grandriver

Investment Thesis

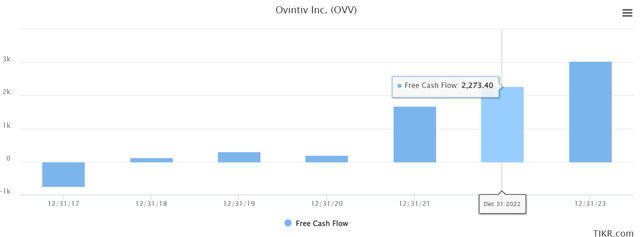

Ovintiv (NYSE:OVV) is an exploration and production (“E&P”) company. Its free cash flows are depressed by its substantially hedged book. To illustrate, Q3 2022 saw OVV’s hedges lead to a loss of approximately CAD$820 million. For a company with a market cap of CAD$20 billion, this is a huge loss.

So why am I bullish on this company? Because as it enters 2023, its hedges will significantly improve. The hedges are better positioned and allow OVV to be exposed to significantly higher WTI and natural gas prices.

As we look forward over the next twelve months, we should expect to see closer to 10% to 13% combined yield, even if WTI and natural gas prices remain flat.

What’s Happening Right Now?

Three different dynamics are at play. Two affect oil prices. One affects natural gas prices.

For oil, there’s the Strategic Petroleum Reserve (”SPR”) and China’s lockdown policy. In more detail, I believe that as we enter 2023, the slowing down of the SPR release is going to remove a significant amount of oversupply in the oil market.

Also bullish for oil, China reopening in 2023 will be a huge driver for oil demand.

While on the natural gas front, there’s been unseasonably warm weather in the Northern Hemisphere, which has seen natural gas demand turn out significantly lower than expected for this time of year.

Assuming normalized weather, we should see natural gas demand increase in the coming months.

Both of these factors will be very bullish for oil and gas prices.

OVV’s Hedged Book

Before drilling down into OVV’s hedges, consider the following.

OVV Q3 2022

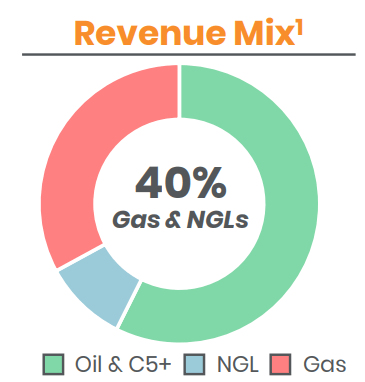

Approximately 40% of OVV’s revenues come from gas and NGLs (natural gas liquids). That means that if anyone is particularly bullish on natural gas, as I am, they’ll not be fully exposed to the very high, plus $9 mmbtu prices.

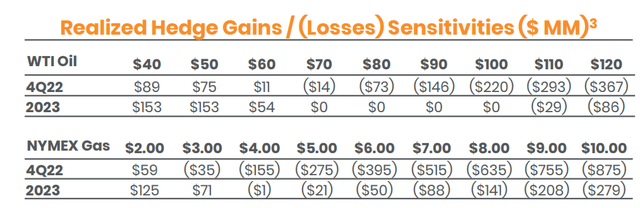

On the other hand, I don’t know whether hoping to see $9 mmbtu in 2023 is realistic either. So, investors have to form a view on that likelihood too.

On yet the other hand, what we can see above, is that for WTI, for 2023, OVV carries no significant hedges at a normalized range of up to $100 WTI. And significant hedges don’t quite kick in until $120 WTI.

In sum, I believe that most reasonable minds would agree with the following statement. OVV’s hedged book in 2023 will be significantly better than in 2022.

Capital Returns Program in Focus, 5.2% Total Yield

Before discussing OVV’s capital returns, let’s first discuss its balance sheet.

