FerreiraSilva/iStock via Getty Images

Investment Thesis

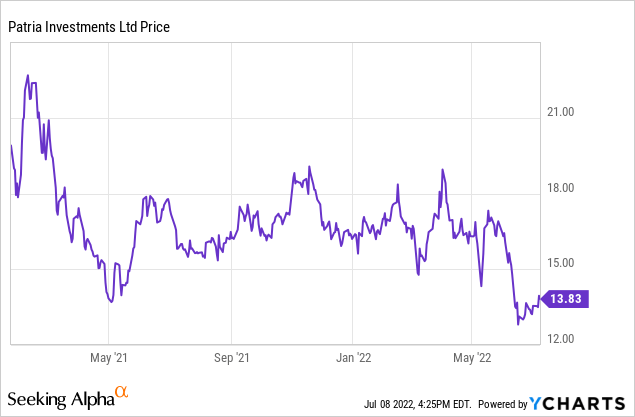

After falling ~40% from its highs in February 2021, PAX represents an opportunity for investors to invest in a highly scalable and growing Latin America alternative asset manager at a discount to a conservatively estimated intrinsic value. Insiders own ~60% of the company and Blackstone owns ~14%. With a history of consistently growing AUM, revenues, and earnings, I believe PAX represents a rare opportunity to purchase a great company with a long runway at an attractive price.

Business Background

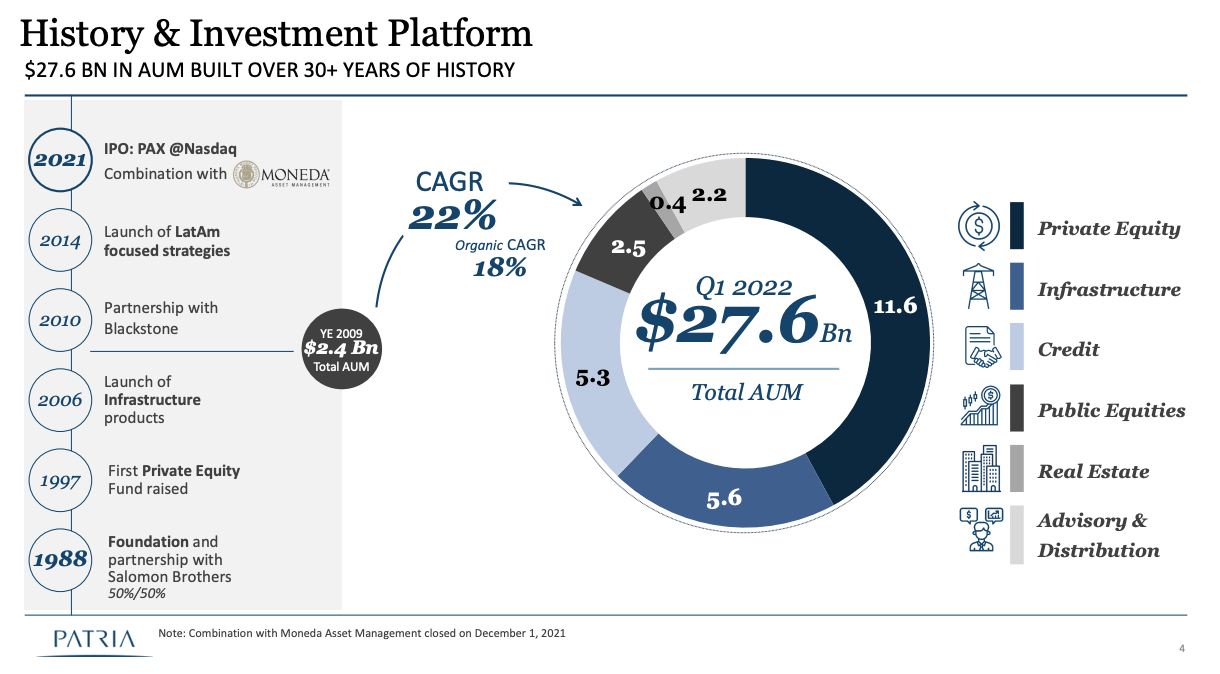

Founded in 1988, Patria Investments (NASDAQ: NASDAQ:PAX) is a Brazilian alternative asset manager focused on Latin America with $27.6B in Assets Under Management (or AUM) (as of May 2022). As an alternative asset manager, they invest in assets outside of conventional assets such as stocks and bonds (examples include private equity, venture capital, hedge funds, real estate, infrastructure, credit / debt).

