Sundry Photography

Palantir (NYSE:PLTR) will be releasing its Q2 results before markets open on Monday. The company’s management issued an extremely conservative revenue guidance for the quarter, in light of the global macroeconomic uncertainty, and investors are now wondering if there’s a possibility of a revenue beat. But in addition to tracking Palantir’s top line figure, investors should also track its customer additions, billings growth, segment financials and its management’s outlook for Q3. These items, collectively, will highlight Palantir’s near-term growth prospects and are likely to determine where its shares head next.

Operating Metrics

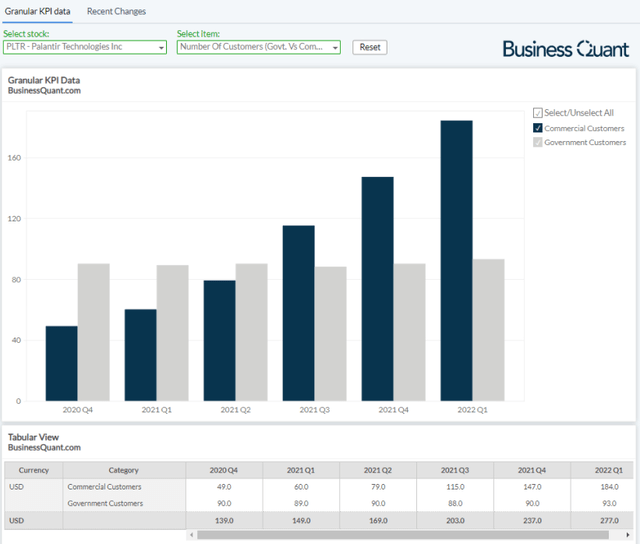

There’s no denying that Palantir is a rapidly growing company but we’ve to keep a vigilant eye and check if its financial and operating growth momentums don’t fizzle out during these times of macroeconomic uncertainty. For this, we can start by monitoring Palantir’s customer additions, which essentially highlights its customer traction and indicates how competitive its platforms really are, in today’s time.

Palantir has been able to expand its commercial customer base at an impressive pace over the past 6 quarters, exactly as I had forecasted in my prior articles like here, by undertaking a slew of initiatives. They rapidly expanded their sales team, offered free/limit trials to major enterprises and switched to a recurring payment model to reduce the inertia amongst its potential customer base. Since these initiatives are still ongoing, I expect them to continue bearing fruit and expect the company’s commercial customer base to expand rapidly in the foreseeable future as well.

However, Palantir seems to have hit a saturation point with regards to its government customer base. Maybe there’s geopolitics at play, or maybe there aren’t many government agencies in the world that are looking for data analytics solutions from a non-native company that has close ties with the US government. I welcome readers to speculate on the issue. But having said that, there haven’t been any major announcements from Palantir to catapult growth in this area so I expect its government customer base to more or less remain flat sequentially.

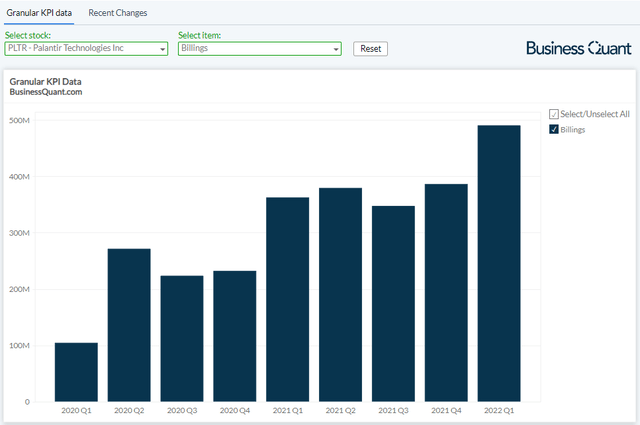

Moving on, the customer adds figure alone won’t be enough to reveal the entire picture. For instance, a sequentially flat billings figure, while customer growth continues, would imply that either existing customers slashed their spending on Palantir’s platforms or its new customers signed up with miniscule contract values. On the other hand, healthy customer and billings growth would imply that Palantir’s new and existing customers are in the process of ramping their spending on the company’s platforms. A third scenario could be if Palantir’s billings and customer growth declines, stagnates, or slows down, which would imply that Palantir has hit a saturation point and its platforms are no longer in vogue. So, pay close attention to Palantir’s billings growth once the company reports its Q2 results this coming Monday.

Now, having discussed the operating levers, let’s now shift attention to Palantir’s financials.

