Michael Vi/iStock Editorial via Getty Images

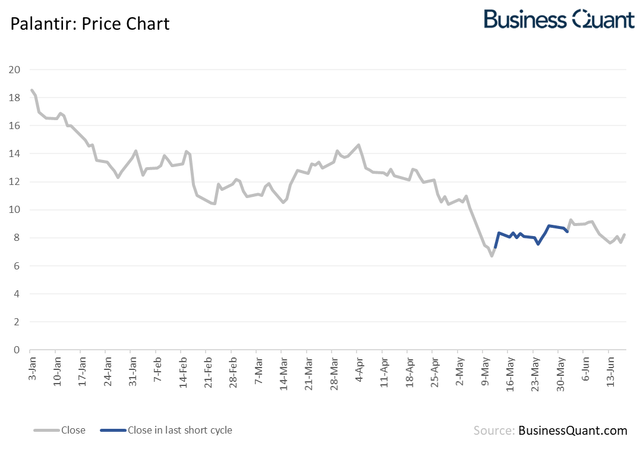

Palantir Technologies Inc.’s (NYSE:PLTR) shares are down 70% over the past one year alone, and its long-term investors have been left holding the bag. The question that everyone is asking now is if Palantir’s shares have bottomed out or if its capitulation point is yet to come. Amidst the ongoing selloff and the ensuing confusion, there has been a positive development. Short interest in Palantir dropped by almost 19% in the last cycle. This suggests that the selling pressure is cooling down and that the stock may be in the process of forming a bottom. Let’s take a closer look to gain a better understanding of it all.

Shorting Subsides

For the uninitiated, short interest is basically the total number of short positions that are open and are yet to be covered. A sharp drop in the metric indicates that short-side market participants have actively wound up their positions as, perhaps, they feel the stock has become fairly valued and doesn’t have much downside potential left. Conversely, a rapid buildup of short interest suggests that market participants are actively shorting the concerned stock, anticipating that it’ll quickly depreciate in value in the foreseeable future. So, the short interest metric is a useful tool to gauge the Street’s ever-evolving sentiment pertaining to any given stock.

In Palantir’s case, its short interest amounted to about 107 million at the end of the last reporting cycle. This figure may not mean much in isolation but it actually amounts to roughly 6.5% of the company’s total floating shares. What’s even more interesting here is that this figure is down by nearly 19% within one month. This considerable reduction indicates that short-side market participants actively wound up their positions in Palantir during the last cycle.

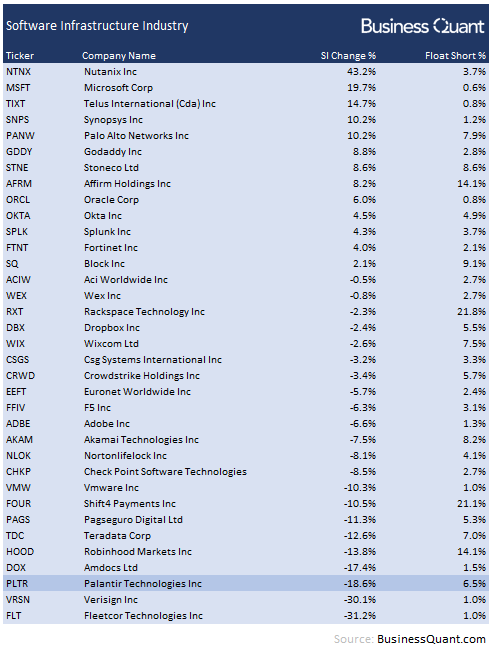

Next, I wanted to see if this short covering was prevalent in the entire software infrastructure industry or if was elevated specifically in Palantir’s case. So, I pulled up the short interest data for 30 other software infrastructure stocks listed on U.S. bourses, that had at least $1 billion in trailing twelve-month revenue. The results were rather interesting. As it turns out, Palantir saw one of the highest levels of short unwinding in the last cycle. This indicates that market participants were far too active with unwinding their short positions in Palantir, than with the other stocks.

BusinessQuant.com

Another point to note here is that this short unwinding took place while Palantir’s shares were still subdued. If the bears had a credible thesis for the company, they would have held onto the short positions a little longer in a bid to profit from further price declines. But these traders covered their short positions instead, perhaps because they perceive the stock to have bottomed out and/or have little downside potential from current levels.

This begs the question – why are market participants actively unwinding their short positions in Palantir in the first place?

Reasons for Caution

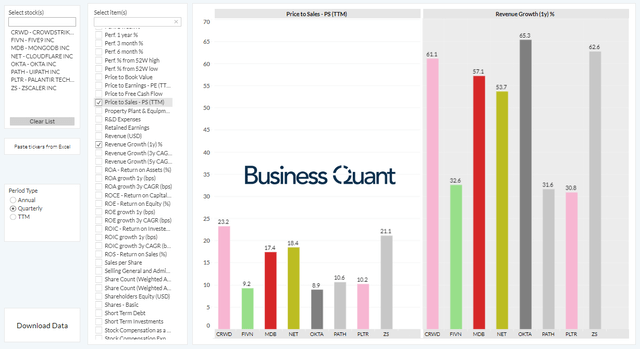

There are broadly 3 reasons as to why market participants may be scrambling to cover their shorts in Palantir. First, the stock has already dropped by a considerable amount over the last year and it’s now valued more or less at par with some of the other rapidly-growing names belonging to the software infrastructure industry. This suggests that Palantir’s shares may have limited downside potential from current levels, thereby making them moribund for short-side traders.

