Warchi/iStock via Getty Images

Written by Nick Ackerman. This article was originally published to members of Cash Builder Opportunities on September 3rd, 2022.

It hasn’t been too long since we last touched on Paramount Global (NASDAQ:PARA). Just over a month ago, we were discussing how we had puts expiring worthless, locking in the option premium. Well, it’s been a wild ride of a month, but we once again have puts expiring worthless.

With no earnings announced from our last update on PARA, the numbers haven’t changed much. The next FQ3 earnings are expected to be announced on November 4th. Analysts are expecting an EPS of $0.49, with revenue of $7.15 billion. That would result in year-over-year growth of -36.10% for the EPS and 8.10%. The EPS here is taking a large hit due to significant spending for content on their streaming platform. That’s something we commented on previously, and nothing has changed on that front.

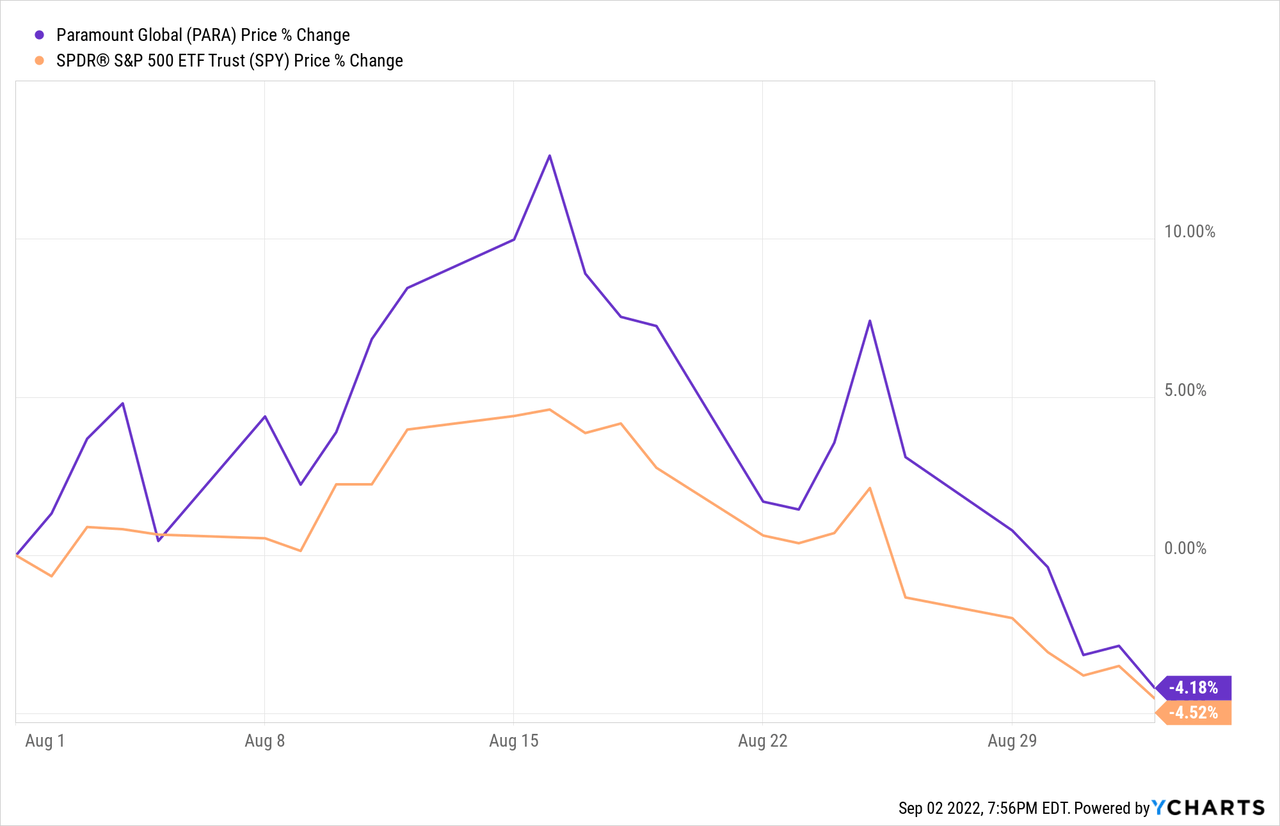

Overall, it would appear that the stock is ultimately just following along with the market volatility. After Powell’s “some pain” comment, the market has been struggling since.

