maybefalse/iStock Unreleased via Getty Images

Seeking Alpha’s readers are an interesting and perhaps unique mix. This is more pronounced in the world of Options than investing in stocks in general. As can be seen in the comments section of our last options article about Palantir (PLTR), SA readers vary from advanced options experts to those who are downright afraid of options to the extent of treating cash secured puts as risky.

This time, we are exploring Alibaba Group Holding Limited (NYSE:BABA) as a potential stock to sell puts on while presenting a few points to ponder based on reader comments in previous articles. Let’s jump into the details.

Alibaba- Key data points

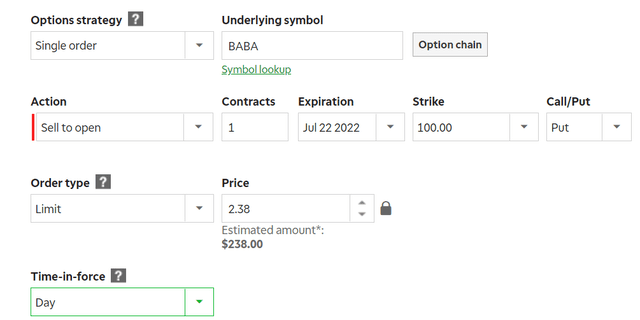

- Strike Price: $100

- Expiration Date: July 22nd, 2022

- Number of Contracts: 1

- Premium: $2.38/share, for a total of $238.

In simple words, the put seller will be collecting $238 to buy 100 shares of Alibaba at $100 if the stock reaches $100 or below by July 22nd, 2022. Time decay is in favor of the option seller.

What’s the expected return and possible outcomes?

Return: The premium collected ($238) for setting aside $10,000 represents a return of 2.38% for about a month. That’s a respectable return for the duration given the current market conditions. Sure, the bear market bounce may continue and the stock may outperform the returns from this option chain but downside starts only at $97.62 for this put seller ($100 strike price minus $2.38) vs. the downside starting right away at the market price for the stock buyer.

Outcome #1: If Alibaba stays above $100 by the expiration date, we retain just the premium above. We will not be obligated to buy the shares.

Outcome #2: If Alibaba goes below $100 by the expiration date, we will be forced to buy 100 shares at $100, irrespective of where the stock trades at that time. Keeping the premium netted in mind, the average cost in this case will be $97.62 ($100 minus $2.38).

Outcome #3: As an option seller, one can “buy to close” anytime instead of waiting till the expiration date. For example, let’s say a week after selling this put, Alibaba’s stock moves up to $130 from the current price of $117. In this case, the put seller may “buy to close” the chain to lock in profits and roll the funds onto another chain (or another stock). That may be appealing to those who have the time and patience to play short-dated options many times over. But we typically let the option expire before choosing another chain (or another stock).

Also note that if you start having second thoughts and don’t want to own the stock if assigned, you may “buy to close” at a loss too, saving your $10,000 in process but perhaps losing few more dollars than the premium you received. In short, you may choose to close the chain any time before the expiration date.

Why we wouldn’t mind owning Alibaba at $100

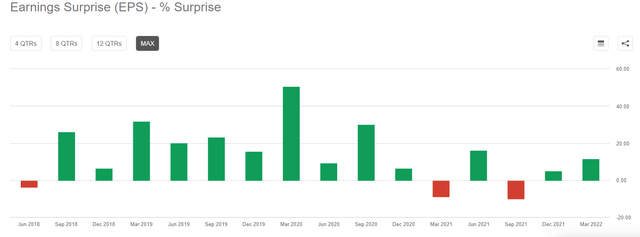

- At $100, Alibaba will be trading at a forward multiple of 13.50. Sure, earnings may be revised down or the company may miss estimates. Let’s water down the projected EPS by 20% from $7.37 to $5.89. Using $5.89 EPS, buying Alibaba at $100 would represent a multiple just shy of 17. As a comparison, despite the near 20% fall year-to-date, S&P 500 is trading at current multiple of about 20. Alibaba has a rich and favorable history when it comes to beating estimates as the company has beaten estimates all but three times in the last 4 years.

