Andreas Rentz

Palantir Q3 results and Q4 outlook were both in line with expectations

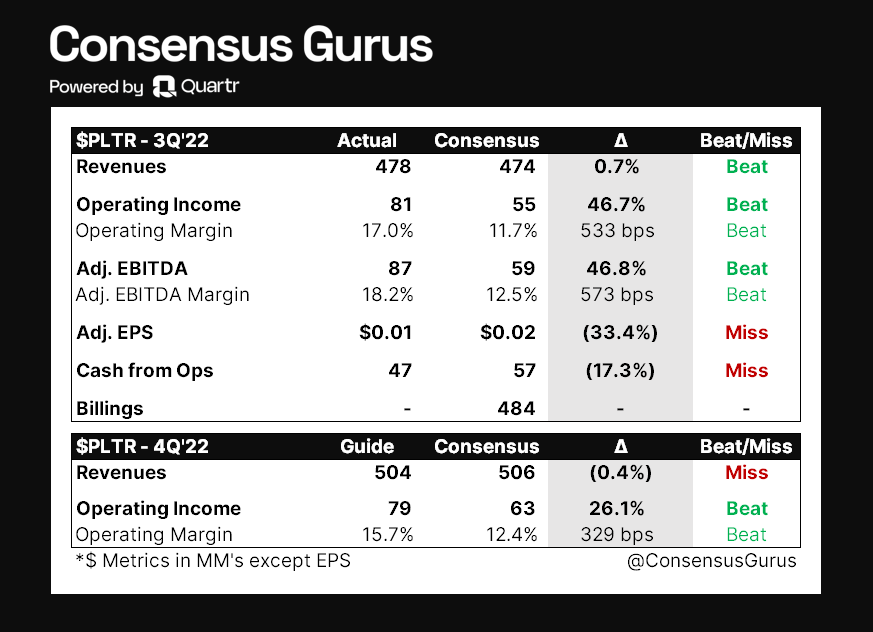

Palantir Technologies Inc. (NYSE:PLTR) reported 3Q22 revenue of $478 million (+22% YoY), which beat $474 million consensus, while adjusted operating margin of 17% also compared favorably against 11.7% consensus. In Q3, total contract value increased to $1.3 billion and customer count grew 66% YoY. Despite the slower 23% YoY growth in U.S. government revenue, U.S. commercial revenue grew 53% YoY, while the commercial client base increased 124% YoY to 132 customers. Adjusted free cash flow (AFCF) was $37 million in Q3 for an adjusted FCF margin of 7.7%. Management was proud to highlight that this was the 8th consecutive quarter of positive AFCF.

ConsensusGuru

For Q4, management expects revenue of $504 million at the midpoint (+16% YoY) vs. $506 million consensus. This includes a $5 million FX impact, which seems rather minimal compared to most tech companies that derive a substantial portion of revenues from overseas. Palantir’s revenue is largely U.S.-based, hence it is relatively safe from FX headwinds. Q4 adj. operating income is expected to be $79 million at the midpoint, implying an adj. EBIT margin of 15.7% vs. 12.4% consensus.

While most companies are either reducing outlooks or not providing forward guidance, Palantir actually reiterated its full year 2022 revenue guidance of $1.9 billion, including a small $6 million impact from FX headwinds. On the surface, nothing that Palantir said was out of the ordinary, as Q3 results and Q4 outlook were mostly in-line with expectations.

But why doesn’t the market care?

As of writing, shares of Palantir are down 11% despite the company just delivered everything the Street asked for. Why is this happening? The first issue is that investors are uncertain as to how to value the stock given top-line growth is expected to moderate to 16% in Q4 from 22%/26%/31% in Q3/Q2/Q1. Remember that one year ago, Palantir was a company growing its quarterly revenue at well over 40% YoY in an environment where GAAP (growth at any price) was the dominant theme for the investment community. This is no longer the case as the Fed has said many times that rates will stay high until inflation drops to the 2% policy target.

The recent post-earnings price action (-18%) from another high flyer like Cloudflare, Inc. (NET) has also introduced a spillover effect on many fast-growing yet unprofitable names like Palantir. When earnings are non-existent, there’s really no way of judging the potential price levels at which markets will find valuation support when top-line growth slows down.

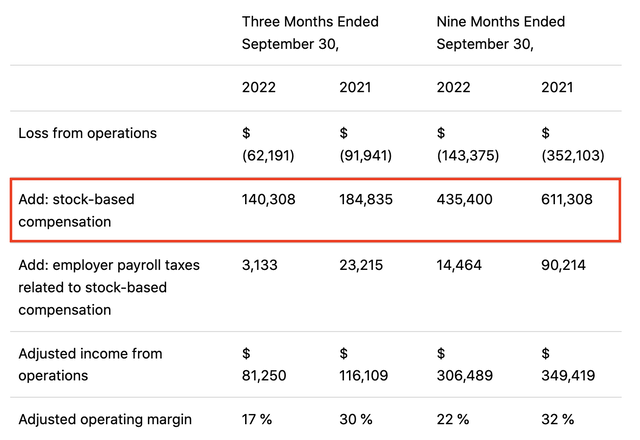

This is where Palantir’s history of zero (or negative) profitability becomes a major problem, as the company has struggled to make money over the past 19 years. While management talked about terms like adjusted operating margin and free cash flow, these figures appear positive only because management wants analysts to add back a list of financial shenanigans. Stock-based compensation (SBC) is the magic number that could make the company “profitable.”

In the first 9 months of 2022, Palantir’s reported an actual loss from operations of $143 million (-10% EBIT margin) and net loss of over $400 million (-29% net margin). However, if we simply add back the $450 million in stock-based compensation plus the associated payroll taxes, Palantir is suddenly profitable, with an adjusted operating income of $306 million (22% adj. EBIT margin). Evidently, markets are done with this trick, and it doesn’t require much for investors to understand that SBC is arguably the best way to dilute their financial interest in any business.

What to do with the stock?

Avoid Palantir at all costs. I maintain my Sell rating following my last article published in September. This is a structurally unprofitable business that will do investors more harm than good despite how massive the TAM (total addressable market) may be. The company offers mission-critical software for the U.S. government and corporations in the private sector, but at the end of the day, investors are unlikely to get excited if these activities cannot be carried out at a profit. Let’s also not forget that the CEO’s ambition is to reach $4.5 billion in revenue by 2025, implying a 33% CAGR for Palantir in the next 3 years after 2022.

With Palantir growth decelerating to just 16% in 4Q22 and potential uncertainty in federal spending in 2023, it’ll be a painful process when expectations receive further adjustments to come in line with reality.

Be the first to comment