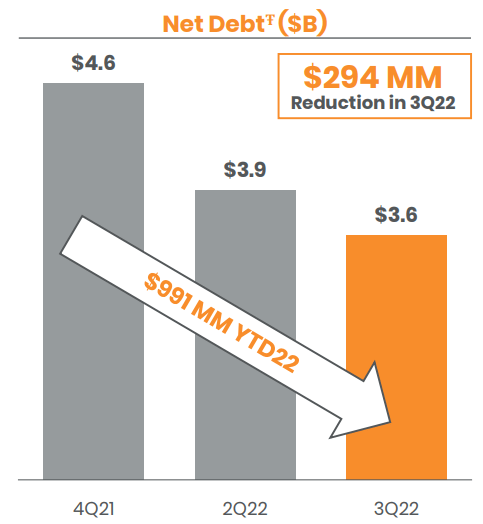

OVV Q3 2022

At the current rate, OVV will see its net debt get to under $3 billion at some point in Q1 2023.

This will help ensure that OVV will continue returning to shareholders at least 50% of its free cash flows.

Consequently, looking ahead to Q4, OVV has set out to return $250 million back to shareholders. In fact, this amounts to approximately 57% of its prior quarter’s free cash flow.

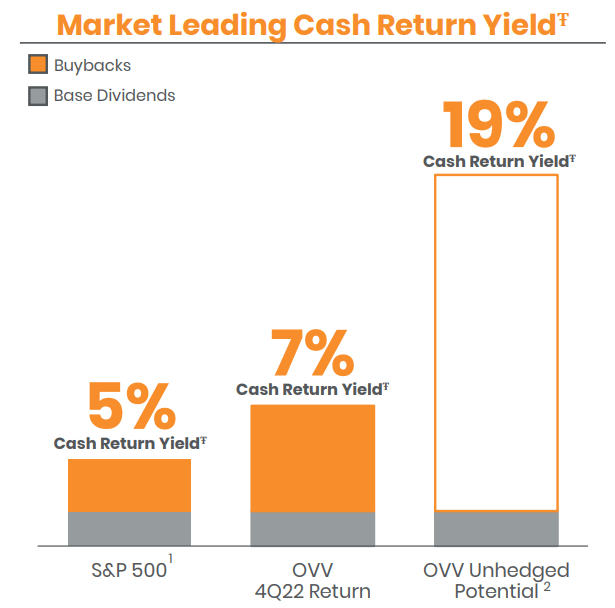

Put another way, on an annualized basis, OVV is returning to shareholders a 5.2% combined return.

Again, as noted already, as OVV enters 2023, with its significantly improved hedged book, we are likely going to see its free cash flow yield approximately double, as its hedges roll off.

OVV Q3 2022

I could be wrong, but I’m not banking on a 19% cash return yield. But somewhere around 10% to 13% is very much achievable in 2023.

OVV Stock Valuation – 4x 2023 Free Cash Flow

I highlight the above analysts’ consensus free cash flow figures not for accuracy, but for directionality. For many E&P companies, analysts’ free cash flow estimates for next year are lower than this year’s.

But you can see above that this is not the case for OVV.

That being said, I don’t fully believe these figures to be accurate, though. I believe that in 2023, OVV will be able to report significantly higher free cash flows than CAD$3 billion.

Indeed, as a point of reference, this quarter, on an unhedged annualized basis, OVV saw CAD$5 billion in free cash flow.

This implies that OVV is priced at closer to 4x next year’s free cash flows than it is to 6x 2023 free cash flows.

The Bottom Line

OVV Q3 2022

As we head into 2023, OVV’s story is going to dramatically improve. In the first instance, its hedged book will be massively cleaned up. I can’t express enough how much of a game-changer this is going to be.

In the second instance, OVV’s balance sheet will also be significantly better.

Altogether, I believe that investors will come to view OVV in a very different light in 2023.

Furthermore, as you can see from the graphic above, OVV still holds more than 10 years’ worth of oil inventory. It’s not a huge amount, but for a company priced at approximately 4x free cash flow, I believe that’s ample inventory.

Be the first to comment