BABA EPS Surprise (SeekingAlpha.Com)

- Our portfolio consists of US based stocks almost exclusively. Sure, many operate internationally but almost all are US stocks at the end of the day. We could use some diversification and the market we’ve studied the most after US is China, due to past experience of owning stocks like Baidu (BIDU) and Sohu.com (SOHU). Please note that owning Alibaba or any other Chinese stock for that matter is fraught with risks including but not limited to delisting fears and trustworthiness of their accounting. That said, almost all the negatives appear to be priced in. But for the bear market rally going on, Alibaba would likely still be trading in double digits.

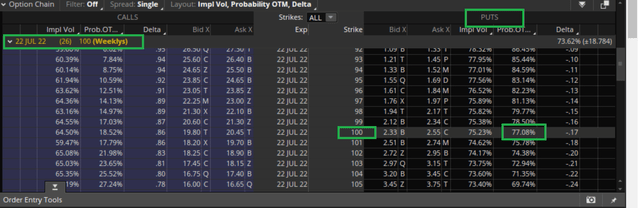

- Stocks are in a bear market bounce as of this writing and we believe this bounce has more room. The $100 strike price is almost a good 20% away from current price and the stock will likely be above $100 with a probability of 77% as shown below. Our intent is the premium in this case, as described below.

Key learnings from previous articles

“When the facts change, I change my mind. What do you do, Sir?” is a popular quote attributed to English Economist John Maynard Keynes. A good investor learns from mistakes made by self and keeps an open mind for feedback from others. This section highlights three key topics from reader comments in the previous articles.

What is your intent, lower price or premium?

Some readers rightly pointed out that too often, the put seller forgets the true intent behind the exercise. Is it to own the shares at a lower price or is it collecting premium as a source of income? Neither is wrong. For us, the intent is generate additional income using the cash in our portfolio. We carefully pick stocks we wouldn’t mind owning at our strike price but quite often, we move onto the next stock should the previous trade close without getting assigned. For example, the cash that we used to secure the premium on Amazon (AMZN) is now free to be used elsewhere. We are not looking at Amazon right now but at Alibaba instead. However, if your intent is to strictly own Amazon at a lower price, consider selling puts on that same name till you get assigned. If you say, “I’d rather buy the stock if am chasing anything in particular“, then the next section is for you.

Stock or Option?

Buy the stock if you like it right here right now. This is not a recommendation to buy Alibaba here per se. But to clarify the obvious, if ownership of shares in the long run is the ultimate goal and you believe the price is right, go for it. But please do understand the downsides of this approach and the cushion Options provide.

One reader argued that selling the $5 puts on Palantir was risky as stocks may plunge through the strike price. Sure, sometimes they do. But sometimes they don’t. Let’s say Palantir plunged to $3 and the put seller gets assigned at $5 in our previous example. After accounting for the premium of 21 cents a share, the put seller is looking at a paper loss of $1.79 per share or $1,790 in total. This is calculated as follows:

- Strike Price: $5

- Market Price when assigned: $3

- Premium collected when selling the put: 21 cents

- Total shares purchased at expiration: 1,000

- Paper Loss is calculated as: 1,000 * ($3-$5+$0.21) = 1000 * (-$1.79) = -$1,790

Now, had the same put seller, who is supposed to be a believer in the stock, bought 1,000 shares at $8, the paper loss would be $5,000 in the event the stock falls through to $3 as argued above.

Climate vs Weather

We wrote in some of our previous articles that selling covered calls works better in down-trending market and selling puts works better in up-trending market. We still stand by this statement. However, an addendum is due.

- In down-trending markets like the present, sell covered calls on days the stock in question is up. This nets higher premium as the stock is closer to your strike price.

- In up-trending markets, sell puts on days the stock in question is down. This nets higher premium as the stock is closer to your strike price.

To understand this nuance, think of the often misused terms: “Weather” and “Climate”. Climate is long term. Weather is short term. Down or Up trending market is long term. Down or up days in a market trend is short term.

Conclusion

Using Options exclusively may not be for everyone but once you understand your intent, risks, and options (pun intended), basic Options strategies can be used profitably around a core portfolio. Get your goals straight (intent), pick a stock you wouldn’t mind owning, execute, learn, and repeat. Good luck.

Be the first to comment