imaginima

Shares of Ovintiv (NYSE:OVV) have been a strong performer over the past year, rising by about 38% as the company benefits from the rise in natural gas and oil prices. Over the past two years, the management team has needed to focus on cleaning up an overly indebted balance sheet, and with that work largely complete, the company can pivot to significantly accelerate shareholder returns.

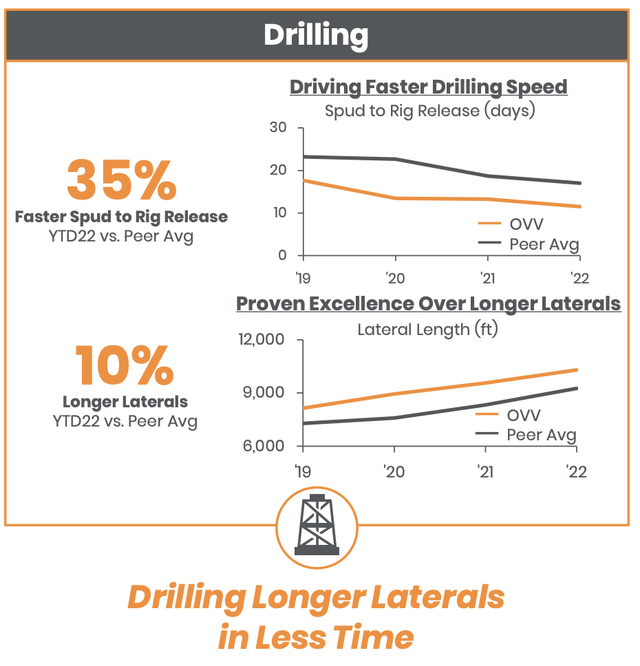

In the company’s second quarter, OVV earned $1.36 billion or $5.21 a share. This came despite a $300 million loss on its hedging program, which it has since reworked to give shareholders more upside to higher commodity prices. Production came in at the high of guidance at 500MBOE/d (thousands of barrels of oil equivalent), leading to just over $700 million in free cash flow. Operations remain strong with a 20% improvement in the drilling speeds in the Permian and Anadarko and a 7% jump in the Montney. Indeed as you can see, the company is drilling further more quickly than peers, which has kept operating costs low at below $17 a barrel, contributing to the very strong free cash flow.

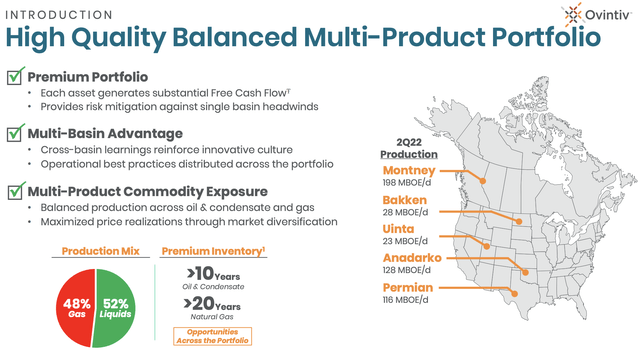

For those unfamiliar with the company, it operates out of four major plays with an 11.5 year reserve life as you can see below. Ovintiv used to be called EnCana (hence its legacy Montney position). While the Montney is its largest play, it is most aggressively growing in the Permian. Of its $1.75 billion capital budget, the Permian is getting $650-700 million, about the same as the Anadarko and Montney combined.

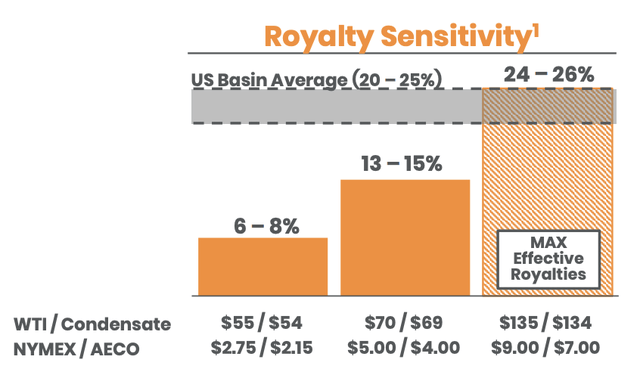

The Montney is a critical provider of base cash flow for the business, from which it has expanded into the Permian, and is now paying off debt and buying back stock. This field provides $2 billion in operating free cash flow, and the company is targeting 0-5% production growth. This is primarily a gas field (about 90%), and beyond its free cash flow profile, there are several reasons I like it. First, the Canadian royalty system is structured so that when prices fall, the royalty rate declines. This insulates results somewhat from a decline in prices, making cash flows a bit more predictable.

