pichet_w/iStock via Getty Images

As global investors know full well, no country in the world has a monopoly on great businesses – companies that outmatch their competition in providing products and services that create value for their customers, and do so in a way that attractively rewards their shareholders. Throughout its history, Switzerland has had its fair share of such great businesses, whether large companies with market-leading global positions such as Nestle (OTCPK:NSRGY) and Roche (OTCQX:RHHBY), or so-called hidden champions like Belimo (OTC:BLHWF) and VAT Group (OTCPK:VACNY), to name just a few examples. And yet, the story of Partners Group Holding AG (OTCPK:PGPHF) stand out as a singular example of a company’s rise to prominence; so much so that in 2016, the renowned Harvard Business Review (HBR) published a case study entitled: ‘Partners Group: Ain’t No Mountain High Enough’.

This article aims to briefly retrace Partners Group’s (PG) short but eventful history since its founding in 1996, and – with the help of the aforementioned case study – highlights some of the strategic choices the company has made on its way to becoming one of the world’s largest private markets’ investment manager. We’ll then jump into our customary review of the company’s fundamentals, and look at some valuation scenarios, before drawing some initial conclusions.

Company Background & Description

Founded 26 years ago by Fredy Gantner, Marcel Erni, and Urs Wietlisbach, who all formerly worked at Goldman Sachs, PG initially aimed to provide asset management services to high net worth clients. However, before long, the founders came to recognize that the European market for private equity (PE) was relatively underdeveloped, with few investors there having any meaningful exposure to this asset class, mainly due to legal and regulatory barriers. They saw this as a massive opportunity to service this flourishing, yet untapped market – and grow the company at a rapid pace.

In the first few years after founding, PG created a number of structured vehicles which invested in some of the top private equity funds, thereby enabling European investors to make this asset class part of their asset allocation for the first time. The company also raised its first ‘direct’ buyout fund in 1998, focusing on a combination of lead- and co-investments in small-cap European companies. Thereafter, PG complemented its fund of funds (which it refers to as ‘primaries’) and ‘direct’ businesses with the development of a ‘secondaries’ business, by being one of the first firms in Europe to establish a secondary market for private equity limited partnerships interests.

|

PG terminology |

Investments |

|

Direct |

Direct lead- and co-investments in private companies |

|

Primaries |

Fund of Funds (FOF) investments (i.e., Investments into funds of other private equity managers) |

|

Secondaries |

Investments in acquiring existing limited partnerships interests |

Source: Oyat

Unlike its peers, which at the time very much focused on standalone products, PG then started to raise more capital for vehicles which combined a mixture of direct, primary, and secondary investments in a single fund. This ‘integrated’ approach, which allocates capital in different stages of the private equity value chain, resonated strongly with clients, and it soon became one of PG’s flagship strategies.

Then, starting in 2003, PG began to expand into other asset classes within private markets, including private debt. Such investments focused on providing varying types of loans to private equity-backed companies.

Fast forward to March of 2006, and PG completed its IPO by listing 33% of its shares on the SIX Swiss Exchange (today’s free float is approx. 83%). This was motivated by a number of considerations. First and foremost, as the company had always encouraged an alignment of interests between its employees and clients, slightly more than 20% of shares were held by the firm’s partners, managing directors, and employees. This created an issue in terms of liquidity and fair market valuation, should a partner ever decide to leave the firm and cash in on his/her shares. Second, there were increasing demands from investors for more transparency on the part of private markets investment managers, and an IPO – together with the accompanying regulatory and reporting obligations – was seen as a way to address this issue. So in 2006, PG was one of the very first private equity firm to go public. Most other PE firms followed shortly thereafter: Blackstone (BK) and Fortress went public in 2007, KKR (KKR) in 2010, Apollo (APO) in 2011, Carlyle (CG) and Oaktree in 2012. And the trend has since continued: just last year, 11 private equity firms went public, according to an article by the Financial Times.

From a strategic standpoint, going public only accelerated two major shifts that had already been years in the making. The first was to increasingly focus on direct investments, in other words sourcing deals where PG could be the lead investor, rather than the historical focus on primary and secondary investments. This was a bold move, which would put PG squarely in competition with its peers, but offered the potential to ‘actively drive the value creation of our portfolio companies for our clients’ [1].

