Michael Vi/iStock Editorial via Getty Images

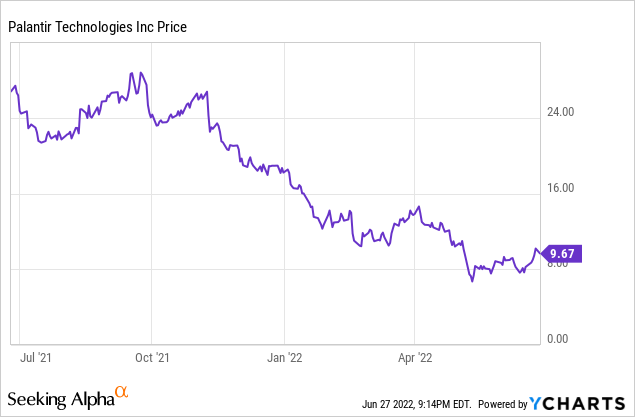

If you were to ask me for a single stock I would choose to invest in for a year-end rebound, I wouldn’t hesitate to name Palantir (NYSE:PLTR). This big data giant, a fabled software company for its close relationships with the U.S. government (particularly the armed forces), has seen a tremendous stock market reversal this year. Dropping quite suddenly from being one of the most celebrated and richly-valued tech stocks in the industry, Palantir has now shed half of its value.

It’s time, in my view, for investors to take a hard second look at this name.

What’s going on with Palantir? Slightly soft guidance doesn’t justify the massive share price collapse

First of all, let’s address the recent goings-on with Palantir. If you look at the stock price chart above, you’ll notice that Palantir’s correction accelerated in May, after the company released Q1 earnings results and updated its guidance. Two things are at play here: of course, the broader stock market correction and “risk off” attitude have hammered high-growth stocks like Palantir.

Separately outside of that, investors reacted harshly to Palantir’s Q2 guidance outlook.

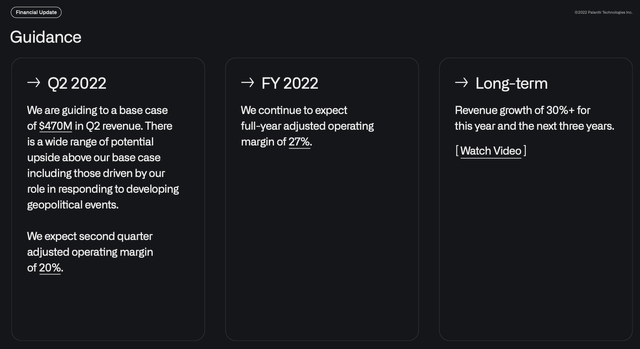

Palantir outlook (Palantir Q1 earnings deck)

For Q2, Palantir is guiding to “base case” revenue of $470 million. This represents 30% y/y growth, and was below the $483.8 million (+34% y/y growth) that Wall Street had hoped for.

The key thing here, however: Palantir has a “wide range” of potential upside drivers to this forecast. The company has notoriously long offered very flimsy guidance targets relative to other companies and frequently sets a low bar for itself to cross. This guidance update should not be read as any meaningful slowdown in Palantir’s go-to-market performance.

The long-term bull case is still vibrant

Wall Street and most investors are famously short-term oriented, but with a company like Palantir, we should be far more interested in the longer-term bullish thesis.

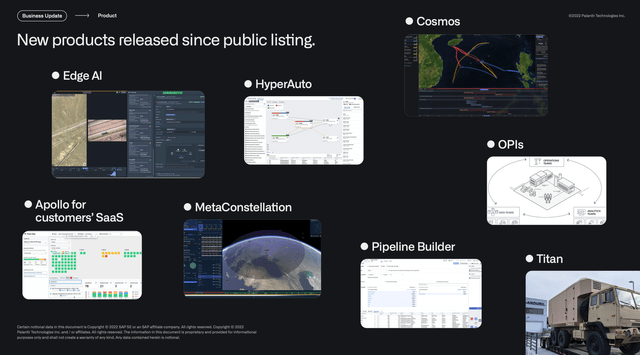

It’s important to recognize that Palantir remains one of the leading software companies in big data and AI. Since its IPO only two years ago, the company has rolled out a slew of new products:

