Charday Penn/E+ via Getty Images

The modern era has come to be defined by technology. This is especially true of technology that’s dedicated to the processing and understanding of data. This has opened a tremendous store of opportunity for companies, but it has also brought along with it a number of challenges. Incidents can easily occur across any complex ecosystem, resulting in, at times, tremendous cost and time. And one company that has built a platform dedicated to empowering teams to more easily handle this kind of trouble is PagerDuty (NYSE:NYSE:PD). Over the past few years, the financial growth achieved by PagerDuty has been impressive. Long term, that’s likely to continue to be the case. Having said that, the company is having issues with profitability and shares look rather pricey. At some point in time, the firm may make sense to buy into. But at this moment, shares don’t look even remotely close to being attractive.

PagerDuty – A fast-growing tech play

According to the management team at PagerDuty, the company operates as a digital operations management platform that manages urgent and mission-critical work for digital-oriented businesses. More specifically, the company makes it possible for teams within organizations to respond rapidly to incidents for the purpose of resolving them or avoiding customer issues, reducing noise, predicting and avoiding performance degradation, improving productivity, and even accelerating digital transformation.

To best understand the company, though, we should dig a bit deeper into its specific functionality. For starters, one service the company has is its PagerDuty Modern Incident Response. This particular offering provides a real-time view across the status of a digital service while working to reduce noise and remove false positives from the picture. In short, when an incident does occur across a customer’s services, PagerDuty’s product immediately engages in task automation in order to automate diagnostics and remediation when and where possible. It also provides advanced incident response capabilities for the purpose of identifying and mobilizing the appropriate responders needed to manually address anything that might need addressing. Their PagerDuty Rundeck Automation offering empowers users with the ability to create automated workflows that span different tools, APIs, system commands, and more, all in order to safely hand off the knowledge required to use those tools correctly and consistently. This gives customers the ability to safely extend operations privileges to other teams and business units within an organization.

Through their PagerDuty Event Intelligence offering, the company utilizes machine learning to correlate and automate the identification of incidents, even if that means picking them out from billions of individual events. The service then groups related events into a single incident, performs advanced suppression to prevent notification of non-actionable events, and constantly learns from similar incidents in order to provide teams with better context and insight in the future. And finally, we have the PagerDuty for Customer Service offering. Using real-time data, two-way communication, and a fully integrated tool stack, the company gives its customers the ability to act as a unit and to resolve issues within their own organizations faster.

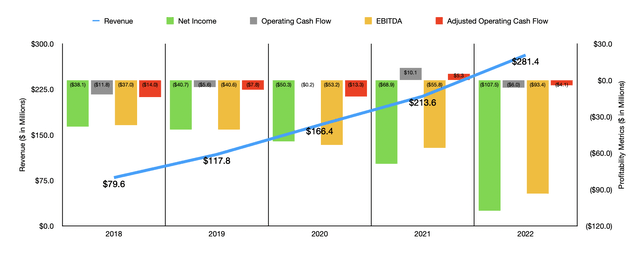

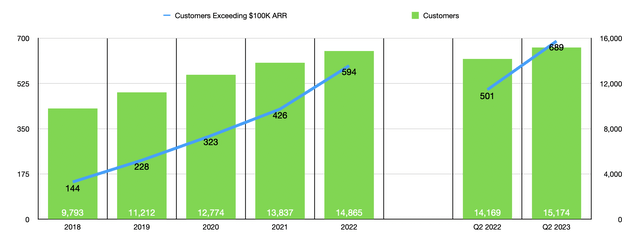

Clearly, companies out there have found these services to be immensely valuable. Between 2018 and 2022, sales of the company expanded from $79.6 million to $281.4 million. This growth in revenue was driven by a significant improvement in the number of customers on the company’s platform. Back in 2018, for instance, the business had 9,793 customers. By 2022, this had grown to 14,865. Even more impressive has been the growth in the number of customers responsible for over $100,000 in annual recurring revenue. This number rose from 144 to 594 over the same five-year window.

Although the revenue picture for the company has been great, the growth of the enterprise has come at a high cost. In 2018, for instance, PagerDuty generated a net loss of $38.1 million. This loss grew in each of the past five years, hitting $107.5 million during the 2022 fiscal year. Although this is bad, operating cash flow has been stuck in a fairly narrow range of between negative $11.8 million on the low end and positive $10.1 million on the high end. In 2022, the company generated a net outflow of $6 million. A similar trend can be seen when looking at operating cash flow but adjusted for changes in working capital. Meanwhile, EBITDA for the company has been anything but great. It has closely mirrored what the net profits of the firm were over the past five years, growing from negative $37 million to negative $93.4 million over the same window of time.

