Michael Vi

Given that the NASDAQ (QQQ) and software stocks in particular have been some of the hardest hit in this bear market, we have been searching there for opportunities, but it has been more than challenging finding cheap software stocks, especially when considering the large amounts of stock-based compensation they tend to give out.

One company that, at first glance, we found promising and thought would be interesting to analyze is PagerDuty (NYSE:PD). It is an interesting company that is working on a really hard problem of “anticipating the unexpected in an unpredictable world.” What it means by that is it tries to predict when a software application will fail, so as to respond to the issue as fast as possible, ideally even before the issue happens.

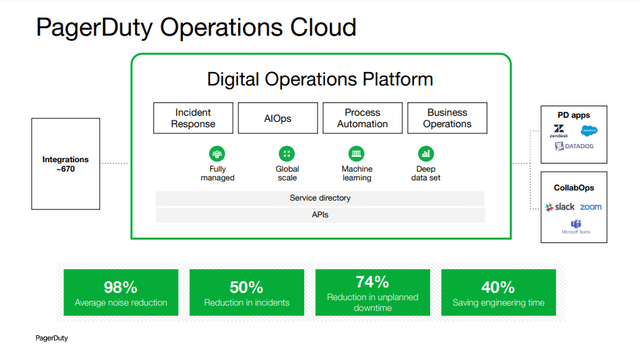

PagerDuty’s technology helps reduce time to troubleshoot issues by ~77%, it reduces unplanned downtime by ~74%, and helps reduce incidents by ~50%. The slide below shows a good overview of PagerDuty’s operations cloud and its benefits.

PagerDuty Investor Presentation

Addressable Market

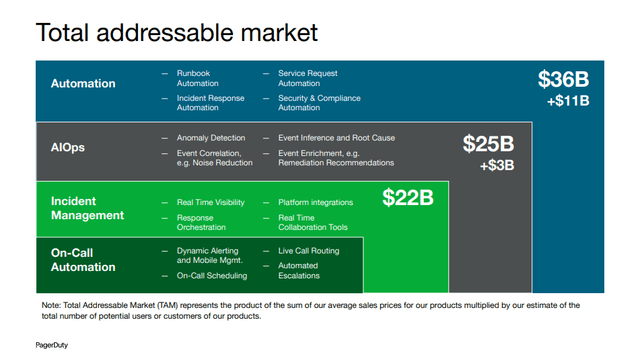

The addressable market for PagerDuty is big to start with, but expands greatly as you add AI/Machine Learning to anticipate incidents and when you add Automation to the technology. By adding incident management, AIOps, and Automation, PagerDuty estimates that its addressable market expands to a massive $36 billion.