Financial Bifurcation

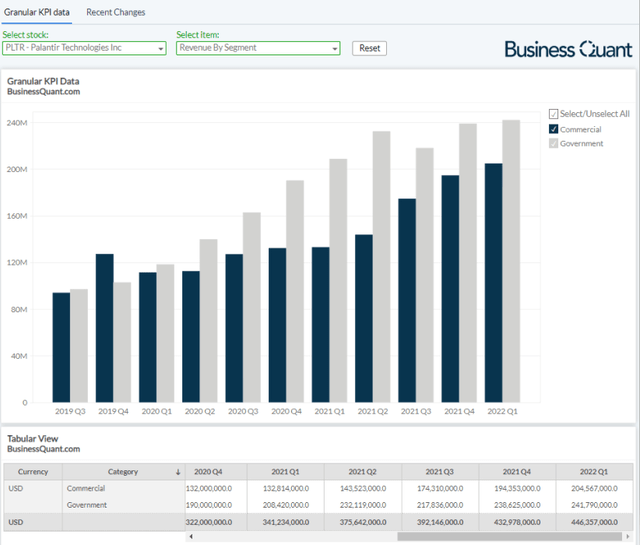

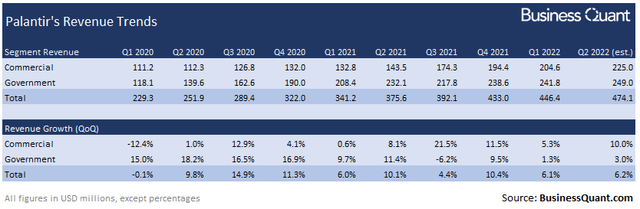

It’s worth noting that Palantir classifies its revenue in two reportable segments, namely commercial and government segments. The commercial segment happens to be the smaller one out of the two, at least in terms of revenue, and amounted to nearly 46% of the company’s total sales last quarter.

Thanks to the rapid commercial customer adds in recent quarters, Palantir’s commercial revenue has been growing at a breakneck pace of late and driving growth for the company as a whole. I expect this dynamic to continue in Q2 as well, with commercial revenue growing 10% sequentially and amounting to $225 million during Q2 2022.

The government segment contributed a little over 54% to Palantir’s overall sales last quarter and the revenue stream has been growing at a relatively slower pace. This is, in part, due to the saturation in government customer additions as seen in the first section of this article. If the company’s government customer base has saturated, then it’s only natural that its government revenue stream would saturate as well.

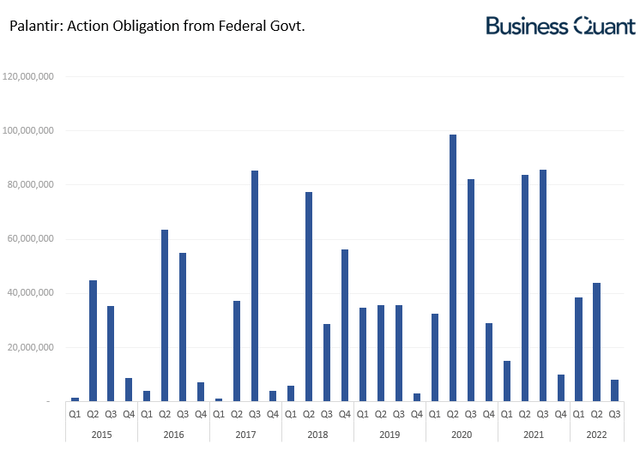

What exacerbates the problem is that the inflow of federal government contracts has considerably slowed down in the last 2 quarters. Although Palantir’s management noted in their last earnings call that they are “seeing an acceleration of our U.S. government revenue”, the ground reality isn’t all that encouraging. As it turns out, the dollar-value of new orders signed with various US government agencies during Q2, is up 14% sequentially but still down 48% year over year. This means that even though Palantir has made some progress on this front, there’s still a long way to go when compared to the company’s own prior history with government contract wins.

So, as far as Q2 is concerned, I expect Palantir’s government revenue to grow marginally by 3% sequentially, with its revenue figure coming in at approximately $249 million. At this pace, I expect Palantir’s commercial revenue to overtake its government revenue and become the leading contributor to the entire company’s top line sometime in Q4 2022 or Q1 2023. But coming back to our discussion, this brings us to a company-wide revenue estimate of $474.1 million. My forecast is coincidentally in-line with the Street’s estimates that are spanning from $470 million to $475.9 million.

But having said that, pay close attention to Palantir management’s revenue and billings outlook for Q3. As companies and government agencies across the globe cut down on spending, Palantir might be affected as well. This could come in the form of order cancellations, deferred contract signings and/or slowing down revenue growth. So, look for management’s comments on their growth momentum.

Final Thoughts

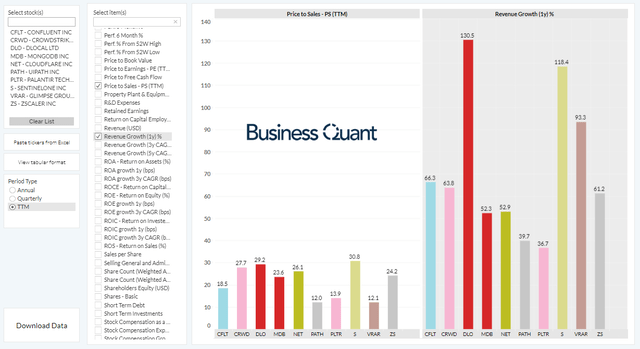

Palantir’s shares are down 62% from their 52-week highs and they’re now attractively valued at current levels. The stock is trading at 14-times its trailing twelve-month sales at the time of this writing, which is more or less in-line with many of the other rapidly growing software infrastructure stocks.

I, personally, expect Palantir to continue growing rapidly in the next 2 years at the very least. The company has compelling platform offerings and it has market validation in the form of rapid commercial customer additions. So, I remain bullish on Palantir. But, at the same time, I would recommend readers and investors to remain vigilant and monitor its customer additions, billings growth, segment financials and its management’s outlook for Q3. These items will indicate if Palantir is succumbing to macroeconomic pressures or if its growth momentum remains intact. Good Luck!

Be the first to comment