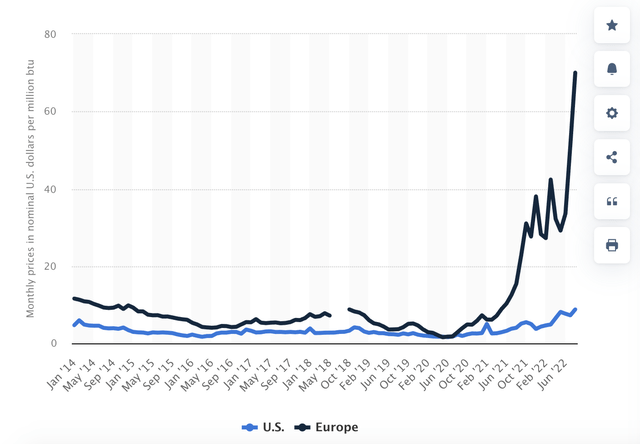

More importantly, Canada is developing large LNG export facilities, which should be operational by the end of 2025. Beyond those already under construction, there are plans to potential triple their capacity with additional projects. This year, we have seen prices for natural gas rise dramatically because Europe has needed to buy more LNG. As Russia is unlikely to be selling gas to Europe anytime soon in my view this structural demand for LNG is likely to persist, creating the potential for OVV to capture much higher realizations from this field over time.

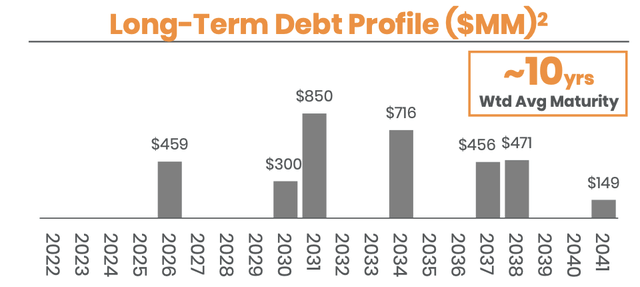

Importantly, the company this past quarter announced it would return at least 50% of FCF to shareholders from 25% previously, leaving the rest for debt paydown or bolt-on acquisitions. Previously, the company had to prioritize reducing debt. Over the past year, it has paid down $1.3 billion in debt to reach $3.9 billion gross debt. This debt load was $7.3 billion two years ago. The company is on track to reach its $3 billion net debt target by the end of this year. As you can see, the company has no maturities for four years. This entirely insulates OVV from the impact of higher interest rates as it has no near-term maturities to refinance.

With its debt target being reached, the company as bought back $325 million of stock in Q3 as of its mid-September update, taking out 6.7 million of shares. This is on top of a base $0.25 quarterly dividend that costs $64 million per quarter. Like other oil companies, OVV is paying a base dividend and then will use excess cash flow to buy back stock or pay special dividends. It is also important to note that if not hedges, the company would be able to buy back another $400 million in stock this quarter alone.

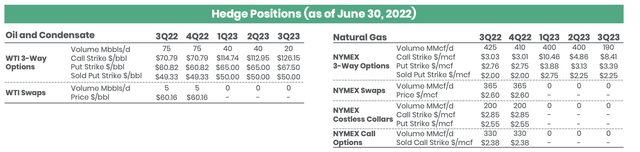

On the hedges, management stated they structurally are looking to “hedge about 20% to 25% of production. We’re doing it a quarter at a time, four quarters out. So if you look at our disclosure today you can see the first quarter ‘23 and the second quarter ‘23 books are done, and we’re part way through building the third quarter ‘23 book today.”

The company’s production next year should be about 180mbbls/day of oil and 1475-1500mmcf/d of natural gas. As you can below, the company has begun laddering out its hedges, but the greater upside exposure in 2023 becomes quite apparent. While its oil hedges are capped at $71 for this year, for next year, it is over $110. For natural gas, it could realize as much as $10.86 during the seasonal peak in demand in Q1 when Europe may be most desperate for cash.

This means that even if energy prices stay flat, OVV’s cash flow will improve considerably over the next twelve months because it will realize much more of that upside. On an unhedged basis, each $5 move in oil is worth $180 million to the bottom line over a full year, so this upswing is very significant.

At current oil and natural gas prices, assuming a 10% increase in cap-ex spending next year, OVV should generate $3.3-3.8 billion of free cash flow. With a $14 billion market cap, that is 25% free cash flow yield. OVV can comfortably pay out $2 billion to shareholders, retiring up to 15% of its common stock at the current price, in 2023, and I see upside risk to that estimate. As markets realize how much cash flow the company can direct to shareholders now that it has paid off $3.3 billion in debt the past two years and has higher hedges going forward, I see material upside. At even a 10% free cash flow yield, shares could rise above $70. As far as OVV has run, there is greater upside ahead, and I would buy shares.

Be the first to comment