marchmeena29

Written by Nick Ackerman. This article was originally published to members of Cash Builder Opportunities on July 30th, 2022.

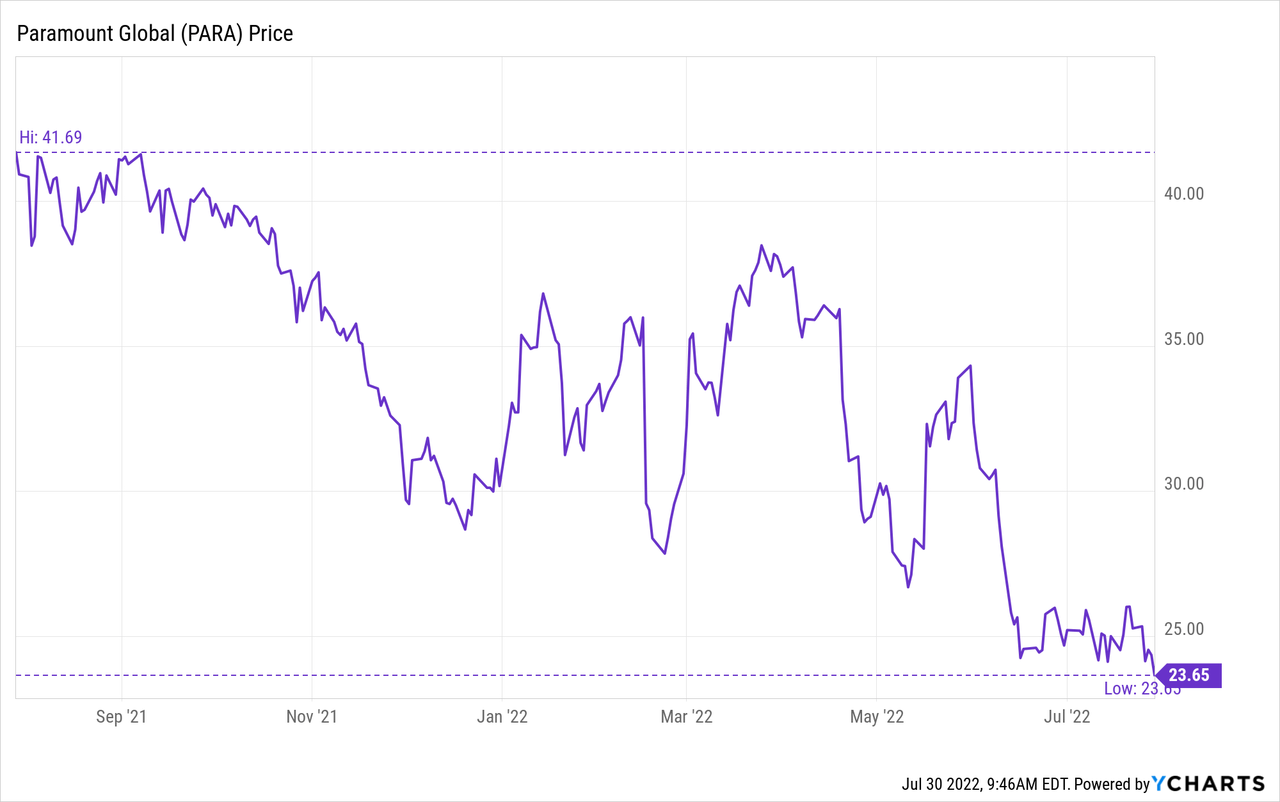

Paramount Global (NASDAQ:PARA)(PARAA) hasn’t been receiving any love from investors. It has been on a downward trajectory for the last year, falling considerably.

Ycharts

The stock is stumbling near a 52-week low. While that might have been the case, when we originally sold the puts, we went with a strike price of $22. That means we had locked in the entire premium after letting the trade expire worthless with PARA over our strike price.

One of the latest hits to the stock was a double downgrade from a “Buy” rating straight to a “Sell” rating from Goldman Sachs. They see near-term headwinds that are going to impact the stock. Advertising is a big business for PARA and one of the easy costs for companies to cut out.

Not to mention that the growth leg of PARA is streaming. If customers are strapped for cash, they might have to cancel subscriptions. I happen to think we won’t be in that tough of a recession, and a streaming service such as Paramount+ will be an affordable luxury.

That wasn’t the only downgrade recently, either. Also, in July, Morgan Stanley downgraded the stock to “underweight,” with a price target of just $22. They mostly said the same thing, uncertain headwinds at this time.

While those are certainly near-term catalysts that could continue to pressure the stock, I view PARA as quite attractive as a longer-term play. Even potentially a play as an acquired company as it is relatively small with a bunch of recognizable brands.