Not even a jobs report that came in line with expectations could prop the market up, which had indexes falling once again on Friday. That was after initially rallying at the opening and fading in the afternoon. A long U.S. weekend could mean some investors didn’t want capital to be tied up over the holiday. A shaky geopolitical world means a long weekend could bring just about anything.

With that, just because there weren’t any new earnings to discuss, that doesn’t mean there wasn’t any worthwhile news in the last month worth pointing out for PARA more specifically. There were two noteworthy developments since the last trade that hasn’t been reflected in the stock price at all as the stock makes new lows.

The biggest thing about the new information on PARA, in my opinion, was teaming up with Walmart (WMT) on their Walmart+ to offer Paramount+ as a streaming service. That should provide a financial benefit to Paramount. Plus, it provides a competitive edge for WMT against Amazon (AMZN), too. It seems a natural fit. I’m hoping we get more details with the next earnings as the financial terms were not disclosed.

There are 11 million Walmart+ customers in the U.S. Paramount+ currently has 43 million subscribers, so that’s quite the new audience that can stream their content. That was with an additional 4.9 million additional subscribers for the latest quarter and removing 1.2 million Russian users.

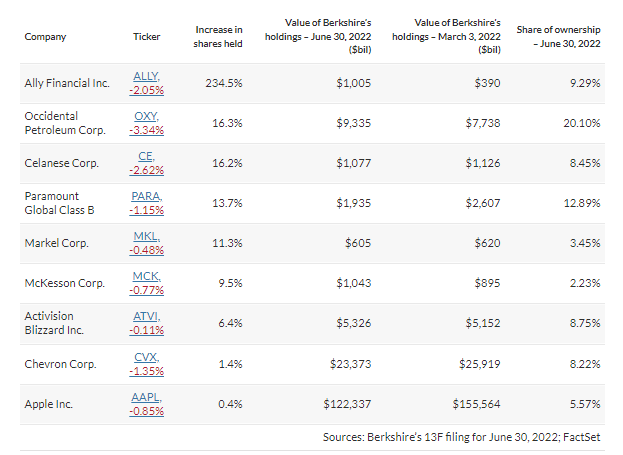

The second was Warren Buffett’s Berkshire increasing their stake in PARA. That doesn’t provide any fundamental changes to the stock. However, it doesn’t hurt to get the backing of one of the greatest investors of all time.

Berkshire Position Changes (MarketWatch)

I think that if Berkshire (BRK.A) is in this position, they see the dividend as a fairly safe bet. Considering they were adding to it, it would make me more confident. Here is a quick comment from our previous last PARA post.

When asked about the dividend previously in Q4 earnings, they sounded confident that it was a priority for them.

We’re very well equipped to invest to capture the growth on D2C and to continue to fulfill all of our financial priorities, which as I’ve articulated before, include investing in organic growth through streaming. It includes funding our dividend and it includes deleveraging our balance sheet. I think you’ll actually see us doing all three of those things in 2022.

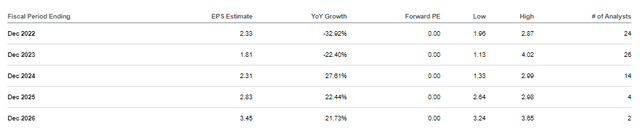

That being said, a negative development is that analysts now expect fiscal 2023 EPS to come in at $1.81. That’s a fairly substantial decline from the $2.04 they were estimating a month ago. That could take the EPS payout ratio to 53%, which puts it at a large margin of safety.

PARA EPS Estimates (Seeking Alpha)

Despite these mostly positive developments, the stock has hit a new 52-week low after it started making some strong runs higher. Again, a lot of this seems to be playing out primarily due to the overall market reversing.

