Michael Vi

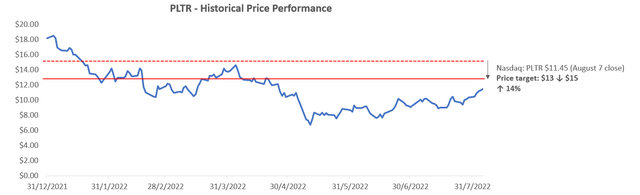

The Palantir stock’s (NYSE:PLTR) gains from the uptrend observed over recent weeks has been wiped out in pre-market trading Monday after the company reported a Q2 earnings miss and slashed guidance for the year.

Revenues from the previous quarter totaled $473.0 million (+26% y/y; +6% q/q), beating the average consensus estimate of $471.7 million (+26% y/y; +6% q/q). However, EPS came in at -$0.01, missing from consensus estimates of $0.03 for Q2. Revenue guidance for the current year has also been decreased to a range of $1.9 billion to $1.902 billion, which falls short of the company’s multi-year growth target of at least 30%, due to near-term macro uncertainties and added pressure from the strong U.S. dollar. The weak Q2 results and soft 2H guidance renews investors’ worries over extended growth deceleration.

Yet, continued deceleration in government likely underscores choppiness in the segment’s revenue performance as a result of the varying nature in public sector spending. However, consistent with our previous analysis, Palantir’s “land, expand and scale” business model is working, considering the steady flow of extensions on contracts with the U.S. Army and other non-defense public agencies. This is further corroborated by a reacceleration in U.S. government revenues, which grew 27% y/y in the second quarter. The company is also demonstrating gradual expansion of its market share to overseas allied markets, such as the U.K.’s NHS, which is favorable to sustaining continued government segment sales growth over the longer-term.

On the commercial front, Palantir’s exposure to recession-prone small- and medium-sized enterprises (“SMEs”) is expected to remain a near-term downside risk considering the macro uncertainties ahead, with rising interest rates and record high inflation prints. This is consistent with the downward-revised revenue guidance for the year, which falls short of Palantir’s long-term multi-year expansion target at a minimum of 30%. Yet, its broader enterprise deal flow remains resilient, with revenues from top dollar commercial customers increasing 17% y/y to compensate for near-term volatility in SME demand.

Specifically, in its core U.S. market, Palantir’s commercial customer base grew 250% y/y to more than 119 customers today. This also corroborates our bullish thesis that Palantir’s continued modularization of its flagship Foundry solutions for the private sector will remain an effective strategy in maximizing returns on its R&D investments, while driving greater mass market adoption ahead of favorable digital transformation trends.

Despite today’s (August 8) release of disappointing Q2 results and forward guidance for FY 2022, we remain confident in Palantir’s long-term growth trajectory and valuation prospects, buoyed by continued innovation, favorable secular trends pertaining to digital transformation, and positive progress on its land, expand and scale business strategy. While the stock continues to exhibit promising upsides over the longer-term, broad-based market volatility that has impacted the performance of tech stocks in 1H will remain a persistent theme over coming months. Paired with the company’s softer-than-expected forward guidance, investors should remain cautious of some near-term turbulence ahead.

Choppiness in Government

Palantir’s government revenues continued to decelerate, growing at 13.5% y/y (Q1: +16.0% y/y) in the second quarter. The results represent a continuation of the sore spot that has been eroding investors’ confidence in the stock over the past several quarters. However, the rate of deceleration has slowed, and the company maintained earlier observations of reacceleration in U.S. government revenues during May through the second quarter:

In the face of our customers’ challenges, we have and will continue to incur expenses prior to having contracts in the delivery of mission-critical capabilities. Following these investments, we expect acceleration of our U.S. government revenue into the second half of the year. In Q2 to date, we’ve already seen the reacceleration of U.S. government revenue and expect acceleration of the overall government segment to follow in the next quarter or shortly thereafter.

What We Did Not Like: The continued deceleration in government revenues at the end of the second quarter is dwarfing hopes of reacceleration for the segment in the near-term. The results are consistent with observations reported by RBC in early August on slowed U.S. federal government spending during the June quarter compared to the same period in 2021. As mentioned above, continued deceleration in government segment revenues remains a sore spot that investors are focused on, and represents an ongoing downward drag on the stock’s performance.

