ake1150sb/iStock via Getty Images

Thesis

PAR Technology (NYSE:PAR) serves in the restaurant software and hardware solutions business, while also maintaining a somewhat unrelated government segment, providing technology solutions to defense and intelligence institutions. Incorporating more recurring revenue into its overall sales mix, PAR displays strong growth prospects primarily in the restaurant segment. In this analysis, sales growth record and outlook are explored along with the key factors contributing to the expected expansion. In addition, a business breakdown, along with some valuation, stock price history and financial health insights are also offered.

Business Breakdown

PAR Technology Corporation, operates in two distinct reporting segments, Restaurant/Retail, and Government.

On the restaurant side of the business, the company is a leading provider of software, hardware, and services to the restaurant and retail industries, with more than 500 customers, across more than 50,000 active locations. The company looks to develop solutions to help restaurant brands build lasting customer relationships. While many restaurants tend to use many different applications that serve different functions, PAR offers a cloud platform that delivers a fully integrated suite to serve as a comprehensive point-of-sale (POS) system. The platform delivers 4 key capabilities: elevated guest engagement, end-to-end ordering and fulfillment, optimized planning and operations, and sophisticated analytics and insights. The company’s popular Brink POS system can integrate with numerous partners across various product solutions, including Punchh, PAR’s cloud customer loyalty and engagement solution, and Data Central, a cloud back-office solution the company provides. PAR also offers POS hardware that syncs with its software solutions.

PAR’s Government segment provides technical expertise and development of advanced systems and software solutions for the department of defense, intelligence organizations, and other federal agencies. In addition, the company provides support services for satellite command and control functions in different DoD facilities worldwide. Even though the company was recently awarded a significant contract in the government segment, over the long-run segment growth has been slow, while the company is primarily focused on its restaurant business, which is the main focus of this analysis as well. The possibility of selling the government segment has also been on the table for a while, to help provide investors with a clear-cut vision for the company’s future as a software provider for the restaurant industry.

Q4 Results & Recent Developments

On March 1st, 2022, the company reported results for the fourth quarter and the entire 2021 fiscal year. Revenue reached $81.6M for the fourth quarter of 2021, a 39.4% or $23.1M increase compared to $58.5M for the same period in 2020. PAR surpassed analysts’ estimates looking for $76M in revenue. For the entire year revenue was reported at $282.9M, an increase of 32.3% or $69.1M when compared to $213.8M for the same period in 2020. Brink POS Annual recurring revenue at end of Q4 ’21 totaled $32.1M. The net loss for the fourth quarter of 2021 was $25.6M (-$0.95 per share), compared to a net loss of $13.0M ($0.60 per share), reported for the same period in 2020.

Just a few days ago, on March 25, 2022, PAR Technology announced the acquisition of Techknow, offering a multi-sensor drive-thru timer, in order to expand its drive-thru solutions in the restaurant technology space. The multi-sensor timing solution will be offered to customers in conjunction with existing drive-thru communications and Brink POS products. As a complete end-to-end solution, it will allow the company, through strategic pricing to capture its sales growth potential.

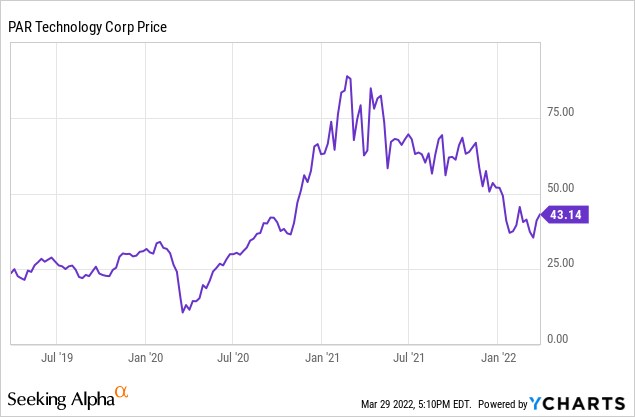

Recent Stock Price History

Throughout its 10-year trading history PAR has covered some ground uphill, debuting in 2012 at a stock price of around $5. After an impressive post-Covid-19 rally, however, with the stock reaching $88, PAR saw a spike in volatility. After the first half of 2021, the stock found itself caught in the broader market downturn, especially when tech stocks were considered. For the past six months, the stock has been in a bear market with its price being cut in half. PAR currently trades at $43 and a $1.08B market cap, while paying no dividend.

Growth Record & Prospects

While not significantly benefiting from the effects of the Covid-19 pandemic like other major software providers, recent growth numbers have been strong. Sales are accelerating, growing at a 32% YoY rate, compared to a trailing 3-year 12% CAGR, implying that the company is now entering its prime growth phase. For the next few years, analysts forecast revenue growth of 14% CAGR, with sales reaching $365 by the end of 2023.

