Drew Angerer/Getty Images News

Investment Thesis

When it comes to trade-offs around complex questions such as individual privacy versus collective security, a person will always feel alienated from opinionated dogmatists assertively choosing one side over the other, whether they share the same opinion or not. The reason is that zealots often seem to disregard competing values surrounding such complex questions. In a letter filed to the SEC, Palantir (NYSE:PLTR) CEO states that the data-mining company “have chosen sides,” standing by its government clients “when it is convenient, and when it is not.” Albeit well-intentioned, PLTR’s stance entangled the company in Washington’s debates more than would have been necessary, alienating half of the political institution and perhaps the public. I wasn’t surprised that Avril Haines, the former deputy director of the CIA, removed references to consulting work with the software vendor from her biography shortly after joining the Biden Campaign, as reported by The Intercept.

Mainstream media captures’ the public’s perception of PLTR’s controversial position in the following news headlines and excerpts:

Palantir trades: Shares in the controversial data analytics company Palantir Technologies begin trading publicly on Wednesday. Financial Times, Sept 2020

Palantir Embraces Controversial US Government Contract Work – Bloomberg, August 2020

The U.K. government has ended a controversial data agreement with U.S. tech firm Palantir following criticism from privacy campaigners. CNBC, Sept 2021

Palantir, the controversial data company, makes its Wall Street debut. CNN, Sept. 2020

Palantir is not a consumer-facing company but its work has generated public protest. Financial Times, December 2019

Peter Thiel’s Secretive Data Giant Palantir. WSJ, February 2019

This image will have a detrimental effect on the company’s plans to become the “default operating system for the government,” a stated goal fully incorporated in its share price. For example, PLTR’s COVID-19 contract to track vaccine and infection data reignited controversies over its work with the Trump administration on immigration executive orders described as “cruel” by human rights organizations, arbitrary, and not justified by The Supreme Court, and controversial in mainstream media (as mentioned above). Its co-founder’s outspoken support for Trump and its CEO’s libertarian views didn’t help either. Several congress members wrote:

Naturally, we have valid concerns on whether the existing surveillance framework Palantir has created to track and arrest immigrants will be supplemented by the troves of potentially personal health information contained within the HHS Protect platform

The strong resistance from politicians to give too much power to PLTR despite the COVID crises (letter posted on the Washington Post on July 1, 2020) mirrors the deep-rooted concerns over PLTR’s activities and values. I believe that it is reasonable to say that the bigger PLTR gets, the more it will attract public and private scrutiny over its influence, as happened with the COVID contract.

PLTR acknowledges that public image and news reports over its operations might harm its shares in SEC disclosures. I don’t think management made enough effort to address this issue beyond its lobbying spending. The way PLTR is depicted on mainstream media challenges its ability to maintain government contracts and expand in the commercial sector, harming its valuation. For example, PLTR has consistently traded below peers with similar growth. Moreover, it lacks the safety net available for other companies, presented by M&A prospects. Given the reputational challenges manifested in the news headlines listed above, I doubt that larger tech firms will line up if management deems M&A is a preferred strategic option, touching on the voting power exclusively held by the company’s three co-founders.

Finally, the inability of PLTR to penetrate the Fortune 500 market after nineteen years of operations mirrors the commercial sector’s worries of being associated with PLTR, in the same way, that Avril Haines decided to delete references to her work with the company.

Competition

Listening to shareholders’ questions, one can’t help but sense a distorted image held by some retail investors regarding PLTR’s competitive stance. For example, one shareholder compares PLTR’s market position to the influence of Microsoft’s (MSFT) MS Office. One asked if PLTR has competitors at all? Some think the PLTR products are so unique that they don’t have competitors.

PLTR faces intense competition, and its products are replaceable. In 2020, the Anti-money Laundering division of The Department of Justice “DOJ” replaced PLTR with DataWalk (DAT.WA), a small-cap, Polish software vendor.

Many confuse PLTR’s rapid growth with product superiority. However, its high growth stems from its relatively low revenue base in a large market. In 2018, PLTR won a verdict against the government that now mandates Federal organizations to consider commercial software before attempting to build their own. This, benefits PLTR, but also many of its peers who have built-in software solutions such as Microsoft’s Synapse, Oracle’s (ORCL) Database, Cloudera’s (CLDR) Enterprise Data Hub – part of KKR (KKR), Databricks Lakehouse Platform, IBM’s (IBM) Netezza Performance Server, Neo4j, and NuoDB – part of Dassault Systèmes (OTCPK:DASTY), to name just a few.