What We Liked: Yet, Palantir has demonstrated in the second quarter that its land, expand and scale strategy is working to its favor, which is consistent with our discussion in the previous coverage. Expanding existing deals with the U.S. government has provided a strong helping hand in reaccelerating U.S. government segment sales during the second quarter, compensating for the slowdown in new deal awards from the U.S. government observed by RBC in the three months through June. Since our last analysis on Palantir’s recent contract extensions with public sector agencies in late July, the company has further expanded its existing government relationships:

- U.S. Army Research Laboratory: Palantir was awarded an extended contract by the U.S. Army Research Laboratory to facilitate the continued integration of data and AI/ML capabilities “across the combatant commands (“COCOMS”)”. The contract has an execution timeline of two years, with a deal value totaling $99.9 million. The partnership represents an extension of Palantir’s ongoing work with the Army Research Lab in providing defense personnel on the frontlines with “state-of-the-art operational data and AI capabilities”, effectively enabling insight-driven decisions “from outer space to the sea floor, and everything in between”.

While the government segment’s contribution to Palantir’s consolidated revenue mix is declining as a result of recent deceleration, the growing volume of existing contract extensions continues to support sustained growth, which we view as favorable still. And although new deal wins have slowed recently, it is important to acknowledge that government spending is choppy in nature. This is further corroborated by recent observations in the drastic slowdown in Q2 U.S. government spending compared to the prior year, while budgets have continued to increase across major public service agencies including the DoD and HHS, which potentially implies greater calendar 2H volumes. The calendar third quarter has also historically been a period of comparatively stronger government spend given the “fiscal year-end for the U.S. federal government is September”. And the majority of public sector spending lands within the final quarter of the reporting period, further supporting the potential improvement in 2H22 results for the segment.

And over the longer-term, the increasing urgency across public sector agencies to modernize their respective technology stacks are also favorable tailwinds for Palantir’s government segment. Within the U.S. Army alone, funding allocated towards R&D and procurement of emerging technologies like AI systems have increased by more than $3 billion in the prior year, and the figure is still on the rise. Frontline healthcare workers in the U.S. have also indicated technology as one of the top three items that can “help reduce their stress and become more effective”. Specifically, tools that can help “automate tasks, provide remote assistance and help communicate with colleagues” – which Palantir has proven it is capable of providing through its existing partnerships with the HHS and NHS during and after the pandemic – are seen as the most helpful. This signals that a greater market of opportunities from government agencies across the U.S. and its allies are coming Palantir’s way, underpinning sustained multi-year growth into the foreseeable future.

Resilience in Commercial

Commercial revenue growth continues to demonstrate resilient take-rate from the private sector despite looming recession risks that have spawned uncertainty over near-term technology investments. The segment’s revenues totaled $210 (+46% y/y; +3% q/q) in the second quarter, representing an increasing mix of consolidated sales. The results also reflect the continued effectiveness of Palantir’s modularization strategy taken over the past year to better suit its Foundry solutions for diversified enterprise sector use cases, and drive greater market share gains.

What We Did Not Like: The slowing momentum in commercial acceleration is likely an early indicator of deteriorating SME take-rates due to near-term macro headwinds. Management has also alluded to near-term macro uncertainties for its decision to slash base case revenue guidance for the year. While we had previously commended strategies like “Foundry for Builders” as an effective way for furthering mass market adoption for Palantir’s commercial platform and diversifying its private sector customer base beyond large corporations, looming recession risks are likely starting to impact spending from the recession-prone cohort over the near-term.

What We Liked: However, continued modularization of its Foundry platform, development of industry-specific data solutions, as well as commercial partnerships with industry leaders like Hyundai Heavy Industries and IBM (IBM) are progressing favorably in furthering Foundry’s penetration into enterprise opportunities, which are comparatively more resilient than SMEs in the face of near-term macro uncertainties.

The investment pipeline across corporate enterprises on digital transformation projects remains robust despite looming recession risks, considering the “mission critical” nature of modernizing the technology stack in order to maintain economic and operational competitiveness. Trailing 12 months revenue from Palantir’s largest customers grew 17% to $46 million, while the company’s total commercial customer base in the U.S. alone topped 119 customers in the second quarter, with growth momentum remaining resilient into 2H based on management’s observations to date on new deal acquisitions and existing deal expansions.

Based on the latest “CNBC Technology Executive Council Survey“, more than 75% of tech leaders recognize technology as a “business driver” today instead of a cost center, and is looking to ramp up related investments this year despite a potential economic downturn in the near-term. More than half tech investments are expected to be allocated towards efforts in migrating workloads to the cloud, while more than three-quarters of related spending on technology stack modernization will prioritize emerging technologies, such as “smart analytics (99%), process automation (100%), hybrid cloud (97%), and cybersecurity (100%)”, which makes favorable trends for Palantir’s commercial segment over the longer-term.

