Juan Jose Napuri

It’s been a rough year for the Gold Juniors Index (GDXJ), and while Osisko Mining (OTCPK:OBNNF) was able to buck the trend until April due to its strong fundamentals, the stock has since come under pressure, suffering a 50% drawdown from its April highs. While this might lead some to believe that the investment case has weakened, I don’t see this as the case. In fact, Osisko Mining has only become more attractive from an investment standpoint when the list of developers worth owning has shrunk to 20 or less, given the unfavorable backdrop for the group (higher labor/contractor costs, higher cost of capital, a more difficult environment for raising money).

Fortunately, Osisko Mining is sitting on a hoard of cash & securities (~$130+ million), is getting closer to the finish line with its updated resource out, and several catalysts are on deck, including a Feasibility Study and results from its third bulk sample at Windfall. Given that the stock has now retreated to a much more attractive valuation (~0.50x P/NAV) in a period where its valuation should be higher as it moves closer to its potential first gold pour in 2025, I would view any further weakness in the stock as a buying opportunity.

All figures are in United States Dollars at an exchange rate of 0.78 CAD/USD.

Windfall Mineralization (Company Website)

Updated Resource Estimate

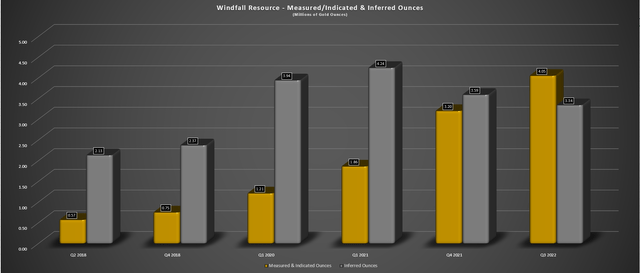

Osisko Mining (“Osisko”) released an updated resource estimate for its Windfall Project in the Eeyou-Itschee James Bay territory of Quebec last month, increasing the size of the measured & indicated [M&I] resource to ~4.1 million ounces, with an 8% lift in grades to 11.4 grams per tonne gold. This was ahead of the target of 4.0 million ounces at 10+ grams per tonne of gold outlined by the company to support its upcoming Feasibility Study. Most importantly, this resource is quite robust, with less than 12.5-meter drill spacing and a relatively conservative $1,600/oz gold price assumption, and is backed up by over 1.8 million meters drilled.

Windfall – Resource Growth (Company Filings, Author’s Chart)

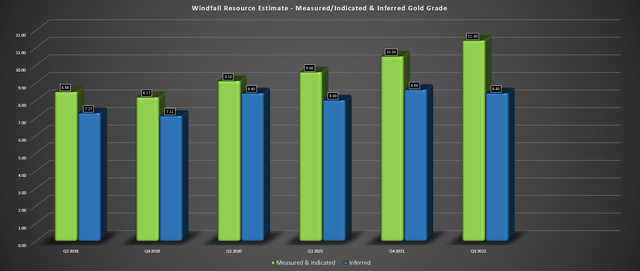

Looking at the chart below, we can see that M&I grades have improved materially since the initial resource update, up from 8.48 grams per tonne of gold (Q2 2018) to 11.40 grams per tonne gold in the most recent report. The resource is dominated by Lynx, which is home to 3.06 million ounces at ~13.0 grams per tonne of gold, making Windfall one of the highest-grade gold mines, assuming it was in production today. Among solely Canadian mines, Windfall would rank among the top 5, only marginally behind Macassa (AEM), Eagle River, and Kiena (OTCQX:WDOFF).