Second, the company was to continue its efforts to diversify into other asset classes within private markets, including private debt, private infrastructure, and private real estate. This was to be achieved predominantly via organic growth, so as not to disrupt the distinct corporate culture that PG had been cultivating since its founding, although smaller acquisitions of firms with specialized expertise in new or adjacent private markets were to also play a part. In doing so, PG hoped to become a ‘one-stop-shop’ for clients looking for investment solutions within private markets.

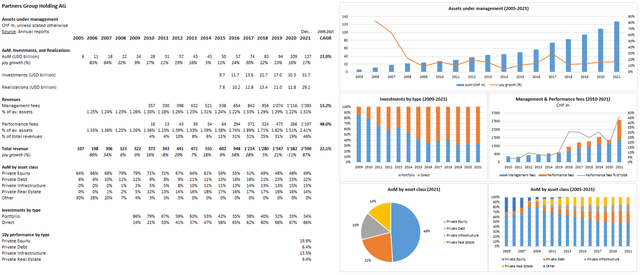

Let’s illustrate some of the things we’ve described above with the following graphics:

PG annual reports and other IR publications

Source: PG annual reports and other IR publications

As shown above, PG has grown Assets under management (AuM) at a CAGR of 21% since 2005, reaching USD 127 billion by the end of 2021.

Looking at investments by type, we can see that PG has executed on its strategy to ‘go direct’, with ‘portfolio’ investments declining from 86% of assets in 2009 to 31% in 2021. This has had a positive impact on PG’s revenues, with significant growth in performance fees once the firm started realizing some of its direct investments.

We can also observe that PG has indeed gradually diversified across asset classes within private markets, with private equity now representing about half of total assets, while private debt (22%), private infrastructure (15%), and real estate (14%) have all grown significantly.

Last but not least, we should point out that the annualized performance of its investment products over the past 10 years (private equity: 20%, private debt: 6.4%, private infrastructure: 13.5%, real estate: 9.4%) is very solid, and that most of PG’s funds rank favorably relative to peers.

Company Fundamentals

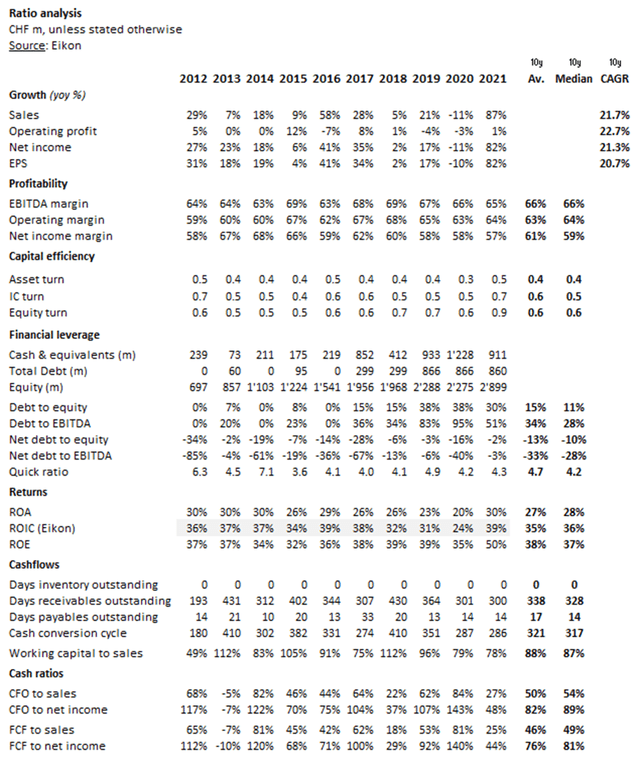

Let us now turn to a condensed version of our customary review of the company’s fundamentals:

Source: Refinitiv Eikon

We’ve already alluded to PG’s impressive growth in AuM, and revenues from management and performance fees. Looking at profitability levels, we can see that PG maintains operating margins slightly above 60% with remarkable consistency, due to adequate cost control on the downside, and broad employee participation from variable compensation on the upside. The firm generates very attractive levels of return on investment, mainly thanks to its highly profitable business. Cashflow conversion can be very choppy (which is mainly due to the investments that PG makes in short-term loans, that are accounted for as receivables) but on average over a number of years, PG has historically converted approx. 80% of net income into free cashflows. It’s balance sheet is very strong, with CHF 1.6 billion in net cash as of the end of 2021 (over CHF 910m in cash and CHF 1,490m in short-term loans, versus CHF approx. CHF 800m in debt).

