MarsBars

Some BDCs, such as Main Street Capital (MAIN), have seen a run-up in their share prices in recent weeks, but there are some that have been left behind, offering investors a high yield. This brings me to Owl Rock Capital Corporation (NYSE:ORCC), which remains rather inexpensive while throwing off a near 10% dividend yield. In this article, I highlight what makes ORCC a good opportunity at present for income investors, so let’s get started.

Why ORCC?

Owl Rock Capital is one of the top 3 largest BDCs by asset size and is externally managed by Owl Rock Capital Advisors. It was founded in 2015 and due to its larger size, focuses on direct lending solutions for upper middle market companies in the U.S.

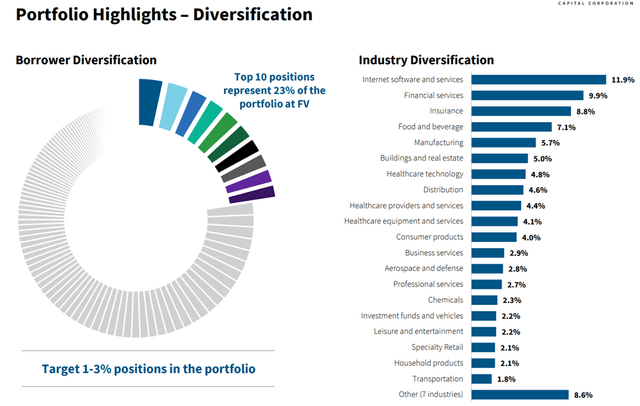

At present, its investment portfolio carries a fair value of $12.6 billion across 168 portfolio companies, an increase of 11 companies since the first quarter this year. The portfolio is comprised primarily of senior secured loans, representing 88% of the portfolio (73% first lien, 15% second lien), and is well-diversified by industry. As shown below, software, finance/insurance, food, and manufacturing make up ORCC’s top 5 sectors representing 43% of portfolio fair value.

ORCC Portfolio Mix (Owl Rock Capital)

ORCC recently released second-quarter earnings that beat Wall Street expectations. This includes achieving a net investment income of $0.32, exceeding the average analyst estimate of $0.31 and rose from $0.30 in the prior year period. This is on the back of $273 million in total investment income, which rose 9.8% from $249 million in Q2 of last year.

Also encouraging, ORCC maintains sound portfolio metrics, with just 1 investment on nonaccrual status, representing just 0.1% of the fair value of the debt portfolio. Moreover, 90% of ORCC’s portfolio investments carry the highest ratings of either 1 or 2 for safety.

It’s worth noting, however, that ORCC’s net asset value per share declined by $0.40 on a sequential basis to $14.48. I’m not too concerned, however, as this was primarily driven by unrealized portfolio markdowns due to wider credit spreads across the broader market. This makes sense, since ORCC’s loan investments are essentially bonds whose value get marked down during times of economic uncertainty, as the market requires a higher premium for taking risk.

Looking forward, ORCC is well-positioned for rising rates, as 98.8% of its debt investments are floating rate. This bodes well for NII per share in Q3 as management outlined the benefits from higher interest rates during the conference call:

As I discussed last quarter, we will see a meaningful benefit from rising rates starting in the third quarter. As you will recall, at the beginning of the second quarter, many of our borrowers reset their interest rate election to three months LIBOR, which was approximately 1% at the time and slightly above the average floor in our portfolio. So there was a limited benefit to our interest income in Q2.

The second quarter ended with three months LIBOR at 2.3% which meaningfully increase the base rate for those borrowers. Holding all else equal had our base rates as of June 30, has been in effect for the entirety of the second quarter, we estimate NII would have increased $0.02 per share, to a total of $0.34 per share in Q2. Additionally, borrowers will continue to reset their interest rate elections throughout the third quarter which will continue to benefit the yield on our portfolio and be accretive to NII.

Meanwhile, ORCC maintains sound leverage with a debt to equity ratio of 1.2x, sitting well below the 2.0x regulatory limit. This gives it plenty of breathing room and funding capacity for its deal pipeline, as ORCC has $1.7 billion in total liquidity, comprised of cash on hand and undrawn debt capacity.

The quarterly dividend of $0.31 is also more than covered by NII per share, and I would expect for coverage to improve considering the above management remarks on rising rates and their impact on NII.

I see value in the stock at the current price of $12.83, which equates to a price to book ratio of 0.89x. As shown below, this sits at the low end of ORCC’s trading range over the past 3 years. Sell side analysts have a consensus Buy rating with an average price target of $15.09, translating to a potential one-year 27% total return including dividends.

ORCC Price to Book (Seeking Alpha)

Investor Takeaway

Overall, I’m encouraged by ORCC’s second-quarter results and believe the stock is attractively valued at current levels. The company is well-positioned for rising rates, as its NII will get a boost from higher interest rates on its floating rate loan portfolio. Additionally, ORCC maintains a strong balance sheet with plenty of liquidity to fund its deal pipeline. For these reasons, I believe ORCC is a compelling value and income play in the BDC space.

Be the first to comment