Maskot/DigitalVision via Getty Images

Interruptions to profit growth will soon clear

The last 12 months the market has rightly punished many unprofitable technology champions. However, some growing companies in emerging markets have been unfairly punished. PagSeguro Digital (NYSE:PAGS) is such a company and it has also overcome some severe profit headwinds that should soon ease as interest rates peak.

First, a quick reminder on PagSeguro Digital.

PAGS is a Brazilian company, in some ways similar to StoneCo (STNE), that has upended the cozy oligopoly of the dominant merchant acquirers. Merchant acquirers provide a link between small retailers to a switch, like Visa (V) or Mastercard (MA) that then links to the user’s bank account.

Being a merchant acquirer is the bulk of PAGS current business and all their profits, there remains much growth ahead as they move into the SMB (small medium business) market.

Pagbank is the big opportunity for the future. It is growing revenue at 120% per annum and is adding consumers quickly in one of the most under-banked large countries outside of India. A long runway still beckons for growth.

So let’s look at both PagSeguro – the merchant acquisition part, as well as Pagbank to see how growth has continued and how profitability might improve over the coming quarters as macro factors like interest rates ease costs.

PAGS has fast growth with a long runway

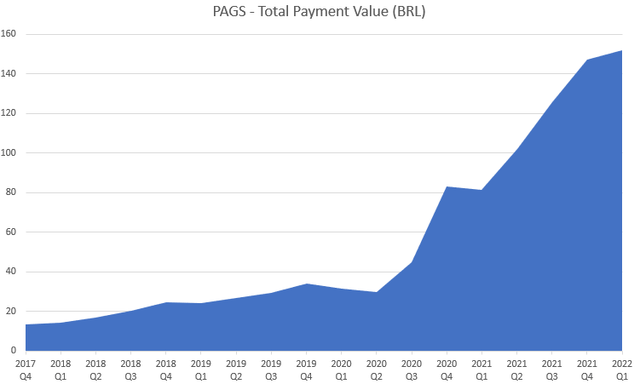

The key to understanding PAGS today is Total Payment Value (TPV) growth.

This is a combination of merchant acquiring business, which is the vast bulk of current profits and growth.

PAGS TPV Growth (Caterer Goodman)

Growth has actually accelerated since the COVID dip of Q2 2020. This is a combination of:

- PagSeguro acquiring business widening focus to small and medium companies rather than solely targeting micro-businesses.

- Pagbank is also growing active users very quickly and the transactions that result from this are from merchants and consumer’s e-bank accounts.

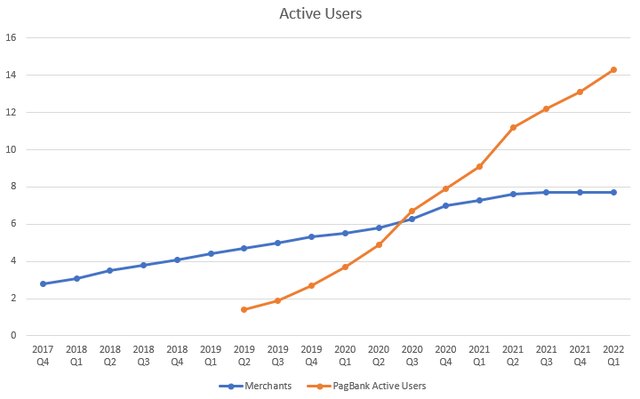

PAGS Active Users (Caterer Goodman)

Merchant acquiring might look like it is slowing but user growth is the wrong metric. TPV (Total Payment Value) is the better metric and continues to grow quickly due investment in Hubs which are targeted towards slightly larger companies than the traditional focus on micro-businesses.

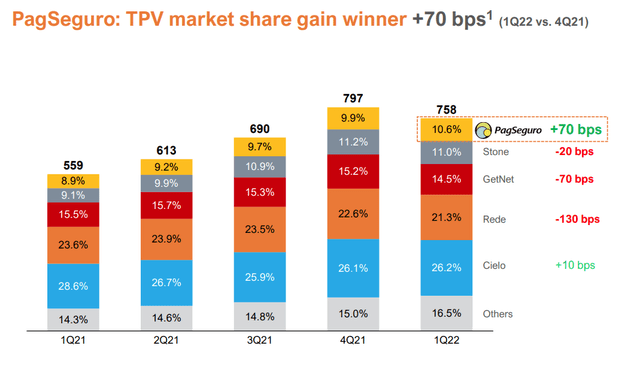

SMBs (small and medium businesses) often have an existing provider yet have much larger transaction volume per month. You can see the results in the improvement of market share in the last year, see below.