Palantir new products (Palantir Q1 earnings deck)

Though not a new product, the product we should be watching closely is Palantir Foundry, which is the company’s PaaS (platform-as-a-service) offering for both government and corporate clients to build and deploy applications. Palantir has ambitions of Foundry overtaking AWS as the central hub for app development. Per COO Shyam Sankar’s prepared remarks on the Q1 earnings call:

The greatest opportunity for Foundry continues to be the application development infrastructure platform. We believe that Foundry will become the place that you go to build the applications of the future. With AWS or Azure with their highly unopinionated collection of services, most of the work remains in front of you to get to value. And all of that onus is on you, the customer, to get to that value.

With Foundry, you’re 90% of the way there on day 1. Software-defined data integration, native multi-tenancy for your applications, the OPIs, version pipelines, applications, artifacts, to just name some of the components, that make Foundry work from the start.

That’s why U.S. Space Forces’, Kobayashi Maru factory realized their ambition, building 13 operationally accepted applications on top of Foundry in months while sunsetting legacy $100 million-plus programs. That’s why Airbus rolled out an internally developed supply chain network control tower, a suite built on top of Foundry’s application development infrastructure. And this set of applications, it mitigates supply chain issues and is working towards saving hundreds of millions of euros annually by speeding up production against existing fixed capacity and reducing inventory across all parts.

What AWS was in the last decade, Foundry will be in the next.”

Here, in my view, are all the key reasons to be bullish on Palantir for the long haul:

- Big data is a massive discipline that can be applied in nearly limitless ways. Palantir isn’t a software company that serves only one or a limited set of use cases. Data and inferences that can be made from data are prevalent in just about everything: which explains why Palantir is such a powerful tool for both public and private sector clients.

- Growth at scale. Despite being at a ~$2 billion annual revenue scale, Palantir continues to deliver 30-40% y/y revenue growth, and its long-term outlook calls for the company to be able to sustain growth rates in excess of 30% y/y through at least 2025. Few companies are able to achieve this kind of growth at scale, and it’s a testament to the wide applicability of Palantir’s products and the humongous clientele it has drawn (in particular, the U.S. Army).

- Stepping up go-to-market momentum. Palantir is chasing growth across a wide variety of channels. The company has stepped up its sales hiring this year, a nod at the broad market opportunity it has and the need for more territory coverage. Palantir also has deepened relationships with ISVs (integrated service vendors) that can resell Palantir’s products without its involvement and offer additional coverage that Palantir’s direct sales force can’t handle.

- One foot in the public sector, one foot in private. Palantir made its name on being a large federal government contractor, but its products are just as compelling to an enterprise segment that is growing ever more obsessed with the value of big data. Most software companies start off as primarily dealing with enterprise buyers, and then hopefully getting FedRAMP certification to sell into public sector clients later. Palantir did the reverse: but now, its momentum with Fortune 100 companies is continuing to grow, and customer adds are continuing to trend at an impressive pace.

- Free cash flow. Though not yet profitable from a GAAP standpoint, Palantir continues to exceed internal expectations for free cash flow, which means the business is self-financing (a departure from many other rapid-growth software companies that continue to need to raise capital to finance their losses).

In short, focus on the long-term expansion potential here: Q2 guidance is just noise, a drop in the bucket.

Formidable growth continues

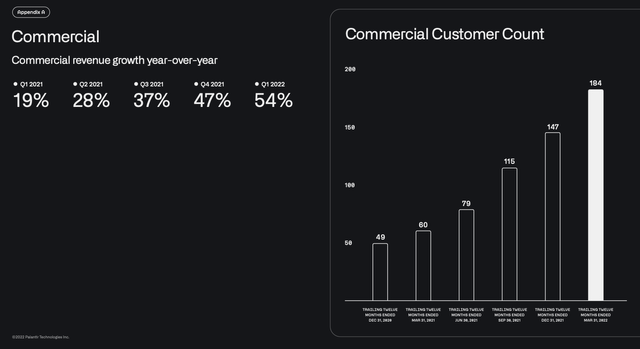

Nor should investors get the impression that Palantir’s growth in recent quarters has been lagging, either. One highlight to extract from Palantir’s Q1 earnings results: total commercial revenue grew 54% y/y to $205 million. As seen in the chart below, that represents four straight quarters of acceleration:

