SHansche

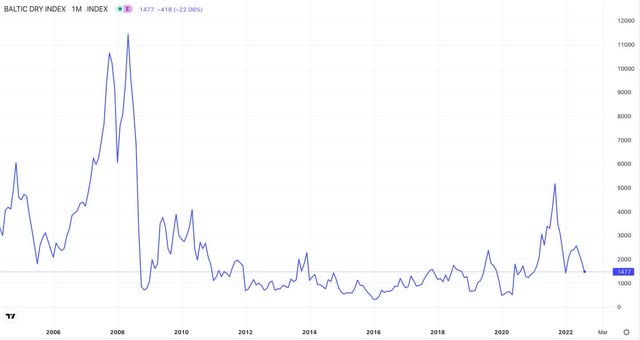

Shares of Pangaea Logistics Solutions (NASDAQ:PANL) have risen more than 40% in the last 12 months due to extremely favorable macro tailwinds, raising the question of what’s going to happen next. We think Pangaea’s business model is good and the company would outperform peers in a market downturn, but we disagree with the “strong buy” rating being given to the stock by others. Given the current Baltic Dry Index (BDI) decline from a record high and the depressed world GDP, we believe that there are possible macro headwinds ahead. Therefore we rate the stock as a “hold.”

Business Model

Pangaea is a drybulk shipper that operates a fleet with 45-60 ships. Unlike its peers, Pangaea leases the majority of its fleet and has a pretty strong balance sheet. As of its latest 10-Q, Pangaea has zero net debt (right after acquiring multiple ships), while its peer EuroDry (EDRY) has a net debts/common equity ratio of 69%, per the last quarterly result. Pangaea leases most of its fleet in a short-term manner (nine months), therefore it’s easy for the company to reduce variable costs during market downturn. The shortcoming of this leasing model is the inability to capture large return during up cycles, since the charter rates (lease rates) increase with the market. This can be partially offset by higher margins generated by Pangaea’s owned fleet.

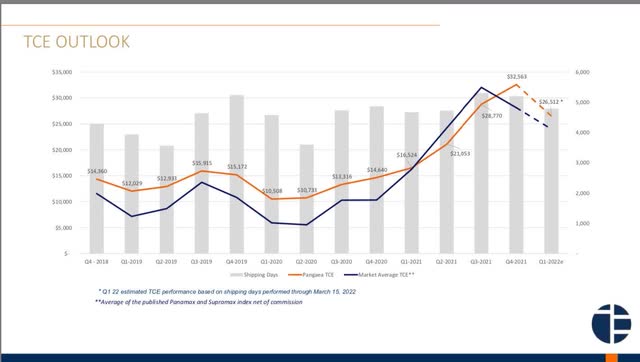

As per the latest 10-Q, Pangaea owns 24 dry bulk vessels and one barge. Virtually all of its owned fleet are Ice Class ships, which can operate on ice restricted area during the winter, thus generating “extreme” margins. According to its last 10-K, “The ice-class fleet has historically produced margins that are superior to the average market rate.” The chart below shows Pangaea’s 2020/21 TCE compared to market average.

Pangaea’s TCE vs. Market Average (Investor Presentation)

Also, Pangaea operates in a conservative manner. It generates a substantial amount of revenue from COAs (contracts of affreightment), which span over multiple years and generate recurring revenue but lower margins. Despite that fact, Pangaea’s margins have been pretty strong due to its focus on niche markets – namely the ice-restricted area.

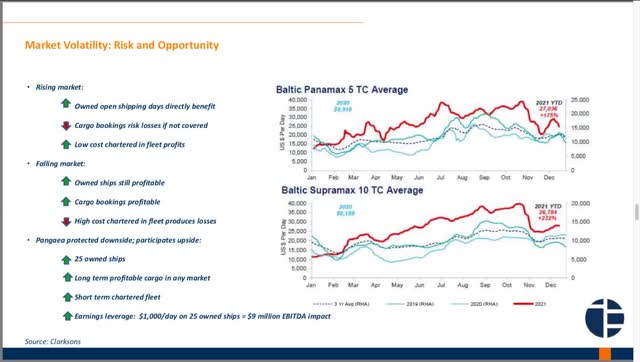

Thanks to the factors above, Pangaea has been outperforming its peers. When the market is hot, it can generate higher income from its owned ice class fleet; when the market is down, it can immediately terminate the short-term leases, thus reducing variable costs. This strategy was proven efficient during 2020 as Pangaea managed to generate positive net income, which shocked some analysts.