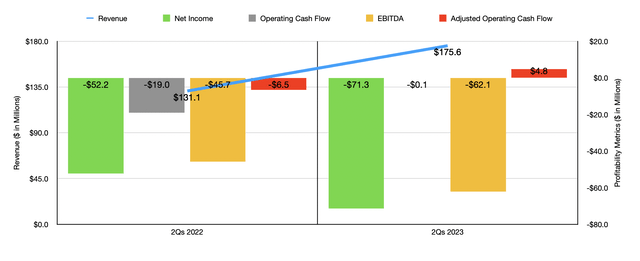

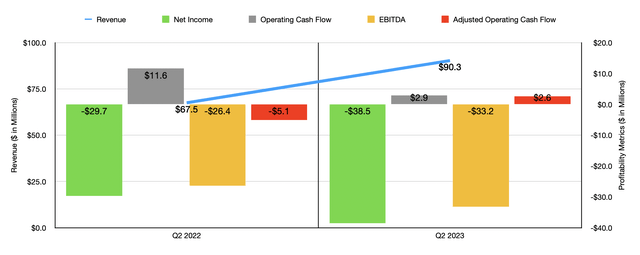

When it comes to the 2023 fiscal year, growth for the business continues. Revenue in the first half of the year came in at $175.6 million. This represents an increase of 33.9% over the $131.1 million generated the same time last year. This growth was driven in large part by a rise in the number of customers on the company’s platform. This number increased from 14,169 at the end of the second quarter of 2022 to 15,174 today. Meanwhile, the number of customers responsible for more than $100,000 in annual recurring revenue grew from 501 to 689. For the second quarter of the year alone, which management just reported for, sales came in at $90.3 million. That represents an increase of 33.8% over the $67.5 million generated one year earlier. In addition to dwarfing results from last year, the company’s performance also translated to revenue that was $2 million higher than what analysts anticipated leading up to the release.

On the bottom line, however, the picture has not been so great. For the first half of the year, the company generated a net loss of $71.3 million. That compares to the $52.2 million net loss generated the same time last year. For the second quarter alone, the company’s net loss was $38.5 million, coming in worse than the $29.7 million loss achieved in the second quarter of 2022. On a per-share basis, the loss of the company came out to $0.44. That’s down from the $0.35 generated one year earlier. It’s also $0.20 per share worse than what analysts were hoping for. But if we were to use the adjusted loss per share of $0.04, then the company would have beat expectations to the tune of $0.04 per share for the quarter. Of course, we should also pay attention to other profitability metrics. For the first half of the year, the firm’s operating cash flow went from negative $10 million to negative $0.1 million. And the adjusted figure for this went from negative $6.5 million to $4.8 million. The only profitability metric, other than earnings, to worsen was EBITDA. This went from negative $45.7 million to negative $62.1 million. This same kind of trend year over year can be seen in the second quarter alone, as the chart above illustrates.

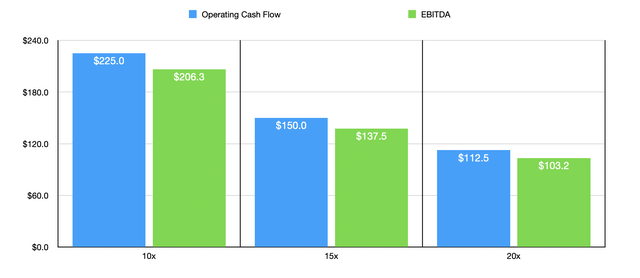

When it comes to the 2023 fiscal year in its entirety, management anticipates revenue of between $365 million and $370 million. This should translate to year-over-year growth of between 30% and 31%. The adjusted loss per share, meanwhile, should translate to a net loss for the company of roughly $9.8 million. There has not been any guidance when it comes to other profitability metrics. This really makes it impossible to value the company. But what we can do, instead, is ask ourselves what kind of cash flow the firm would need to generate in order to be at least fairly valued at current pricing. In the chart below, you can see hypothetical scenarios where the price to operating cash flow multiple and the EV to EBITDA multiple would each be either 10, 15, or 20. What you should notice here is that the company is far away from any of these levels at present. Yes, investors are anticipating rapid growth to continue. But at some point, the firm must generate positive cash flows in order to be a worthwhile investment.

Takeaway

All things considered, PagerDuty seems to be a fantastic growth story. Recent earnings results were mixed, but the company does have a history of significant losses that investors need to feel comfortable with. Eventually, the company must improve operations enough in order to generate positive cash flow if it wants to thrive. What I worry about is that the bridge between where things are today and where they would need to be for the business to be at least fairly valued seems awfully significant. Because of the rapid growth the company is experiencing, it’s difficult to rate the company too harshly, but until we see bottom line results improve significantly, shares look overpriced.

Be the first to comment