Palantir commercial revenue performance (Palantir Q1 earnings deck)

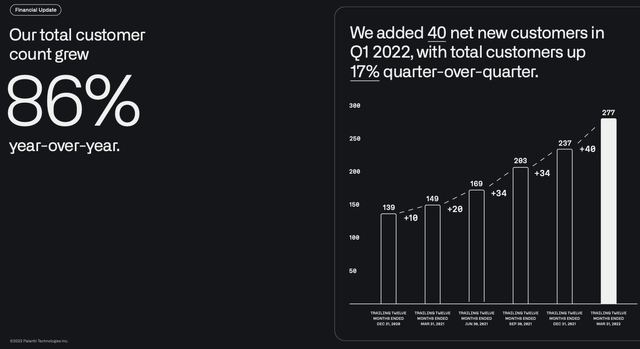

The company has also broadened its customer counts. At present, Palantir’s business revolves primarily around large government contracts and mega blue-chip corporations. But with the company stepping up its go-to-market activities on the commercial side, the mid-market represents another major growth leg for Palantir that it has not yet tapped into. In Q1 alone, Palantir grew its customer base by 40 customers, or 17%.

Palantir customer growth (Palantir Q1 earnings deck)

For now, Palantir’s growth metrics are still vibrant (and note as well that with 124% net revenue retention rates, there’s plenty of revenue expansion happening within the existing install base too). The fact that the company is expecting to continue pushing for 30%+ y/y growth through 2025 is also quite rare for a company of its scale.

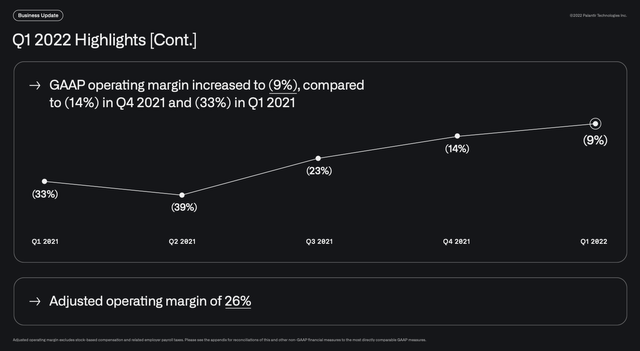

GAAP margins are drifting toward breakeven

One final point to extract from Palantir’s latest Q1 results: though investors flagged Palantir’s high GAAP losses at the time of its IPO, these margins are slowly converging toward break-even. In Q1, GAAP operating margins boosted to -9%, versus -33% in the year-ago Q1 (helped in no small part by the devaluation of Palantir’s stock, which reduces stock-comp expenses on paper):

Palantir margin trends (Palantir Q1 earnings deck)

Valuation and key takeaways

In spite of Palantir’s strengths and all its long-term potential, the stock is currently trading at what I consider to be an unmissable bargain. At current share prices just below $10, Palantir trades at a $19.70 billion market cap. After we net off the $2.52 billion of cash on Palantir’s most recent balance sheet, its resulting enterprise value is $17.16 billion.

For the current fiscal year FY22, Wall Street analysts are expecting revenue of $1.99 billion (+29% y/y), and for next year FY23, consensus stands at $2.56 billion (+29% y/y). Both estimates, by the way, fall short of Palantir’s stated guidance of maintaining 30%+ growth through 2025 (and so far, Palantir has never backed down on a commitment). Nevertheless, at Wall Street’s consensus figures, the stock trades at:

- 8.6x EV/FY22 revenue

- 6.7x EV/FY23 revenue

There was a time when A) Palantir traded north of >25x current-year revenue, and B) when software companies with mere 15-20% y/y growth traded at a 9-10x revenue multiple. Though I’m not exactly calling for tech valuation multiples to revert to the excesses of 2021, I think Palantir looks incredibly cheap given its target to sustain 30% y/y growth for the long term.

The bottom line here: Palantir is a rare combination of strong execution, unparalleled branding and reputation, a wide basket of massive-TAM products, and reasonable valuation. Don’t miss this buying opportunity.

Be the first to comment