Windfall – Resource Grade Progression (Company Filings, Author’s Chart)

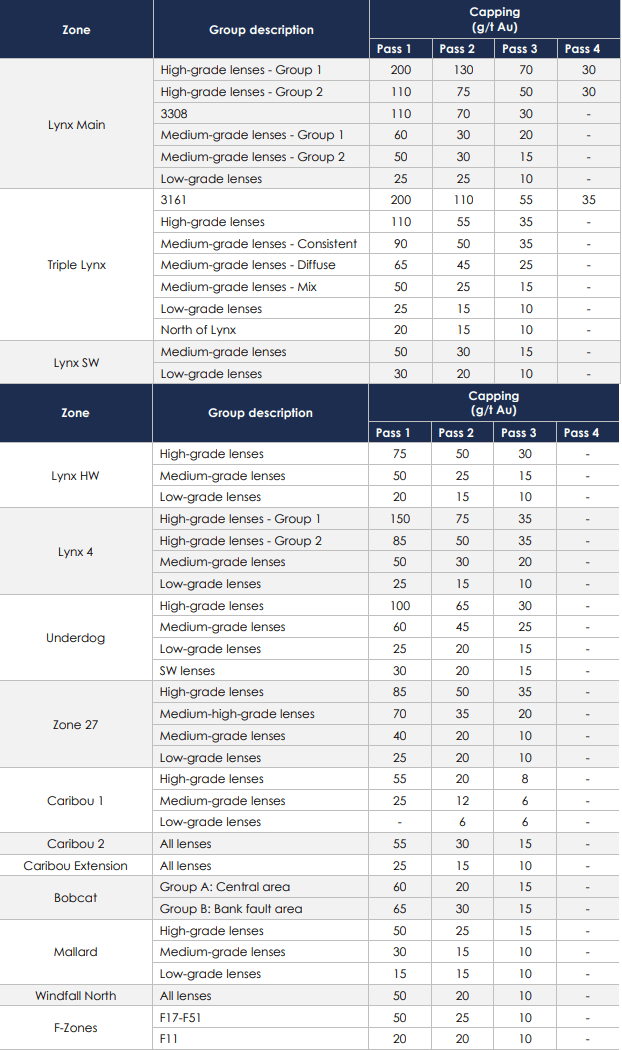

That said, based on the very conservative three-step capping strategy, which has whittled down holes like 90,700 grams per tonne over 0.30 meters to just 200 grams per tonne, there could be positive surprises once mining begins at Windfall. If we look at the table below, we can see the parameters for this grade capping, similar to what Kirkland Lake Gold used at Fosterville, with gold grades associated with disseminated sulfides top cut to 75 grams per tonne gold. As those following operations at the Fosterville Mine may have noticed, several stopes have surprised the upside over the years, providing a nice boost to expected production.

Osisko Mining used a three-step capping strategy for all zones except Lynx Main and Triple Lynx, for which some groups of lenses were interpolated using a four-step strategy in its recent Technical Report.

Windfall Grade Capping (Company Technical Report)

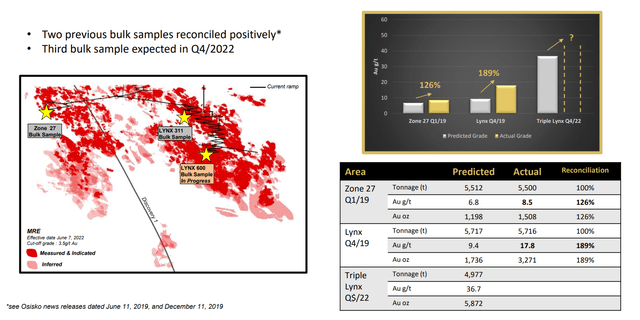

Looking at bulk sample results to date, we can see that the previous two bulk samples at Zone 27 and Lynx saw 26% and 89% positive grade reconciliation, significant outperformance relative to expectations. It’s important to note that these are small bulk samples (~5,000 tonnes) relative to the overall resource (10+ million tonnes), but this grade outperformance is quite encouraging. The third bulk sample has now been completed, and if we see similar outperformance, it wouldn’t be a stretch to assume that the upcoming Feasibility Study might slightly understate this asset’s true potential from a production profile standpoint.

Windfall Historical Bulk Samples (Company Presentation)

So, how does the project stack up vs. peers?

