Olemedia

Thesis

As the cybersecurity industry continues to sink along with the whole tech sector, the prices are finally back on the investors’ side. Palo Alto Networks, Inc.’s (NASDAQ:PANW) leading position in the cybersecurity industry and its diversified portfolio of next-generation solutions and products, combined with fundamental undervaluation, create an attractive case for investors. However, it would be logical to consider a more diversified approach. First Trust Nasdaq CEA Cybersecurity ETF (NASDAQ:CIBR) provides an opportunity to invest in the whole industry with relatively low fees.

So, in this article, I will be discussing whether or not CIBR could provide more value to investors than Palo Alto Networks.

Why CIBR?

The First Trust Nasdaq CEA Cybersecurity ETF is the largest in terms of funds under management. CIBR has a pretty high management fee of 0.6% and a portfolio of 37 holdings. The three largest holdings are Infosys (INFY), Cisco (CSCO), and Broadcom (AVGO).

The idea is to use the fund’s rather narrow portfolio to capitalize on the rapid growth of the market, as most of the companies in CIBR are absolute leaders in their fields and are separated from their competitors by breakthrough products.

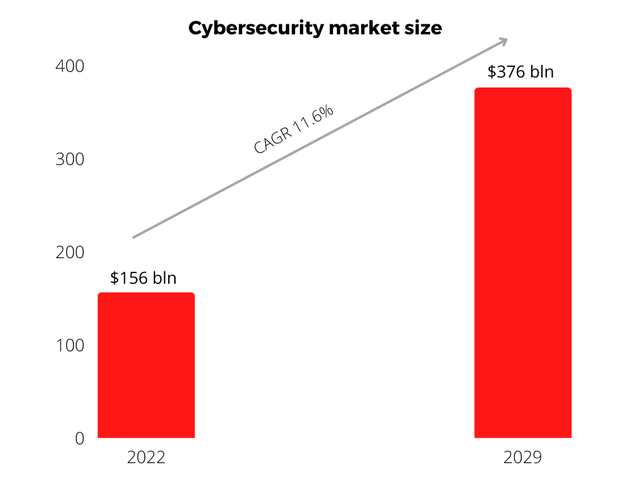

In the next few years, the main growth driver of the industry will be the strong demand for network security solutions to protect cloud applications and IoT-enabled devices. In modern realities, ensuring cybersecurity is becoming one of the main tasks of any business. The need and importance of cybersecurity are recognized at all levels. Industrial enterprises, for example, reduce the use of human labor in production and massively bet on automation. Thus, they highly need the software to ensure the safety of the production processes, in which devices connected to the IoT now play a major role. Overall, Fortune Business Insights predicts that the global cybersecurity market could grow to $376 billion by 2029.

I believe that CIBR is the best cybersecurity ETF as it has over $4.5 billion in assets under management (“AUM”) and a balanced portfolio of large leading companies in different areas. I did a comparison with its main peer, First Trust Nasdaq CEA Cybersecurity ETF (HACK), in my previous article.

Palo Alto’s case

The company operates in three segments: network security, cloud security, and SOC security.

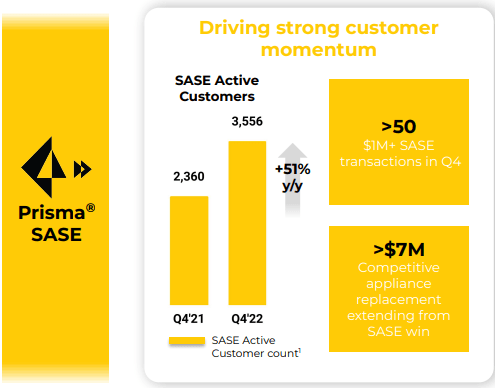

In the Network Security segment, Palo Alto provides a complete network security system Prisma SASE program, which allows companies to control incoming and outgoing traffic and protect an internal network from external cyber-attacks. Prisma SASE is a set of products that can be purchased as a single package or separately. 74% of the Global 2000 companies were Prisma SASE clients at the end of 2021. The number of total active customers reached 3,556 in FQ4.

Palo Alto

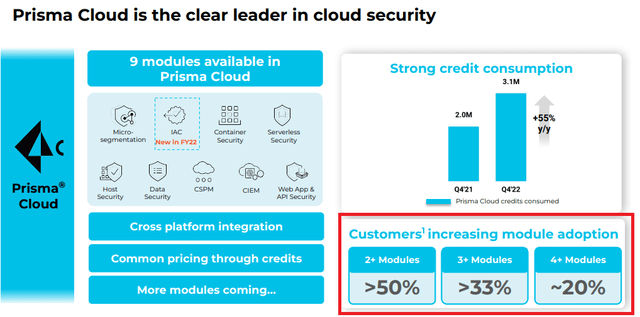

In the cloud segment, the company’s key product is the Prisma CLOUD program. Prisma CLOUD is the leading cloud-based security platform that provides end-to-end protection for hosts, containers, and serverless computing throughout the entire application lifecycle. It allows to monitor the performance of every application running in the cloud, every device that enters the cloud, data centers, and the entire cloud infrastructure. Customers are increasing module adoption as more than half currently use more than 2 modules. Every week, the program processes 700 billion events for threats worldwide.

According to Forrester, the average security operations team receives more than 11,000 security alerts daily, 28% of which are simply never addressed, while the investigation of each incident takes an average of 4 or more days.