PARA is described as “a leading global media and entertainment company that creates premium content and experiences for audiences worldwide. Driven by iconic consumer brands, its portfolio includes CBS, Showtime Networks, Paramount Pictures, Nickelodeon, MTV, Comedy Central, BET, Paramount+, Pluto TV and Simon & Schuster, among others. The company delivers the largest share of the U.S. television audience and boasts one of the industry’s most important and extensive libraries of TV and film titles. In addition to offering innovative streaming services and digital video products, Paramount provides powerful capabilities in production, distribution and advertising solutions.”

Earnings And Valuation

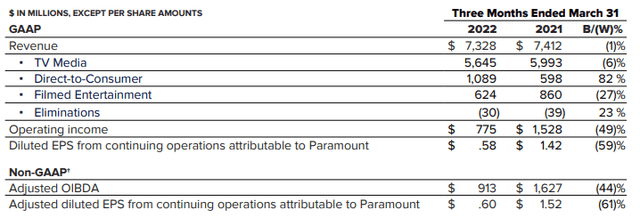

The largest revenue segment of the company is still the TV Media portion. Direct-to-Consumer (the streaming brands Paramount+ and Pluto TV) are the company’s growth engine but still make up a fairly small portion of the revenue pie.

Unlike Netflix (NFLX), PARA was still growing many new subscribers in the last quarter. They added 6.8 million, bringing up the total subscriber count to 62 million.

Still, a softness in NFLX, which spends billions more than PARA, is something concerning. If they can’t grow by spending so much on new material, it could be harder to see how PARA could. In the latest quarter, NFLX announced that they had lost fewer subscribers than they originally anticipated. PARA has earnings coming up on August 4th, which will give us some new insights into how the company is performing.

Although, in my personal opinion, PARA has better IP. That’s quite subjective on what people enjoy watching, though.

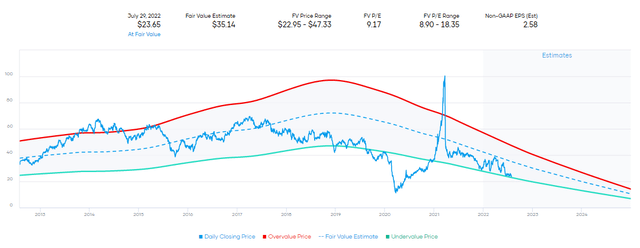

Due to spending $6 billion or more in 2024, earnings are going to take a big hit. That being said, the valuation is still quite compelling at this time. Not to mention that this big amount of spending is going into new content that could result in subscribers continuing to grow. That would eventually start to add to the earnings and offset the additional costs of the new content. If this spending starts to pay off, we could see these estimates start to rise rather than continue to slide.

PARA Valuation (Portfolio Insights)

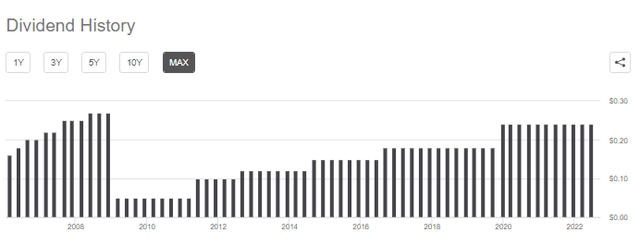

Dividend

Investors waiting for that to play out have another reason to continue to hold on. That is, the dividend is quite attractive. The stock currently comes to an over 4% yield. They don’t grow the dividend annually but have been bumping it up along the way after cutting it in 2008.

PARA Dividend History (Seeking Alpha)

When asked about the dividend previously in Q4 earnings, they sounded confident that it was a priority for them.

We’re very well equipped to invest to capture the growth on D2C and to continue to fulfill all of our financial priorities, which as I’ve articulated before, include investing in organic growth through streaming. It includes funding our dividend and it includes deleveraging our balance sheet. I think you’ll actually see us doing all three of those things in 2022.

The forward payout ratio comes to 37.07%. So that includes the anticipated declines in EPS in the next year. If analysts are right about 2023, they expect earnings to decline to $2.04. That would result in the payout ratio still only being around 47%.