Dividend

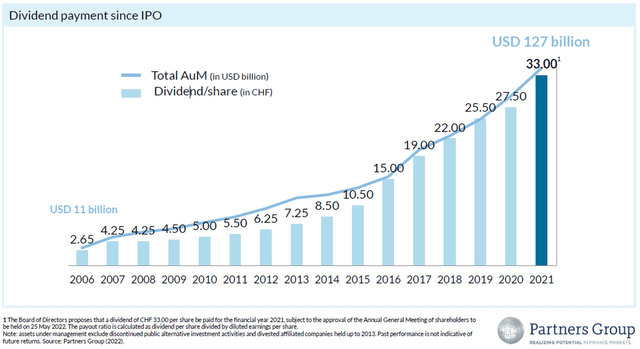

Short of an official policy, PG’s strategy regarding the dividend is to broadly align it with the growth in AuM. As shown below, the two have essentially followed the exact same trajectory since the firm’s IPO.

For fiscal 2021, the proposed annual dividend was CHF 33 per share, up 20% yoy, which was paid out on June 1st 2022. It represented a payout of 60% of net income, which is slightly below the long-term average payout. As of today’s share price, the dividend yield was approx. 3.9%, marginally above its long-term average of approx. 3%.

Source: Investor presentation

Valuation

Assessing the fair value of PG’s shares essentially rests on the answers one might have to the following key questions:

- At what rate can the company continue to grow AuM?

- Will management fees for private equity investments, which have held up comparatively better than fees for other types of asset managers, continue to remain stable around 1.25% going forward?

- Following fiscal 2021, during which performance fees jumped to 46% of total revenues due to record exit activity, what is the long-term pathway for performance fees as a % of revenues?

- Can the company continue to maintain stable operating margins slightly above 60%?

- What can free cashflow conversion look like, on average, in the coming decade?

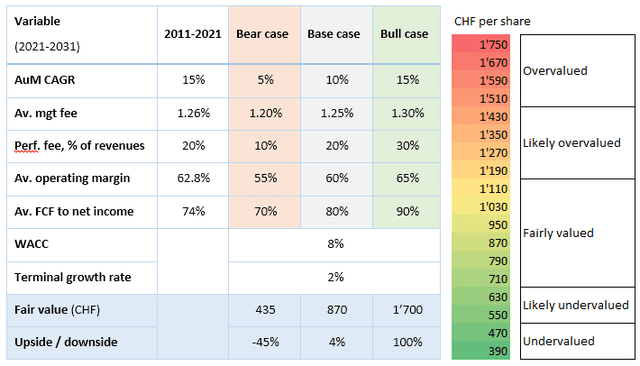

We’ve looked at 3 different valuation scenarios, for which the main assumptions are summarized in the table below:

Source: Oyat

According to our base case – which assumes AuM to grow at a CAGR of 10% over the coming decade, an average management fee of 1.25%, performance fees normalizing back to 20% of total revenues, average operating margins of 60% and average free cashflow conversion rate of 80% the – fair value of PG’s shares is approx. CHF 870, marginally above the current share price.

Our bear and bull cases provide a broad range of fair values, mainly due to the compounding of more pessimistic/optimistic assumptions for the key value drivers described above. But overall, it is not uncommon to see such a wide range of fair values for PG shares, as is often the case with faster-growing companies.

Initial Conclusions

As we hope to have presented throughout this brief article, Partners Group is a phenomenal success story of a company that came from nothing and established itself as one of the world’s largest private markets investment manager in a little more than a quarter century. In fairness, we’ve not done the Harvard Business Review case study justice, by a long way, and recommend prospective and current investors alike to consider investing $9 to purchase it. It is well worth the read.

That success story, clearly, rests upon a number of key factors, including an uncompromising focus on providing value-adding services to clients, the disciplined underwriting of investments leading to the above-average performance of its funds, shrewd strategic choices along the way that differentiated it from its peers, as well as a certain style of leadership and corporate culture.