Patria’s main business is to raise, invest and manage investments spanning several categories:

-

Private Equity ($11.6B): focus on resilient sectors with motivated entrepreneurs to create value through organic and inorganic growth initiatives

-

Infrastructure ($5.6B): focus on a diversified portfolio of infrastructure-related assets in Brazil and selected Latin American countries

-

Credit ($5.3B): focus on corporate / structured credit solutions

-

Public Equities ($2.5B): focus on investments in public equities

-

Advisory & Distribution ($2.2B): focus on wealth management and alternatives distribution

-

Real Estate ($0.4B): focus on Brazilian real estate-related companies

Investor Presentation (PAX)

Blackstone (NYSE: BX) has held a non-controlling interest in Patria since 2010 and Patria seems to be running the Blackstone playbook of scaling their funds, expanding their products and geographical presence. Patria’s flagship private equity and infrastructure funds have achieved a net IRR of ~29% since inception.

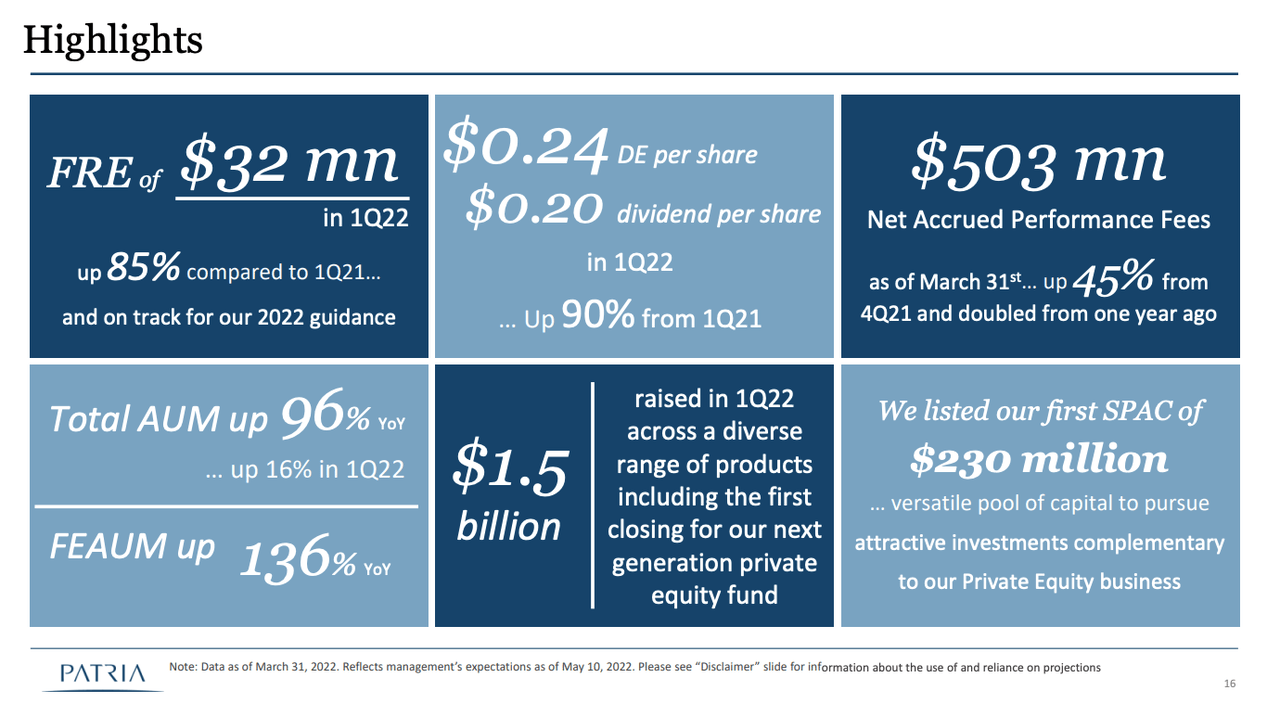

Patria’s business is firing on all cylinders. From its Q1 2022 presentation:

-

Fee Related Earnings (or FRE) is up 85% compared to Q1 2021

-

Total AUM is up 96% YoY

-

Net accrued performance fees have doubled from one year ago

-

Raised $1.5B in Q1 2022

Staggering numbers.

Investor Presentation (PAX)

Before moving on to valuation, I just want to touch upon how great the asset management business model is (when done properly).