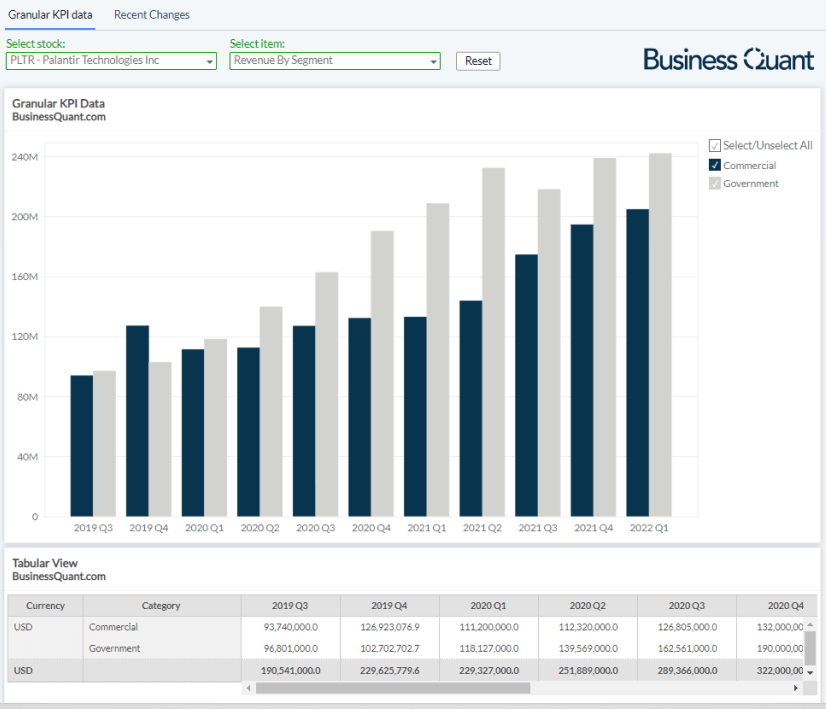

Secondly, Palantir was lambasted in investing circles for several months after its direct listing about how its commercial business wasn’t taking off. While some bears suggested that Palantir’s revenue growth entirely hinged on its government ties and secret deals, others felt that the company didn’t have any moat to compete in the commercial space. But those days are in the past, as Palantir’s commercial revenue growth has finally taken off in recent quarters.

BusinessQuant.com

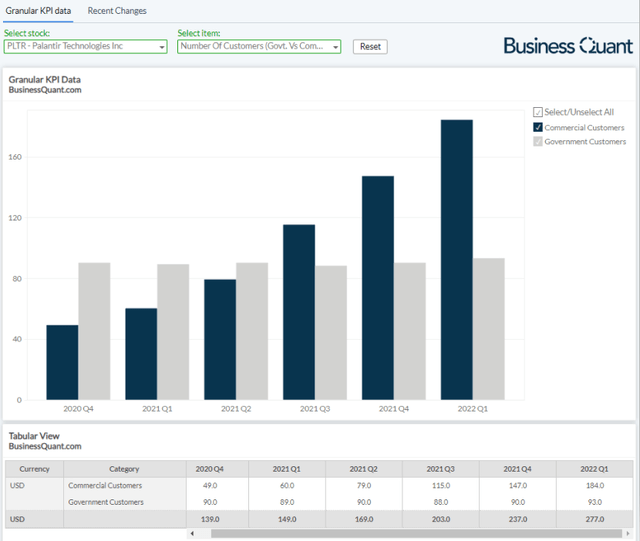

Third, Palantir’s commercial revenue growth momentum is likely to continue in the foreseeable future as well, and the segment is likely to become a major growth driver for the company as a whole. See, Palantir has been adding customers at a rapid rate. Its commercial customer count in Q1 was up 205% year-over-year whereas its commercial revenue was up 56% in the said time frame.

This leads me to believe that these new customers are starting out with relatively smaller contracts and they’re likely to gradually ramp up spending on Palantir’s platforms as their personnel get familiarized with the new workflows and the companies drop their legacy reporting tools. This implies that Palantir’s commercial revenue growth momentum will remain at elevated levels and eventually become the predominant growth driver for the entire company.

Besides, I’ve also covered in my prior articles how Palantir’s stock-based compensation is subsiding and is no longer a cause of concern, how its insider selling has dropped substantially, and why the company will be relatively unfazed in an inflationary environment (read here, here, and here). All these factors, collectively, suggest that Palantir’s shares are bottoming out at current levels, making it a very risky short for the time being at least.

Final Thoughts

I’d like to clarify that short interest data highlights trades that have already taken place in the past. It does not predict trades that are yet to take place and/or the ensuing price action. So, this data should, at best, be used to confirm the trade direction and to ascertain if the underlying investment thesis lines up with shorting activity.

Having said that, the sharp short interest reduction in Palantir should come as a relief for its long-side shareholders. It indicates that the incessant selloff in the stock may now be over and the security may be in the process of forming a bottom. Therefore, I believe this may be a good time to accumulate the stock with a long-term time horizon. Good Luck!

Be the first to comment