YCharts

PARA is at the mercy of the overall market, so we definitely could see the stock run lower. Analysts still have an average price target of $29.10 for PARA. With the high estimate at a lofty $58 and a low estimate of $19. The forward P/E is at ~10x, presenting an attractively valued position.

The Trade

With the latest weekly options expiration passing, we have our trade expiring that we entered on August 1st, 2022. We had selected a strike price of $22, collecting $0.80 over the course of 32 days. That worked out to 3.333x the actual quarterly dividend – and we did it in about a month. The potential annualized return for this trade came to 41.48%.

As mentioned above, despite the price coming down quite aggressively towards the expiration date, the downside cushion was enough that we didn’t have shares assigned. To be quite fair, though, taking assignment of PARA at these levels is something that I’m certainly prepared to do.

That’s why it sets it up as more of a win-win scenario when selling puts. You either end up receiving the premium, or you receive the premium and might own a stock you wouldn’t mind buying anyway.

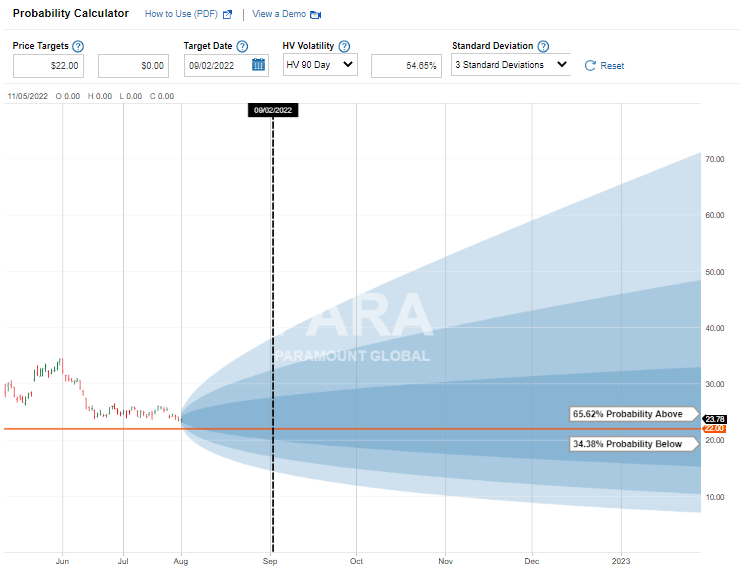

It was noteworthy that the probability of assignment was fairly high in this case. Higher than quite a few of the other trades that we’ve entered into previously anyway. I think that reinforces my personal feelings of seeing assignment in PARA, at this point, as quite an attractive proposition. This was the calculation at the time the trade was entered from Fidelity.

PARA Assignment Probability (Fidelity)

What’s Next?

With that trade expiring worthless, we have some cash freed up. However, this is a time when I entered into new written put contracts before expiration even happened. As shares slid, that was the opportunity I was looking for to sell more puts. Seeing a new 52-week low on a stock that I actually want to own is an exciting thing.

That’s why the day before expiration day on September 1st, I took the opportunity to sell puts with an expiration of September 30th, 2022. For this trade, I had gone with a slightly reduced strike price of $21, collecting $0.58 in premium. At the time of the trade, it worked out to a cushion of 9% before the stock would hit that level, which was also a bit wider of a cushion than the original trade.

The probability of assignment here was also lower than that original trade. Just a ~25% probability, which makes no surprise that the PAR on this trade came to 34.76%. That was quite a meaningful deduction from our previous trade, but also quite an elevated level, in my opinion.

On Friday’s close, the last trade came in at $0.45, so there is still an opportunity at that level. The PAR, in this case, drops to around 27.93% now.

For some further downside protection should shares continue to fall, I believe the $20 strike on the same expiration date is also fairly attractive and offers a higher amount of volume. The last bid at that strike came in at $0.33. That would still work out to an attractive PAR of ~21.5%.

Be the first to comment