-

Scalable: the company is able to increase revenues without a commensurate increase in capital expenditures or fixed costs

-

High-Margins: Patria’s FRE margins are ~50-60%

-

Asset-Light: similar to Blackstone, Patria runs the business with an “asset-light” approach, which allows it to pay out the majority of its earnings (Patria targets ~85% of their distributable earnings)

-

Sticky Earnings: capital is often locked up for a few years, which makes the earnings stream fairly predictable or “sticky”

Valuation

So how do we go about valuing Patria? Similar to my valuation on KKR, Apollo, and Ares, one can think of Patria (or any asset manager) as two segments:

-

The income stream (management + incentive fees)

-

The balance sheet (cash & investments net of debt). In other words, the book value.

The recurring management fees come from managing the pools of money and the variable incentive fees come from being profitable (over some hurdle). Think of it as the typical “2 and 20”.

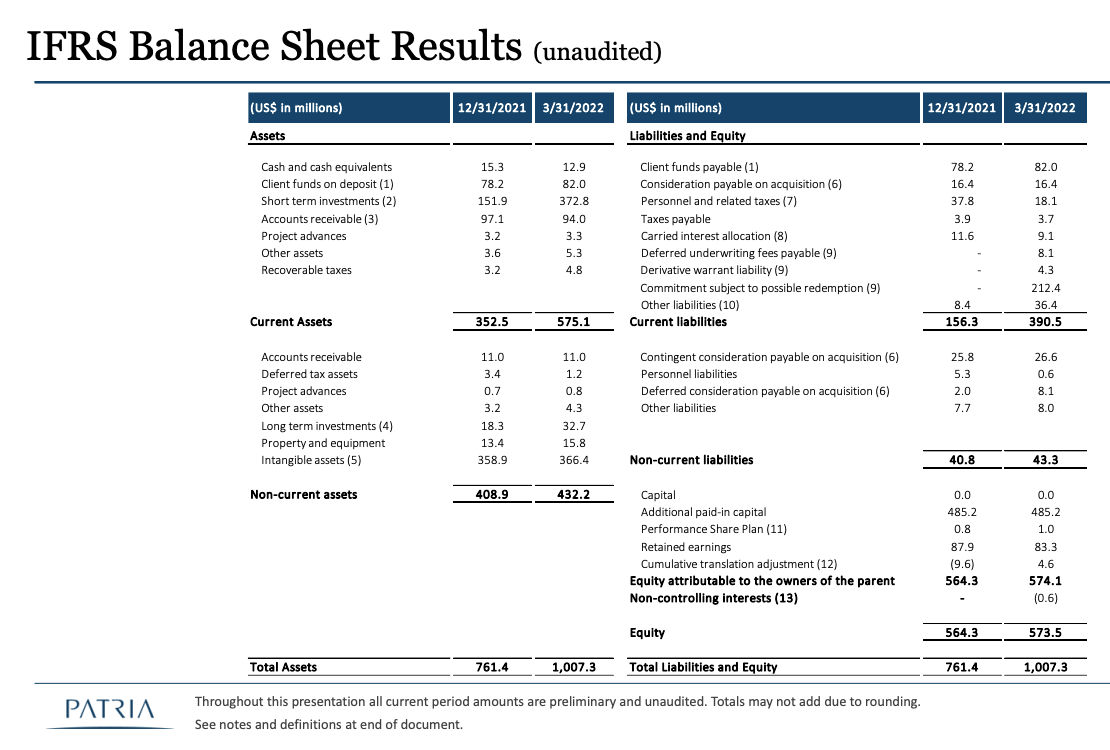

The balance sheet is simply the cash and investments that PAX has on its balance sheet minus the debt.

Using a sum-of-the-parts (SOTP) approach, we can apply certain multiples to the income streams and balance sheet to estimate PAX’s intrinsic value.

With 147.2M shares outstanding (~54M Class A and ~82M Class B) and a current price of $13.84, the current market cap is ~$2B.