Pangaea’s 2020 result surprised analysts (Investor Presentation)

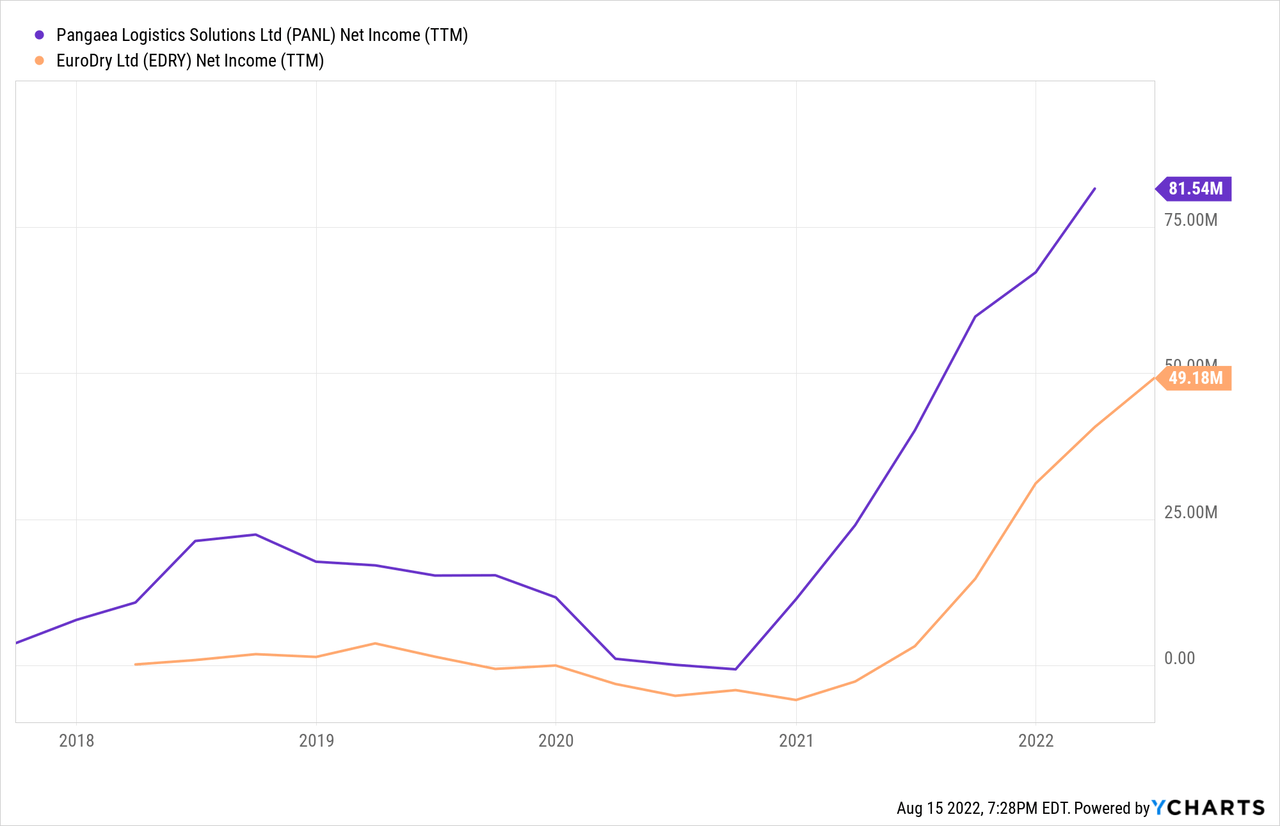

Here is Pangaea’s net income compared to EuroDry, from which we can see that Pangaea generated positive net income while EuroDry experienced substantial loss during 2020. And Pangaea’s line also has a larger slope during recovery (faster recovery rate):

Here is management’s opinion on their business model:

Management’s discussion of business model (Investor presentation)