The Trade

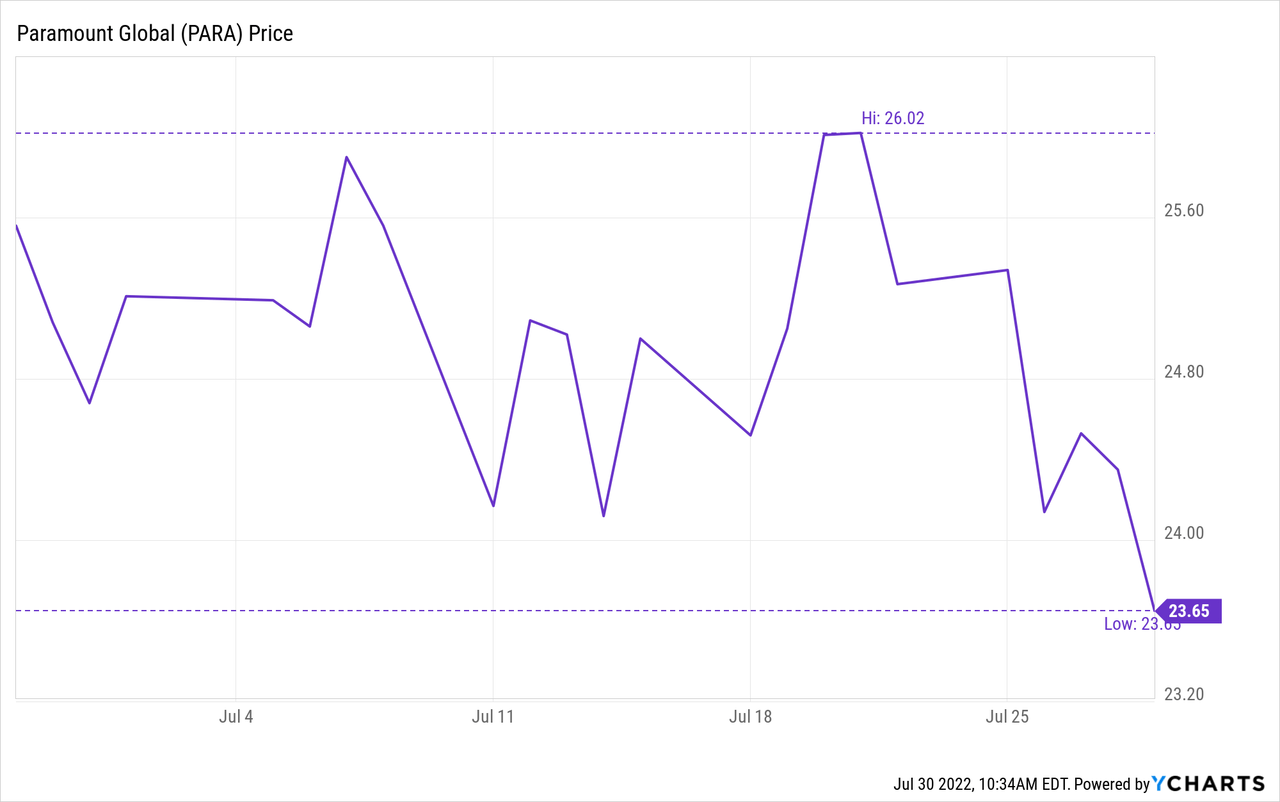

With all this being said, the real reason I’m discussing PARA today is the trade that we recently had expire. This was our first trade on the name. That was the July 29th, 2022, puts we sold to collect $0.39. We initiated this trade on June 28th. Shares were closer to $26 and had slumped, but it never really came close to our $22 strike price.

Ycharts

In fact, just a couple of weeks ago, it was much further away from the strike price we had selected. This trade took place over the course of 31 days, which works out to an annualized return of 20.87%. That is if we were able to utilize a similar trade every 31 days throughout the next year.

As the stock continued to slide lower over the last year, it has caught my attention as being quite attractive now, despite all the potential headwinds. I think the valuation makes more sense at these levels to play around with the stock. I wouldn’t mind personally holding the stock at these levels now.

What’s Next?

Knowing that I wouldn’t mind owning the stock at these levels, I’d be willing to make further trades. Now that the stock has sunk further, there would be an opportunity to lower the strike price. Alternatively, selecting the $22 strike price could pay off in even more premium at this time.

With their earnings report coming up on August 4th, any trade entered early next week would mean we might see some more volatility. Which again often translates into more potential premium to make up for that greater risk.

As an example of how this pricing works, we can go out to the September 2nd, 2022 expiration at the $22 strike. That’s 34 days away, similar enough to the 31 days in this latest trade.

Yet, we can collect $0.81 (based on the bid on Friday’s close) in premium rather than the $0.39. This is due to the current price being much closer to the strike and the earnings report that will be announced within the duration of this trade. It takes the ~20% annualized return up to a ~40% annualized return.

That’s one potential trade that I believe is also quite appealing if you are a more aggressive trader or wouldn’t mind assignment at $22. For those that want a further cushion to the downside, one could take that same expiration and move down to the $20 strike. The bid there is $0.37, or what would translate into a potential annualized return of 20.4%. That’s still quite appealing.

Here’s to recap of these two trades:

- September 2nd expiration with a strike of $22 collecting $0.81 has a PAR of 39.53%.

- September 2nd expiration with a strike of $20 collecting $0.37 has a PAR of 19.86%.

Utilizing a combination of more aggressive and more conservative trades means you can fine-tune it even more to what feels more appropriate for yourself.

I personally like trades around 30 days out. That’s why I’m looking at September 2nd. The stock has weekly options too. So August 26th, 2022, at 27 days out, has some potential.

- August 26th expiration with a strike of $22 collecting $0.69 brings you to a PAR of 42.4%.

- August 26th expiration with a strike of $20 collecting $0.29 has a PAR of 19.60%.

Overall, PARA would be a more aggressive trade due to future uncertainty. However, the valuation, in my opinion, is quite attractive despite these headwinds.

Be the first to comment