TPV Market Share Winner (PagSeguro Digital)

An improvement of 70 bps in a quarter and 170 bps in a year might not seem dramatic but it is strong and steady growth in a market with real inertia.

TPV growth however continues to exceed 50% per annum.

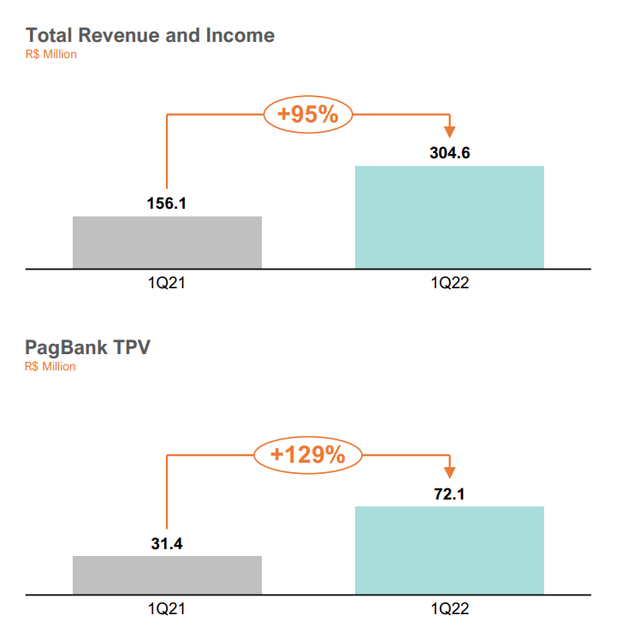

Pagbank is continuing to grow at 100%+

Any company that is growing at or above 100% is always worth a look. Rates this fast can’t be sustained forever. But given the size of the opportunity, double digit growth should last for many years.

Pagbank Growth (PAGS Q122 Presentation)

It’s useful to note that Pagbank’s initial growth came from its base with merchants but it has since broadened.

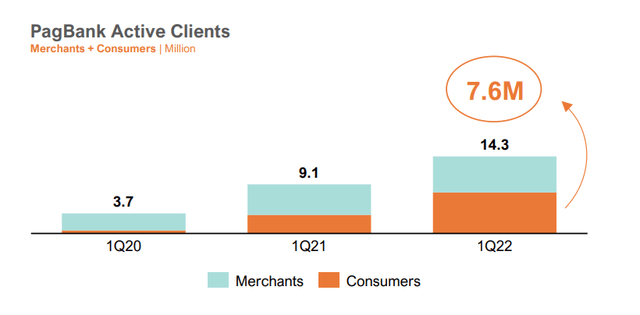

PagBank Active Clients (PAGS Q122 Presentation)

From negligible numbers just 2 years ago consumers now comprise 7.6 million active users and more than half the total. Still, Brazil has 212 million people so that 7.6 million active consumers could double a few more times yet.

Pagbank has a long runway in Brazil

The TAM (total addressable market) here is vast. Brazil is both highly concentrated with the big 5 banks handling 80% of banking. Yet some estimate 30% of Brazilians are still entirely unbanked.

As a reminder, Pagbank’s market began in converting the unbanked micro-businesses and consumers, but isn’t limited to here.

Via this approach, in just over 3 years Pagbank has become the second largest regional bank in Brazil. But that underplays the potential size.

Let’s have a look at quick comparison of two leading banks and PAGS.

| Deposits R$ | Growth y/y | Rank | |

| Itau Unibanco | R$ 828 B | 4.4% | 1 |

| Banco Bradesco | R$ 756 B | 11.6% | 3 |

| Pagbank | R$ 11.2 B | 124% | NA |

- Deposits are customer deposits without repo agreements.

- Rank is by assets in 2021.

- Pagbank rank is unknown but outside Brazil’s top 50.

Even if growth rates ease from year 3, it seems of R$ 100 B in deposits in 4 years is achievable. That would be sufficient for a profitable lending operation.

