Melpomenem

Intro

Given the elevated volatility in Pagaya Technologies (NASDAQ:PGY) (Israeli fintech firm) of late plus the fact that the company has a $7 billion-plus valuation, this company would be a prime trading stock for us if indeed the stock had associated derivatives. Shares popped to the upside by more than 100% last Friday in what looked to be a short squeeze in the stock.

When trading solely stock, it’s all about registering a capital gain from the long or short side. This means irrespective of Pagaya‘s fundamentals, one is essentially taking a 50/50 shot when choosing a direction. On the contrary, when trading a stock’s associated calls and puts, one has the option to trade volatility which usually is an excellent choice from a probability of profit standpoint.

This means (due to the absence of associated call and put options in Papaya), those short sellers who got caught on the wrong side of the short squeeze late last week were not able to use options (which would have potentially defined their risk) in their positions. Although the number of outstanding shares currently comes in at almost 459 million, the actual float only comes in at a mere 340k which means that future squeezes remain a distinct possibility especially if any significant number of shares get shorted in here.

PGY Stock’s Price To Sales

The spike in Pagaya’s share price will undoubtedly attract more short sellers (When short-ratio conditions stack up) in due time. The valuation of the company remains the biggest calling card for short sellers as Pagaya‘s revenues come in at $446 million over a trailing twelve-month average off a market cap of $7.66 billion. These numbers equate to a trailing sales multiple of 17.18 which remains light years away from the fintech average sales multiple which comes in well under 2.

Pagaya Technologies Business Model

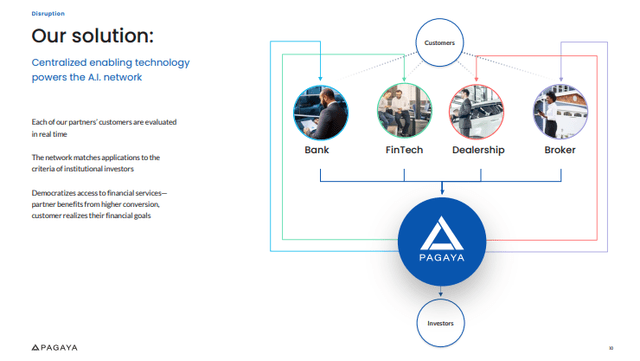

Now for a fintech firm no matter how good the company’s fundamentals may seem, the company’s current valuation is certainly on the high side. With the company just off the back of the recent news concerning the EJF Acquisition Corp as well as the commencement of trading on the Nasdaq, management reiterated that it wants to be an AI frontrunner in the overall banking ecosystem. By being the middle man (through collecting fees derived from its AI technology) between Pagaya‘s partners (banks, car dealerships, etc.) and investors, the company is adamant that the technology (where it believes it can vet borrowers far more efficiently) can be a win-win situation for everybody involved.

Although this may be true at present, the proof of the pudding will come when we see how Pagaya’s technology will stand up to a potential recession when borrowers´ disposal income would come under pressure. Remember, Pagaya’s forward-looking growth rates are baked into the stock’s present valuation. Revenues grew by close to 400% in 2021 which on the surface may seem very difficult to replicate but we would remain cautious in shorting this stock for the following reason.

Pagaya AI Network Solution (Company Website)

Strong Banking Tailwind

Given that 2021 revenues actually beat guidance by close to 20%, these types of growth rates make me remember the fact that markets can remain irrational far longer than one can remain solvent. In saying the above, the “expected” steep drop in Pagaya‘s sales growth is not a foregone conclusion by any stretch of the imagination when one studies how banking is changing extremely quickly in earnest. Whether it be phone services, cars, or the e-commerce terrain just to give a few examples, the world is moving faster and faster toward a “service” economy. This means that on average in the future, consumers will be enticed into lower monthly payments for their products and services (renting the commodity instead of owning it) so more banking transactions can take place.

Who’s going to benefit? This shift in banking is obviously a huge tailwind for Pagaya because its partners and investors will have huge amounts of business to choose from. This is why short-sellers need to be careful here because there will not be a lack of partners here from Pagaya‘s standpoint. How could there be when the potential is there for payments to be going in one direction forever?

Conclusion

Therefore, to sum up, irrespective of how expensive this stock seems at present, investors looking at this play from the short side should never dismiss Pagaya‘s share-price action on the technical chart. Shorting this name remains very risky. We look forward to continued coverage.

Be the first to comment