Michael Vi

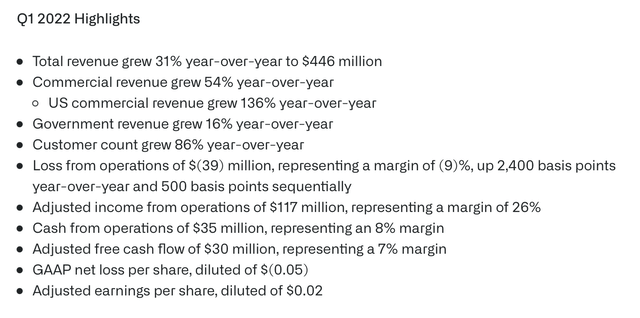

Palantir Technologies Inc. (NYSE:PLTR) is one of the most controversial companies. The company’s market cap is floating at around $18 billion, more than ten times TTM sales. Moreover, the company is infamous for its dilution and has never shown a net profit in a single quarter. Therefore, it is no surprise that since the growth meltdown began last year, Palantir has been one of the worst-hit stocks. The company experienced an epic drop of 80% from peak to trough, but the share price has begun to recover.

PLTR 1-Year

Benjamin Graham may have said it best – “In the short term, the market is a voting machine, but in the long run, it is a weighing machine.” Mr. Graham was a brilliant investor, and the saying applies exceptionally well to Palantir, in my view. The market seemed crazy about Palantir when the stock was at $20 or $30, but is not fond of Palantir these days. The stock was severely diluted after its IPO, and the criticisms of stock-based compensation (“SBC”) continue today. Moreover, growth and high multiple stocks are not as popular as they were throughout most of 2021, and with a possible recession approaching, the market is voting “No” on Palantir.

However, let’s weigh Palantir’s stock instead of voting for it. Dilution and SBC compensation are common phenomena with IPOs, and Palantir is not an exception. Let’s not look at past sales, but let us focus on the company’s revenue growth and earning potential. Additionally, let’s consider Palantir’s unique, leading, and dominant market position and how it could impact future growth prospects and profitability potential. Moreover, Palantir’s growth runway is massive, and its profitability potential is vast, making the stock possibly one of the best buys for the next decade.

Palantir – The Government’s Favorite Contractor

One of Palantir’s most unique facets is its dominant position as a government contractor. The company provides software solutions through its Gotham program to numerous government agencies. Some of Palantir’s government clients include the U.S. military, intelligence, and police. More specifically, the FBI, DOD, CIA, NSA, and many other agencies use Palantir’s linked databases, data mining solutions, analysis software, and much more. Furthermore, Palantir services the NHS, FDA, and other agencies. While Palantir is growing its corporate business aggressively, it still derived most of its revenues (54%) from government contracts last quarter. Advantageously, Palantir gets a substantial portion of its revenues from the government as the government is famous for its loose spending policies. Moreover, the company should continue growing government revenues, and even when a recession comes, the government will continue its spending.

It’s All About Growth – For Now

I hear a lot of complaints that Palantir is not profitable, but Palantir does not need to be profitable. The company is growing at more than 30%.

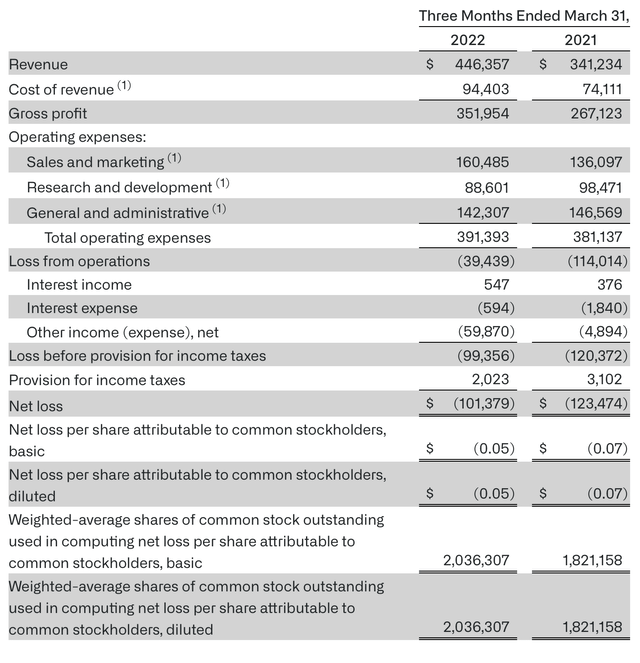

Q1 Highlights (investors.palantir.com)