PagerDuty Investor Presentation

PagerDuty Financials

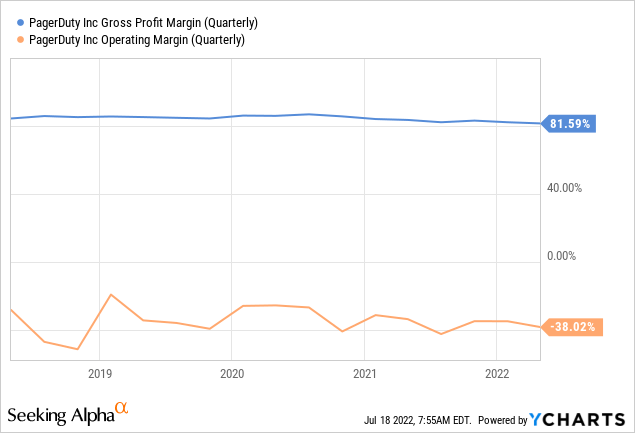

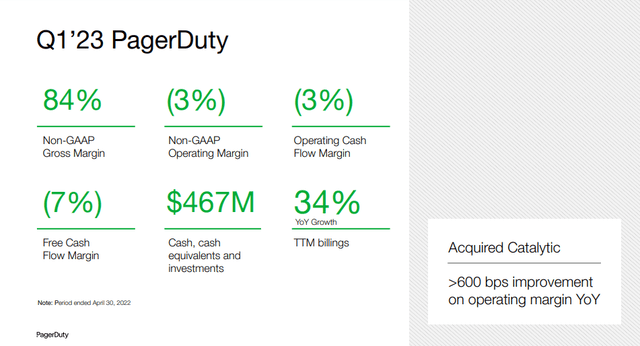

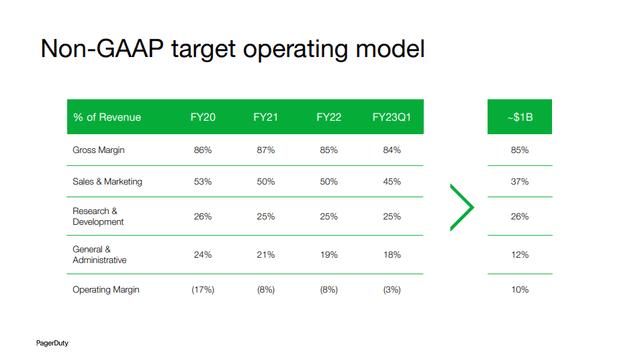

One big problem with PagerDuty is that despite showing that it is getting close to break-even in non-GAAP numbers, its GAAP losses are massive, and worst of all, there does not appear to be any significant operating leverage from increasing sales, as operating margins are not showing an upwards trend. We find this very worrisome, as it makes it difficult to see a path to GAAP profitability for the company, unless the company starts to moderate its spending, including its stock-based compensation.

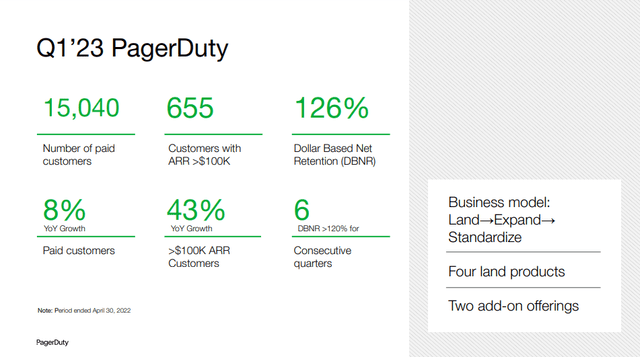

On the positive side, PagerDuty has remarkable retention numbers, with a dollar-based net retention rate of 126% in Q123, with 6 consecutive quarters during which the retention rate is above 120%. The company also showed some growth in paid customers of 8% year over year, but we find this less impressive given that the company is still supposed to be in the early stages of growth. Therefore most of the growth is coming from up-selling current customers, which at some point will start being an issue as the company runs out of add-ons and extra-services to sell to existing customers.

PagerDuty Investor Presentation

We find it a red flag when GAAP and non-GAAP numbers differ significantly, and in this case PagerDuty is trying to present a financial picture of a company close to break-even, despite massive GAAP losses. Most of this difference comes from stock-based compensation, which the company is giving out in large amounts.

PagerDuty Investor Presentation

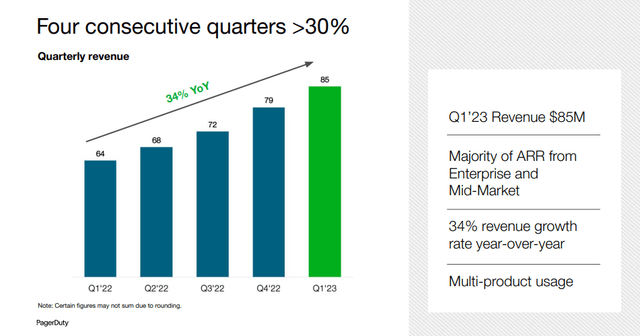

Growth

The company is growing revenue at a fast pace, mostly by up-selling customers as we saw, and to a lesser extent by adding new customers. We have no reason to doubt the company that the addressable market is massive, offering the opportunity to grow revenues at a high rate for a long time. We do worry somewhat that most of the growth appears to be coming from existing customers through up-selling, and would find the growth healthier if it was more balanced between up-selling and new customers.

PagerDuty Investor Presentation

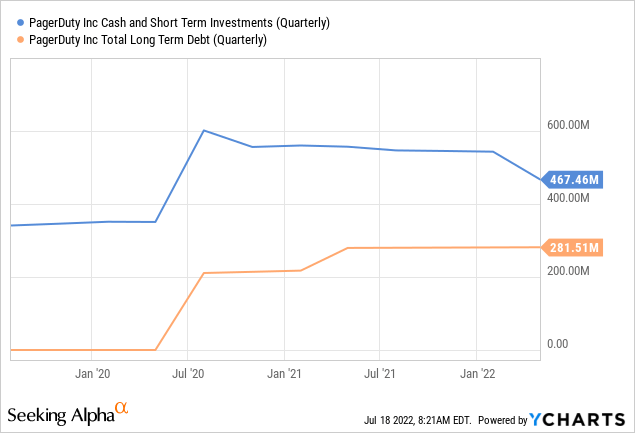

Balance Sheet

We have no concerns about the balance sheet which has more cash and short-term investments than long-term debt. Its net cash position is about $185 million which means the company is in no immediate need to raise funding or achieve profitability. Still, it is important to remember that the company remains unprofitable, so the cash is still needed to fund losses and cash-burn.

