that rigs that eliminate emissions and help mitigate diesel consumption will receive still further premium pricing.

Catalysts for growth

PTEN is reactivating and upgrading 4-rigs for delivery in 2023. Andy Hendricks, CEO, commented-

We’re also increasing our 2022 CapEx forecast to approximately $425 million, up from the previous $390 million. The increase includes the acceleration of rig upgrades for delivery in 2023 where this CapEx is being largely funded by customers. Across the industry, pricing continues to grow as rig demand remains strong. Supply continues to be limited due to the dwindling availability of Tier-1, super spec drilling rigs combined with the overall tight labor market and challenged supply chain.

PTEN is also increasing the number of high spec rigs under contract, increasing this metric by 61% in Q-3. Many are for a just a year with a rollover provision that includes an escalator, Hendricks noted one three-year contract for 5-rigs.

Increasing rigs and extended contracts are bullish for PTEN stock.

Q-3, 2022

The PTEN rig count grew from 113 to 132 in 2022 with another four lower tier customer funded upgrades to Tier I scheduled for 2023. What’s more impressive is the growth in the late 2021 Tier I day rate from the low $20,000’s to the current $40,000’s that has led to revenues topping $702 mm for Q-3, a 64% increase from the first of the year. $288 mm of this came from pressure pumping. EBITDA grew 4X to $198 mm. Capex for the full year is set at $425 mm, including some $40 mm supplied by clients to reactivate and upgrade older rigs to Tier I status. Long term debt stands at $852 mm.

The rise in revenue has been at increasingly profitable terms, bringing EPS (Earnings per Share), from -$.038 in Q-4 of 2021 to a positive $0.18 in Q-3, 2022. With rates at the current levels, the company is now seeking and getting longer term 3-5 year contracts, which will stabilize cash flow at high levels for years to come. This figure may improve still further in the year to come as was noted in their Q-3 quarterly conference call where CEO Andy Hendricks commented.

“Going into next year, we expect to see further pricing increases as many of our existing contracts roll over, especially in contract drilling. As such, I believe we still have significant upside to our current margins and free cash flow.”

They have doubled the quarterly cash dividend to $0.08 per share and increased the share repurchase authorization to $300 million. The dividend was payable on December 15, 2022, to holders of record as of December 1, 2022.

Guidance for Q-4 was given as a repeat of Q-3.

Risks

I view PTEN as being derisked in the current market conditions. It is generating the cash flow to cover interest payments, cover capex, fund its dividend, and share repurchases, and pay down debt. A collapse in oil prices would obviously impact those dynamics.

Your takeaway

As I noted above, PTEN is trading at a EV/EBITDA multiple of 5.6X. Clearly PTEN is not going to grow at its 2022 rate in 2023. But it will experience some growth that could end up being significant. Andy Hendricks, CEO, commented in regard to an analyst question-

When we look at ourselves and what we will likely do with various customers and what we will likely do in terms of reactivations and some upgrades, our rig count add in 2023 is probably in that 15 to 20 rig range.

The upper end of that is pretty significant and could add as much as ~$200 mm of revenue and ~$65 mm of EBITDA for the year, on a back of the envelope basis.

Bottomline we will probably drill about 2,000 more horizontal wells in 2023, than we did in 2022. The only way we are going to get there is with more rig upgrades and reactivations. The motivation to add to existing fleets will be increases in the day rate, and as I said earlier, it’s a sellers market.

I think PTEN can revisit the recent highs from its current 15% discount. I wouldn’t be surprised with the market strength in shale drilling and the shift to longer term contracts, to see PTEN get awarded a higher multiple from the market. A 6X, not excessive in a rising market, would take the share price toward the middle to upper $20’s, implying ~40% growth from present levels.

I think investors looking for intermediate and long term growth underpinned by solid market fundamentals may find PTEN attractive at or near current prices, subject to individual tolerance for risk.

Be the first to comment