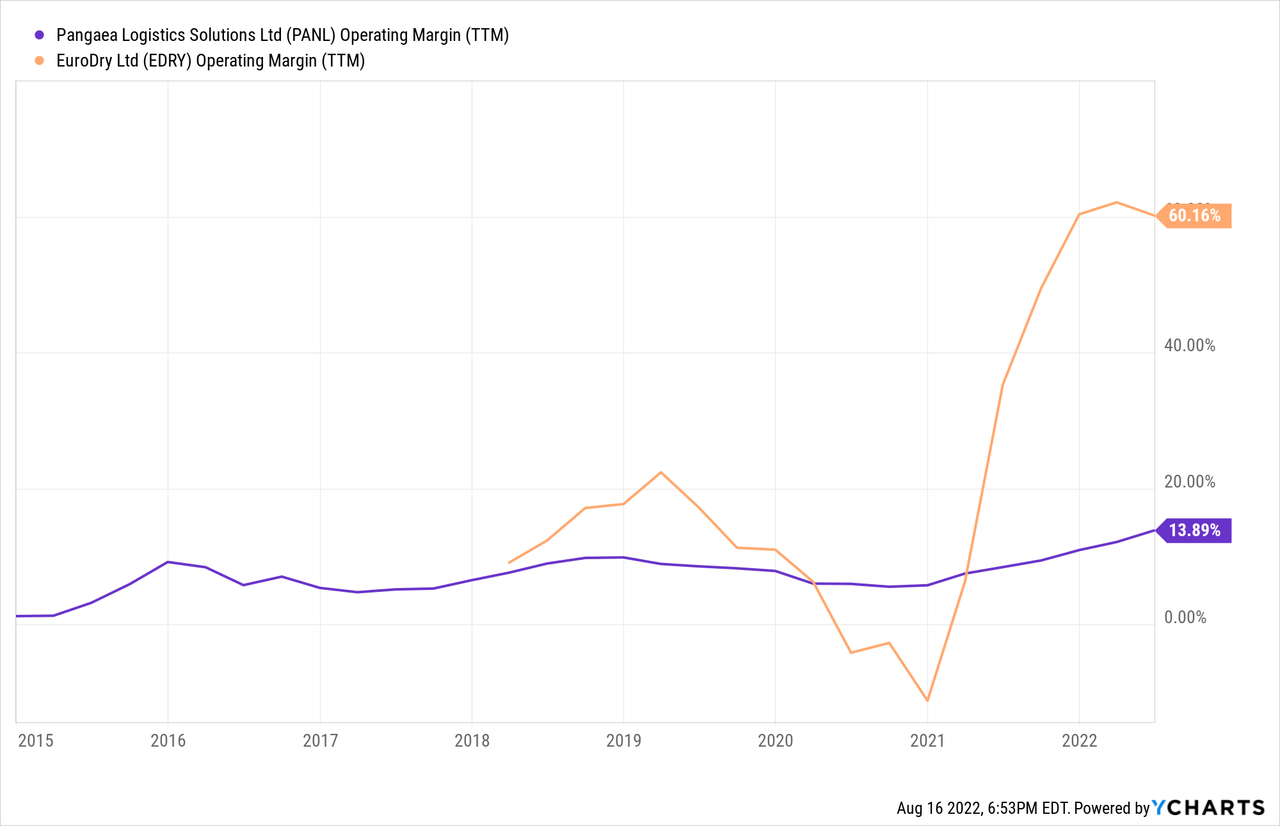

Operating Margin Stability

From the long-term performance of Pangaea’s operating margin (see the chart below), we can clearly see that the company does a lot better than its peers during market downturns. Pangaea’s operating margin is lower than EuroDry because EuroDry owns all of its fleet, while Pangaea charters in vessels to provide service and make thinner margins (customer rates minus charter rates). But Pangaea has been enjoying superior margin stability over a long period of time. The company is profitable as long as its revenue can cover its fixed cost (because variable cost can always be reduced), thus a larger size and higher operating leverage can be beneficial since the fixed cost can be spread over a larger revenue base.

During 2014-15, when the BDI plunged to 350-550 level, Pangaea’s operating margin dropped to (0.75%) and its gross margin dropped to 14%. In comparison, its average operating margin was ~5% and its gross margin stayed at 25% during 2020, when BDI dropped to ~500 again in January. Meanwhile, Pangaea’s owned fleet size had grown from 14 in 2015 to 24 in 2021. I think this long-term improvement shows that Pangaea’s business model and operating leverage growth has made the business more resilient to market downturns, compared to its peers.

Macro Headwinds

Despite having a differentiated business model, Pangaea’s business can be challenged from time to time because it’s in a very cyclical industry. Its revenue can be affected by lots of factors, such as the world economy, vessel new build rate, supply and demand balance, etc. BDI – which measures the cost of shipping goods worldwide – is a very good indicator to demonstrate where we’re at currently in the cycle, and Pangaea’s TCE is based on BDI. In 2021, the BDI hit a multi-year high (peaked at 5000) due to economic recovery and supply chain issues, and then plunged to ~1500 in 2022. It rebounded during Q2 2022, before dropping again.

From the chart we can see the BDI has experienced a downtrend. The current environment is not great either: high inflation, large rate hikes, fear of a recession, free world GDP decline, the Russia-Ukraine war, etc. Since the shipping business inherently correlates to international economic activities, it’s reasonable to expect BDI to return to its pre-pandemic average, or even go lower.

In 2021, Pangaea’s net income was $67.2 million – a record high. This earnings boost was largely driven by the BDI spike. In the latest 10-K (linked to above), management also said the following:

In 2021 drybulk freight markets reached levels not seen in a decade driven by strong global demand in major and minor bulks, and supply constraints driven by lack of supply and port congestion. The Baltic Dry Index, a measure of dry bulk market performance, averaged 2,956 for 2021, up from an average of 1,085 for 2020. Seasonal volatility within the year resulted in an intra-year low of 1,452 BDI in January and a high of 5,167 in September, which was this highest level since 2008.

