R. Ellard/Hulton Archive via Getty Images

Investment Thesis

Paramount (NASDAQ:PARA) (NASDAQ:PARAA) has spent years as a top player in film and television media. The company is now executing a transformation to streaming services. I believe the company is well diversified across multiple segments and revenue models.

The increased spending for streaming content is a drag on the stock’s recent performance. But I think the company is well positioned for high growth. A successful transformation means shares could have significant upside. I think the risk to reward is favorable at the current price, even if it may take a while for the market to adjust.

Streaming growth is surging

The key focus of Paramount’s transformation is its streaming businesses. The company began reporting this segment as its Direct to Consumer business in its latest 10-Q filing. Paramount has diversified its subscription offerings into both paid and non-paid channels. Both have experienced massive growth over the past few years.

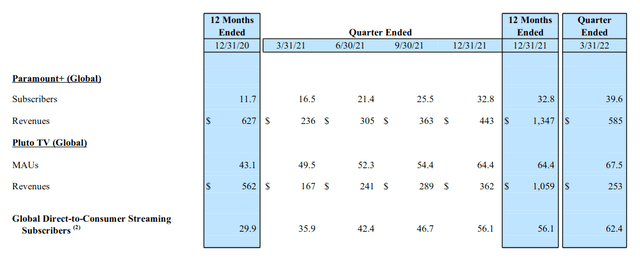

The fastest growth is currently in the company’s paid service, Paramount+. The basic service has been around for many years as CBS All Access. But Paramount has only recently started heavily investing in exclusive content. Since then, both subscribers and revenues from Paramount+ skyrocketed by over 140% year over year. I think there’s still a lot of room for heavy growth in paid subscriptions.

Paramount Q1 2022 Trending Schedules

One subscription driver is the service’s international expansion. Last month, the service launched in South Korea and the United Kingdom. Over the next two quarters, the service is expected to launch in Italy, Germany, France, Switzerland, and Austria. I like the company’s strategy of expanding globally through partnerships. This lets them leverage the resources of streamers and broadcasters around the world. Both parties share their content libraries across their services. Many deals include joint ventures to produce new content. I think this strategy gives the service an edge over competitors like Netflix (NFLX) and Amazon (AMZN).

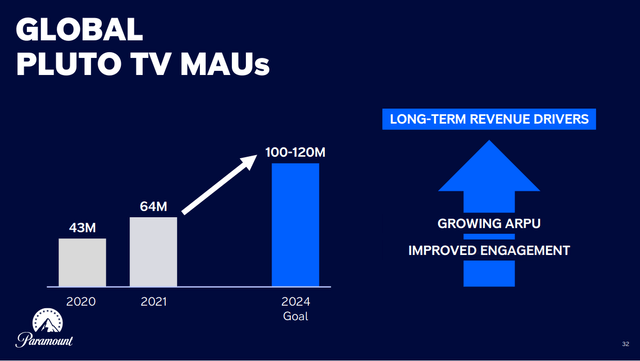

The company’s advertising supported streaming services are anchored by Pluto TV. It is the number one free streaming service in the US by a significant margin. This gives Paramount a rare lead in a space where competitors are still catching up. The company has taken the opportunity to invest heavily in EyeQ, its digital advertising platform.

I like that Paramount’s other media businesses have long standing relationships with advertisers. This lets the company simply upsell existing clients rather than search for new ones. I see solid opportunities for increasing revenue per user in this category. At a recent conference, the company’s CEO remarked that he sees political advertising as a “huge plus in the second half of the year.”

Paramount Q4 2021 Earnings Slides

During the last quarter, Pluto TV increased its subscribers by 36% year over year. More impressive was the company’s revenue, which increased by over 50%. I think this is a great addition to Paramount’s paid subscription services.

Traditional media is still strong

Paramount’s old TV and movie businesses are still performing well. CBS was the most watched network last quarter. This marks its 14th consecutive season with the title. This is during a period where NBC (CMCSA) had broadcast rights to both the Olympics and the Super Bowl.

CBS, Showtime, Paramount Studios, Nickelodeon, and Paramount’s other networks all generate immensely popular content. The company’s sports network is the broadcaster for the NFL, NCAA, PGA, and UEFA Champions League.