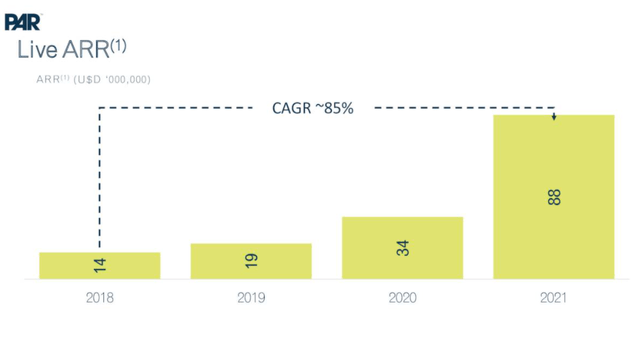

In 2021 Brink POS had an installed base of 15,897 restaurants, compared to 11,722 restaurants as of December 31, 2020 (35% increase). A growing customer base will cause growth acceleration as the company allows customers to pay through their order volume, instead of a lump-sum payment when the system is installed. While this allows for the creation of a consistent flow of annual recurring revenue (ARR), critical for margin expansion, it also delays sales growth from being materialized. PAR’s impressive ARR growth record (85% CAGR between 2018 and 2021) is shown in the graph below, provided in the company’s most recent investor presentation.

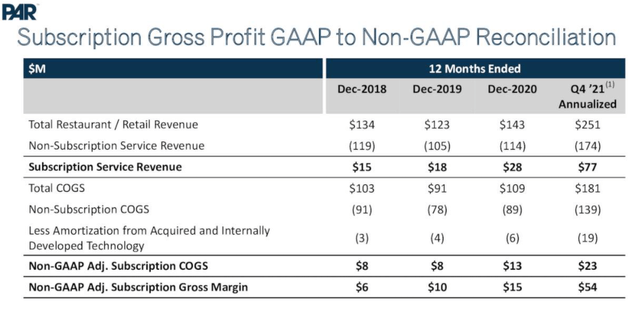

PAR’s subscription revenue is consistently growing, accounting for 30% of total Restaurant/ Retail revenue in 2021, compared to just 18% in 2018. Accordingly, margins are also expanding with the company reporting an adjusted subscription 70% gross margin in Q4 2021 2021, compared to 44% in 2018. Subscription margins are on track to improve the company’s overall profitability as recurring revenue gains a progressively larger stake in the company’s overall revenue mix. ARR for the Brink POS system and the Punchh system grew at 30% and 47% respectively, compared to Q4 2020.

PAR looks to further penetrate a large Total Addressable Market (TAM), consisting of over 1m restaurant locations, just in the U.S, spending 2-3% of their revenue on technology. According to the national restaurant association, revenue in the industry is expected to reach $900B in 2022, returning to pre-pandemic levels. A 3% technology spending on total revenue would establish a TAM of around $27B. Considering that the company is expected to generate $320M in sales during 2022, it is obvious that there is still ample room for expansion ahead. According to additional research by Mordor Intelligence, The U.S food-service market is projected to register a CAGR of 3.7% between 2016 and 2017, displaying a moderate growth outlook.

Financials Overview

The company carries a $300M long-term balance that is not insignificant, given the size of the company and the lack of profitability. That said, PAR also maintains a sizable cash stockpile of around $190M. Short-term liquidity should not be a concern as the company carries 4.7 and 3.9 current and quick ratios. Shareholder dilution, on the other hand, is somewhat concerning, especially if the profitability struggles persist, as PAR technology has increased its share count from 15M in 2015 to 25M as of the last filling.

Valuation

Being still in an early growth stage, it is difficult to value PAR through traditional growth metrics. That said, in the absence of profitability, the Price/Sales ratio is a good proxy to determine where the company trades compared to historic levels and sector averages. Currently, PAR trades at a forward 3.4x revenue, a multiple that appears reasonable, especially for a software company. While PAR has not enjoyed the growth, gross margin generosity and notoriety of other post-Covid-19 high-flying names (recently sustaining substantial losses), the company is still building its platform and is in the process of acquiring more government contracts, as management argues that accelerated growth lies ahead.

Final Thoughts

After all things are considered, PAR technology provides an interesting proposition, despite some flaws like a stagnant government segment the company should probably spin-off, and a lack of overall profitability. The absence of short-term profits should be compensated by the company beating revenue growth estimates, in order to cause any significant upward stock movement. Margin expansion, should, in the long run, lead to profitability, increasing the appeal of the company for more conservative, value-oriented investors that still maintain reservations.

Be the first to comment