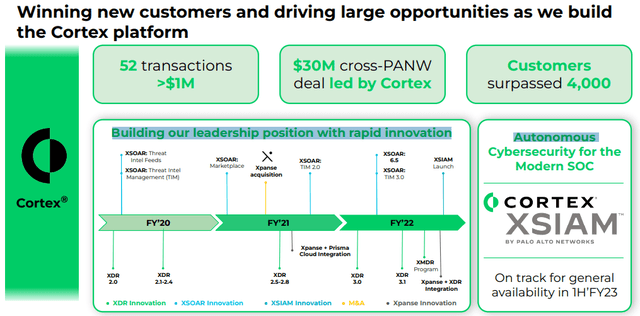

With the CORTEX XDR program, Palo Alto aims to detect and neutralize 100% of the threats, while incidents can be processed and analyzed in minutes. Cortex is based on Artificial intelligence and Machine Learning technologies, which allow to automate most of the work. Thus, the dependence on the human factor is reduced.

The main factor is that the combination of all three Palo Alto solutions allows enterprises to build an effective next-generation cybersecurity system based on the Zero Trust Security model, which assumes no trusted zones and checks all users, devices, and applications that request access to corporate resources without exception.

No alternative on the market would allow to build a full Zero Trust system. Thus, Palo Alto has a wide moat protecting it from competitors.

Palo Alto maintains high growth rates, but that’s not enough

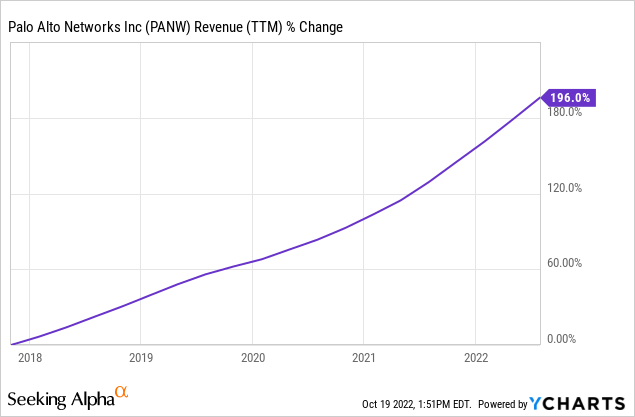

Over the past 5 years, the company’s revenue CAGR was 19.3% and the stock’s CAGR was 26.4%.

At the same time, Palo Alto manages to maintain a stable and positive free cash flow.

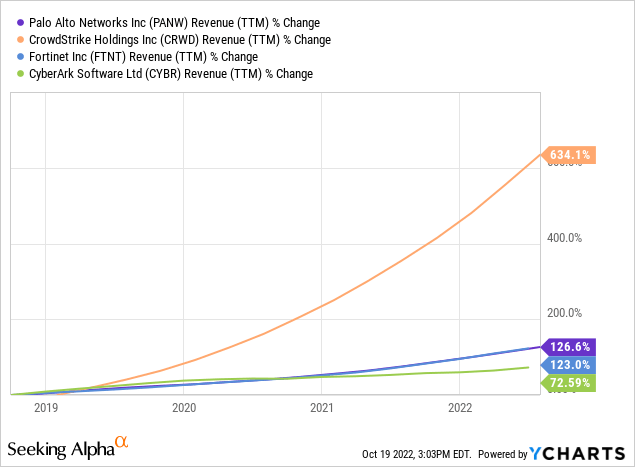

However, the same trend is observed in other industry leaders.

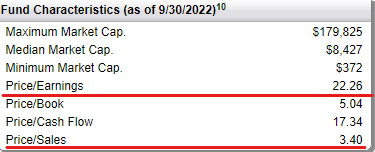

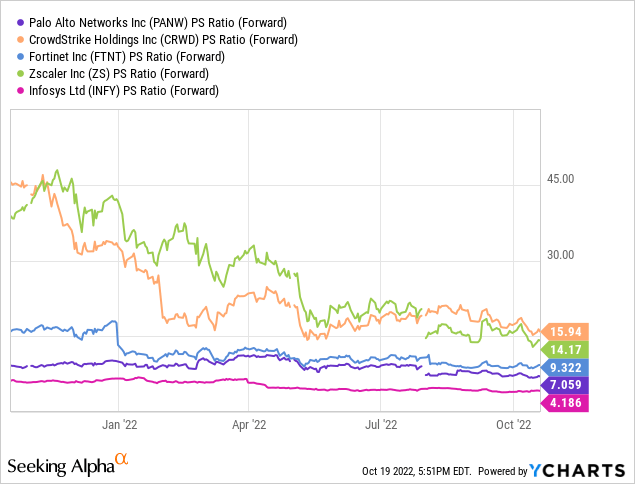

When it comes to the valuation, Palo Alto doesn’t look cheaper than CIBR as its P/S is almost twice as high as the fund’s.

First Trust

This is due to the higher growth rate of Palo Alto than the majority of companies in the ETF. Compared to other fast-growing giants, PANW looks pretty cheap.

In Palo Alto, there is a fairly wide moat in the form of a full-fledged Zero Trust system, which has no alternatives at the moment. The risks here are much higher than in CIBR. This moat is probably wider than that of most rivals, but the case is not strong enough to count on long-term organic growth. There is no clear leader in the industry yet, different companies occupy different niches.

Conclusion

Palo Alto is primarily a bet on the ongoing global growth of the cybersecurity market and the surge in demand for Zero Trust products. The company looks promising and fast-growing. While this might be true, I would rather pick CIBR. It has a high-quality portfolio of good companies that is being smartly rebalanced pretty often.

PANW will surely bounce back with the rest of the market, but CIBR looks like a much safer pick for me.

Be the first to comment