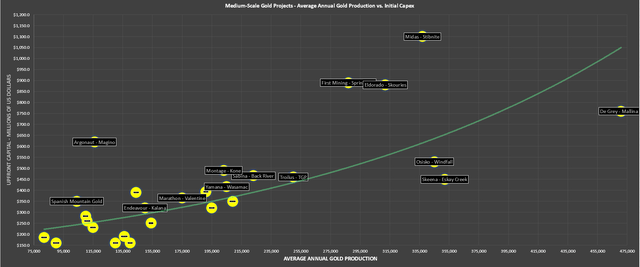

As shown below, Osisko Mining’s Windfall deposit is one of the great ones from an economics standpoint, with the only project boasting similar economics being Eskay Creek. This is because both projects are capable of producing over 320,000 ounces per annum on average, but with upfront capex below $600 million and all-in sustaining costs likely to come in below $700/oz. To put these operating costs in perspective, the industry average for FY2022 is likely to come in above $1,290/oz across a universe of 70+ producers, meaning that Windfall’s projected costs could be 45% below the industry average, and that assumes no positive grade reconciliation.

Undeveloped Gold Projects – Average Annual Production vs. Initial Capex (Company Filings, Author’s Chart)

Exploration Upside

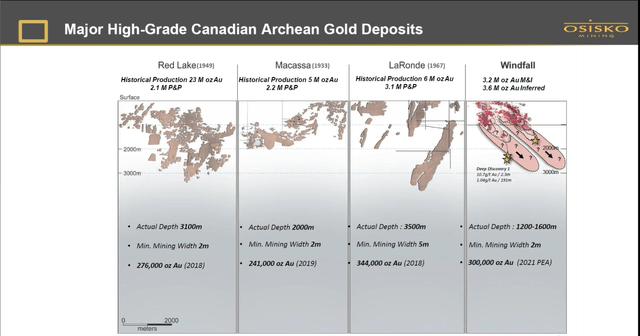

While Windfall is already a phenomenal project, and the team has done an incredible job considering that previous operators didn’t come anywhere near uncovering its true potential, there looks to be considerable gas left in the tank from a resource growth standpoint. This is because 98% of the resource is within a 1,200-meter vertical depth, and high-grade archean gold deposits in Canada have a habit of extending well below 2,000-meter depths. Osisko has done limited drilling to depth but intercepted 2.3 meters at 10.7 grams per tonne gold at ~2.3 kilometers below the surface and 4.0 meters at 5.25 grams per tonne gold 2.4 kilometers below the surface. So, even assuming this only goes to 2.4 kilometers and grades aren’t quite as robust, this could push Windfall’s resource north of the 12.0 million-ounce mark.

High-Grade Canadian Archean Gold Deposits – Depth Extent (Company Presentation)