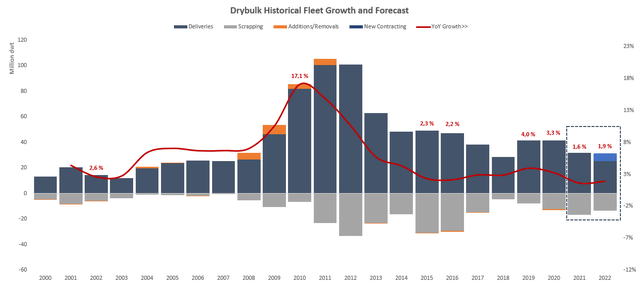

Despite the headwinds mentioned above, I noticed something favorable that can possibly offset some concerns: the still-low drybulk ship fleet count. There was tremendous bulk ship supply post-2008, which caused the depressed BDI afterward. But as of now, the fleet size growth isn’t as near large as the post-2008 period (as seen in the chart below).

Dry Bulk Fleet Supply (Hellenic Shipping News)

It’s also worth mention that Pangaea acquired several new ships during 2021. I am not optimistic about it due to the macro headwind mentioned above, but the lower fixed interest rate obtained during the time of the pandemic is a plus.

Q2 Results

Pangaea posted strong Q2 results a week ago. Its revenue grew 34% YoY, gross margins went from 18.5% to 25%, and net income grew 12.8% YoY to $25 million. According to management, the top-/bottom-line growth was driven by a 29% increase in the TCE rate (BDI rebounded during Q2) and a 16% increase in Voyage shipping days. While the Q2 results are strong, I am still worried about the coming headwinds because most of Pangaea’s contracts are long term; as such, it takes time for the current BDI decline to work its way onto the company’s P&L statements.

This can be evidenced by bad charter results: Charter revenues decreased by 21% YoY due to a 48% charter day decrease. Charter revenues don’t rely on long-term contracts, so in my opinion that can reflect the current market conditions. EuroDry’s CEO has said the following:

It is notable though that in the latter part of the second quarter of 2022, and during the month of July, the drybulk market started reflecting the volatility and uncertainties present in the broader economic and geopolitical environment registering charter rate declines of nearly 40% as compared to their late May levels.

Valuation

While it’s impossible to predict short-term market trends, I still want to provide a brief valuation based on BDI to assist readers in developing their own opinion. Pangaea is currently trading at 2.95x TEV/EBITDA, while the last five-year average multiple (excluding the pandemic) was ~5x TEV/EBITDA. I think the current valuation is reasonable given that Pangaea is obviously over-earning and given the possible macro headwinds ahead. Prior to the pandemic when the average BDI was ~1700 (2018-19 level), Pangaea’s run rate EBITDA was ~$50 million.

Bull Case: BDI rebounds to ~3000, Pangaea’s TEV/EBITDA multiple recovers to 5x, EBITDA ~$80 million (20% lower than 2021). TEV = 5*80 = $400 million, market cap = TEV (because net debt ~ $0) = $400 million, share price = $400 million/46.01 million shares =$8.69, indicating a ~61% gain. I think the bull case is extremely unlikely to happen because the BDI just came off of a multiyear high and because of the macro headwinds discussed above.

Base Case: BDI returns to ~1700 (2019 level), the TEV/EBITDA multiple returns to 5x, EBITDA ~$50 million. Market cap = TEV = 5*50 = $250 million. Share price = $250 million/46.01 million = $5.43, indicating ~0% gain. We think the base case is likely to happen because BDI should approach pre-pandemic averages as economic growth slows down and supply chain bottlenecks begin to clear up.

Bear Case: BDI plunges to ~700 (2015-16 and the pandemic level), TEV/EBITDA multiple returns to 5x, EBITDA ~$40 million (2020 level), Market cap = TEV = 5*40 = $200 million. Share price = $200 million/46.01 million shares = $4.35, indicating ~20% loss. We think the bear case is unlikely to happen because global economy is stabilizing as the pandemic fades away, and that current low bulk ship fleet size should provide support to BDI.

Risks

Frankly, the only company-specific risk I can see right now is that the recently acquired ships might hurt margin stability during a market downturn due to higher fixed costs (compared to short-term chartered in ships), if they are improperly managed. As a capital-light business with ~$0 net debt and a five-year average ROE of ~11%, I think Pangaea has very little risk other than the coming macro headwinds, which can be mitigated by a pair trade.

Conclusion

Despite possible headwinds discussed above, I recommend a “hold” rating because Pangaea has a decent moat given its capital-light business model and historical better-than-peers performance. A possible way to play Pangaea’s superior model is a pair trade – short the capital-intensive players while going long Pangaea to eliminate market risks. It’s reasonable to assume Pangaea would outperform its peers during a market downturn due to its manageable variable costs and its focus on the ice-restricted niche market.

Be the first to comment