The biggest catalyst for PAGS? Peak interest rates

The biggest headwind for net income the last 18 months might start to ease.

Quickly spiking interest rates have created a big cost headwind for PAGS as well as competitors like STNE.

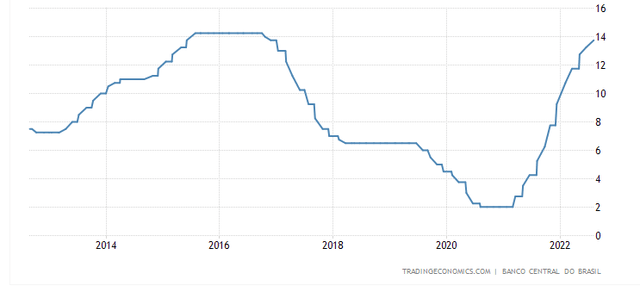

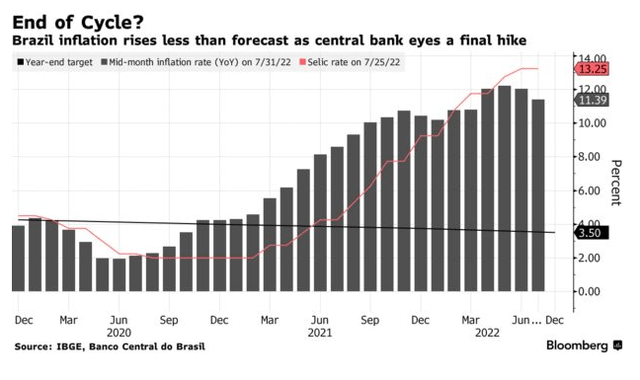

Brazil’s central bank chief moved to cool inflation long before the Fed. Rate hikes started back in early 2021, rising from 2% to an eye-watering 13.75% in early August this year. See figure below.

Brazil Interest Rates (Trading Economics)

This interest rate rise has been a material challenge as the cost of deposits on Pagbank has risen quickly. During the Q1 2022 conference call,

Our financial expenses in Q1 2021, was R$44 million and in Q1 2022 was R$621 million. So it’s a difference around R$580 million in financial expenses. Of course, that’s happened because of the increase in base interest rates.

If you annualize that, this R$600 million times four, we are talking about R$2.4 billion as an increase in financial expense, a big headwind. And even with that, we are growing our net income in absolute terms, which for us is a huge, huge achievement because you can imagine R$2.4 billion before taxes is a big headwind and we’re still delivering a net income higher than last year of 29%, if you look in GAAP measures.

How much further will rates rise?

Currently rates are 13.75% and inflation was 11.39%, so Brazil has positive real yields. Further, the figure below shows inflation may have peaked in June. Provided energy doesn’t go crazy again, we’d suggest interest rates are close to their peak. Forecasters expect perhaps one more hike of 0.25% in September but few think more will be required.

If rates are close to a peak, then the worst of the financial expenses hikes are also likely in the rear vision mirror. Any fall will become a tailwind.

Higher interest rates would be less of an issue if PAGS were more active in credit, and lending its deposit base, but that’s not (yet) the case.

Lending growth has been conservative

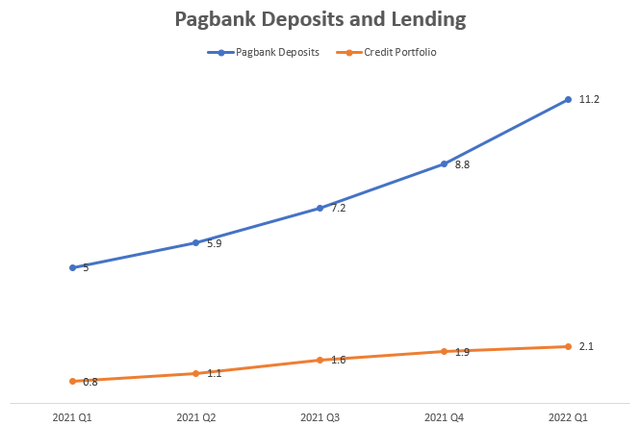

While deposits have jumped by R$ 2.4B in a quarter, lending out this asset base doesn’t seem urgent for PAGS. Lending increased by only R$ 200M. That translates to $480M USD in deposits vs just $40M increase in credit.