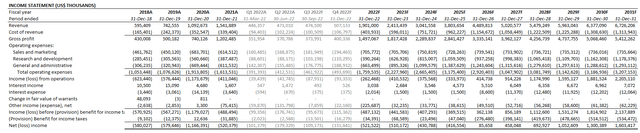

Palantir Fundamental Analysis Update

With first half revenue totaling $949.4 million (+28% y/y; +41% multi-year CAGR), Palantir is still about $981 million away from reaching its revised y/y top-line growth of approximately 23%. PY compare in 2H22 is also expected to be easier given 2H21 growth was comparatively more mild and normalized from 1H21, which benefited from a surge in deal volumes from pandemic-driven demand. However, this is expected to be partially offset by ongoing FX headwinds given the stronger USD, as well as expectations for near-term macro uncertainties ahead, which is consistent with management’s decision to revise its base case guidance downwards on a conservative basis.

Based on the foregoing analysis, we remain optimistic that Palantir’s long-term 30% y/y revenue growth target will return when there is further clarity on the macro front in 2023. Downside risks pertaining to SME slowdown ahead of looming macro uncertainties are expected to be compensated by resilient enterprise deal flow and adoption. Meanwhile, government deal extensions are expected to partially offset choppiness in new deal rewards going forward. Continued penetration into non-defense and overseas public sector opportunities are also expected to broaden Palantir’s government market share in the provision of next-generation technology. This is further corroborated by management’s observation of rapidly growing take rate from the healthcare sector – related revenues grew from $42 million in 1H2020 at the onset of the pandemic to $153 million in 1H22, a strong double-digit multi-year CAGR.

Adjusting our latest Palantir financial forecast for its actual second quarter financial results, and growth outlook based on recent developments across its government and commercial businesses discussed in the foregoing analysis, our base case forecast now projects revenues of approximately $1.9 billion by the end of the current year (+23% y/y), driven by resilient commercial acceleration, as well as expectations for improved government momentum in 2H, offset by near-term FX and broader macro headwinds, as well as anticipated choppiness in government revenues.

Over the longer-term, based on Palantir’s improving cost structure and gradually moderating stock-based compensation expenses as the business continues to grow and scale, our base case projection expects GAAP-based net income within the next five years, which is consistent with the timeline in which management expects Palantir to generate $4.5 billion in annual revenue and profitability.

Palantir Financial Forecast (Author)

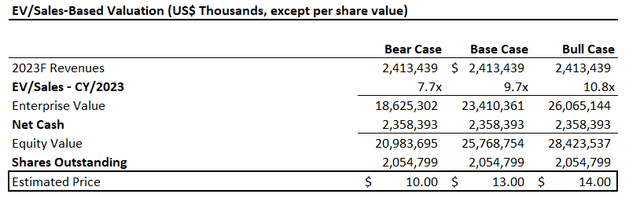

PLTR Stock Valuation Analysis Update

On the valuation front, we are revising our price target for the Palantir stock at $13 in anticipation of added pressure from near-term macro uncertainties and management’s downward-revised guidance. This represents upside potential of more than 30% based on the shares’ last traded price of approximately $9.80 in post-earnings pre-market trading Monday (August 8th).

Palantir Valuation Analysis (Author)

The key valuation methodology and assumptions applied in the analysis remains largely consistent with those discussed in our previous coverage on the stock, considering Palantir continues to progress favorably on its long-term fundamental growth objectives, adjusted for the current year’s anticipated slowdown. The assumptions applied also reflect Palantir’s ongoing maintenance of a robust balance sheet with expanding positive cash inflow from operations and zero debt, minimizing exposure to rising costs of capital in the near-term. We remain confident in the return of a favorable risk-reward pay-out at current price levels for patient long-term investments in the Palantir stock.

Palantir Valuation Analysis (Author)

Final Thoughts

While Palantir’s long-term prospects remain favorable based on the foregoing analysis, the stock is likely in for some continued turbulence in the near-term as investors respond to the company’s recent decision to lower its fundamental guidance given exposure to macro risks in coming months. However, based on management’s observations of increasingly sticky demand for Palantir’s products, as well as growing visibility into long-term government revenue expansion, we are maintaining our view that the stock demonstrates a compelling risk-reward trade-off at current levels.

Be the first to comment