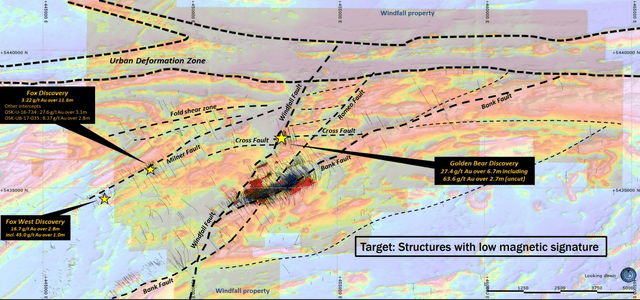

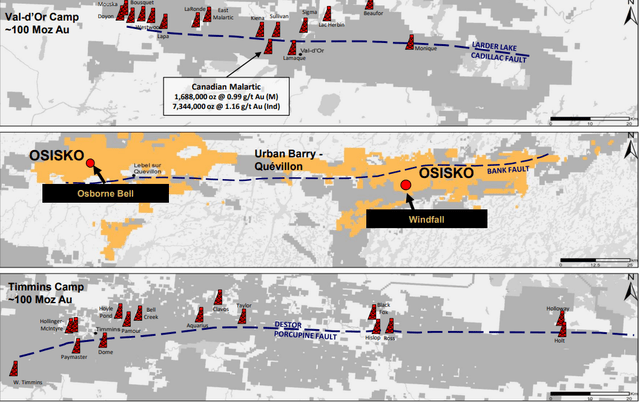

From a regional standpoint, Osisko has multiple targets that it hasn’t spent time following up on within 10 kilometers of Windfall Main and is sitting on a land package (2,400 square kilometers) that dwarfs the Val D’or Mining Camp in scale. Obviously, this does not imply that Osisko can find another five or ten Windfalls on its land package. Still, given this team’s track record of exploration success and the mineral endowment of Windfall, I wouldn’t count out the possibility that the company is sitting on another monster discovery, given the sheer size of this land package. For now, though, the focus appears to be on Golden Bear, which hit 6.7 meters at 27.4 grams per tonne gold just 1 kilometer north of Windfall.

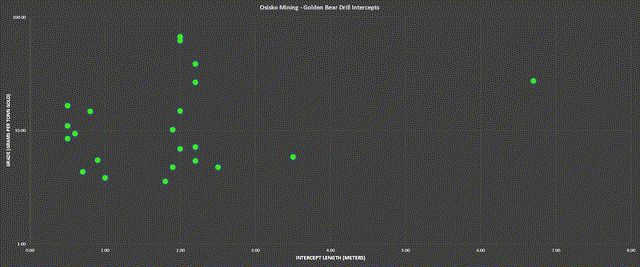

Additional intercepts were as follows:

OSK-UB-21261: 2.00 meters of 62.15 grams per tonne gold

OSK-UB-21273: 2.00 meters of 67.1 grams per tonne gold

Windfall Area – Regional Upside (Company Presentation)

As discussed in a previous update, these results are solid for a new discovery and are plotted on the chart below. Even excluding the best three intercepts drilled at this new discovery, the average hit came in at 1.50 meters at 12.0 grams per tonne of gold, which is not shabby for a new deposit that the company hasn’t had nearly enough time to get its handle on yet, given that it was focused on resource definition drilling to upgrade its resource at Windfall before its Feasibility Study.

The potential addition of a new mining center could augment Windfall’s production profile longer-term and provide operational flexibility, given that it could have two mining centers to pull material from. That said, it’s early to make these assumptions for now, with no resources yet at Golden Bear. Let’s dig into Osisko’s valuation and see whether this upside is priced into the stock.

Golden Bear Intercepts (Company Filings, Author’s Chart)

Valuation

Osisko Mining has 347 million shares outstanding and a share price of US$2.30, translating to a market cap of $798 million, or ~405 million fully-diluted shares. The company currently has over $130 million in cash and marketable securities, with additional exploration credits due next year to fund drilling at Windfall from the Quebec Resource Tax rebate, giving it the flexibility to continue drilling at Windfall and Golden Bear next year without any share dilution. This outstanding share figure is down from Q1 2021 levels (~347 million vs. ~358 million) due to Osisko buying back shares under its NCIB.

Even if we assume an additional 25 million shares of dilution before commercial production is reached to provide a buffer (the majority of the project can be funded with debt and cash), Osisko would trade at a valuation of ~$990 million. I believe this is a conservative estimate, given that it assumes all shares are exercised as well as the convertible debenture and that the company dilutes further, which doesn’t seem to be its intention with it buying back shares recently and hoping to fund construction with debt given the extremely high IRR.

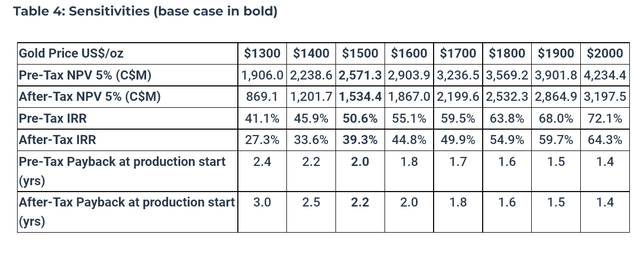

Windfall – After-Tax NPV (5%) Sensitivity (Company News Release)