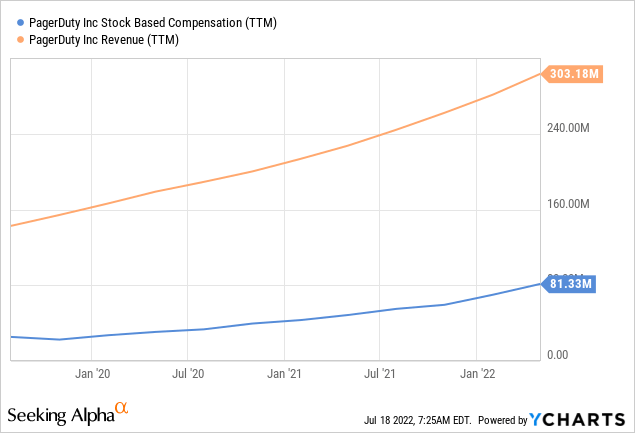

Stock Based Compensation

We find stock-based compensation at PagerDuty to be excessive, at more than 25% of revenues in the trailing twelve months. This is the main reason the company has significantly negative GAAP operating margins, and why it is losing so much money. What is even more worrisome is that the company has been increasing stock-based compensation as revenue has increased, preventing operating leverage from taking hold. Unless the company moderates this expense, we don’t see any clear path to profitability.

PD Stock Valuation

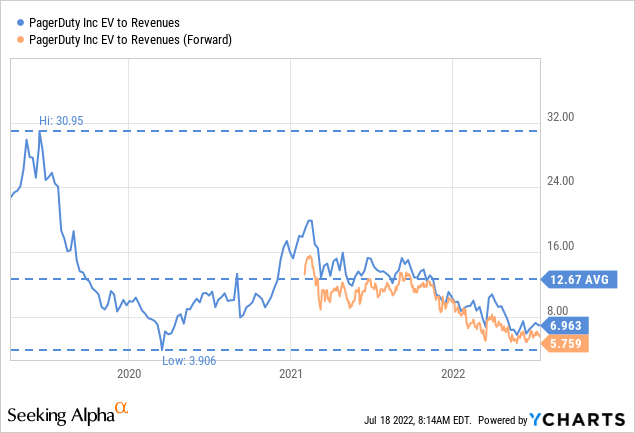

Some might be tempted to call PagerDuty cheap because it is trading at a historically low multiple to revenues. Its forward EV/Revenues multiple is ~5.75x, less than half the ten-year EV/Revenues average at which the company has traded.

Unfortunately, we do not believe this automatically makes shares cheap, and in fact we believe they remain incredibly expensive. Our argument is that the company’s own target operating model for when they reach $1 billion estimates a Non-GAAP operating margin of ~10%. If they maintain the current absolute level of stock-based compensation this would produce paltry GAAP profits of ~$19 million. If the company continues to increase stock-based compensation with revenue growth, and keeps it at ~25% of revenue, this would result in GAAP operating margins of roughly -15%. So based on their own target operating model, even at $1 billion revenue, it is likely that the company will deliver either paltry GAAP profits or worse, significant GAAP losses. As can be seen, the valuation is very dependent on how stock-based compensation progresses from here.

PagerDuty Investor Presentation

Risks

We see three important risks with an investment in PagerDuty. One is that growth appears to be coming mainly from up-selling current customers, which at some point will become much harder. Another risk is that the company is giving out excessive stock-based compensation that shows no sign of moderating, and which could mean that even at a revenue rate of $1 billion the company could continue to generate GAAP losses. Finally, given the lack of operating leverage shown so far with its GAAP operating margin, we don’t see a path to profitability unless the company becomes more disciplined with its spending and stock-based compensation.

Conclusion

Once you take stock-based compensation into account, it is clear that PagerDuty is nowhere near achieving profitability. The lack of a clear path to GAAP profitability makes it difficult to value the shares, and given the likelihood of the company still losing money at $1 billion revenue makes us believe that the company remains expensive even at the current ~5.75x EV/Revenues multiple. Given the massive GAAP losses, and that the company shows no signs of moderating stock-based compensation, we are rating the shares as ‘Strong Sell’.

Be the first to comment