Palantir’s growth metrics are tremendous. 31% YoY revenue growth, 54% YoY commercial revenue growth, 136% YoY U.S. commercial revenue growth, and 86% YoY customer count growth. While the company’s government business remains its anchor, we see Palantir growing its commercial business aggressively now. Moreover, we should continue seeing robust growth from the government and corporate clients as the company moves on. For full-year 2022, the company expects to show an adjusted operating margin of approximately 27% and anticipates providing 30% annual growth or greater through 2025.

Be Patient – Profitability Will Come

Palantir is a high-growth company. Therefore, there is no need for it to be profitable right now. The company needs to focus on growing operations, increasing market share, and setting up future profitability potential. However, when it’s time, Palantir should be exceptionally profitable.

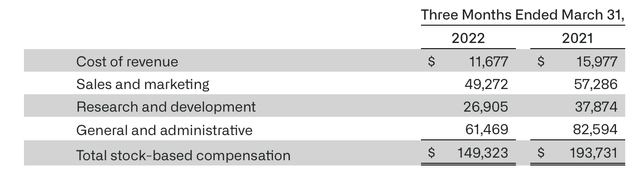

Statement of Operations

Statement of Operations (investors.palantir.com)

Last quarter, the company’s gross profit increased by 32% YoY. At the same time, Palantir’s operating expenses increased by only 2.6% YoY. Therefore, the operating loss last quarter was much narrower than last year’s, just $39.4 million vs. $114 million one year ago. Moreover, Palantir’s gross margin came in at a whopping 78.6% the previous quarter, even higher than the 78.3% from one year ago. Thus, we see Palantir is growing increasingly profitable. As the company’s gross profit continues to increase, it will start outweighing the company’s operating expenses significantly, leading to substantial increases in operating income, net profit, and EPS.

Dilution – Not a Problem Anymore

We see that Palantir’s share count rose by about 11% YoY. Therefore, Palantir is still diluting, but not nearly as much as it did when the company initially went public. Palantir went public with only about 476 million shares. However, the company has more than 2 billion shares outstanding now. Yet, much of the dilation occurred early, essentially right after the company went public. Roughly six months after going public, the company already had nearly 1.8 billion shares. Since then, SBC expenses have been declining significantly and are likely to continue falling as the company advances. Additionally, increased SBC is a common phenomenon with IPOs and is not a Palantir-isolated phenomenon.

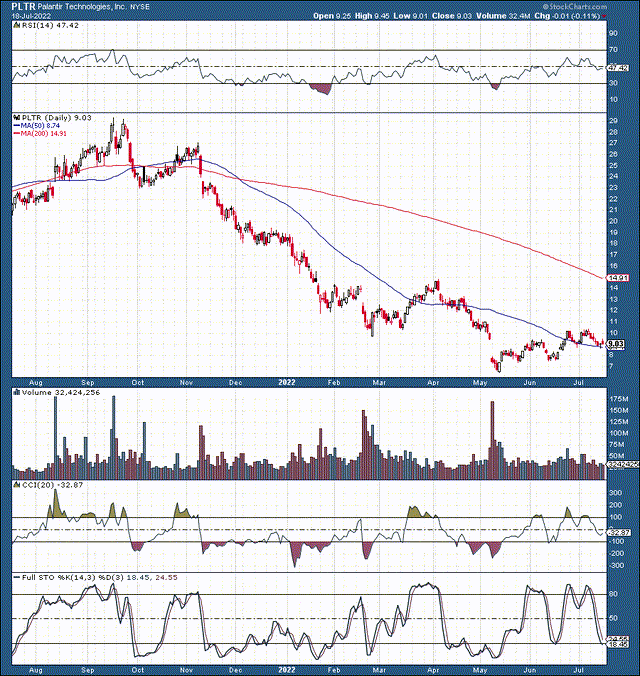

SBS Expenses

SBS Expenses (investors.palantir.com)