Based on the previous Preliminary Economic Assessment, Windfall’s After-Tax NPV (5%) at a $1,725/oz gold price came in at $1.78 billion. This figure could dip slightly at the same gold price assumption in the Feasibility Study, given that we could see capex increase by up to 20% to ~$520 million due to inflationary pressures. That said, we should see some offset from a slightly higher grade profile and the potential for a higher throughput rate (3,400 tonnes per day vs. 3,100 tonnes per day in the PEA). Given these assumptions, I think it’s safe to assume an After-Tax NPV (5%) of $1.45 billion at Windfall, even using a lower $1,700/oz gold price and cost creep from a capex standpoint.

This is already a significant figure, but I don’t think it comes near doing justice for this deposit, project, or the entire land package. This is because, as explained earlier, there is considerable upside at depth unless Windfall happens to have a top-5 mine from a grade standpoint in Quebec/Ontario, but it is the only one where mineralization abruptly stops at 1,200 meters vertical. In addition, the company has barely scratched the surface on other regional targets or its land package. Hence, I would argue we can easily justify assigning another $425 million to exploration upside.

Osisko Mining – Land Package Scale vs. Timmins/Val D’Or Camps (Company Presentation)

Based on Newcrest’s (OTCPK:NCMGF) acquisition of Pretium at ~$380/oz on M&I resources in British Columbia, this would translate to only another 1.1 million ounces being added to its resource base, which I think is a brutally conservative assumption. In fact, I wouldn’t be surprised to see the company ultimately uncover a resource of 12+ million ounces across measured & inferred categories. That said, even being conservative and applying only $425 million for exploration upside at depth, regionally, and ultra-regionally across its 2,400 square kilometer land package, translates to a fair value of $1.85 billion for Osisko.

Even if we assume further share dilution here to provide a cash buffer (~430 million fully diluted shares), this leaves Osisko trading at 0.54x NPV (5%) when it could easily justify trading at 0.95x P/NPV once fully permitted and financed, which could occur by Q1 2024. After applying this multiple, I see a fair value for Osisko of ~$1.76 billion or US$4.10 per share to its 18-month price target – representing a 78% upside from current levels. That said, if this team has even half its success at Lynx elsewhere on the property, this stock could easily trade at a valuation north of $2.50 billion once in production (US$5.00+ per share).

Summary

While the developers’ space has been a tough segment of the gold sector to invest in due to higher labor/contractor costs, a higher cost of capital, and less appetite for equity, which has led to dilutive financings, Osisko is in a sweet spot and is a bit of a unicorn. Outside of the fact that its project is near unrivaled globally (potential for 10+ million ounces at 11+ grams per tonne gold), it’s got a strong cash position (~$120 million), and the ~45% IRR should allow the company to use mostly debt to fund construction. Hence, it’s not in a position where it can be preyed upon like Marathon Gold (OTCQX:MGDPF) in a dilutive deal with warrants attached.

Windfall Project (Company Video)

Meanwhile, the Osisko team has an exceptional track record in the province, permitting, developing, and operating Canada’s largest gold mine (Canadian Malartic) and moved a town in the process. Therefore, I don’t see any reason to count this team out. Besides, work has already begun, with the team making the smart move to order its milling equipment in Q1 2021, getting ahead of peak inflation, and announcing an MOU with the Cree First Nation of Waswanipi, who will finance, build and operate a 120kV transmission line to transport hydroelectric power to the Windfall Project, further de-risking the project.

To summarize, I see Osisko Mining as a top story in the development space. While I usually stick to producers, I believe this is a name that can be comfortably bought on weakness, with the possibility of an accelerated re-rating if a takeover bid is launched. Following a 5-10% increase in operating costs for several producers due to inflationary pressures and the fact that a couple of producers have considerable tax pools in Canada to work in their favor (given that they are underweight in Canada from an operations standpoint), I see the likelihood of a takeover offer increasing given that Windfall would be very margin accretive, especially with Osisko trading at depressed levels currently.

Be the first to comment