PLTR lists several “strengths” to investors, most of which center around the design of its product, which, to its credit, offers an agile data analytics platform. The company also demonstrated exemplary execution, emphasizing working with IT departments before complicating implementation by incorporating end-users into the discussions. PLTR also reduced installation time, shrinking the sales life cycle. However, I believe each client has different design preferences, and I don’t see PLTR as fundamentally superior to its peers.

Growth

Another sign of the market’s failure to assessing PLTR is the market reaction to its EPS miss, which saw its ticker tumble 13% in mid-day trading. Long-term investors should focus on revenue and revenue per share instead of EPS and net income. PLTR’s business model is profitable, as seen in its high gross margins, and its operating losses are temporarily resulting from its growth initiatives. If it chooses, the company can quickly become profitable simply by halting its growth initiatives, but this wouldn’t be in the interest of long-term investors.

For example, R&D expenditure mirror costs related to scaling its platform for its clients, signaling higher future revenue despite short-term pressure on net income. Similarly, Selling and Marketing costs mirror expenses related to pilot programs which also reflect an interest in the company’s products.

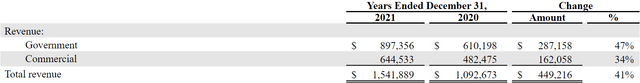

I believe that PLTR will continue to grow in the next five years at a decreasing rate. The company increased sales by $450 million in 2021; $287 million from government contracts awarded in previous periods, while the remaining $162 million is growth in its commercial segment.

SEC Filings

These are solid growth figures, but concerns over management’s ability to maintain these rates will continue suppressing the ticker. Management estimates that its revenue will exceed $4 billion in 2025, which translates to 30% annual growth.

As mentioned above, I don’t believe that PLTR will ever become the default operating system for the government or the commercial sector. A 30% growth rate will translate to a 5% market share in 2026, at which point, more scrutiny over its influence will restrict its growth, similar to what happened when the Trump administration awarded PLTR the COVID-tracing contract.

Valuation

KKR bought CLDR last year for $5.3 billion. At the time of the Purchase, CLDR TTM revenue was close to PLTR’s 2020 revenue of $1 Billion, valuing the company at a 5.3x Price/Sales ratio.

Using Price/Sales sheds light on valuation without engaging too much into PLTR’s spending on growth initiatives, mirrored in the R&D and Sales accounts. As mentioned above, these expenses are temporary, and given the stickiness of customers and low variable costs, Price/Sales offers a valuable tool for comparable valuation.

Applying the Price/Sales of 5.3x on PLTR 2021 annual results yields an $8 billion market cap valuation, much less than the current market cap of $23 billion. This overvaluation is also mirrored in Seeking Alpha Quant Score System, which rates PLTR “D” on valuation.

Even when considering growth, PLTR seems fully valued. Applying a 5.3x Price/Sales ratio on management’s 2025 revenue estimates ($4.4 billion) translates to a $23 billion market cap, less than its current value. Thus, in my view, PLTR doesn’t offer an attractive risk/reward balance.

How I Might be Wrong

Our thesis rests on the inability of PLTR to achieve the 30% growth target through 2025. However, if PLTR hits this target in the short run, the ticker might rise on investors’ optimism, contrary to our expectations.

The challenge in assigning a valuation to a particular ticker stem from the variability of price multiples. The growth-to-value rotation demonstrates this concept. Thus, a reverse in investors’ appetite for risk poses a risk for our hypothesis.

The increased geopolitical risks might increase demand for Gotham. However, this will enhance PLTR’s image as a defense contractor, igniting controversies about immigrant child separation decrees during the Trump era.

Finally, news headlines that have often presented PLTR as a controversial company might change tone as the software vendor expands in the commercial sector, positively impacting valuation, making this analysis obsolete.

Summary

Current prices incorporate above-average valuation multiples, mirroring higher growth expectations beyond 2025. Nonetheless, this implies that at some point, PLTR will have a market share above 5% (based on $119 billion TAM) which I believe is the threshold where the company will face increased scrutiny over its influence on the public and private sectors, given the negative media coverage affecting its reputation. For this reason, I maintain a hold rating, noting that while some investors might profit from the stock volatility, I don’t see the company offering an attractive risk/reward balance.

Be the first to comment