We see that, despite significantly higher revenues and income, SBC is down by about 23% YoY. This dynamic implies that the trend of lower SBC expenses should continue. Also, if we factor out the SBC expenses, we see that Palantir should become remarkably profitable. Minus SBC, the company’s cost of revenue was only about $82.8 million, implying a gross margin of nearly 82% for Palantir. Minus SBC, Palantir’s operating income would have been around $110 million last quarter, illustrating an operating margin of approximately 25%.

The company would have even recorded a small net income of about $10 million once SBC expenses are removed from the equation. The company reported an adjusted EPS of $0.02, illustrating that the company can be profitable right now, even while growing YoY revenues at more than 30%. Therefore, we see that Palantir has the potential to become increasingly prosperous. As the company’s revenues and gross profit continue to rise, its operating expenses should increase modestly, and the SBC should continue declining significantly in proportion to the company’s revenues. Thus, Palantir’s profitability metrics should improve dramatically in the coming years.

Palantir – May Be Recession Proof

There’s much concern about the upcoming recession. However, Palantir is in a unique position, as much of the company’s revenues come from government contracts. The company’s corporate clients are also not likely to reduce their reliance on Palantir’s services, as the company provides essential solutions relating to data analytics, cybersecurity, and other critical aspects. Therefore, even in a recession, Palantir’s growth should continue increasing, making it one of the best long-term buys in the market right now.

A Closer Look At Palantir’s Valuation

Palantir should deliver roughly $2.6 billion in revenues next year, placing its forward P/S multiple at approximately 7. However, Palantir is a dominant market-leading high-growth company with remarkable profitability potential. Recently, the stock got voted down to a 5x forward sales multiple, when the stock fell down to $6. Now at $9 Palantir is trading at about 7 times forward sales, but it may trade at a significantly higher sales multiple down the line. Many companies with far less growth potential sell at significantly higher sales multiples.

Therefore, here’s how Palantir’s financials could look like as the company advances:

| Year | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 |

| Revenue $ | 2b | 2.6b | 3.4b | 4.4b | 5.7b | 7.3b |

| Revenue growth | 30% | 30% | 30% | 30% | 28% | 25% |

| Forward P/S ratio | 7 | 8 | 9 | 9 | 8 | 8 |

| Price | $9 | $14 | $21 | $27 | $32 | $40 |

Source: The Financial Prophet

Utilizing the company’s projected 30% growth rate through 2025 and a slight drop-off through 2027 gets us to approximately $7.3 billion in revenues in 2027. The 7-9 times forward sales multiple projections are not high considering Palantir’s robust growth and substantial profitability potential. Microsoft (MSFT), a software company with much slower growth, trades at about eight times forward sales. Nvidia (NVDA), a growth company with significantly slower growth, trades at approximately 12 times forward sales projections. Moreover, many other growth companies are trading at substantially higher multiples than ten times sales.

Palantir could command a P/S multiple of 7-9 or significantly higher in the coming years, possibly making the stock one of the best buys for the next decade. Therefore, the market will probably start weighing the company’s stock instead of voting for it in the coming years, and Palantir’s share price will likely advance much higher.

Risks To Palantir

Despite my bullish outlook for Palantir, market participants should consider several potential risks associated with this investment. While the growth story is strong at Palantir, shares are not cheap by traditional metrics. Furthermore, the company’s earnings are still minimal and may not increase as much as I envision. Moreover, if the company’s growth picture were to turn less bullish, the stock could head in the wrong direction. For instance, if Palantir lost favor with the government or had a data breach, the stock could experience a notable decline. Please consider these and other risks carefully before investing in Palantir.

Be the first to comment