Paramount Q1 2022 Earnings Release

I think this is a key moat and one of the business’s strengths. Unlike Netflix, Paramount is already able to produce and distribute their content at a profit without streaming. This content can then be leveraged across all their platforms. This distribution model subsidizes the content before it hits Paramount’s streaming services. I see this as a long-term tailwind that boosts profitability.

The company’s traditional media channels drive user acquisition for streaming services. During the company’s Q4 earnings call, management pointed out that the NFL was the number one source of subscriber additions in 2021. Customers who joined for sports then started watching other programming on Paramount+. These channels also provide the company with a lot of potential unpaid advertising.

All these legacy media businesses make up Paramount’s strong moat. This competitive edge is a reason why I think the company can pull off their shift towards streaming.

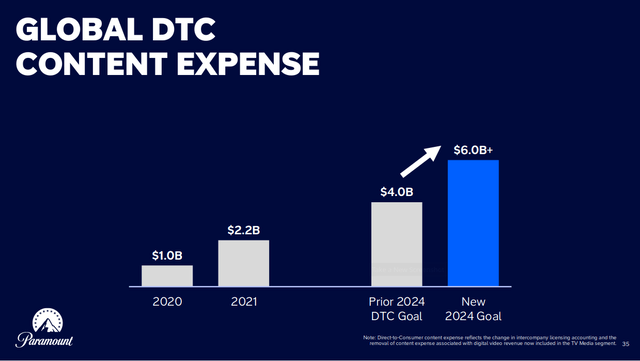

The streaming shift is expensive

There is a catch to this growth, however. This is a fundamental transformation of Paramount’s business. That adds risk and requires a heavy investment. I think this investment is the primary headwind the company is facing.

The company is increasing its cash spend on its content library, especially for streaming. During the last fiscal year, the company generated only $599 million in free cash flow. That’s not even enough to cover the company’s dividend payments. On their last earnings call, management attributed this to a few factors.

The gap you’re seeing today between cash and amort is primarily related to two dynamics: number one, the return of our production to more normalized levels, post-COVID; and then, number two, continued growth and investment around streaming content. And I think on the COVID piece, we expect to see that easing through the remainder of 2022.

Streaming investment will obviously continue to ramp through 2024, though the growth rate does slow over time. And as that growth rate slows, the gap between cash and expense will start to narrow. And then, in parallel, we also, as I’ve spoken about before, continue to drive a number of different working capital improvements that should help overall free cash flow conversion. But hopefully, that gives you some sense of what to expect on the trends there.

In its Q4 earnings presentation, the company guided for $6 billion in annual DTC content spending by 2024.

Paramount Q4 2021 Earnings Slides

I understand the strategy behind these expenditures. But I think this adds substantial risk to the investment story. The company could enter a precarious financial position if it misses its streaming growth targets. Decreased margins due to content investments is another potential threat. At the most recent investor conference, the CEO said he doesn’t expect to reach peak losses until 2023.

For now, the company has enough cash to fund some years of negative cash flow. As of the last quarter, their balance sheet had $5.3 billion in cash on hand and $3.5 billion in credit. This gives the company some margin of safety. I’m keeping a close watch on DTC revenue and subscriber numbers.

Cheap valuation with some risks

Paramount seems obviously undervalued by most traditional comparables. The company’s TTM P/E is just over 4 and their P/S is just under 0.6 times.

The company has a significant amount of debt, but this is not an immediate concern. The company took the opportunity of the past few years to pay off most of its short-term debt. 90% of the company’s debt has maturities after 2026. Adjusting for this debt, the company has an EV/EBITDA of about 5. I think this is still very low. I’d be willing to pay more than that for a company with solid growth prospects and a strong moat.

Free cash flow is still a concern. The metric is negative over the past twelve months. I understand this is intentional and will improve as growth rates catch up to content spending. But I also think this strategy is the primary reason the stock has trended so low over the past year. The valuation suddenly looks expensive if revenue growth doesn’t offset DTC content expenditures. However, I still think the risk to reward is favorable here.

Final Verdict

Paramount is a traditional media business executing an ambitious transition to streaming. Heavy cash spending is likely to be a headwind across the next couple of years. I believe we’ll see a shift as streaming revenue increases and losses narrow. This should kick off growth in the company’s equity value.

I see a favorable risk to reward for investors who are bullish on streaming. Paramount can leverage its fantastic intellectual properties to create popular content. The company is positioned to effectively monetize this content across many distribution channels. I think this is a great buy for patient investors, especially at current prices.

Be the first to comment