Bet_Noire/iStock via Getty Images

Introduction to Thesis

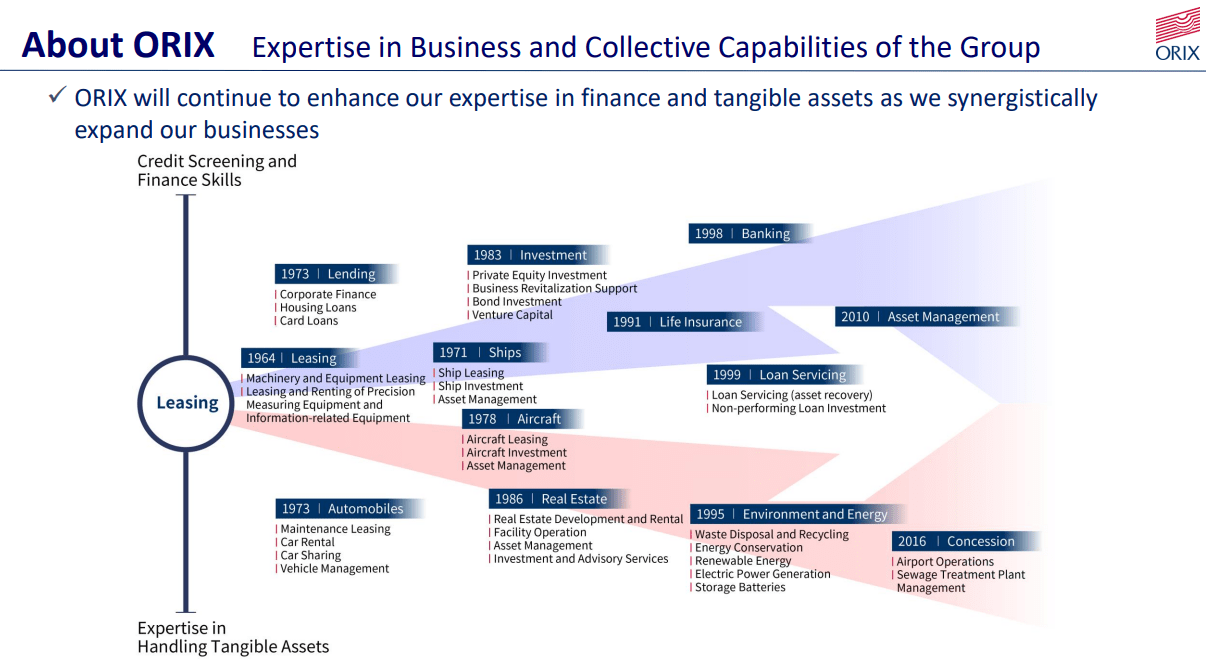

ORIX Corporation (NYSE:IX), based in Japan, is a financial conglomerate with subsidiaries encompassing corporate finance, real estate, private equity, energy production, insurance, banking and credit, aircraft and ships, and asset management. Along with the diverse offerings, one third of the company’s assets are international. This certainly helps provide more income as exchange rates favor currency such as the US Dollar (USD) over the Yen (JPY). The main investment thesis for the company revolves around stability. Much like other, larger, Japanese conglomerates such as Sumitomo Mitsui (SMFG) or Mitsubishi UFJ (MUFG), the companies are relatively indestructible, even as their local country of Japan has had flat GDP growth for at least 30 years.

ORIX

ORIX, however, has a pattern of solid performance and currently looks ready to provide greater returns than the rest of the market. The company is well diversified, but a smaller market cap than peers allows for meaningful one-off events to drive performance in the small-to-mid cap market. Here are a few of the primary catalyst:

-

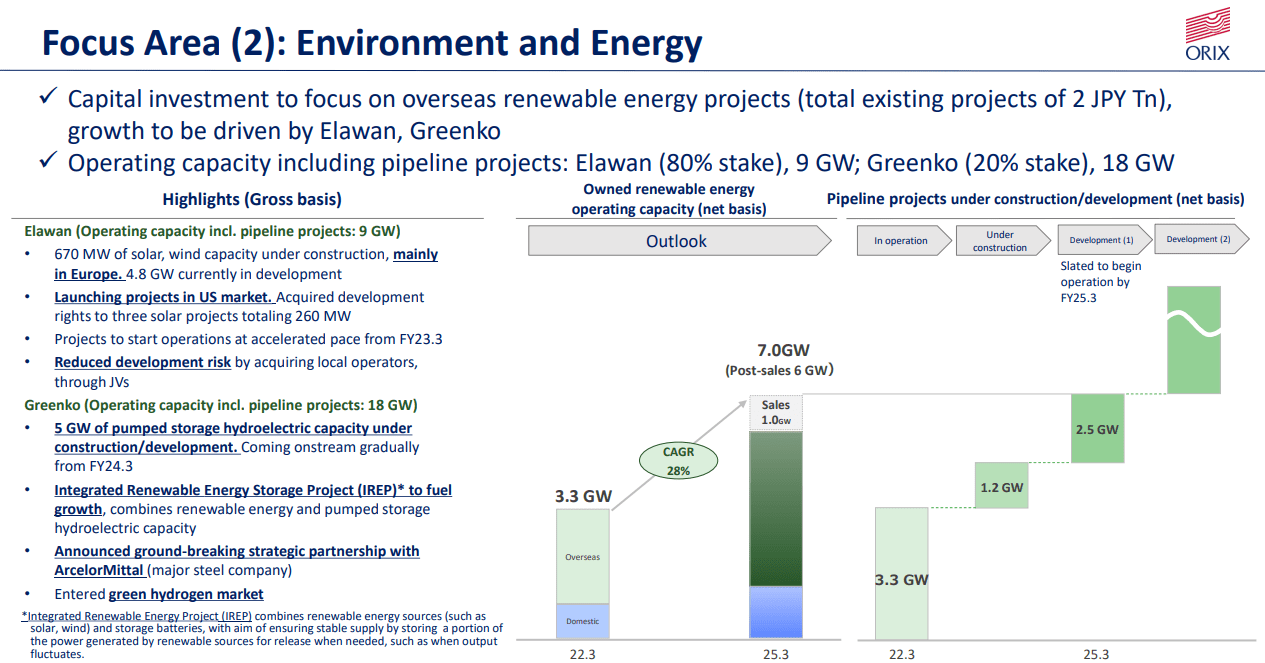

First, moves into renewable energy provide revenue growth in an energy segment that is not in a secular decline (yes, oil & gas).

-

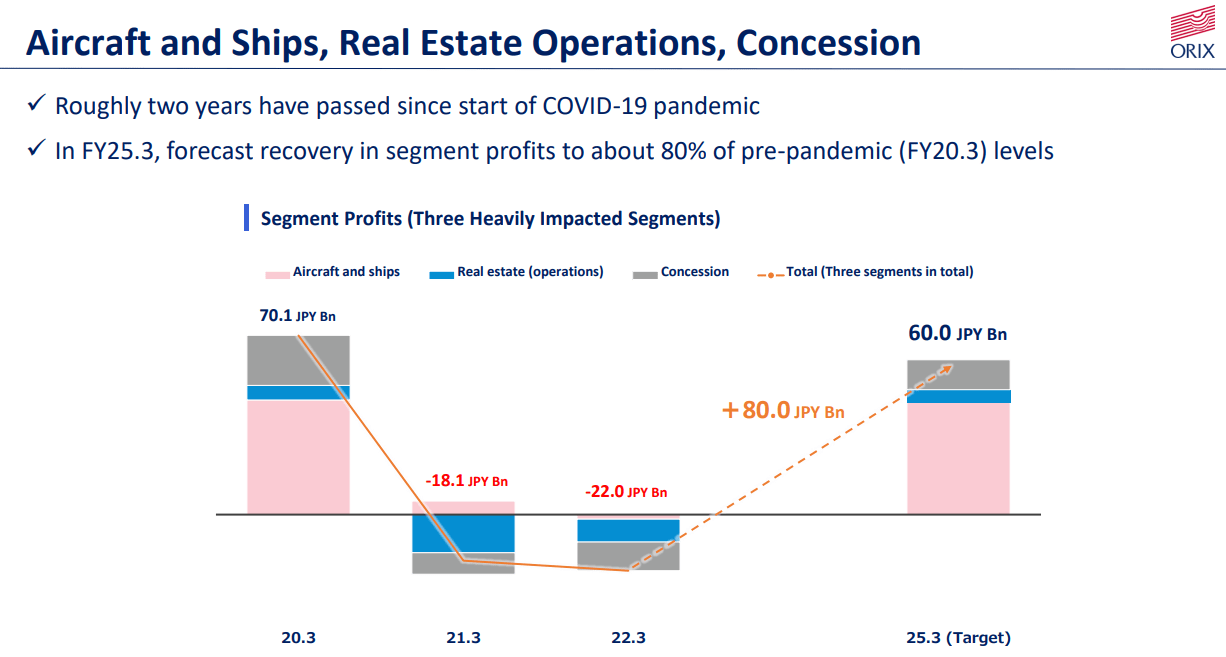

Second, the rebound of their beaten down aircraft and ships segment should also be a catalyst for the coming years as tourism returns worldwide.

-

Third, the continuation of their strong PE investment performance should continue the pattern of earnings growth, even as the market weakens. This is especially true for their international asset groups in the US and EU.

-

Lastly, favorable shareholder practices, such as the current 4.0% dividend and the opportunity for share buybacks, allow for returns regardless of where the share price goes in the current era of market uncertainty.

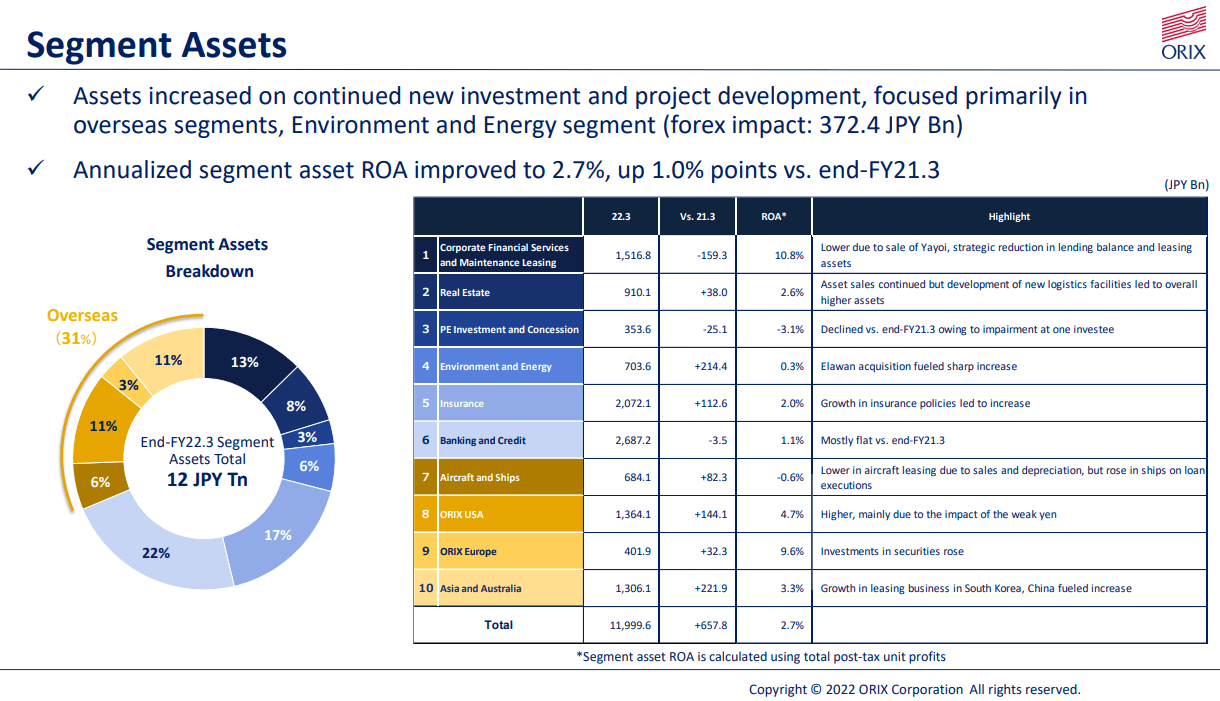

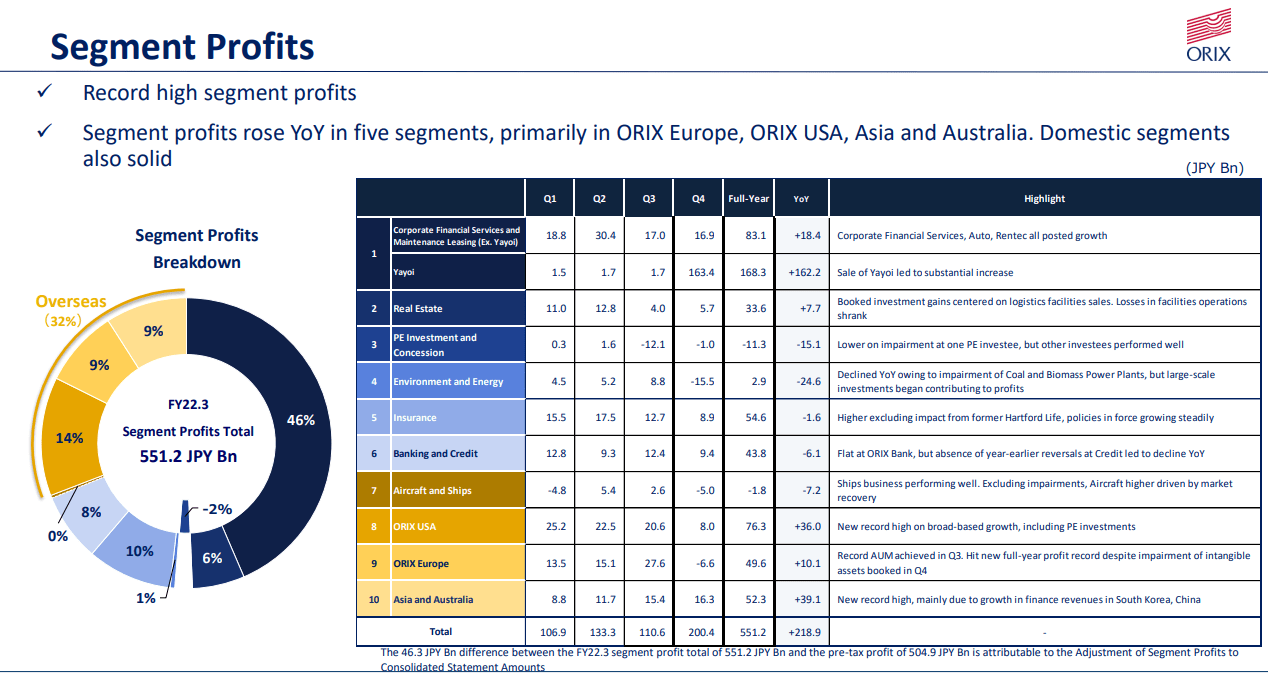

ORIX is perfect for investors looking for tangible inflation-fighting assets, risk-management, and value-oriented investments. Just take a look at the two charts below. The first shows a breakdown in assets by segment, with data on returns for each. Also, the return on assets, based on post-tax profits, averages out to 2.7%. While this may seem weak, current weakness can be attributed to temporary issues. First, an investment in a Japanese pharma company that subsequently was suspended for nearly four months and the assets sold for a loss. Second, the energy segment (now renewable focused) is facing losses as asset values fall and investments flow into increasing production for the future. Lastly, the aircraft and ships segment continues to be hampered by a lack of travel, but is in position to profit upon a return. Also, the second chart below highlights how even as the return on assets is low, overall profits earned is growing YoY.

ORIX ORIX

Financials

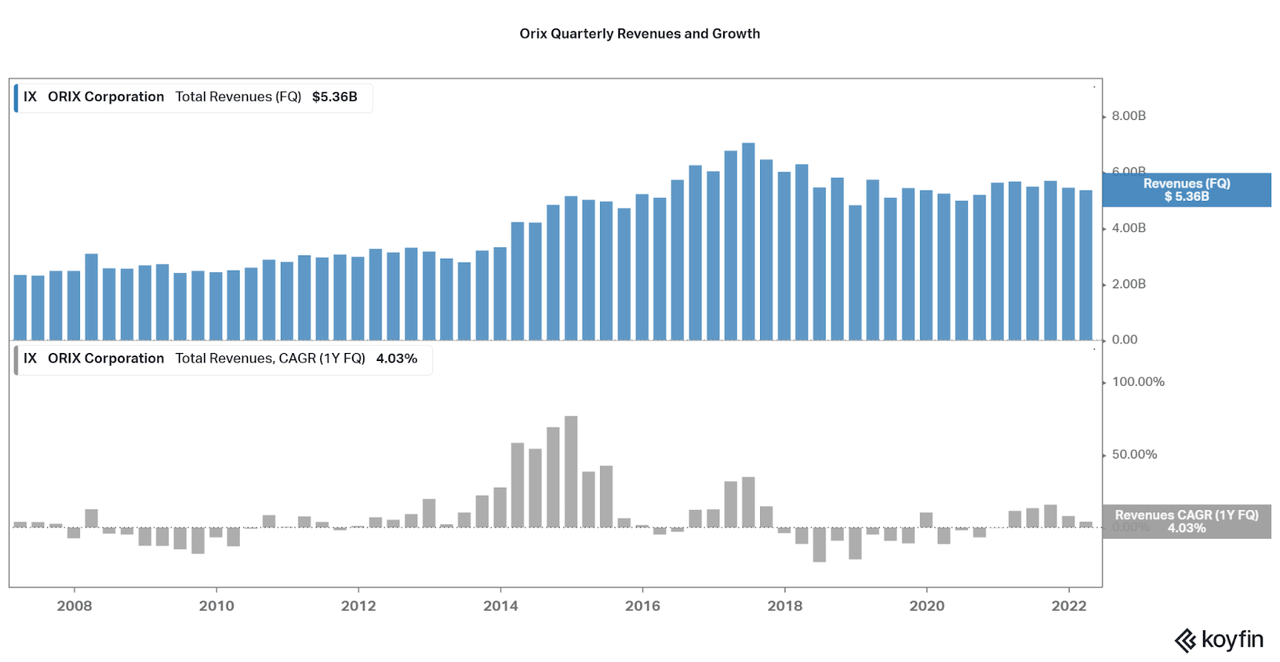

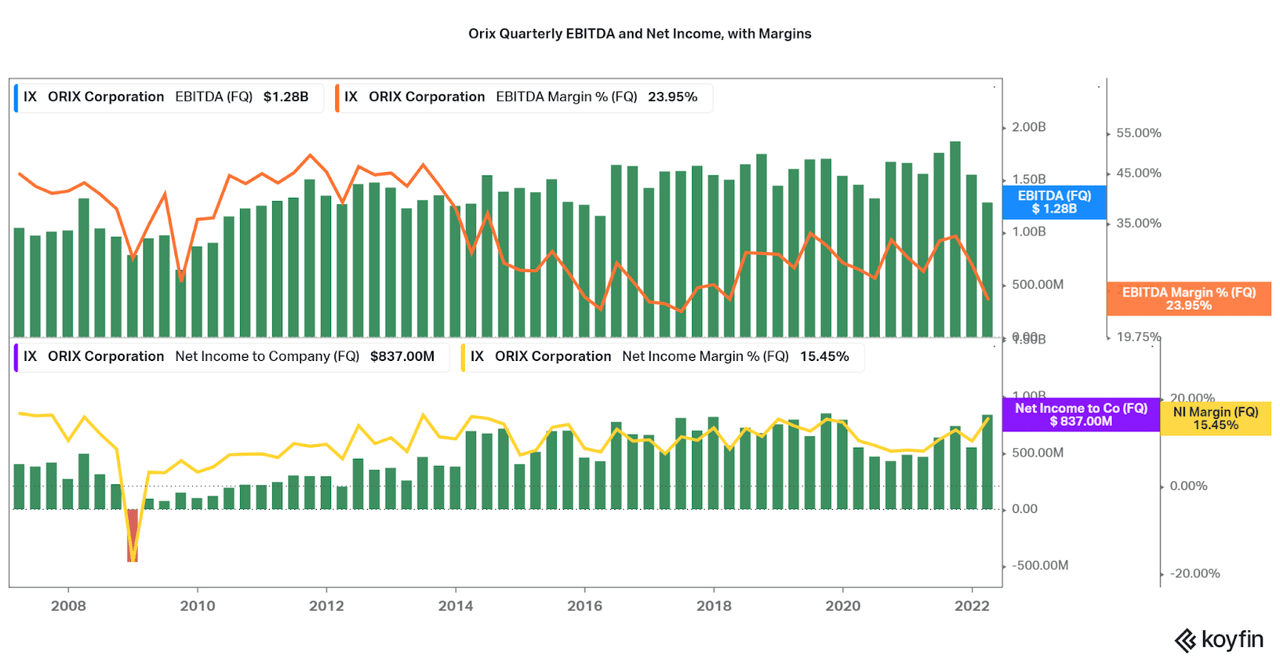

Zooming out to a longer-term chart, we can see that ORIX has had fairly stable revenue growth momentum, but with some cyclicality. This is typical with asset managers, as projects mature at different times, or are sold. However, I am confident in the fact that linear, steady growth will occur over the coming decades, especially as the company matures their portfolio. Good performance through 2020 also highlights the power of diversification even when some units took a beating (such as aircraft). I suspect that the highs in quarterly revenues seen in 2017 will be reached within a few years. More on outlook later in the article.

Koyfin

With the next chart of EBITDA and Net Income, we can see that underlying business performance is much stronger than the revenues may lead one to believe. The EBITDA margin has been hovering around 22-24% for the past few years, while the net income margin improves slowly to over 15%. It is also great to see that losses only occurred in one quarter at the height of the GFC, and were fairly quick to recover afterwards. The great profit performance for more than 10 years is one key reason to invest in the company, especially as revenue segments continue to either maintain performance or improve.

Koyfin

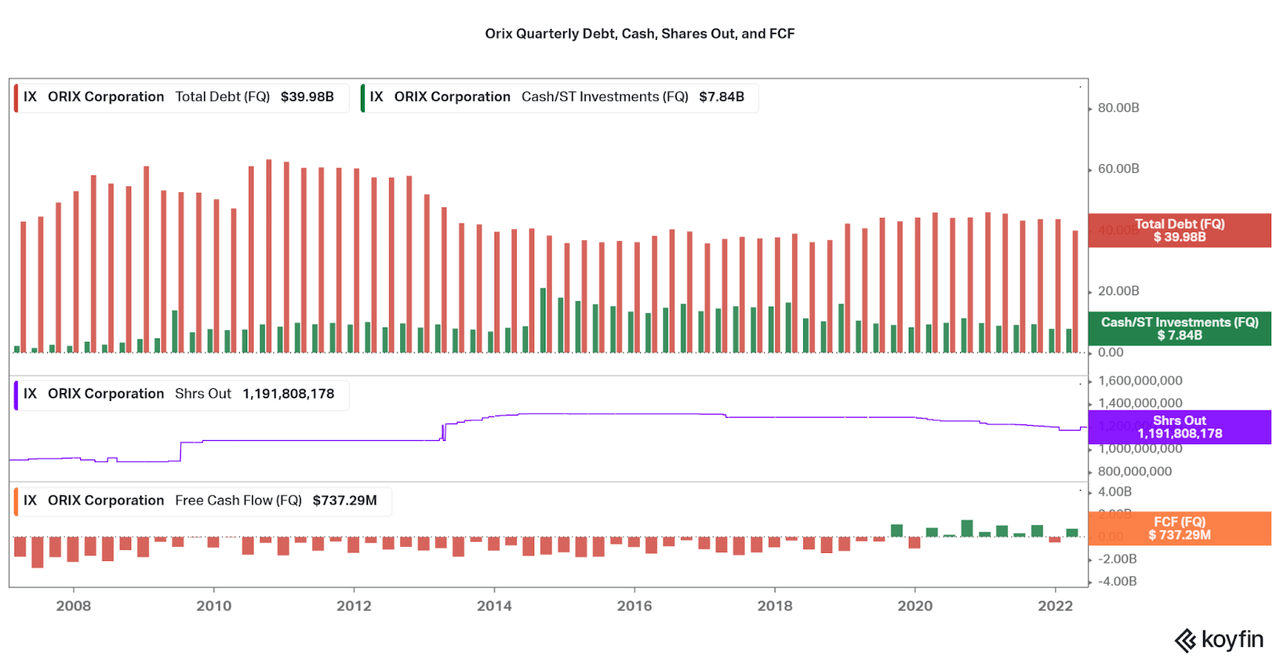

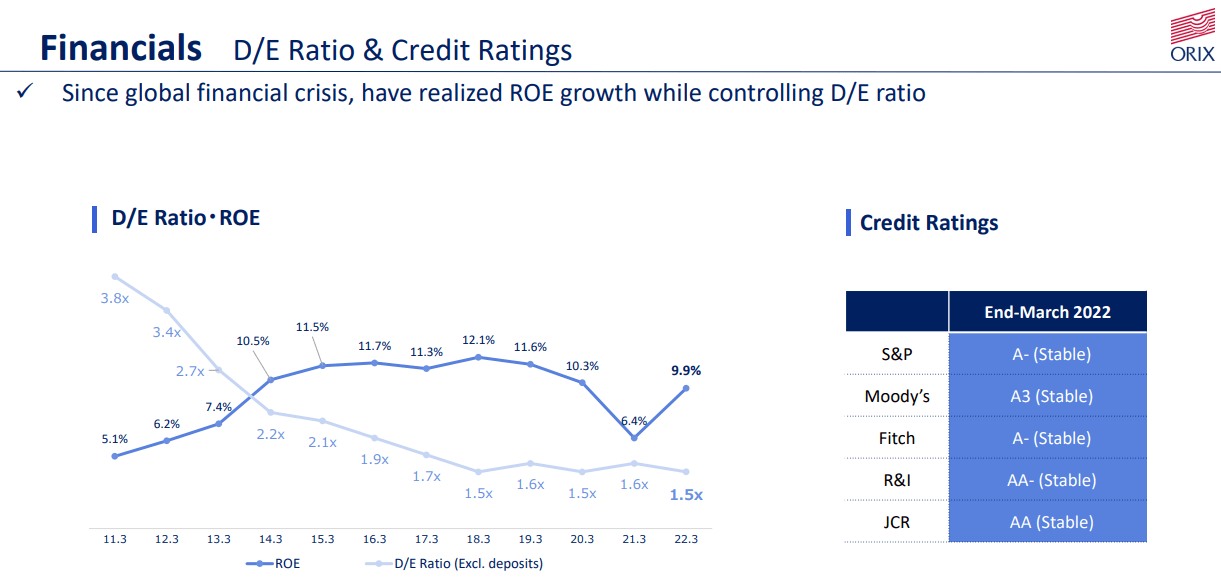

Another key area of ORIX to monitor closely is the balance sheet. While from first look investors may fear there is too much leverage and limited FCF, there is actual strength hiding underneath. First, while debt is far above cash on hand, the company’s debt-to-equity ratio has fallen significantly over the past decade. Post GFC, ORIX had close to a 4.0x debt-to-equity ratio, and this has been improved to 1.5x. Also scary are the negative FCFs, but this can be attributed to multiple factors, including increasing the asset base, share buybacks, dividends, and more positive factors. This is a common factor in other financial companies as well. With credit rating companies having favorable ratings and return on equity averaging above 10%, I find that ORIX is very healthy financially. Another area where the company shines as a safe investment.

Koyfin ORIX

Outlook

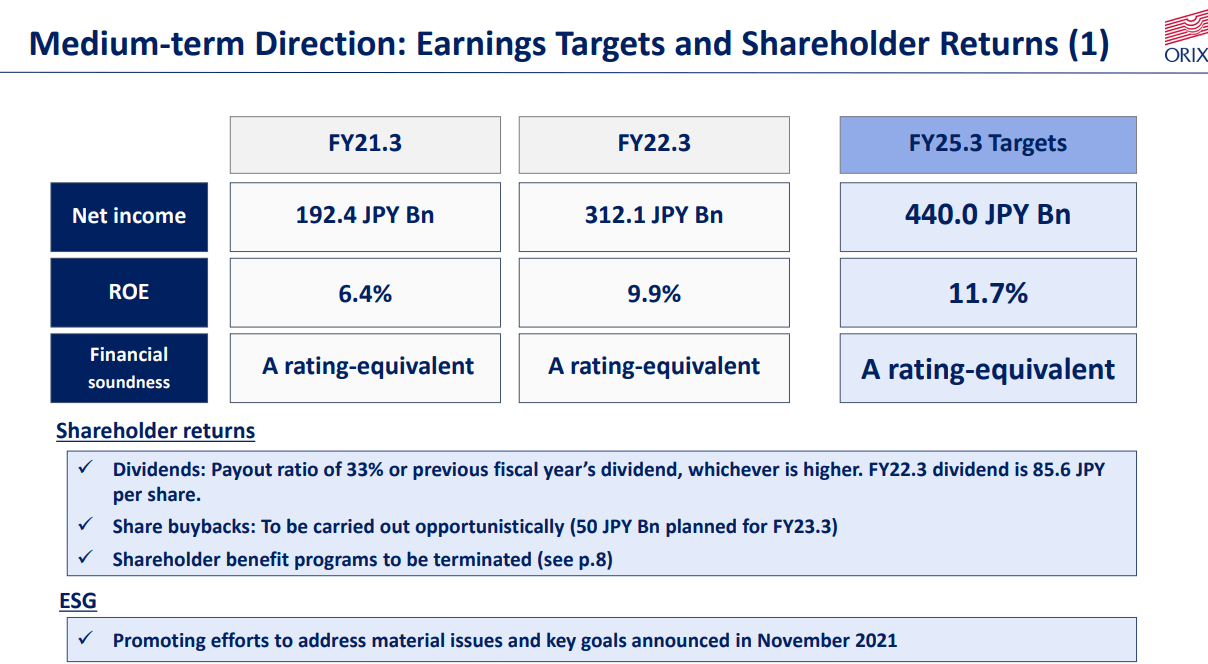

While current and prospective investors can bank on historical and current financial health as their future investment thesis, essentially a continuation of the norm, it is important to consider future catalysts. I will start with covering the company provided outlook. ORIX management has a medium-term outlook for 440 billion JPY of net income for three years from now. This accounts for 12.1% net income growth per year. This is quite substantial considering yen weakness, US recession fears, and the post-pandemic ecosystem, but still remains conservative in expectations. For the past 10 years, net income has grown at 14% so there is room for continued surprise. For those looking for a dividend, ORIX also expects to either grow or maintain their dividend, so the current 4.2% yield is yours to lock in now.

ORIX

2 Big Catalysts

Two areas of the company are set to provide both intermediate to long-term outperformance. The first is the large investments in renewable energy projects, Elawan and Greenko. Both companies are established renewable EPCs, but also are increasing capacity to a significant degree. In fact, ORIX expects to have an ownership share of approximately 7 GWH of electricity production within three years. This is an increase of 28% per year and should be favorable to revenues and earnings to a similar degree (depends on continued investments as a percentage of revenues).

ORIX

The second major factor is the return of profits in the three pandemic impacted revenue segments: Aircraft and Ships, Real Estate Operations, and Concessions. While accruing losses due to the lack of travel, lockdowns, closures, etc., the company expects a return to ~80% of pre-pandemic profits within three years. I find this extremely conservative as Japan opens to tourism, but I will be watching travel numbers intently. However, I find these profits should be returning sooner rather than later. Based on current quarterly earnings, a return to form may provide up to a 20-30% total increase in quarterly profits and may be a hidden catalyst moving forward.

ORIX

Valuation

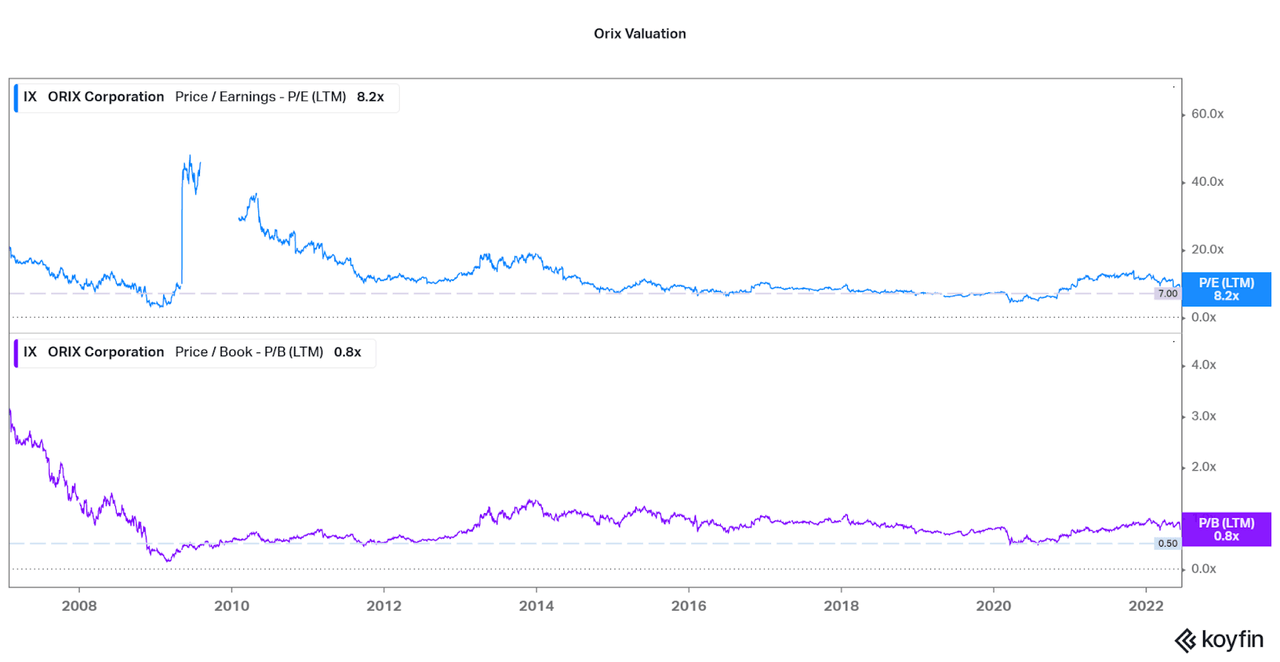

So, considering the current financial health that has improved over the past 10 years or more, plus the opportunity for upside thanks to renewable energy projects and a recovery in the pandemic-hurt segment, ORIX should be able to earn a premium valuation. However, the valuation is currently falling towards a historically low valuation. While the price to sales ratio remains high thanks to increased profitability, both the P/E and P/S are lower than years prior, except for the pandemic and GFC era. As such, I find that the company is entering an extremely favorable time for investors to accumulate shares at a discount. In particular, look for the values to reach the lines on the graph below as particularly beneficial entry points, although I wonder whether the shares will fall that far.

Koyfin

Conclusion

I find that ORIX offers a strong investment for the coming years of potential recession, high inflation, and general malaise. As usual, I will always recommend recurring investments as a way to combat volatility, but investors should feel quite comfortable with the investment. While the company may not offer the same growth potential of peers such as Apollo Global (APO) or Equitable Holdings (EQH), ORIX is far stronger in terms of low volatility, profitability, and safety. The company is certainly my choice for the industry, and one of my only financial recommendations. The company certainly is complicated on the surface, so I recommend you continue on your own due diligence path.

Thanks for reading. Feel free to share your thoughts below.

Be the first to comment