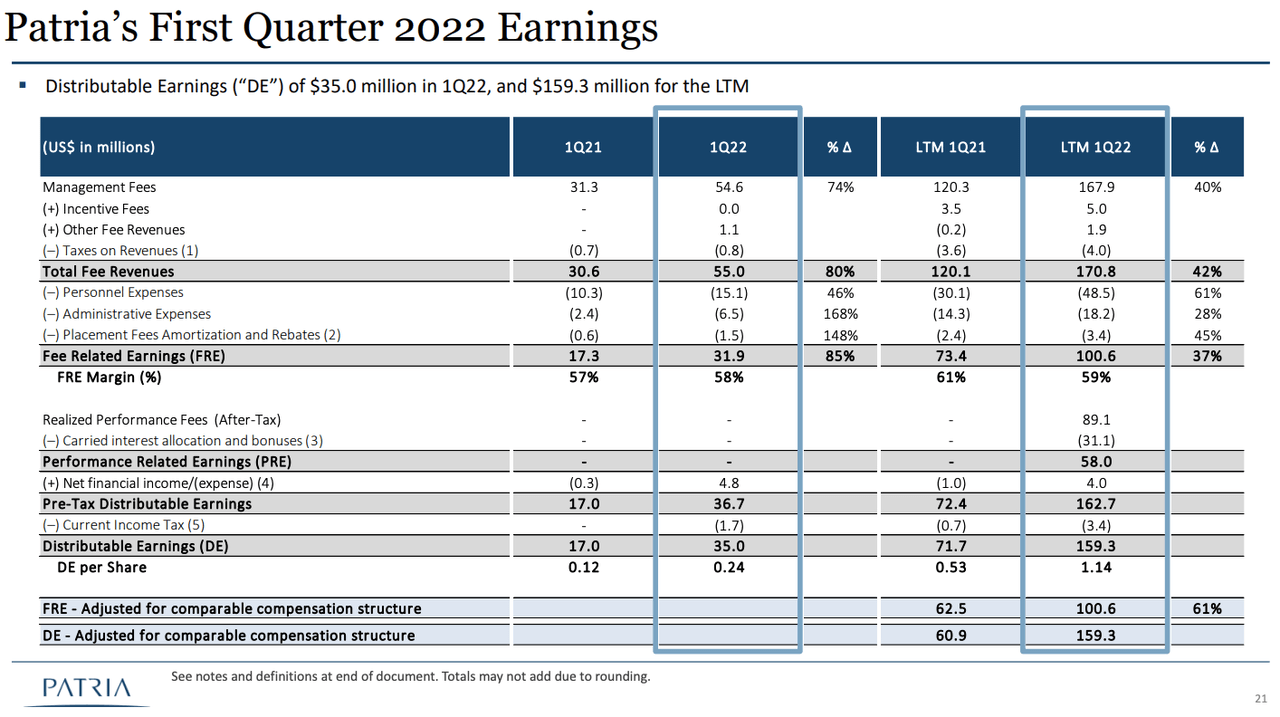

Investor Presentation (PAX)

Management Fee Stream: FRE for LTM 1Q22 was ~$100M. Applying a 20-25x multiple (which I would argue is fair multiple for a sticky earnings stream) , we get between $2B-$2.5B in value for the management fee. Already we see that the market is only valuing the management fee stream and entirely ignoring the incentive fees, book value, and any growth.

Incentive Fee Stream/Carried Interest: like most asset managers, the performance related earnings (or PRE) is pretty lumpy, but PAX states that they have net accrued performance fees of ~$503M. To be honest, I’m not entirely sure how to value this stream given the lack of historical financials, so I’ll just mark it at a draconian zero (even though we know it’s worth something). Consider it a free call option.

Investor Presentation (PAX)

Book Value: taking book value at face value, we get ~$573M of value

So in total, we get:

-

Intrinsic Value: Management Fee + Incentive Fee + Book Value = ($2B – $2.5B) + $0 + $573M = ~$2.5 – $3B

-

Price / Intrinsic Value: ~66 – 80%

In short, we get that PAX is trading between 66-80% of intrinsic value and we get all the future growth in AUM / FRE for free. On top of everything, the current dividend yield is ~5.8%, so investors are paid to wait as the business continues to grow.

Insider Ownership + Buying

2020 20-F (PAX)