Of course, as with any investment, there are a number of risks to consider. Clearly, while private markets benefit from a certain level of stability due to captive assets and being unlisted, they too are intrinsically linked to the real economy, the health of which may deteriorate going forward. In this context, how fast are AuM likely to grow in the coming years? There are also question marks about the future evolution of management fees for PE firms, and whether they may follow the same path as for other asset classes such as public equities, in other words start to progressively erode over time. Moreover, more often than not, growth in itself brings its own challenges, such as maintaining underwriting discipline, as well as attracting, retaining, and developing talent while preserving a distinct corporate culture.

As the HBR case study concludes: ‘how high could PG’s mountain be?’. We may soon become shareholders of the company once again and find out for ourselves.

—

Appendix

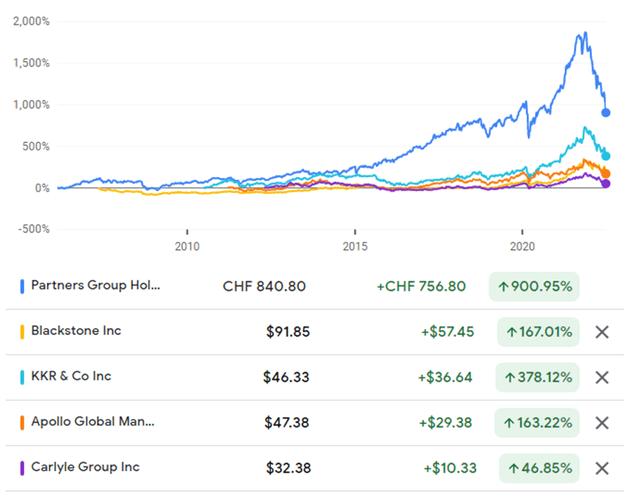

Partners Group’s performance relative to peers (Mar. 2006-present)

Source: Google finance

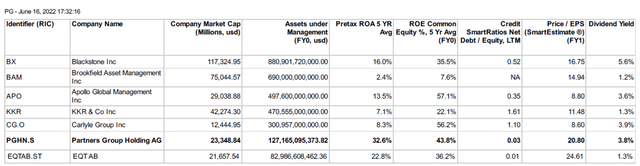

Partners Group: selected ratios relative to peers

Source: Refinitiv Eikon

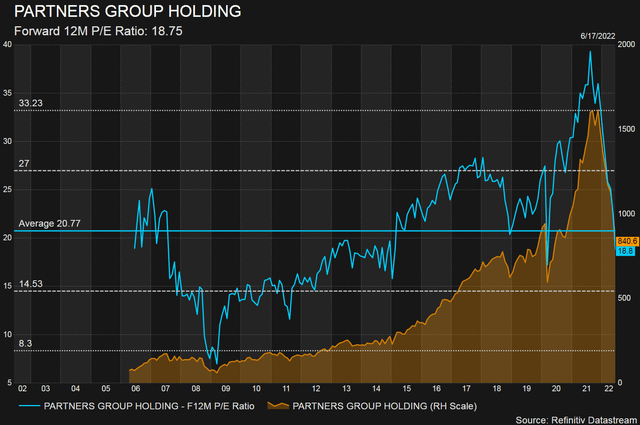

Partners Group’s stock price and 12-months forward PE (2006-present)

Source: Refinitiv Datastream

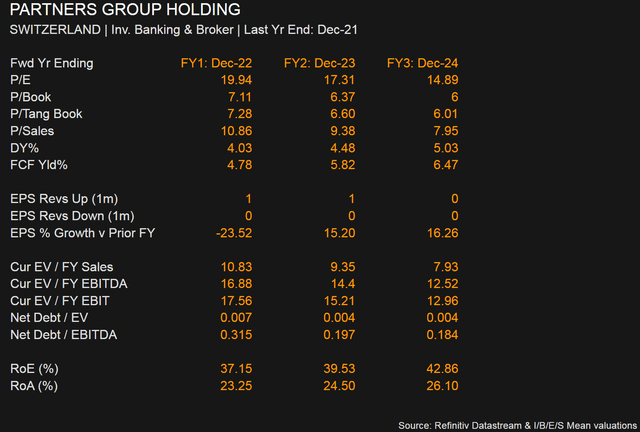

Partners Group: selected valuation multiples

Source: Refinitiv Datastream, IBES estimates

[1] Partial quote attributed to Mr. Gantner, quoted in the HBR case study.

Be the first to comment