ArLawKa AungTun/iStock via Getty Images

At Palm Capital, we look for businesses with durable competitive advantages run by exceptional managers. We patiently wait to invest when their prices are less than we think they are worth, aiming to benefit as they compound economic value over time. We only sell if fundamentals deteriorate, or we find others offering potentially better after-tax returns.

Our performance

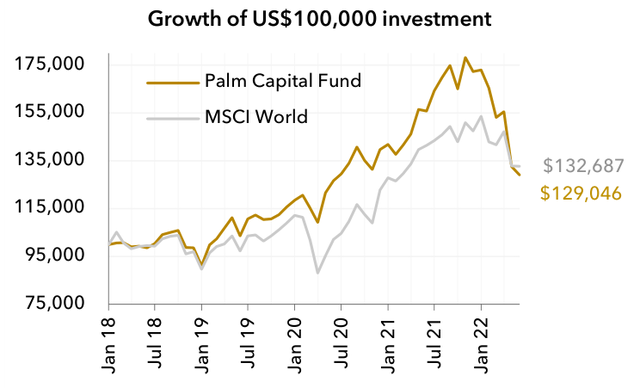

Over the three months ending 30 June 2022 our portfolio fell by 24.1% after management fees & trading expenses.

Since we started, just over four years ago, our portfolio has returned 3.8% per annum after management fees & expenses. We have underperformed the MSCI World Index by 0.6% per annum.

| Period ending 30 June 2022 |

Our Returnλ |

MSCI World |

Out-performance |

|

Quarter |

-24.1% |

-17.8% |

-7.7% |

|

1 year |

-28.1% |

-15.6% |

-14.8% |

|

Since inception (annualised) |

+3.8% |

+4.3% |

-0.6% |

| λafter management fees & trading expenses |

What we know about bear markets

The MSCI World Index officially entered a bear market last month. It has now fallen by 21% from the beginning of the year to the end of June.

Bear markets are trying times for investors. Studies show that the pain of loss is psychologically twice as powerful as the pleasure of gain. As a result, our sense of risk is heightened. We focus on negative news. We extrapolate. And we end up attaching higher probabilities to the worst-case scenario.

Hindsight bias takes hold. It seems obvious that the markets were going to fall – the warning signs were everywhere. The Fed was raising rates. Inflation was taking hold. Markets were overpriced.

We shift into panic mode. Mental shortcuts lead us to rapid, emotional decisions. Our time horizons shrink. We ask questions like “how much more will I lose if I don’t sell?” and “When will markets stop falling?” Our decision making is affected at the worst possible time.

But we are ignoring all the other times when there were warning signs and markets did not fall. It’s never as obvious as it appears.

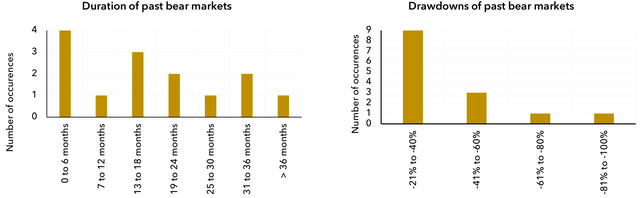

The questions we ask about market direction are pointless. The charts overleaf show data on past bear markets going back to 1929. There is no pattern to them. Markets may reverse altogether immediately or fall further for many more months. No one knows.

Source: Bloomberg, Palm Capital Analysis

Only two things about bear markets are certain; they are inevitable, and they do eventually end.

Focus on fundamentals

During these times, it’s more important than ever to follow a rigorous process that has been tried and tested. Ours is to focus on fundamentals. Rather than try to make short-term forecasts, we can look at the strength of the businesses we own and how well they are performing.

And for our portfolio of shares, prices may have fallen, but they are well positioned to withstand difficult conditions and they are all still thriving.

The median gross profit margin of the companies we own is 73%. This compares favourably to typical companies on the MSCI World Index where the gross profit margin averages around 45%. It means that our companies are less sensitive to inflation in cost of sales. It also means that they don’t have to increase prices as much to maintain profitability.

The median annual revenue growth for the first quarter of 2022 of the businesses we own was 23%. Furthermore, our portfolio has high exposure to digital transformation which shows no signs of slowing down. The IDC expects the global public cloud market to grow at 23% in 2022. And as further evidence, all three cloud services businesses we own are growing strongly, with AWS, Azure, Google Cloud growing at annual rates of 53%, 46% and 37% respectively in the latest quarter.

The slowest annual growth in revenue over the past quarter amongst the businesses in our portfolio came from Meta Platforms (META, 7% growth). We don’t see this is as a cause for concern. After more than doubling its revenue over the past three years from $55b to $118b, we see this as more of a breather. And its growth for the full year is expected to be 15% – not exactly pedestrian. At a price of 13x earnings (excluding cash), this level of growth is nowhere near being priced in.

Here are some comments from recent management calls further indicating the strength in various businesses we own:

“(we are seeing) broad-based strength in advertiser spend and strong consumer online activity” Alphabet Management, Q4 2021

“I don’t hear of businesses looking to their IT budgets or digital transformation projects as the place for cuts. I have not seen this level of demand for automation technology to improve productivity, because in an inflationary environment, the only deflationary force is software.” Microsoft Management, Q1 22

“As a percentage of GDP, tech spend is, on a secular basis by the end of the decade, going to double.” Microsoft Management, Q1 22

“We continue to see that the demand for our systems is higher than our current production capacity…. In light of the demand and our plans to increase capacity, we expect to revisit our scenarios for 2025 and growth opportunities beyond.” ASML CEO, April 2022

“We believe we will continue to grow above the rate of e-commerce and take share. If we look at our track record for the past five years, we’ve consistently done that. And if we look at Q1 whether it be across breadth of our portfolio, we believe we did that same thing.” Paypal Management, Q1 2022

“We believe that digital and cloud projects are still very high priority and are not being deprioritised… we believe the long term trends in digital migration and cloud will still be very strong throughout the cycle… so we feel we’re in very early innings in terms of the deployment of workloads to the cloud.” Datadog Management, Q1 22

Some companies, such as ServiceNow (NOW), even went as far as raising revenue target for 2024 from $10b to $11b.

So, while bear markets are never pleasant, in the short-term prices often diverge from fundamentals. We can’t forecast price, but the fundamentals of all the businesses we own are as strong as ever. It has created a once in a decade investment opportunity that we hope to take advantage of.

Mahomed Ibrahim | July 2022

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment