slovegrove/iStock via Getty Images

It’s been a tough couple of months for the Gold Miners Index (GDX), which was significantly outperforming the S&P-500 (SPY) until Q2. However, with a plunge in the silver price (SLV) and softness in the price of gold (GLD), this outperformance has reversed, and several babies are being thrown out with the bathwater. One name that has been sold off to a large degree for little reason is Osisko Gold Royalties (NYSE:OR), given that the company has not seen a margin hit from industry-wide inflationary pressures. With the stock now trading at less than 0.80x P/NAV, this is an absolute gift, and I continue to accumulate on weakness.

Windfall Project Mineralization – (Osisko GR – 2-3% NSR) (Company Presentation)

Just over two months ago, I wrote on Osisko Gold Royalties (“Osisko GR”), noting that the stock traded at an attractive valuation and its underperformance looked like a buying opportunity. This has been an atrocious call, given that the stock is down 28% from the article’s publication. However, while my position has gone against me despite adding to my position below $10.00, I don’t see any change to the thesis, and I would argue that the story has improved.

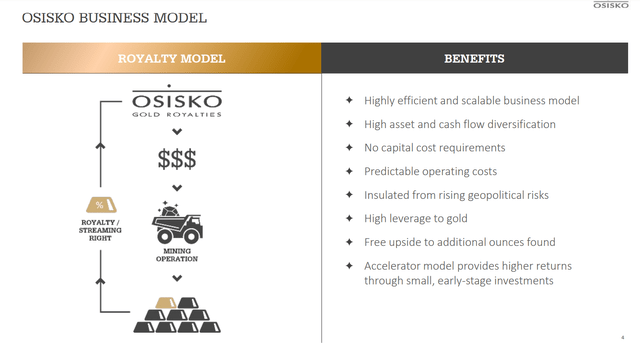

Osisko Gold Royalties Business Model (Company Presentation)

This is because the company just got great news from the Island Gold Mine Phase III Plus Study, which will provide further mid-term growth from its royalty on this high-grade Canadian mine. In addition, while some producers are suffering margin hits due to inflationary pressures, Osisko GR has some of the best margins industry-wide (~94%), and it is immune from increases in operating costs or increased sustaining capital (royalty model). Given the difficulty in owning some producers due to the inflationary pressures, which have changed the cost outlook for some mines, I am surprised at the multiple contraction we’ve seen in royalty/streamers, and the lack of demand for these names.

In fact, one could argue that these names should be in higher demand given that more than half of the producers in the industry are un-investable with all-in costs (all-in sustaining costs + development costs above $1,600/oz). This shift due to inflationary pressures should be directing money to the highest-quality companies with the highest margins. Instead, the selling has been indiscriminate, providing unusual deals in some of the highest-quality names that are now trading near March 2020 valuations.

Recent Developments

Island Gold Expansion

The much-awaited Island Gold Phase III Plus Study was released last week, and the results far exceeded my expectations with blow-out results. Not only has the mine life increased from 16 years to 18 years despite a higher throughput rate, but average annual gold production has surged from ~236,000 ounces at $534/oz to ~287,000 ounces at $580/oz. This will make Island one of North America’s lowest-cost gold mines, with Osisko GR holding an approximate ~2.2% net smelter return [NSR] royalty on the mine.

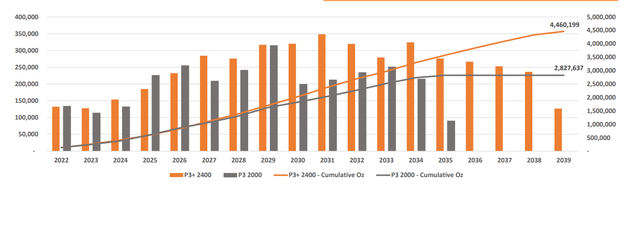

Island Gold Expansion Case – Annual Production (Alamos Gold Presentation)

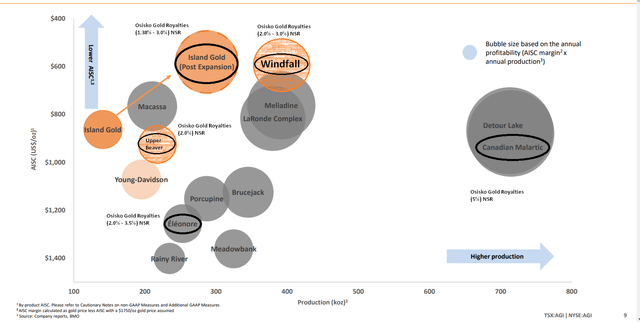

Island Gold Expansion & Other Canadian Mines/Projects + Osisko Royalties (Alamos Gold Presentation, Company Filings, Author’s Notes)

Under the previous assumptions, it looked like Osisko GR would see its annual contribution from Island Gold increase from ~2,000 GEOs to ~4,000 GEOs post-2025. However, under the new study, production should increase to more than 5,300 GEOs in 2026 and 6,000+ GEOs post-2026, translating to 5% attributable production growth from this asset alone. On the above chart, we can see that Osisko GR will now own key royalties on multiple major low-cost Canadian assets. This includes Windfall (~300,000 ounces per annum at sub $700/oz in 2026), Upper Beaver (160,000+ ounces at sub $900/oz costs post-2026), and Canadian Malartic, with a 3.0% – 5.0% NSR royalty on Canada’s second largest gold mine.

Assuming Eagle can ramp up to 250,000 ounces at sub $1,000/oz costs, this asset would also be added to this list, with a 5% NSR royalty on the Yukon Mine.

This growing attributable production profile in Canada is a big deal, as highlighted by the above mines, and cannot be overstated. In a period of rising inflation, royalty/streaming companies are immune from operating cost escalation and lifts in capex. Still, they’re not immune from a weak operator with low margins or a poor financial position simply shutting down operations. Given that most of Osisko GR’s production comes from mid-cap and large-cap companies and some of the largest sector-wide, this is not a worry for investors.

However, in the case of some royalty companies that have chosen to partner with small operators or partner on operations with very high costs, they could see a haircut in their attributable annual production. Some examples are the Moss Mine in Arizona, the Mercedes Mine in Mexico, the Florida Canyon Mine in Nevada, and potentially Fortuna’s (FSM) San Jose Mine, which isn’t that high-cost, but has a permit dispute still in place.

These operations remain in production for now, but if we were to see a $1,700/oz gold price with today’s inflationary pressures that have changed costs for these miners, we could get the unfortunate news that one of these mines is being placed on care & maintenance. The reason is that the all-in cost (development capex included) at these operations (Moss, Mercedes, Florida Canyon) is above $2,000/oz. In Osisko’s GR case, I don’t see any assets at high risk of shutting down, and many assets supporting Osisko GR’s growth work at even a $1,400/oz gold price (Windfall, Upper Beaver, Island, Tocantinzinho).

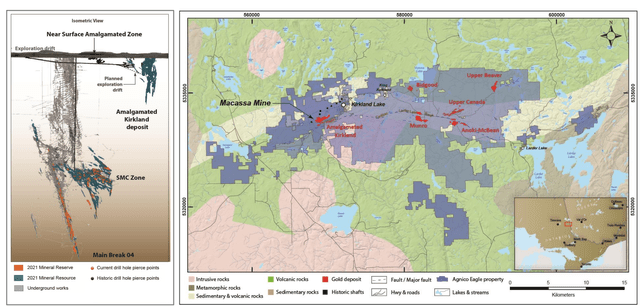

Amalgamated Kirkland / Kirkland Lake Camp

While Upper Beaver looks to be a 2027 opportunity for Osisko GR based on Agnico’s recent presentation, which should contribute at least 3,000 GEO per annum from 2027-3027, Agnico is moving quickly on the Amalgamated Kirkland [AK] opportunity. For those unfamiliar, this was an orphaned gold deposit in the Kirkland Lake Camp (Ontario, Canada), with the ounces not worth chasing previously due to this being a relatively small deposit (~670,000 ounces at 5.80 grams per tonne of gold. Agnico noted that it has already advanced the ramp over 200 meters at AK and believes this could contribute 40,000 ounces per annum, or 800 GEOs attributable to Osisko GR.

Agnico Eagle – Kirkland Lake Mining Complex (Company Presentation)

In addition to this, Osisko GR has a 2.0% NSR royalty on Agnico’s ~25,000 hectares of land in the region, which now benefits from a nearby mill (Macassa), and an idle processing facility/tailings storage facility with 3,000 tonnes per day of capacity (Holt), with Agnico looking to potentially make the Kirkland Lake Camp a new mining complex. This could unlock upside potential on Osisko GR’s royalty land (purple shaded area above), with 2.6+ million ounces in resources at Anoki-McBean and Upper Canada with respectable grades (1.4 to 3.2 grams per tonne of gold).

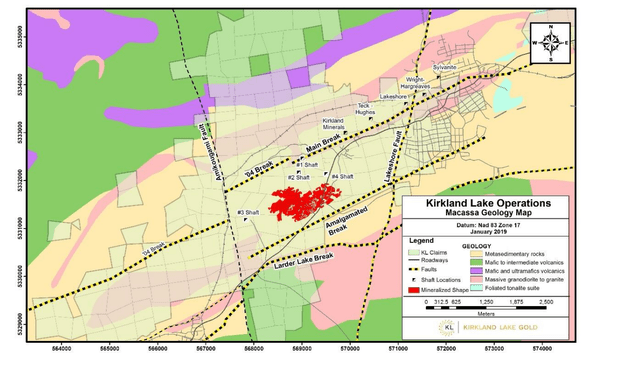

Macassa Geology (Macassa Technical Report)

Given that we don’t have a confirmed production plan for these ounces, this represents further upside for Osisko GR not in its 5-year guidance. However, between AK, Upper Beaver, and other ounces in this area, it’s possible that Osisko GR could see attributable GEO contributions of more than 5,000 GEOs long-term from this camp alone. Perhaps, the most exciting opportunity is a potential extension of the South Mine Complex onto Agnico’s land. The South Mine Complex carries phenomenal grades (half an ounce per tonne of gold) and could also complement Macassa’s production profile (like AK), but on Agnico Eagle land, benefiting Osisko GR.

Tocantinzinho

Finally, G Mining Ventures is looking to secure financing by mid-year, with a goal of construction beginning before Q4 of this year. While Osisko GR’s 1.75% NSR royalty is subject to a 1.0% buy down (0.75% post-buy-down), this would still translate to a contribution of ~1,300 GEOs per annum between 2025-2029, offering additional growth. Notably, G Mining Ventures is led by a phenomenal team responsible for the construction of the following projects over the past decade:

- Essakane

- Fruta del Norte

- Process plant automation in Nunavut at Meliadine

- Merian Project in Suriname, where GMS did a DFS/Project Optimization, Engineering/Construction for Stage 2 at Merian

In my view, this reduces the risk of the project going over budget or behind schedule with a strong team in charge.

Windfall

Finally, Osisko Mining (OTCPK:OBNNF) continues to release blockbuster results (11 meters at 293 grams per tonne of gold) at Windfall, expects to release an FS in Q4, and plans to self-manage construction with a production decision possible before Q3 2023, pointing to 2025 production. This asset alone could contribute 6,000 GEOs per annum in 2026. Assuming a 300,000-ounce plus production profile (first eight years), we should see this annual contribution increase to nearly 7,000 GEOs. This assumes that we do not see positive grade reconciliation, which looks likely given the conservative grade capping in studies completed to date. Based on Osisko GR’s ~80,000 ounce GEO profile (2021), Windfall once in commercial production would translate to 8%+ attributable production growth.

Long-Term Growth

In addition to these recent developments, Osisko GR holds arguably one of the most prized royalties in the sector, a 3.0% – 3.0% NSR royalty on one of the world’s largest gold mines, Canadian Malartic. The asset has been a major contributor to Osisko GR’s cash flow to date, but after more than a decade of production, it’s beginning to look like the best is yet to come. This is because this asset could be capable of producing 900,000+ ounces at the end of the decade if the CM Partnership were to sink a second shaft and look at increasing production from the underground. In what I would argue to be the likely case that a second shaft is sunk, Osisko GR would maintain a 30,000+ GEO attributable production profile from the asset over the next 25+ years (excluding the brief dip between 2025-2029).

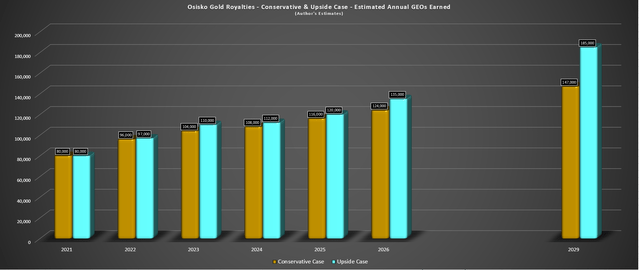

Osisko Gold Royalties – Current & Long-Term Production Potential (Company Filings, Author’s Chart & Estimates)

As shown above, I see the potential for Osisko GR to increase its annual GEOs earned from ~80,000 in 2021 to 120,000 GEOs in 2025, and 124,000 to 135,000 GEOs in 2026. Looking out even long-term, I see the potential for 185,000 GEOs by 2029, given the significant optionality in the portfolio and contribution from a steady stream of new transactions. This translates to a 61% growth rate at the mid-point from FY2021 to FY2026 and an 11% compound annual GEO growth rate long-term. In my view, this should command a premium multiple for the stock. Still, given that some of the growth is lumpy, I believe a valuation of 1.40x P/NAV multiple to be the more conservative multiple until we are closer to the finish line (first gold pour) at certain assets. Once key milestones are met, a 1.70x P/NAV multiple could easily be justified.