Pagbank Deposits and Lending (Caterer Goodman Partners)

PAGS lending operations are still conservative because operations are still new, disrupted by COVID and only now approaching economic size.

Consider this timeline.

- 2019 – January acquired full banking license.

- 2020 – March to August – Decided to pause credit underwriting for COVID.

- 2021 – Launched overdraft loans for business.

- 2022 – Accelerated CD backed Credit Cards but otherwise cautious.

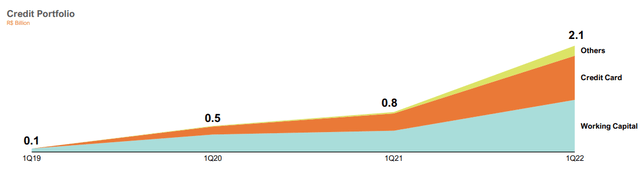

But that if you take the larger view you can see this progression.

PAGS Credit Portfolio Components (PagSeguro Digital)

It’s our impression that PAGS is doing smaller scale testing marketing of different credit offerings until it is comfortable with its product and risk/return profile. That’s comforting to see.

- Secured credit card business for consumers is a good fit for PAGS.

- Working capital for PagSeguro’s merchants is also a good fit.

PAGS strategy of sticking to credit product offerings that utilize its technology, client base and payments expertise rather than rushing loans out the door to get its balance sheet working harder, is an approach we support.

The cautionary tale is easy to find. In 2021 closest competitor StoneCo’s was forced to create credit loss provisions of R$ 400M because of poor controls and a faulty migration of their registry system.

A second catalyst for PAGS? Pagbank turns profitable

Pagbank is still new and costly from growing fast but will soon produce a contribution to the bottom line. That’s a good sign. We know this because it was a response to a question at the last earnings call, CEO Ricardo Dutra;

(Profitability for Pagbank) If it’s not in the Q4 this year, that we said, it’s going to be in the following quarter.

Still, the primary focus is growing client numbers.

…So we are following the idea here or the rationale here to speed up our Pagbank acquisition of clients. We are doing very well, I can see the numbers. Monetization could not happen in the class or the same pace that we expect to have, but we are already the second largest regional bank in Brazil, so keeping in profitability will be a consequence.

Pagbank won’t contribute significantly to net income in 2023 but it remains a big opportunity as growth produces strong economies of scale on top of a very low cost base.

Pagbank’s cost to serve is just 10% of incumbents

In their Q4 2021 presentation PAGS estimated that their cost to serve banking clients is less than 10% of traditional banks. In real numbers it would be R$ 74 per year compared to a traditional bank’s costs of R$ 994.

This means:

- PAGS has profitable access to far larger section of Brazil’s population.

- Brazil’s middle class and SMB are far more profitable for PAGS, or:

- It allows PAGS to price products keenly to win market share.

But why can’t incumbents invest technology to drive cost savings?

It’s possible, but ask any IT consultant to banking about the complexity and fear associated with changing complex legacy systems. Any mistake is a career ender. Bank branches are also harder to close than you’d expect due to community opposition.

There are numerous cultural and technical impediments to improving technology and removing costly branches. This is true of incumbents around the world, who do their best slowly over time. Brazil is no different.

Investments in Hubs have increased costs but are producing continued growth

PAGS commenced their Hubs strategy in the second half of 2020 to target SMBs. As Co-CEO Alexandre Magnani explained on the June earnings call:

… hubs represent today 25% of our TPV. We have around 300 hubs spread all over the country covering around 80% of the Brazilian GDP geography locations.

We have a very compelling paybacks in our hubs operations between four to six quarters. What we see is that through our superior logistics infrastructure same-day prepayment and Pagbank offering, we have been growing much faster than the competition in our hub strategy, exploring and gaining share on the SMB segment

This expansion adds immediately to the cost base while the income adds up over time as merchants send transactions via PagSeguro.

So although HUBS are not a one-time expense, the benefit and return only builds up over time. Whilst the ongoing cost remains the same.

Further, most entries into new market segments are most costly and less productive in their early days. After 18 months of operation, as PAGS is now with their Hub’s approach, executives see what works and what doesn’t. Thus, we will continue to see costs moderate and returns improve.