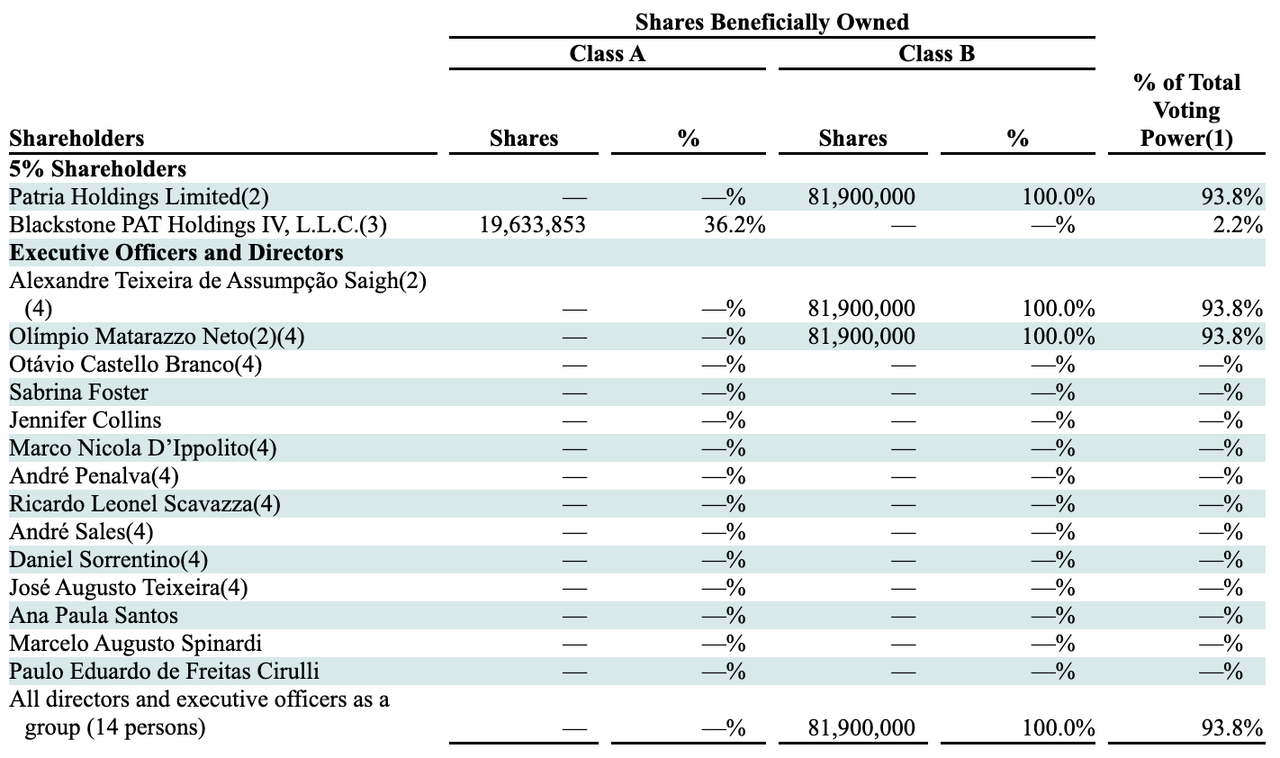

Patria is tightly held by insiders, where they effectively own ~60% of the company (~94% of voting power) through their ownership of Class B shares through Patria Holdings Limited. (Note that Class B shares have a 10-1 voting ratio compared to the Class A shares and are convertible into an equivalent number of Class A shares.)

In addition, the insiders chose not to sell after the IPO and have committed to a 5 year lock-up period instead. Seems like good alignment to me.

On top of that, Blackstone owns ~36% of the Class A shares or ~14% of total shares outstanding (~2.2% total voting power).

Catalysts

-

Continued Execution: PAX continues to execute and scale on its strategies, which leads to higher FRE and distributions

-

Increased Demand for Alternative Assets: according to a survey of alternative asset investors, “at least 77% of investors say they plan to maintain or increase their capital commitments over the next year while at least 81% say they plan to maintain or raise their allocations”

-

Growth in Latin America: relative to the United States (and the West in general), investment in Latin America is fairly unpenetrated; Patria should be able to capitalize on this long runway of growth in the region for decades to come and also take advantage of cheaper valuations due to less competition

-

M&A: Patria has been growing via acquisitions; for example, it merged with Moneda (another asset management firm in Chile) in 2021, which added ~10B of AUM; recently, in June 2022, it also announced that it will acquire VBI Real Estate, a top alternative real estate asset manager in Brazil

Risks

-

Geography: the main risk here is that Patria operates in Latin America, a region that isn’t exactly known for its political and economic stability; one could argue that Patria does deserve a discount, which is evident in the share price and something investors should seriously consider; however, I would argue that this risk is mitigated since Patria has operated in the region for ~34 years, it runs the business unlevered and owns critical businesses in the region

Takeaway

If done right, asset management is a fantastic business as the underlying business is scalable and earns a high-margin (and sticky) earnings fee. Patria has operated in Latin America for ~34 years and I believe the business is starting to inflect and scale. The runway for opportunities in the region is long and Patria is perfectly positioned to capitalize on it.

Insiders own a large chunk of the company and Blackstone has a decent stake in the business as well. At current prices, Patria is trading at ~66-80% of a conservatively estimated intrinsic value and investors are paying for just the management fee, while getting the incentive fee, book value, and future growth for free.

Based on the analysis above, I recommend taking a long position in PAX.

Be the first to comment