Osisko GR is forecasting 135,000 GEOs at the mid-point in 2026 based on its 5-year guidance, but I have chosen to be more conservative to be on the safe side. In this case, the growth rate comes in at 75% vs. the 61% I have discussed above (FY2021 – FY2026).

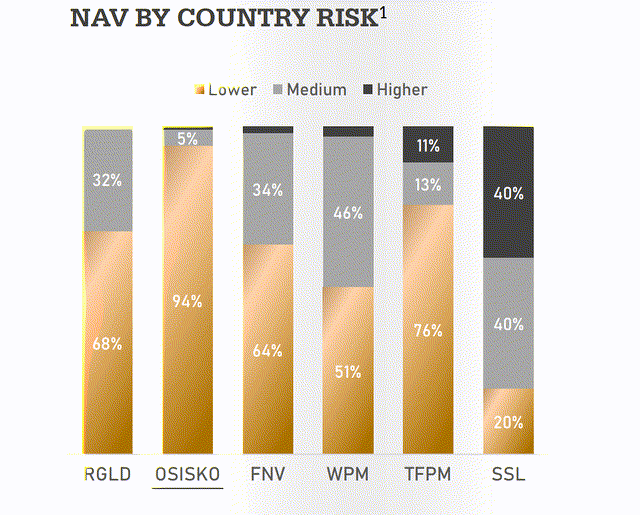

Valuation

Based on an estimated net asset value of $2.3 billion and a P/NAV multiple of 1.40 and 186 million fully diluted shares, I see a fair value for the stock of ~$17.30 per share. This translates to 79% upside to fair value, or ~82% upside to fair value on a total return basis, given the stock’s ~1.90% annual dividend yield to its 18-month target price. Under these assumptions, Osisko GR looks to be one of the most undervalued names in the gold sector, especially on a risk-adjusted basis, given that it is inflation-resistant, its jurisdictional profile is the best among its peers, and it has partners in several large producers with strong financial positions.

Osisko Gold Royalties – Net Asset Value by Country Risk (Company Presentation)

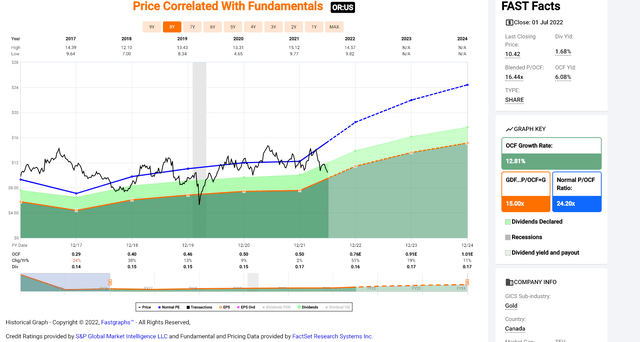

From an operating cash flow standpoint, Osisko GR is also dirt-cheap, trading at less than 11x FY2023 cash flow estimates. This is a more than 50% discount to its historical multiple, and the cheapest the stock has been in years, excluding a brief crash in March 2020. Hence, from both cash-flow and P/NAV standpoints, Osisko GR looks to have considerable upside, coupled with the highest dividend yield in the royalty/streaming space with room to grow. In fact, assuming Osisko GR can grow attributable production to 115,000 GEOs by 2024, I would not be surprised to see the dividend increased to C$0.32 [US$0.26], representing a nearly 3.0% yield on cost.

Osisko Gold Royalties – Cash Flow Multiple (FASTGraphs.com)

Summary

There’s no question that this has been a brutal period for the Gold Miners Index. Unfortunately, much of this decline is justified among the weakest producers, given that inflationary pressures have made sub-par assets relatively marginal. Names that come to mind are Argonaut Gold (OTCPK:ARNGF), Bear Creek Mining (OTCQX:BCEKF), and Iamgold (IAG). However, this correction looks completely unjustified for royalty/streaming companies with organic growth and solid royalty portfolios.

So, with sentiment arguably the worst it’s been in years for the sector, I am plugging my nose and adding to what I believe to be the highest-quality names, and I believe Osisko GR fits this bill. This is evidenced by industry-leading margins, a solid organic growth pipeline, and strong operators as partners still thriving in this difficult period and will have no problem riding out further weakness, even if gold prices do head lower.

Be the first to comment