Brazil’s exports will help sustain the economy

Brazil is very well suited to benefit from a world with shortages of food, energy and some commodities.

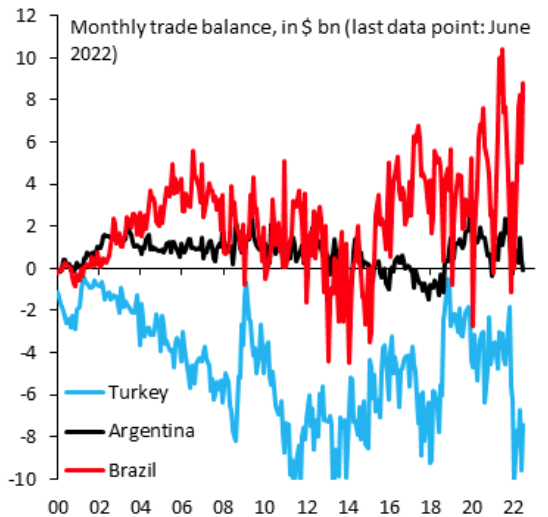

Brazil Trade Balance (IIF)

This has helped Brazil’s trade surplus to continue trending up in 2022.

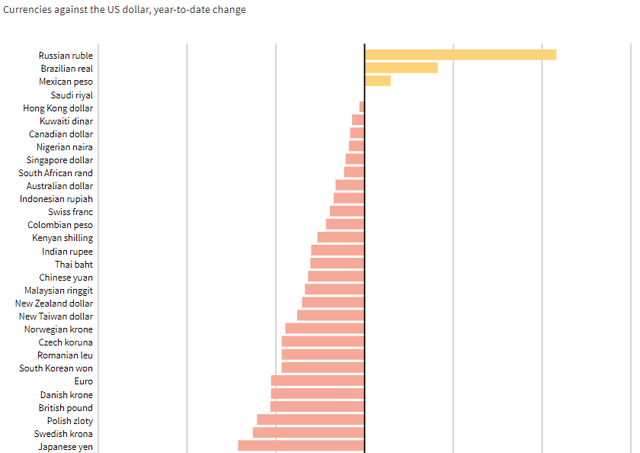

Due to aggressive rate raises and strong trade terms, the Brazilian Real is one of the few currencies up against the USD in 2022.

Currencies vs USD YTD Aug 17 (DailyFX.com)

The lines in the figure above represent 10% increments both plus and minus.

Further, despite higher rates, Brazil’s economy continues to expand faster than economic forecasters expected, growing at 3.09% over the year to June.

Risks

Politics in Brazil could be unstable this year.

Former President ‘Lula’ de Silva has a firm lead over current President Jair Bolsonaro in the opinion polls. The former army captain Bolsonaro has raised concerns he will not respect the October vote results. Brazil has been a more stable democracy in recent decades, so the risk is low, but it exists.

Competition could strengthen

StoneCo remains the most agile and effective competition despite credit missteps over the last 12 months. Another competitor to watch is VC backed private company Neon which is focused on fee-free e-banking and reported to have 16 million clients.

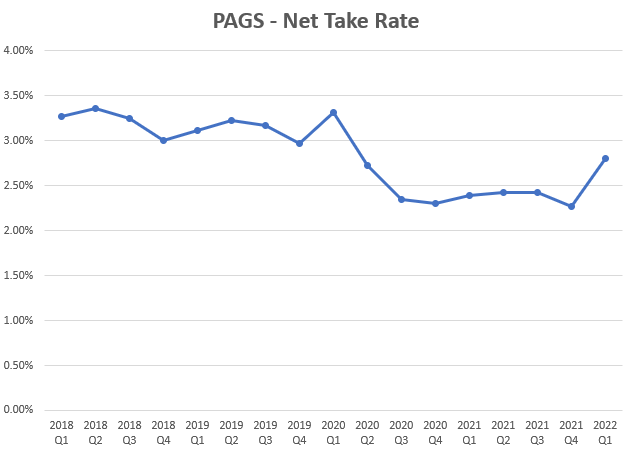

What about critics never-ending forecast of declining ‘Net Take Rates’?

The most common refrain we have heard from critics over the years is that PagSeguro’s industry leading margins are bound to be competed away.

Take rates have indeed eased as PAGS over the last 2 years has entered more competitive markets and experienced cost headwinds.

PAGS Net Take Rate (Caterer Goodman)

The critics seemed right when in 2020 net take rates fell. This was partly from competitive pricing for new markets but also temporarily due to the Coronavoucher payments they helped process for the government.

Yet ‘take rates’ have actually edged up in 2022 as PAGS is getting increasing amounts of ‘full-stack’ transaction processing. Full-stack being all three of the bank, switch and merchant acquirer. This is a result of Pagbank increasingly issuing credit cards. Check out the orange wedge in the credit section above.

Thus, we think 2.5% is a sustainable rate for at least the next couple of years. Yes this is higher than most competitors who are in the 1.5-1.8% range.

But rumors of the death of PAGS Net Take Rate advantage remain overstated.

Valuation is very fair today and cheap for tomorrow

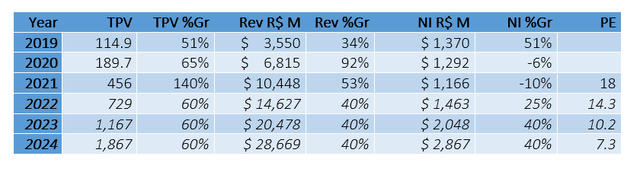

We have combined historical numbers for PAGS with our own forecasts based on the following conservative assumptions:

- TPV growth of 60% and Revenue growth of 40%.

- Assume net margin is 10% (from 11% in 2022 Q1).

- Assume capitalization of R$ 21 B or about $4.2B USD (~$13 per share).

PAGS Earnings Forecast (Caterer Goodman)

We believe these assumptions are conservative given;

- a high chance interest rates are close to a peak and financial expenses cool,

- the growth track record has often been higher in the past,

- that Pagbank is on the cusp of profitability in early 2023,

- strengthening profitability that results from economies of scale in lending.

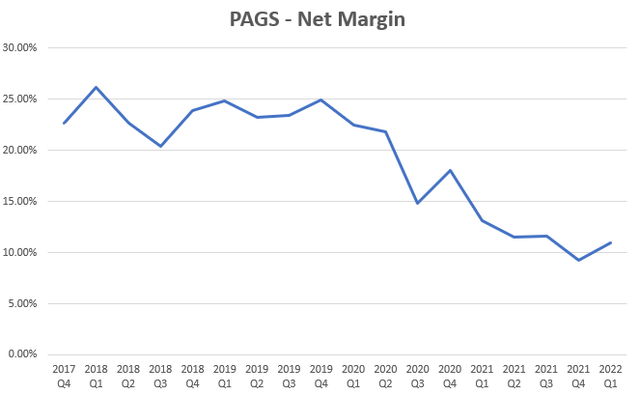

PAGS Net Margin (Caterer Goodman)

In particular the assumption that net margins are 10% is conservative.

See the figure above, and the lowest period was 2021 when 11.5-13.10%, except for Q4, occurred when interest rate spikes increased costs. It had a margin of about 12-15% as things paused and then eventually reversed.

Even with conservative assumptions, we believe PAGS is at fair value and quite likely to outperform our modest assumptions.

Summary: Two near-term catalysts for a profit bounce

When looking for stocks, we look for the following: long term buy and hold winners, strong 30%+ growth, dozy incumbents, large markets, industry leading margins from a sustainable technology advantage, and a profitable track record with strong management.

We think PAGS ticks all those boxes.

Not only that, but over the next 6 months we see net income growth improving from peaking interest rates and a turn to profitability for Pagbank.

Further, Mr Market is currently providing an opportunity to enter at quite a fair price of 18 times 2021 earnings and 7.3 times what we believe is a conservative forecast of what PAGS should be earning in 2024.

However, if you don’t yet own PAGS, stage your entry.

As an emerging market fintech, PAGS can be volatile. Current market conditions look overbought given the global economic and political concerns. More volatility could be ahead. The valuation is acceptable today, but smart investors should be prepared to buy again in the sub $10 range. Be aware that quarterly earnings is this week on August 25 and often has a significant impact on stock prices both up and down.

PAGS is one of our picks for a long-term buy and hold approach.

Be the first to comment